User-Generated Content (UGC) – ratings and reviews, and consumer submitted video, imagery and Q&A content – is typically a core pillar of any successful ecommerce strategy. And with good reason: it’s proven that the more UGC you have on your website, the more sales you generate.

In fact, PowerReviews data from across more than 1,000 brand and retailer websites highlights how consumers who interact with reviews convert at 115% the rate of those who don’t. The same figures for Q&A content and imagery are 153% and 81% respectively.

However, one question we get asked a lot by brands and retailers is: how can we generate more of this content?

There are a wide range of theories behind why consumers opt to provide UGC.

But there isn’t a huge volume of concrete data-driven information examining specific reasons. This survey was conceived to change that. It provides a deep dive into exactly what motivates shoppers to submit all types of User-Generated Content (ratings and reviews, and consumer submitted video, imagery and Q&A content) by exploring the opinions of a total of 10,486 active consumers.

We also dig into whether generational differences affect review submission preferences and behaviors. Does age impact whether consumers are more likely to provide review content? And do different factors motivate different age groups?

Throughout, we offer some tips to optimize UGC collection based on the survey results.

Typical Review Submission Behaviors

To level set, our 10,486 respondents are active shoppers across the United States who have opted in to offers and discounts from retailers. We ran the survey in October 2020.

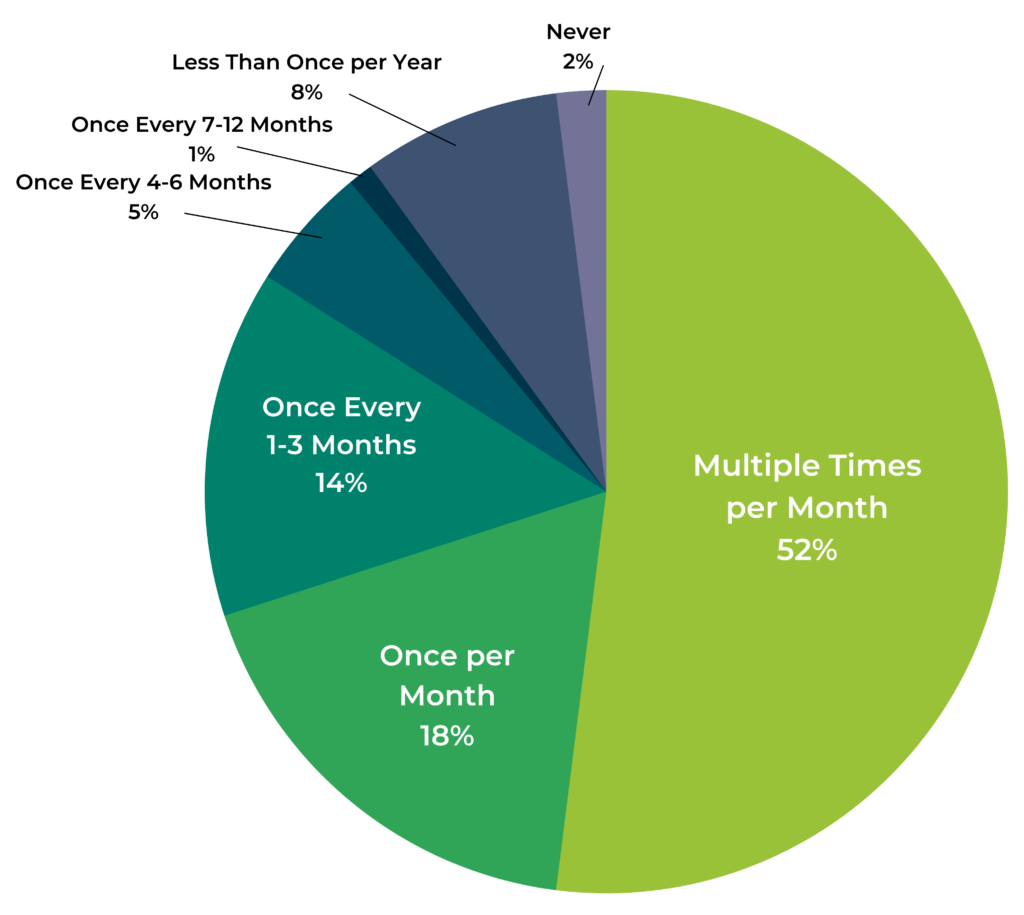

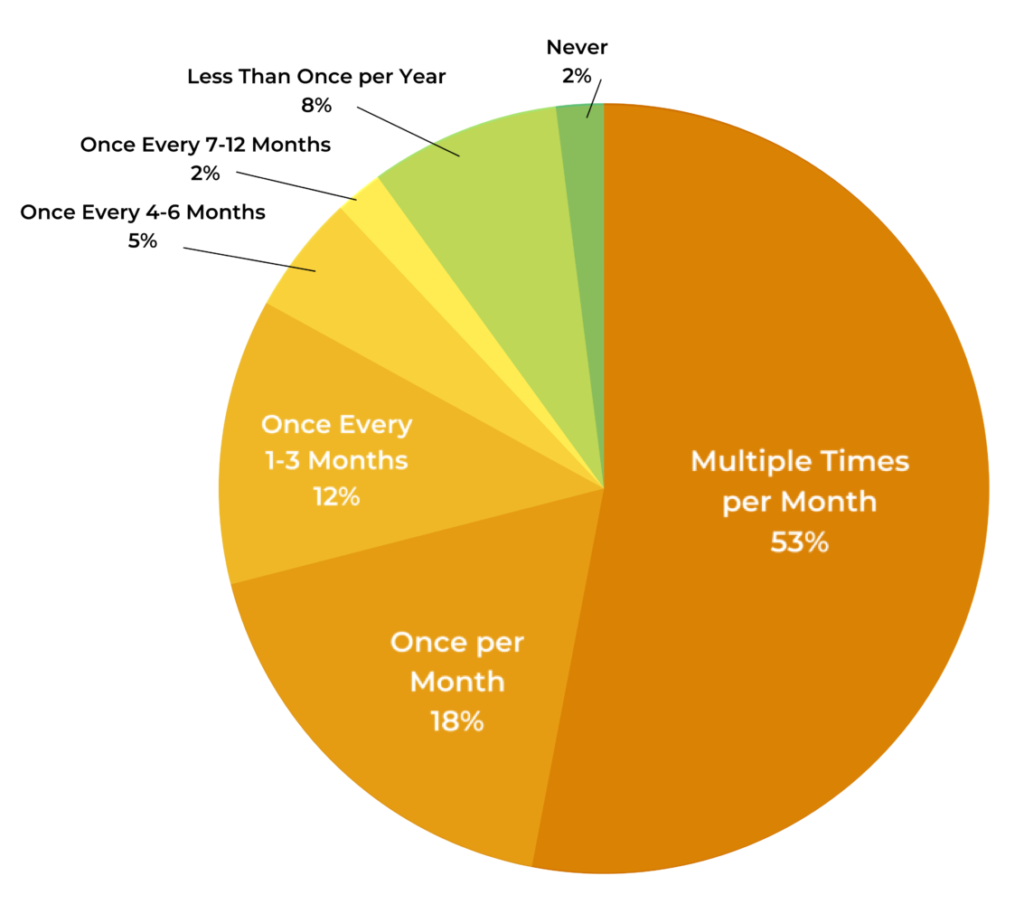

To get an idea of how these consumers approach UGC, we first wanted to understand how frequently our participants typically provide ratings and reviews.

More than half of our respondents claim they provide a product rating or review more than once a month. And almost nine in ten (89%) say they do so at least once every six months.

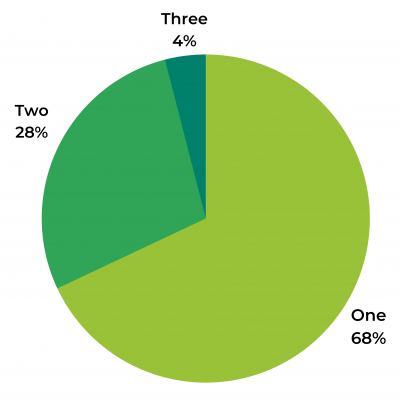

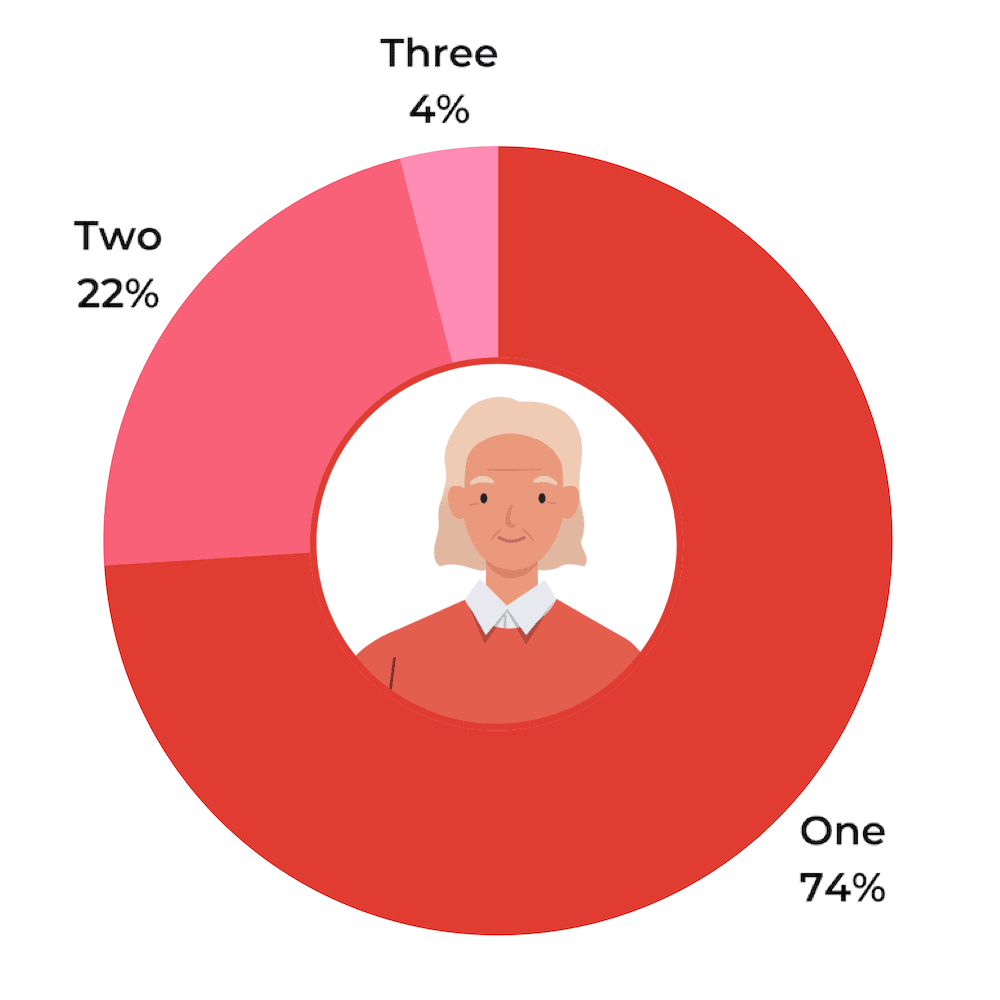

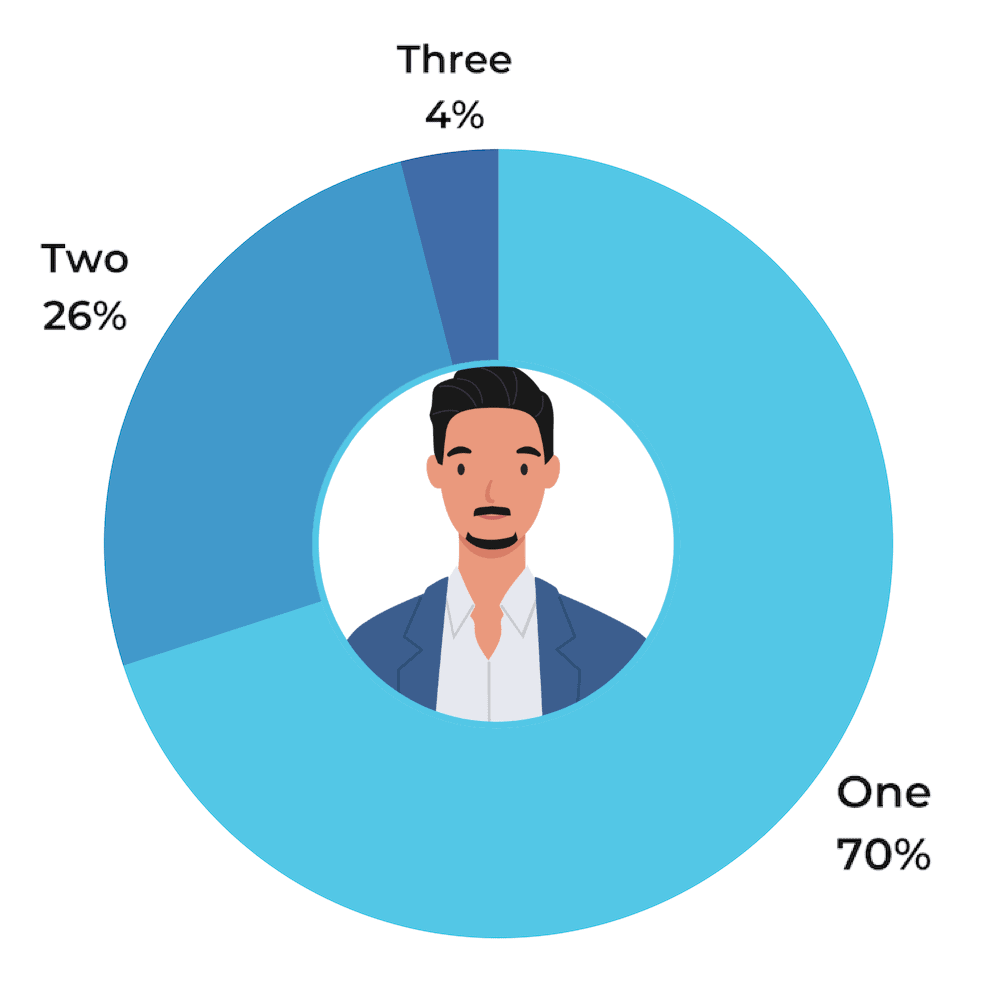

More than two-thirds say they only need to be asked to leave a review once to submit one, while 96% claim they will do so by the second request.

These results show that our survey panel is highly engaged with User-Generated Content (UGC). They submit ratings and reviews in significant volumes.

This means the subsequent findings we highlight are critical for brands and retailers trying to understand how to generate more UGC. Our survey provides crucial insights into how to motivate consumers to provide reviews who are among the most inclined to do so.

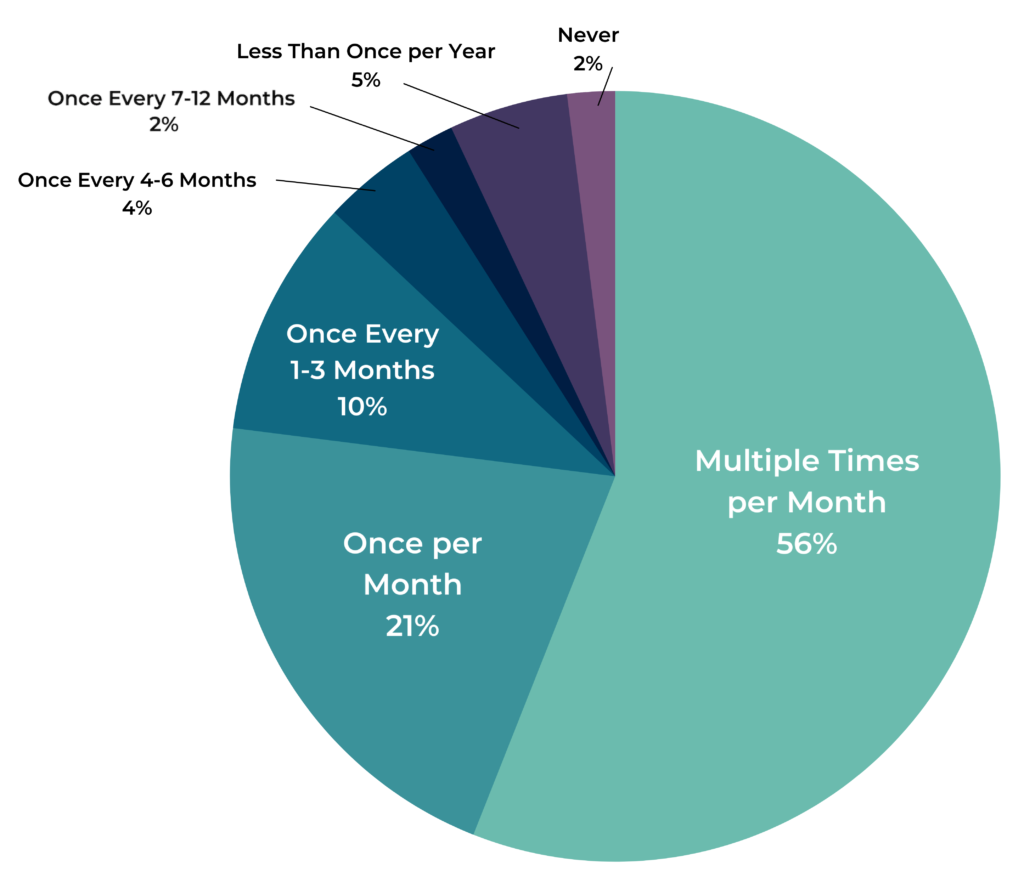

Review submission frequency

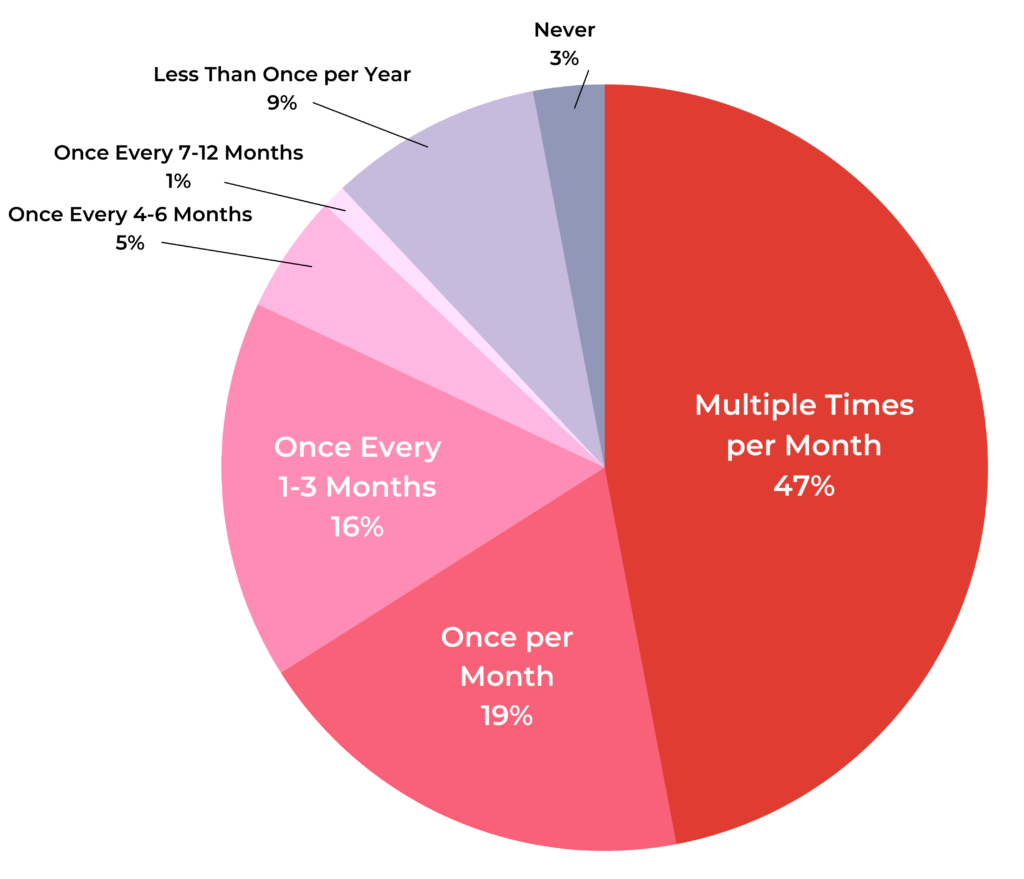

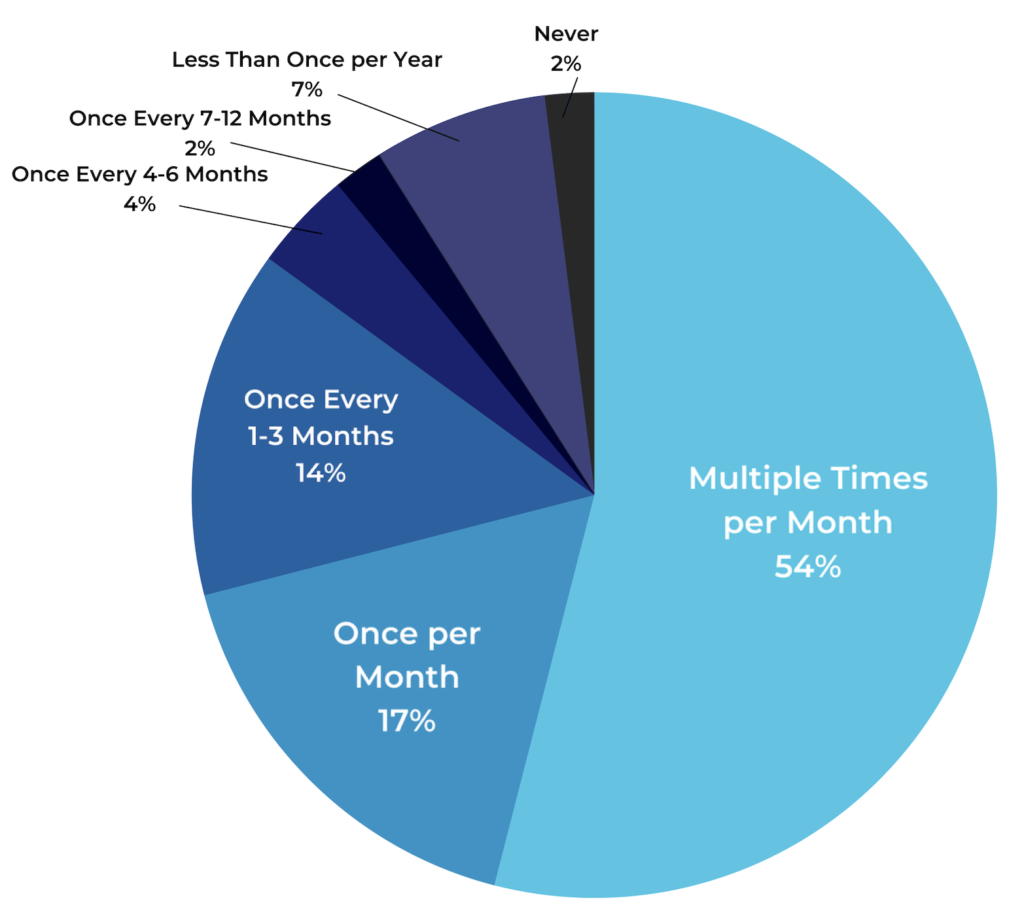

(Generation Comparison)

When comparing review submission behaviors according to age, younger generations are more prolific review writers and contributors. 47% of Baby Boomers submit reviews more than once per month, compared to 54% of Gen Xers, 53% of Millennials and 56% of Gen Zers.

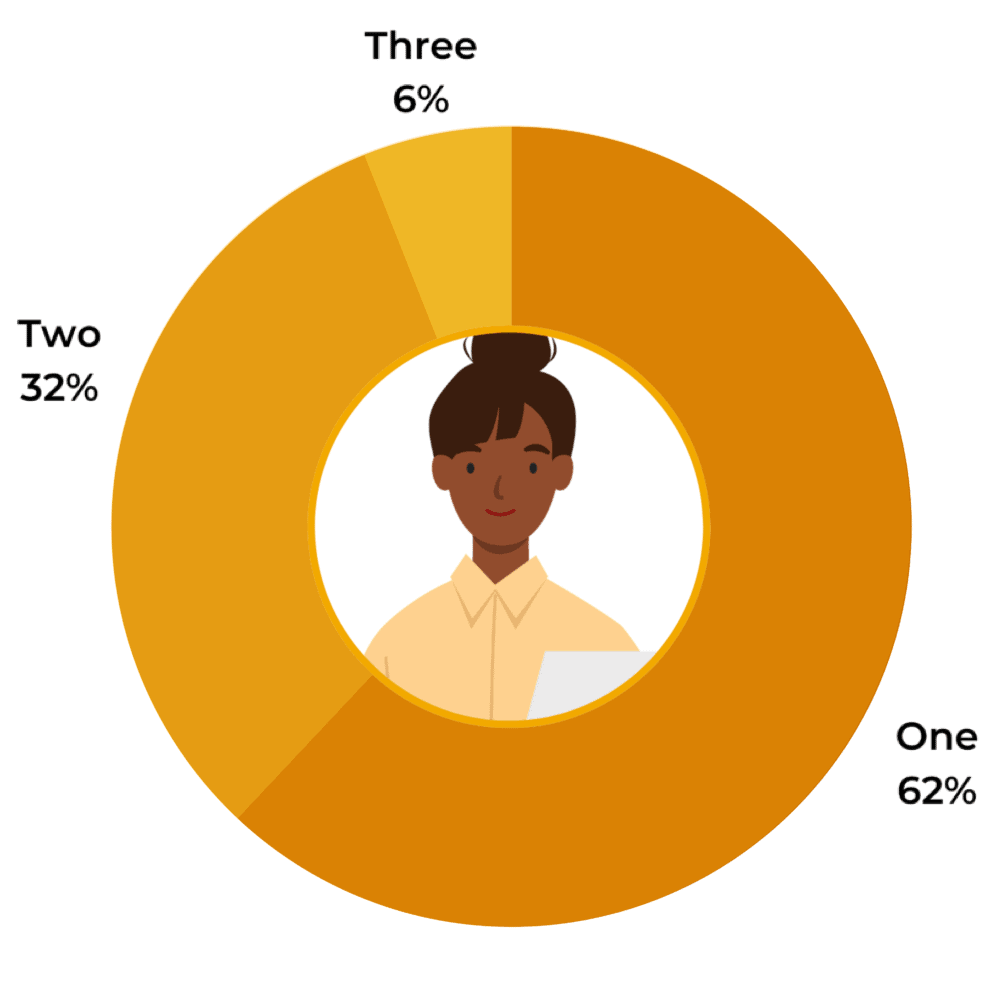

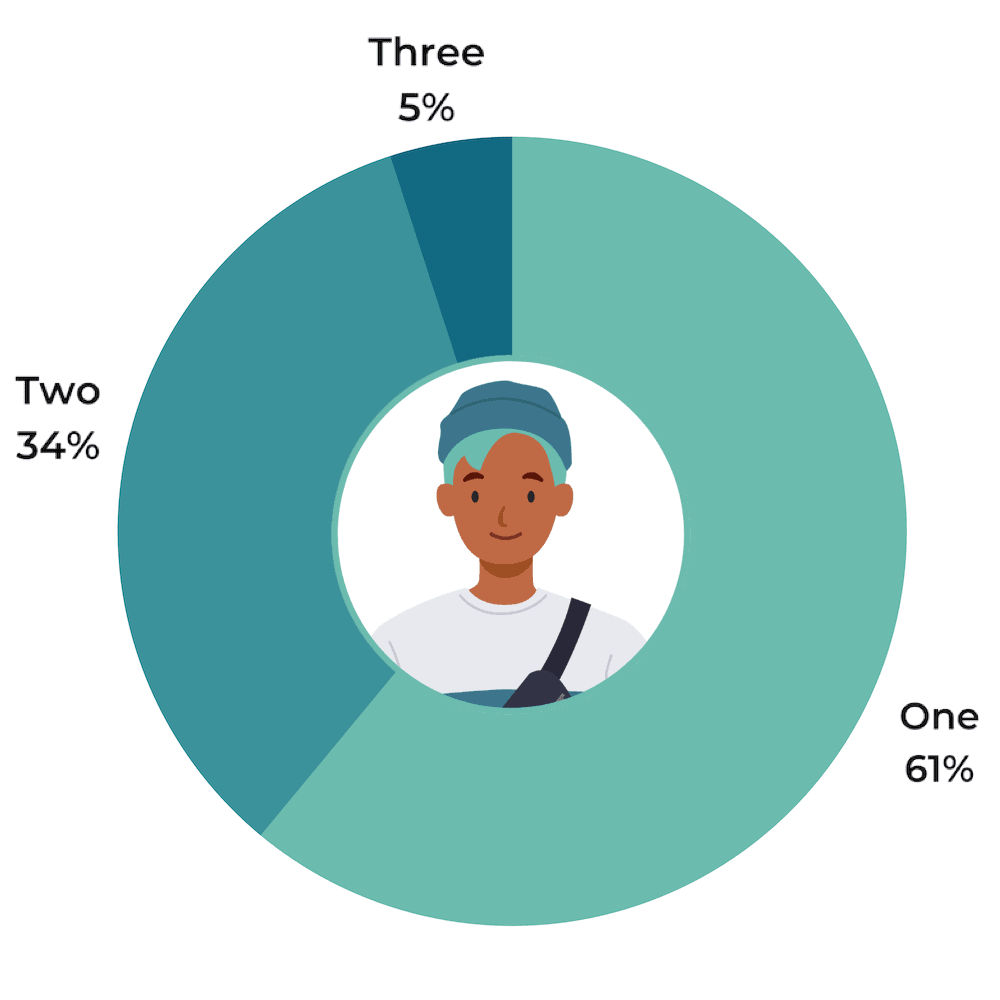

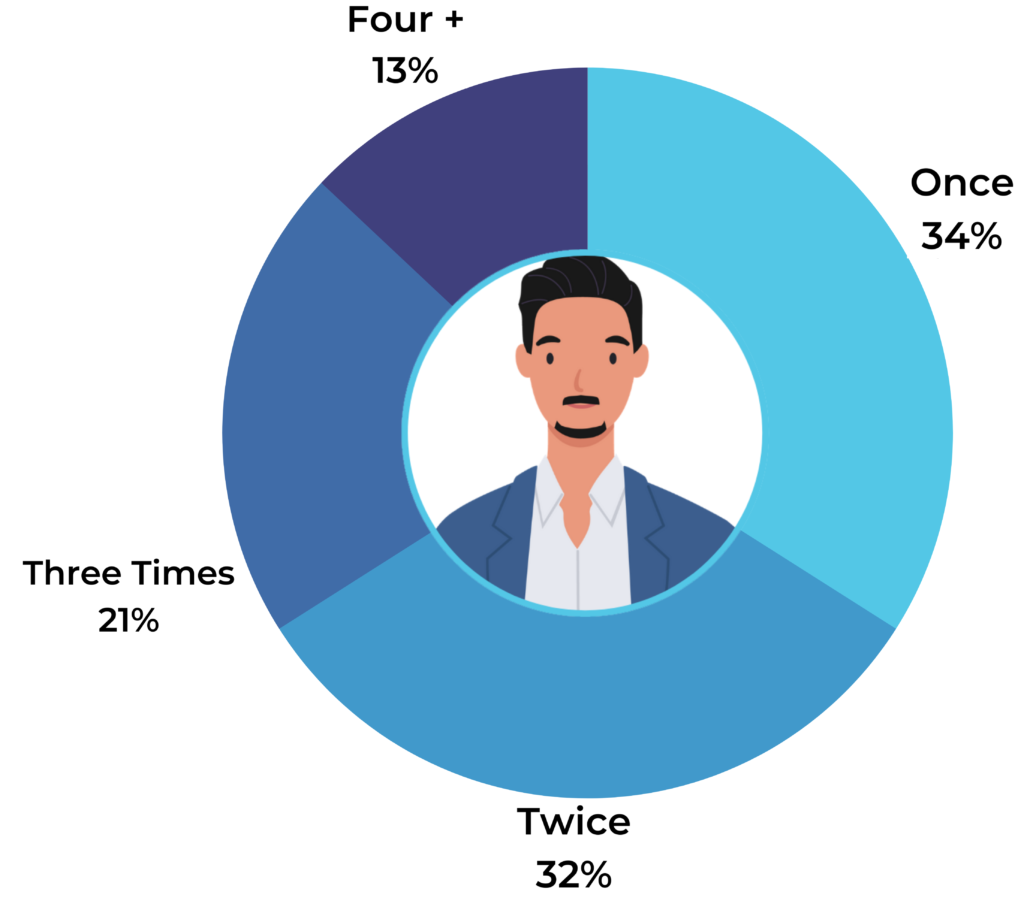

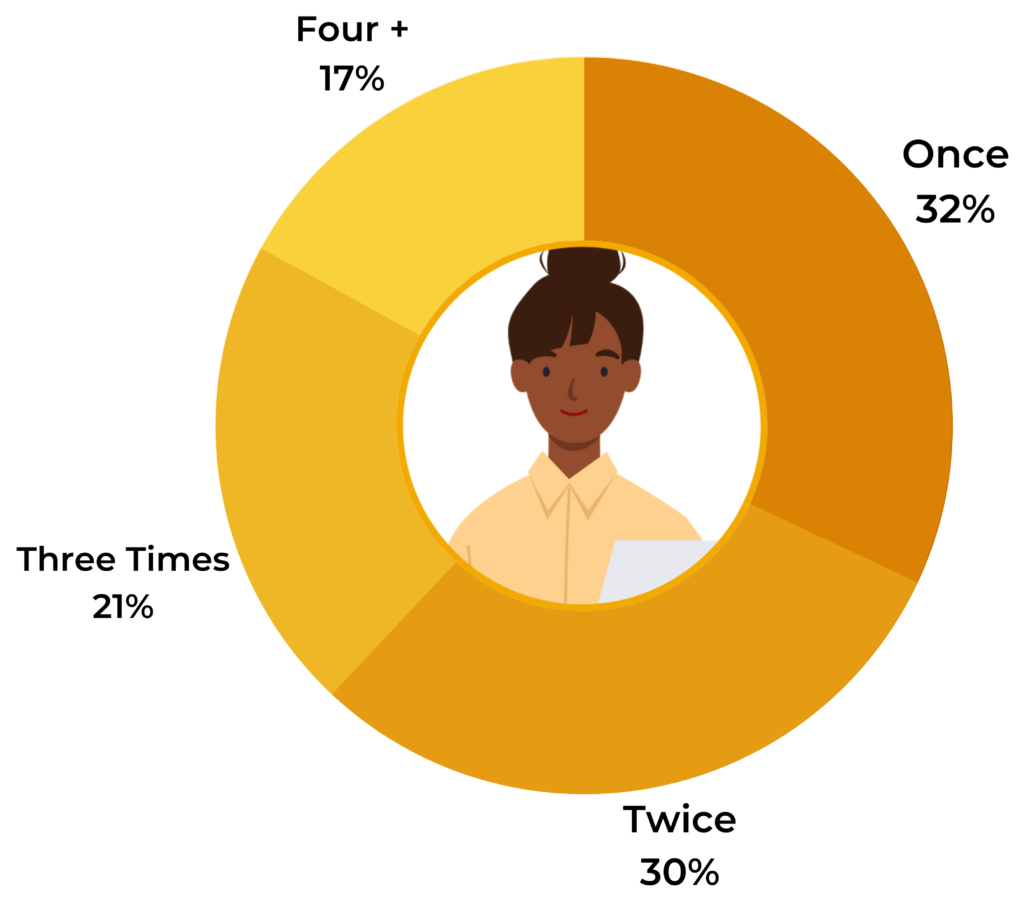

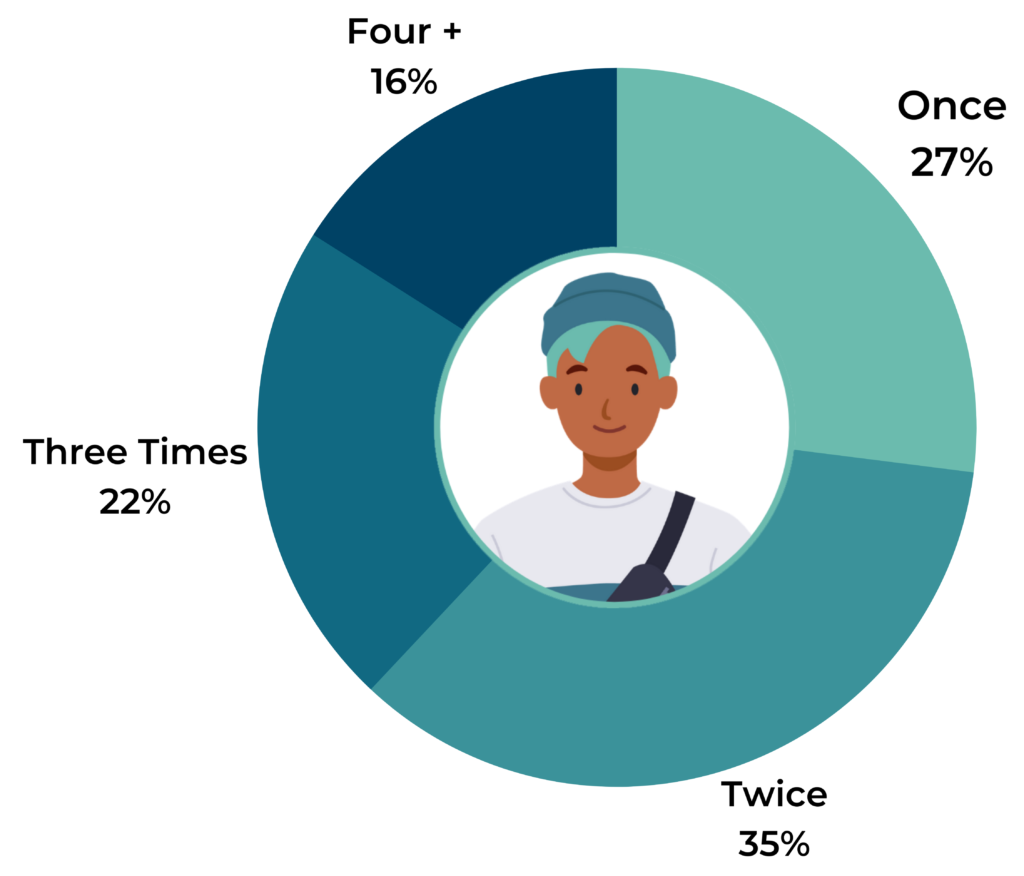

However, younger generations also need to be asked to provide this content on more occasions before they do so. 61% of Gen Zers say they will submit a review on the first request, compared to 62% of Millennials, 70% of Gen Xers and 74% of Baby Boomers.

Based on our results, younger generations are overall more committed to providing reviews but less immediately responsive to initial requests.

In reality, this should be the case regardless of the demographic make-up of your ideal customer profile. But it’s clear younger generations particularly respond to this approach.

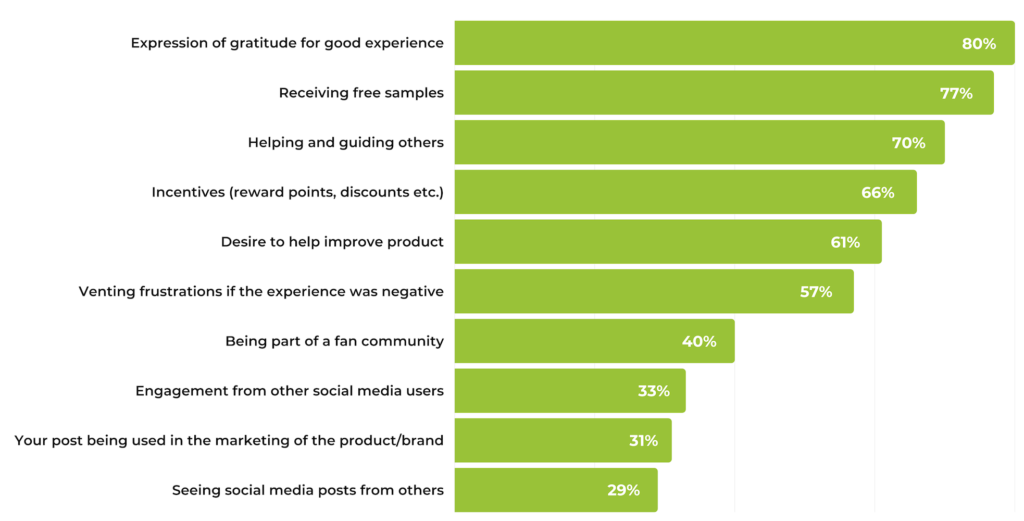

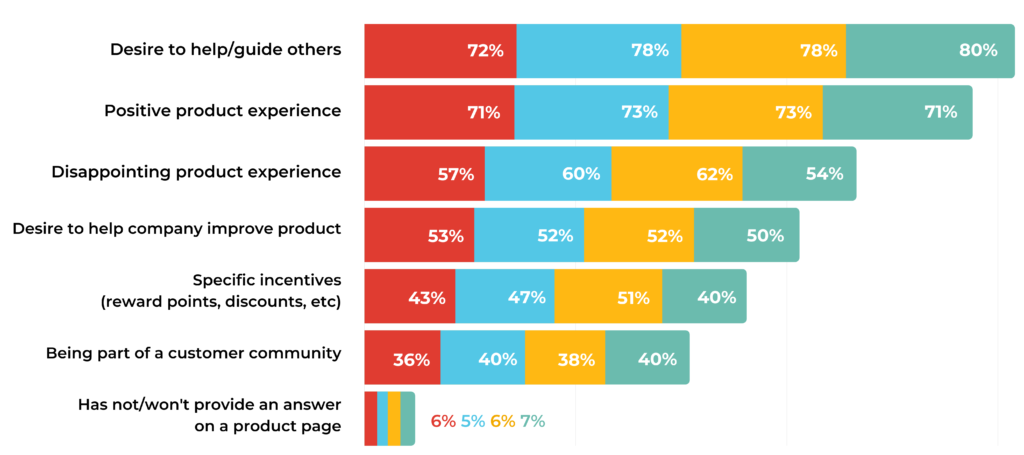

Primary motivators for providing review content

As a starting point, we wanted to understand the main motivating factors for consumers to provide product ratings and reviews.

We based the response options on our experience of working on UGC programs for a number of years at more than 1,200 brands and retailers. In other words: this is what we and our own customers believe to be the main reasons that their customers offer up this content.

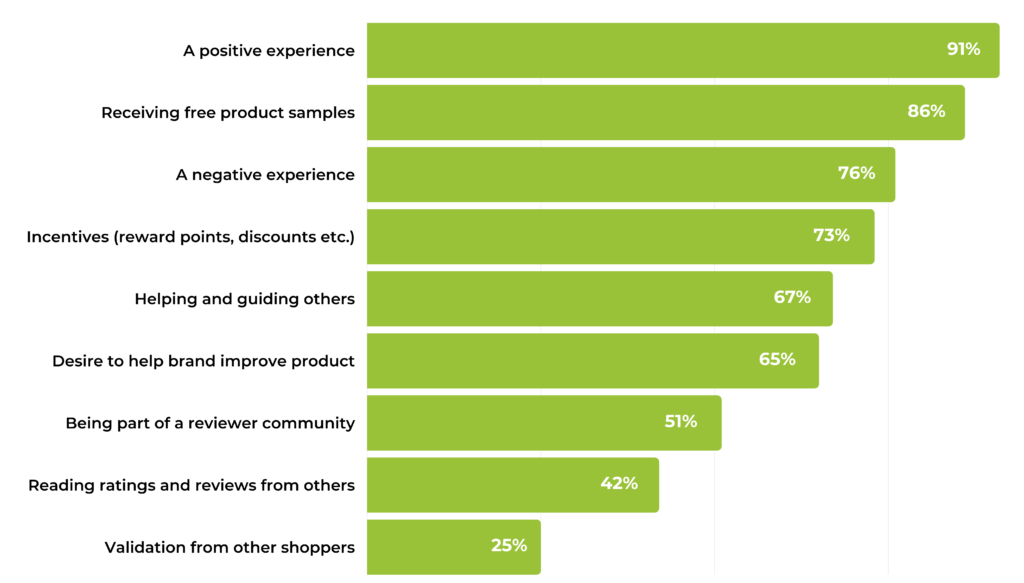

Our responses provide an easy-to-rank list of the most important motivating factors for consumers. Our top ranking result shows there is simply no substitute for a good experience. More than nine in ten say this is the primary reason they choose to provide this content.

By the same token, a negative experience also leads more than three quarters to leave a product rating and review.

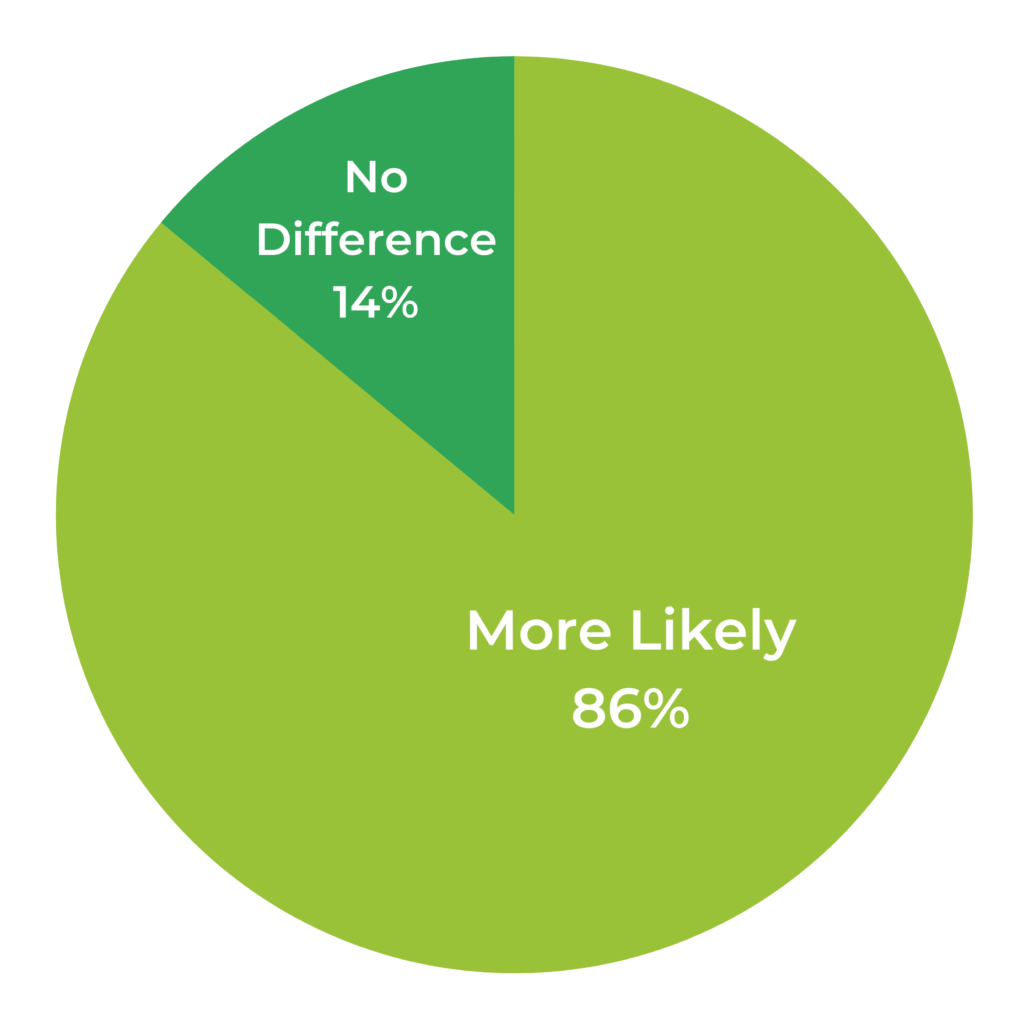

With that being said, incentives clearly – if employed correctly – can stimulate review content. A free sample of the product is a critical motivating factor for a massive 86% of respondents. Incentives are also important for 76% of the consumers surveyed.

However, a close second is offering up free samples. This is clearly the most effective method if you are looking to generate ratings and reviews for a particular product quickly.

(Generation comparison)

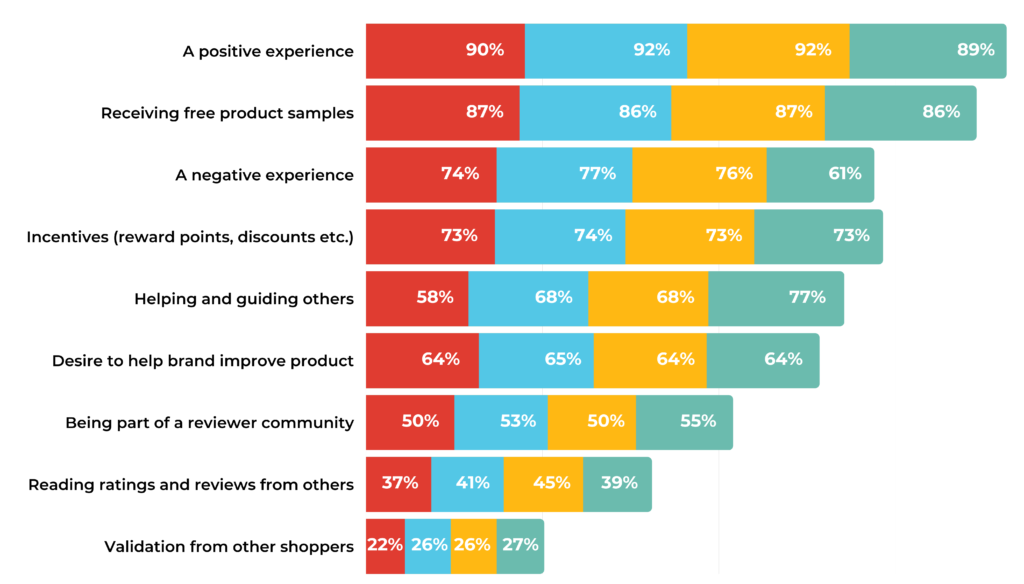

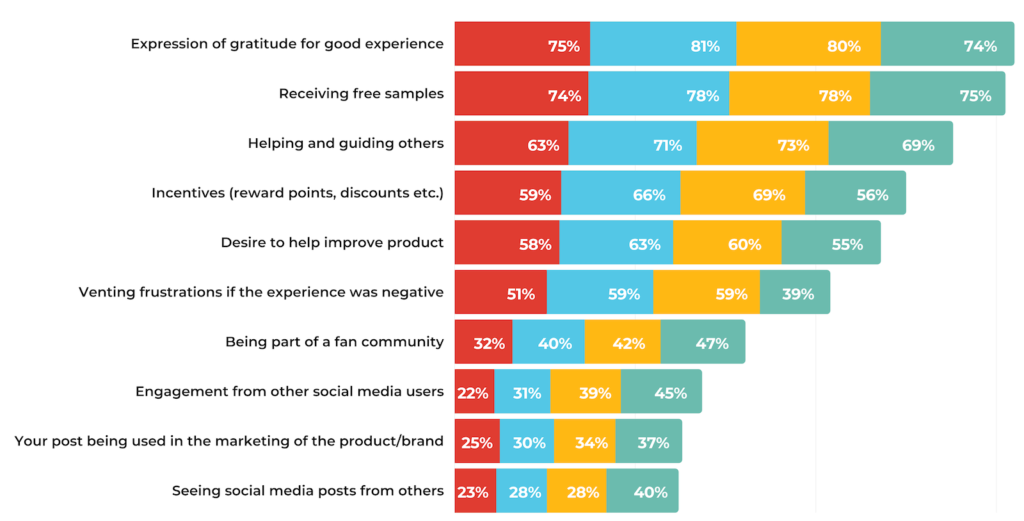

In terms of reasons consumers provide review content, there are not too many cross-generational differences.

Regardless of age, a similar volume of respondents feel compelled to submit ratings and reviews if they:

- have a positive experience

- receive free samples (or are incentivized in some other way)

- are looking to help the brand improve the product

- want to be part of a review community.

The one factor where we identified a clear trend was a desire to help and guide others – younger generations are significantly more motivated to provide reviews for this reason (77% of Gen Zers, compared to 68% of millennials, 68% of Gen Xers and 58% of Baby Boomers).

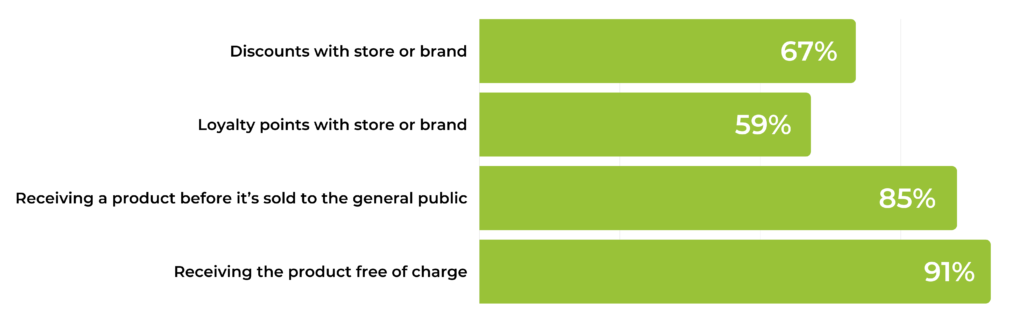

What incentives are reviewers looking for?

With consumers seeking incentives in exchange for submitting ratings and reviews, it begs the question: what incentives particularly motivate them to do so?

Unsurprisingly perhaps, any incentive can be used to generate more review content. But two particularly stand out: receiving the product to be reviewed free or before it officially hits the shelves (digital or physical).

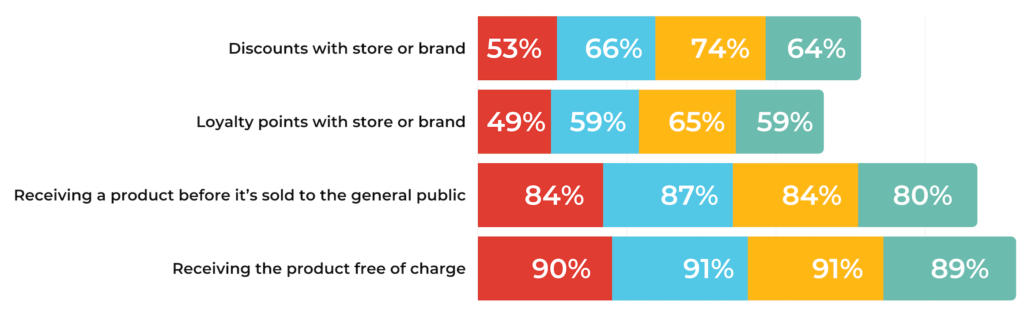

(Generation Comparison)

Influence of existing review content

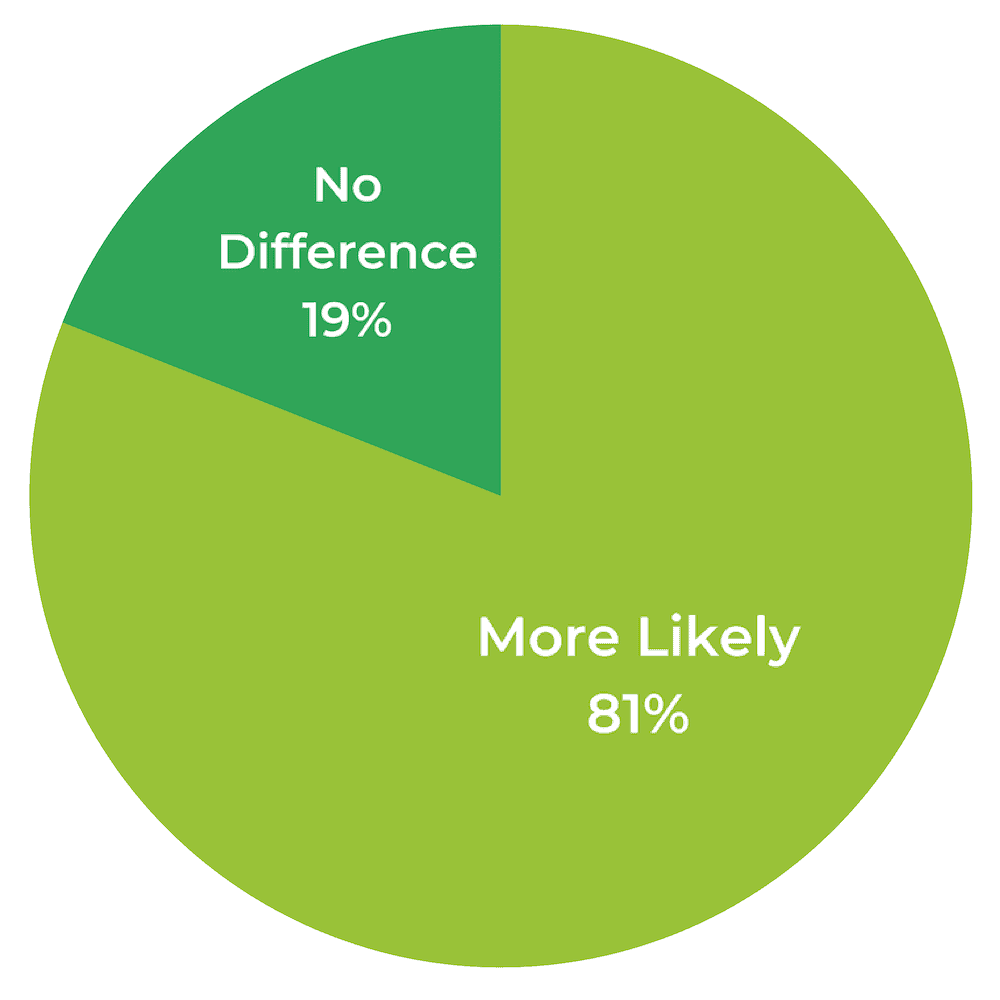

Although near the bottom of the rankings in the list of motivating factors (only 42% claimed this would lead them to submit a review), reading existing ratings and reviews content does still have an impact.

In fact, these results show that 1) reading reviews from others and 2) low review volumes is still a significant motivator.

Timing of review submission

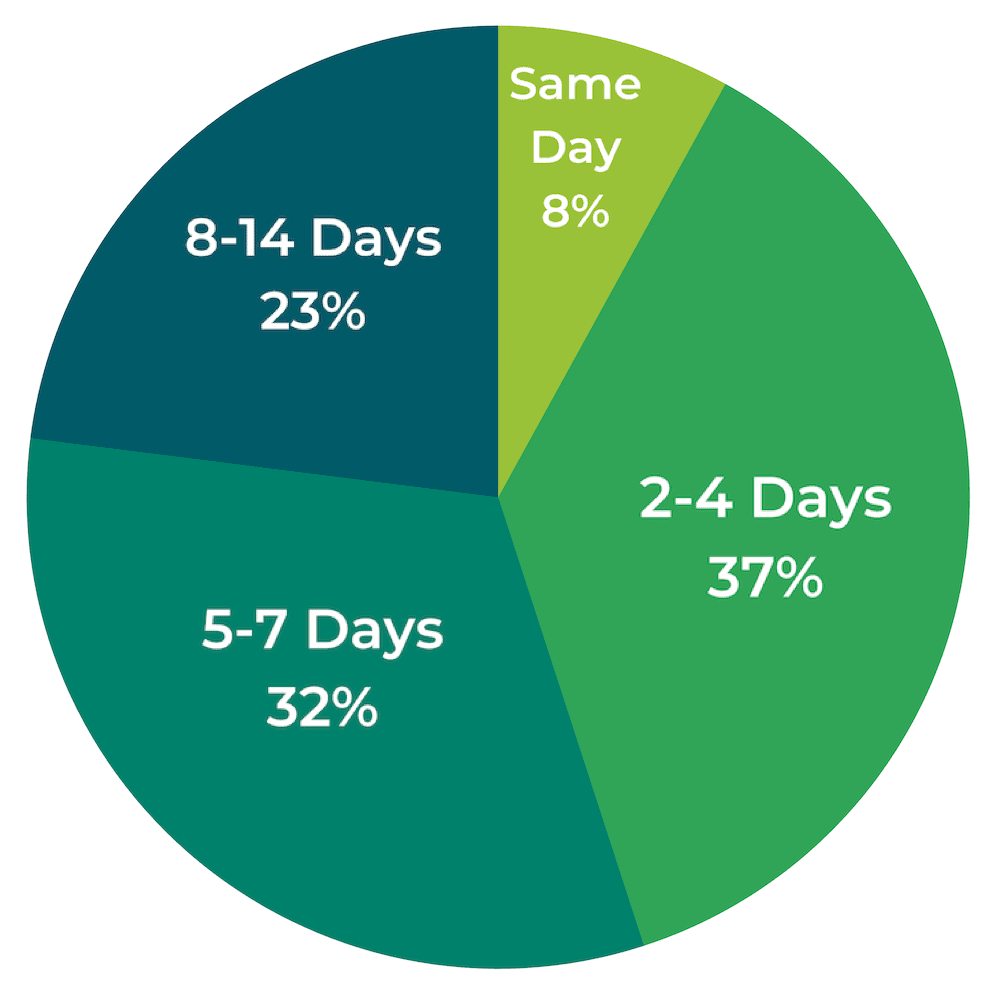

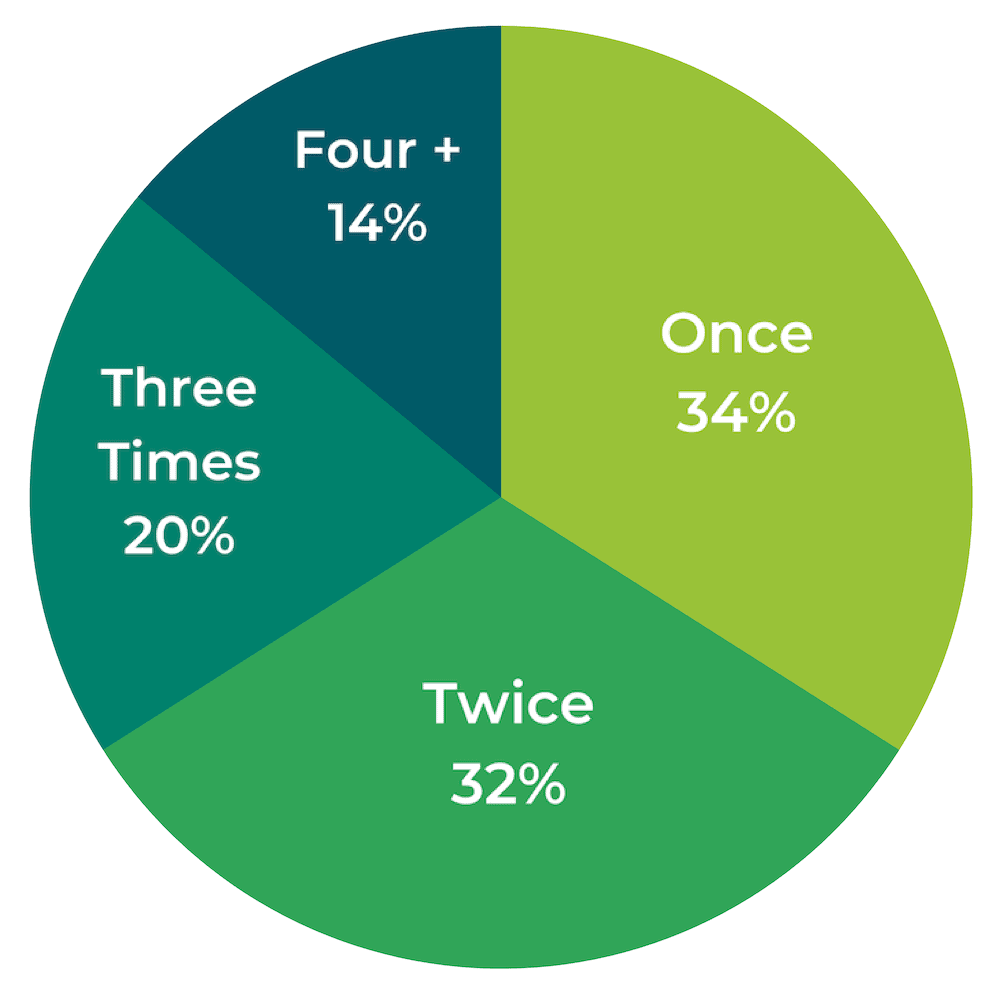

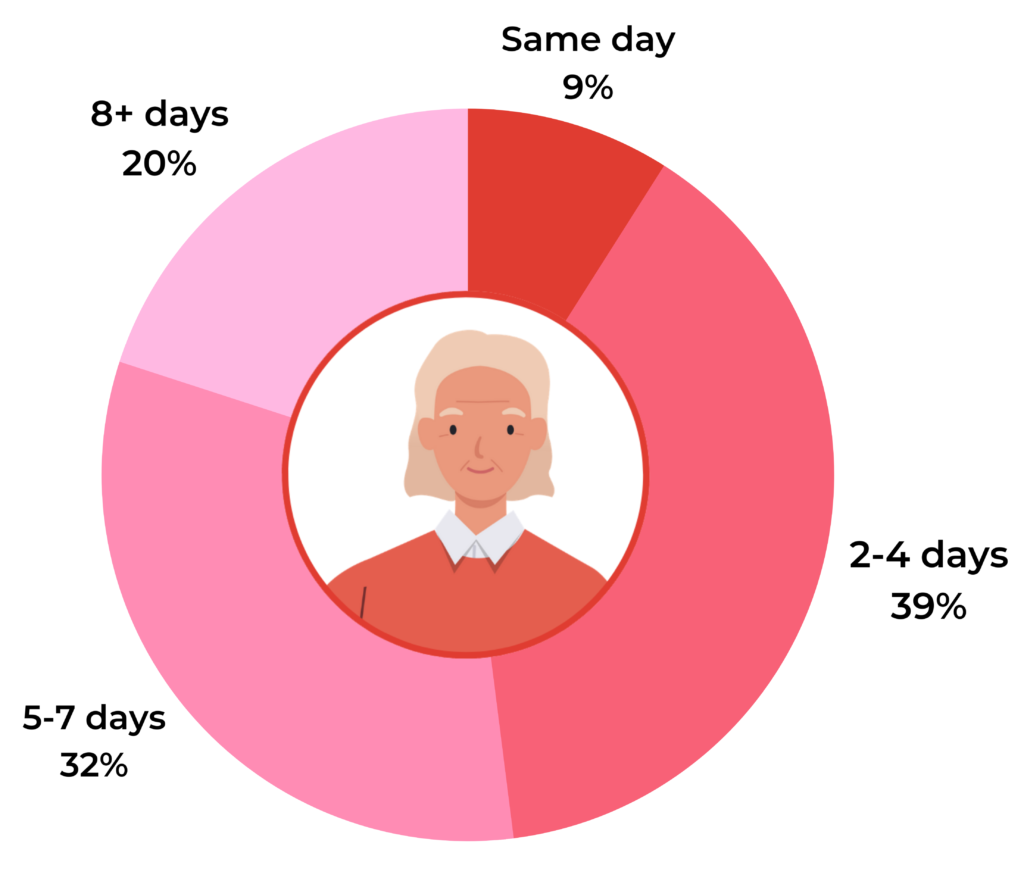

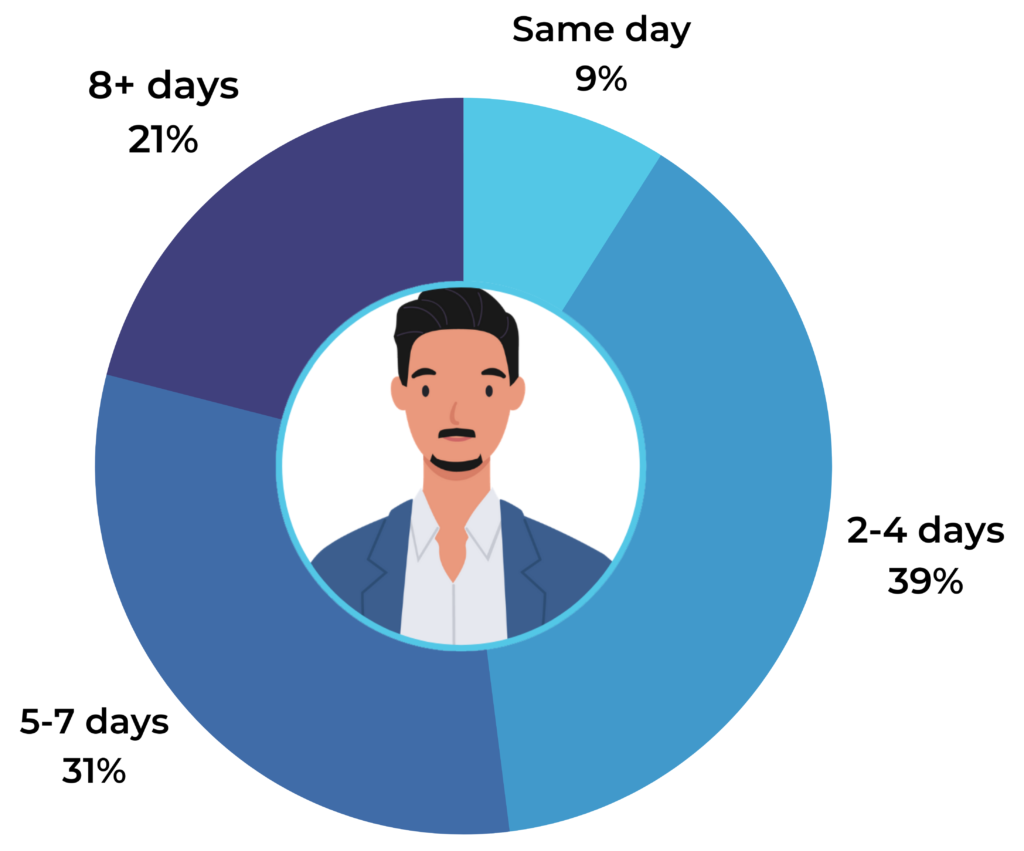

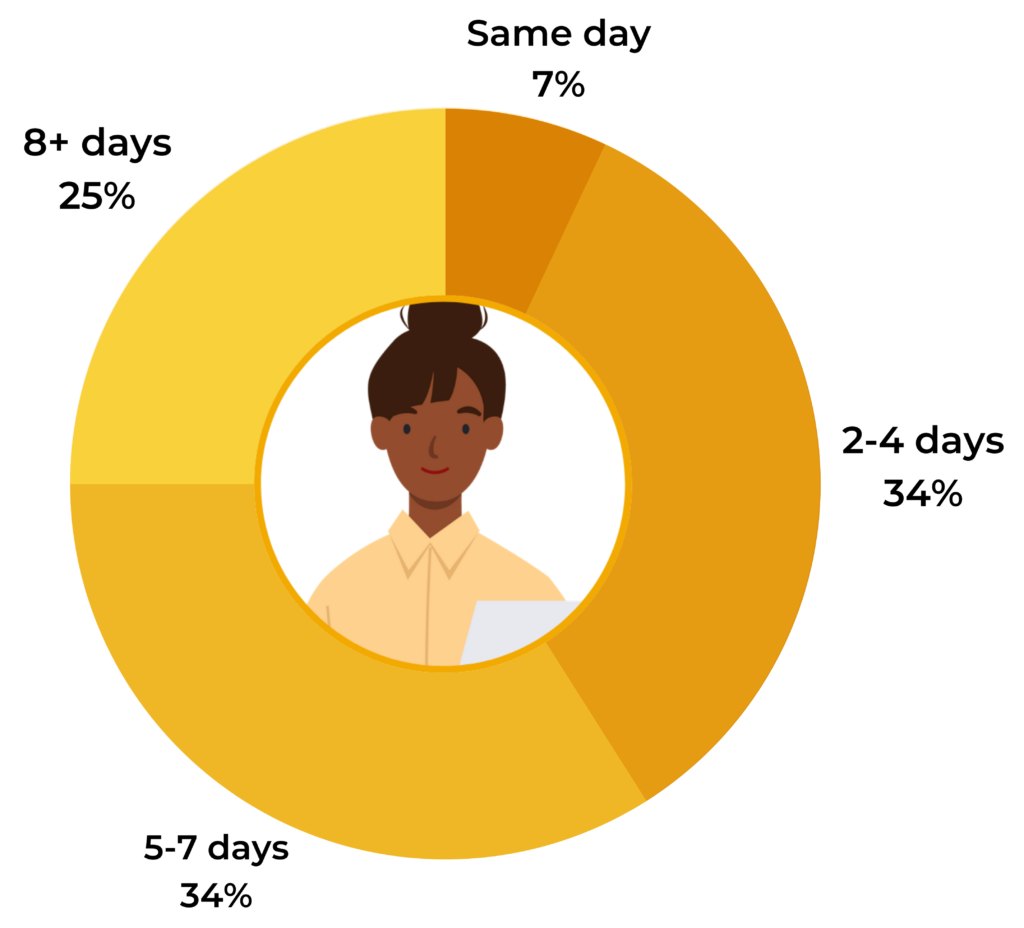

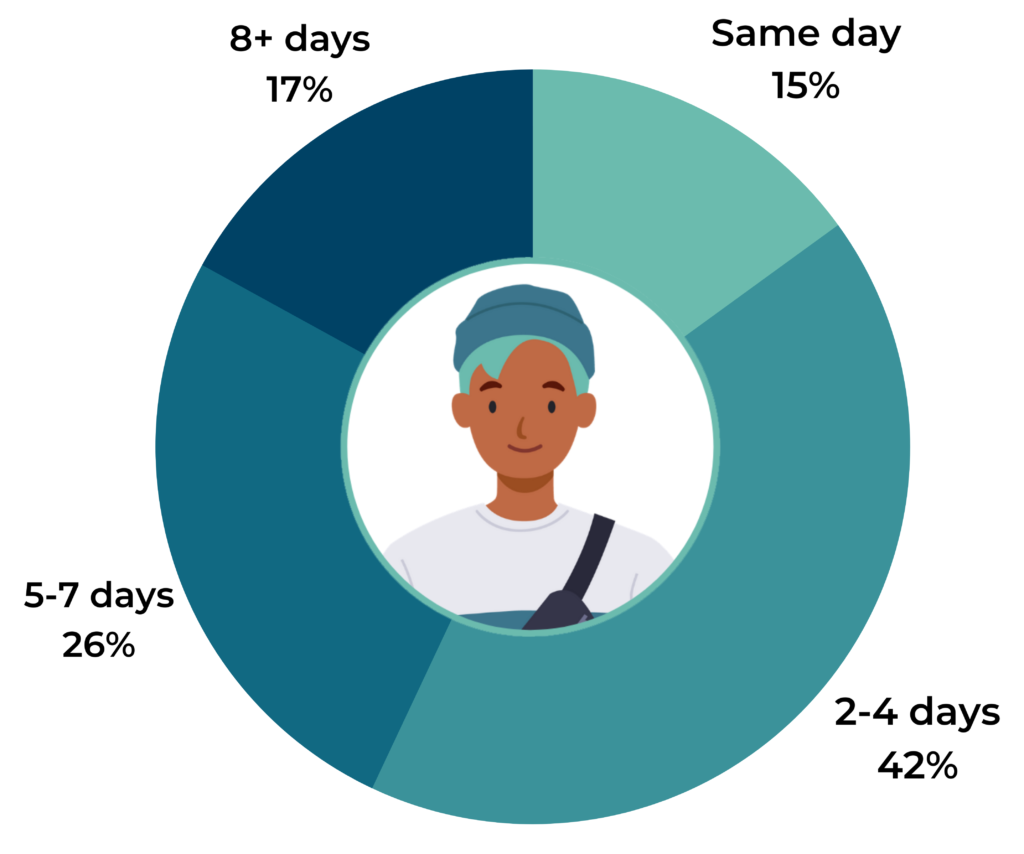

One question we get asked a lot: how long after asking for a review is it likely to be generated? We explored this topic with our respondents, also questioning them about typical product usage before submitting this content.

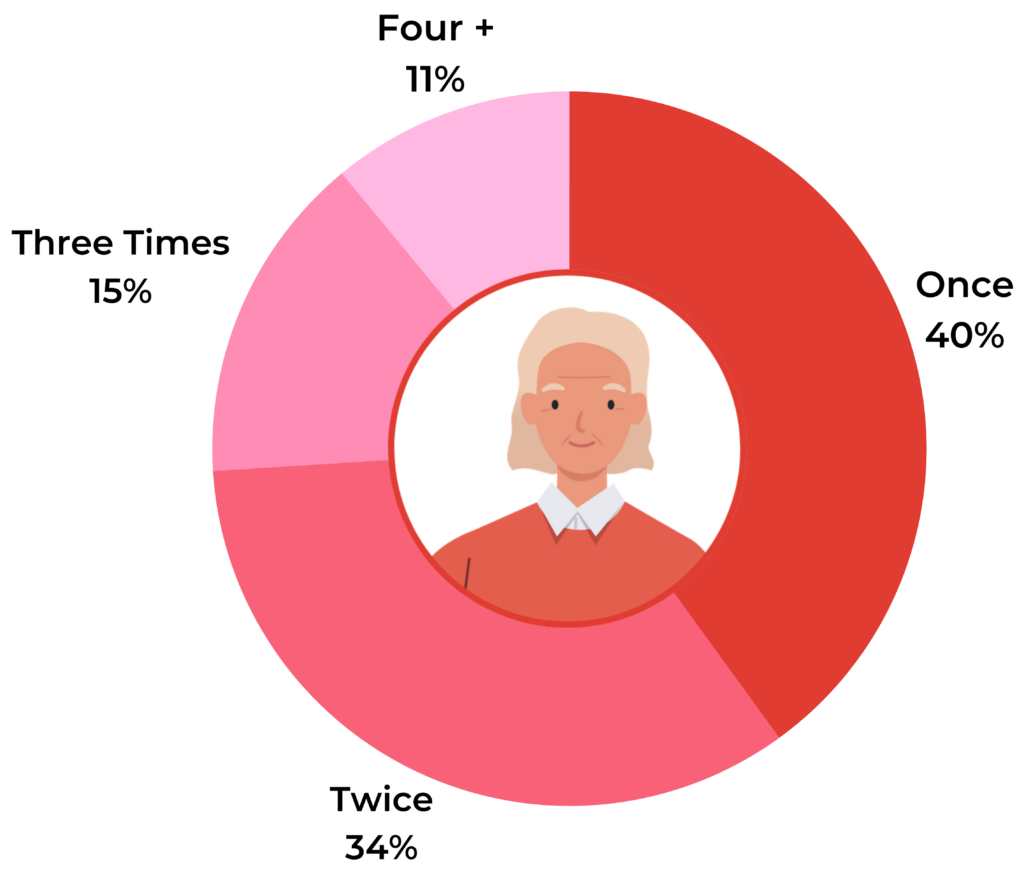

The vast majority of respondents submit review content within a week of receiving the product (76%) or within the third usage (86%) of the product. Few do so immediately but a surprisingly high third of all consumers surveyed will provide a review after only using the product once.

(Generation comparison)

(Generation comparison)

(Generation comparison)

Likelihood to provide a rating and review after only one use increases with age: 40% of Baby Boomers submit reviews after one use, compared to 27% of Gen Zers. It appears that younger consumers like to more robustly road test products before delivering their verdict.

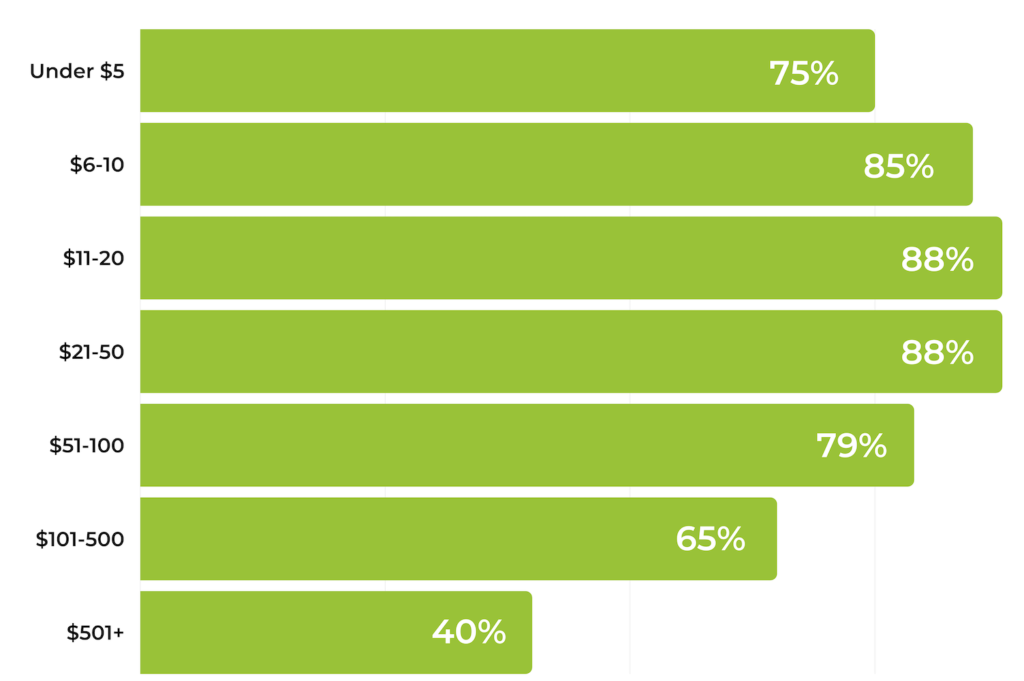

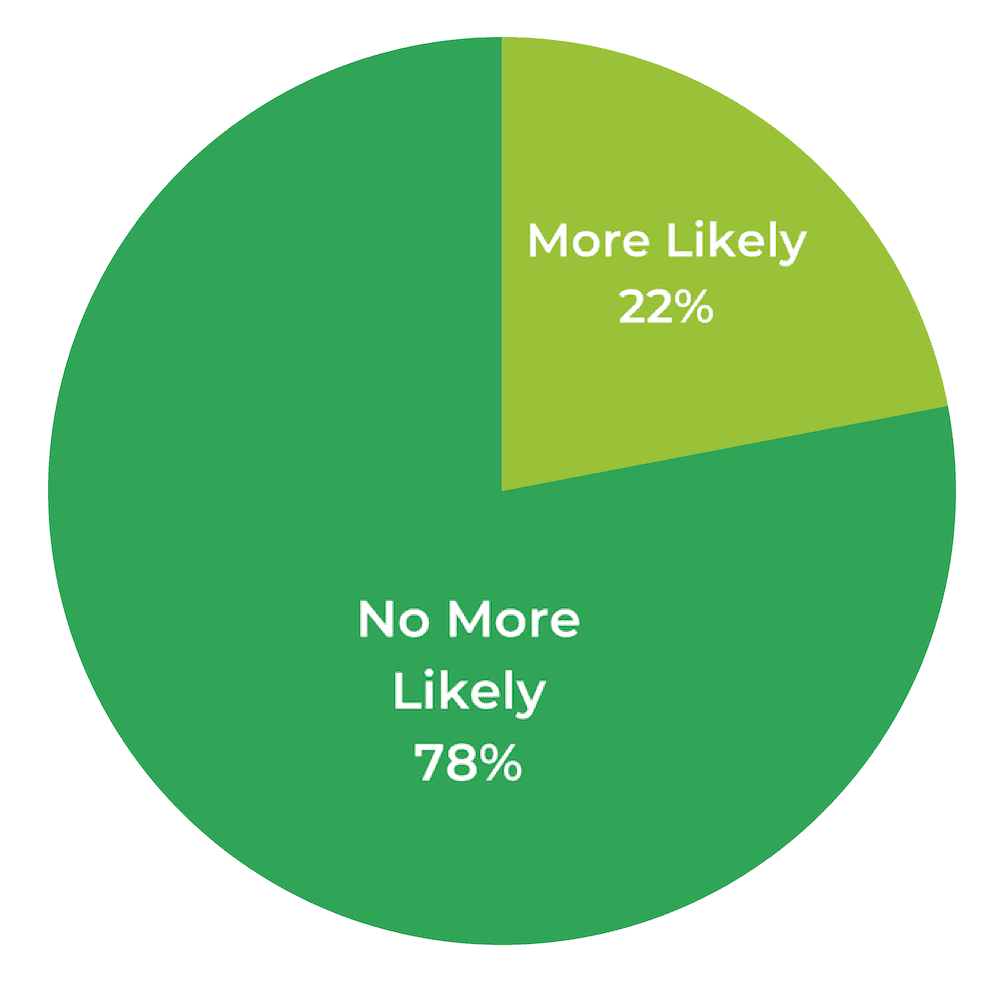

Impact of pricing

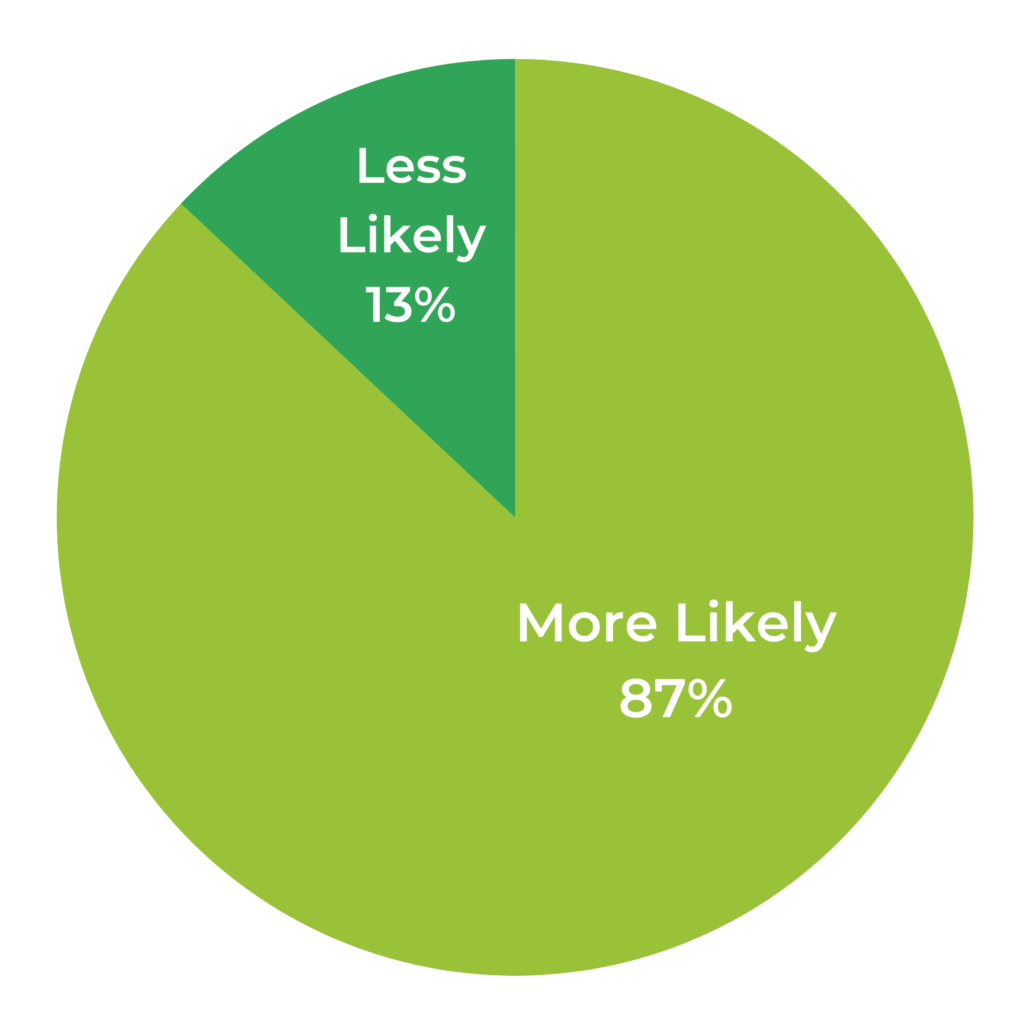

We wanted to explore whether product price point has an impact on the likelihood to submit review content. We know more expensive products typically require higher buyer consideration, so we wanted to see if this was reflected in motivation to submit reviews.

Our results show that price does not have a notable impact on review submission likelihood. In fact, around eight in ten respondents explicitly stated this to be the case.

However, the sweet spot for actual review generation by price point is – according to our results – between $6 and $50. Fewer consumers have left product reviews at the higher ranges ($101+) but this can be explained simply by fewer purchases at this level.

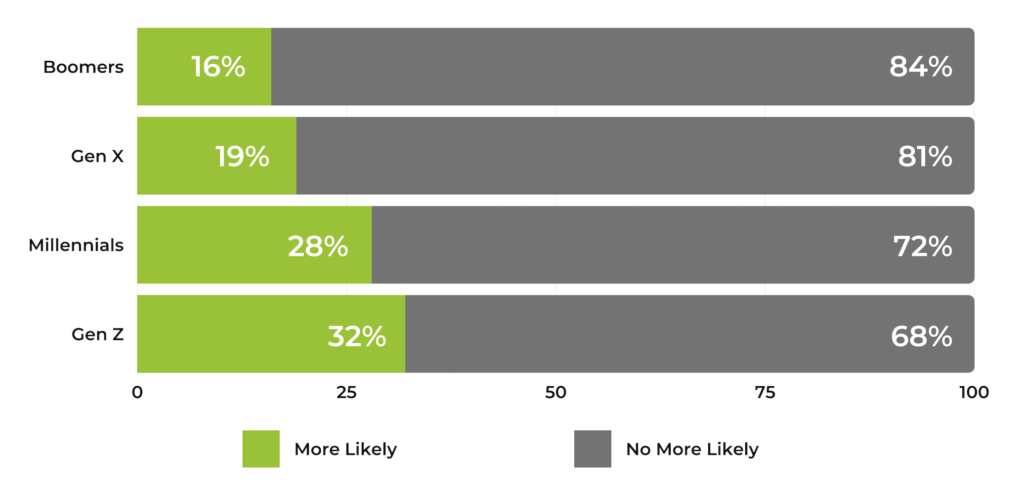

(Generation comparison)

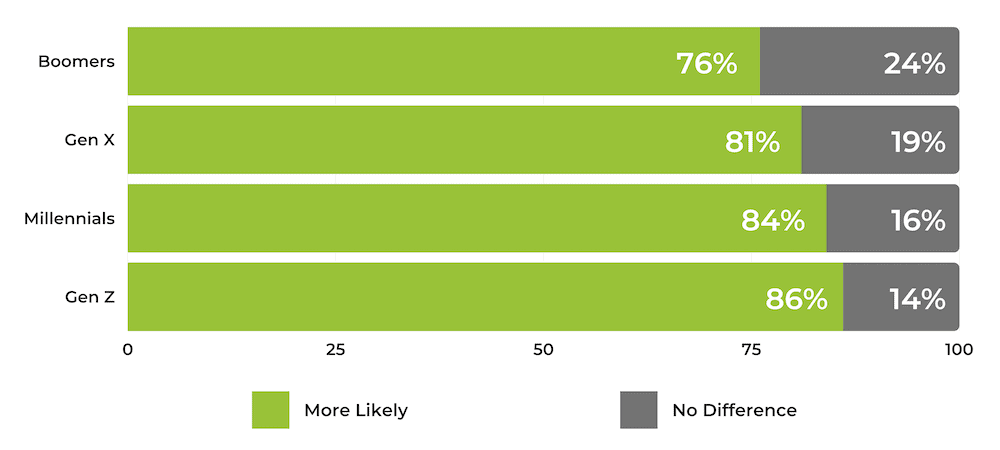

Younger generations are clearly more compelled to provide a rating and review as the price of the product increases. In fact, 32% of Gen Zers say this has an impact (compared to 28% of Millennials, 19% of Gen Xers and 16% of Baby Boomers).

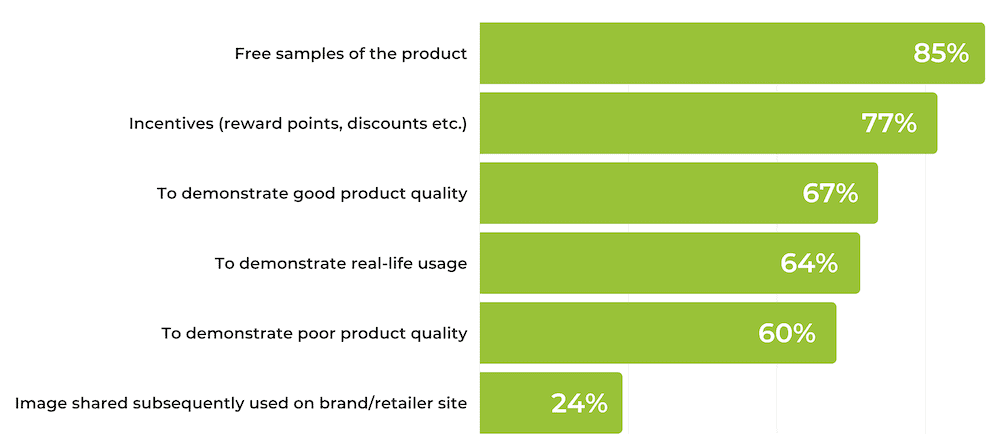

While ratings and reviews are the bread and butter when it comes to UGC, they are also just a piece in a bigger overall puzzle. A best practice UGC strategy will also include many other elements, such as imagery and video.

As we outline above, data from across more than 1,000 brand and retailer websites we work with highlights how website visitors who interact with imagery are 81% more likely to convert than those who don’t.

This is why many brands and retailers incorporate visual media – either collected within the review itself or on social media – throughout their digital experiences (i.e. on their product pages, category pages, homepages, in email marketing and within social media campaigns etc.). It’s proven to drive purchases.

With this being such an impactful and important element, we wanted to see what makes shoppers feel compelled to leave this specific type of content.

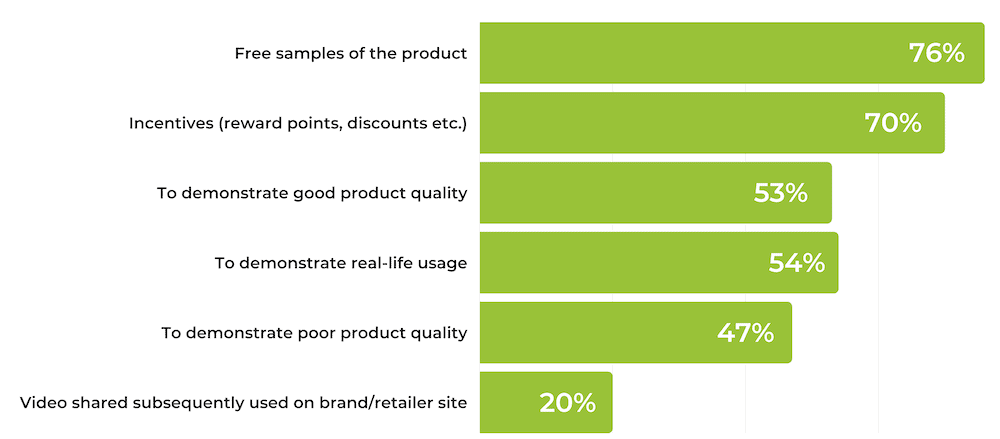

Visual media within reviews

Incentivizing consumers to submit images and videos within their reviews is clearly – according to our survey results – the single most likely factor to drive this outcome.

Again, however, it’s impossible to ignore product quality and demonstration of real-life use cases as a motivator (the main reasons visual media has such an impact on conversions).

There is simply no hiding place for a product perceived to be poor quality when it comes to UGC.

With respect specifically to product quality, this can be managed by appropriately setting expectations up front – primarily through messaging/positioning and pricing. Outlining any features that have potential to be perceived as weaknesses and then adjusting price as necessary goes a long way.

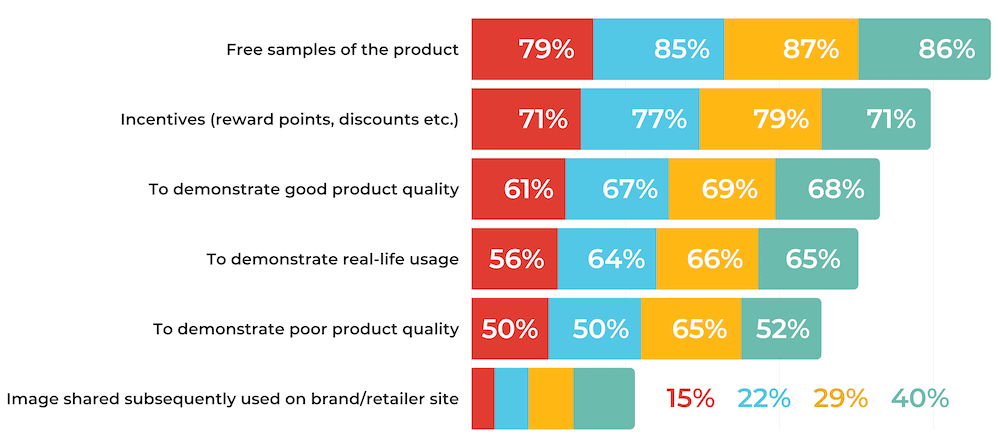

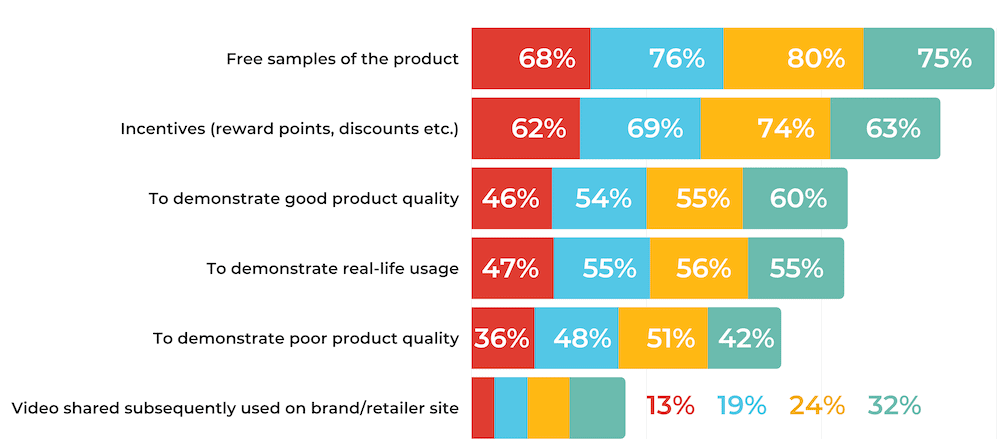

(Generation comparison)

(Generation comparison)

Baby boomers are the least compelled to share user generated imagery and video overall.

The percentage figures for the reasons more senior generations would share this type of content are consistently lower than younger respondents – which highlights a relatively less appetite to submit it.

As mentioned, incentives to submit imagery and video are big motivators regardless of age. But the biggest age-related difference in what compels consumers to provide this content is whether a brand subsequently shares it.

The trend is clear. The younger the consumer, the more this excites them. 32% of Gen Yers say they are motivated to provide product video content if it’s shared by the brand (40% of Gen Yers say the same for imagery), compared to 13% of Baby Boomers (15% say the same for imagery).

This is perhaps unsurprising given the popularity of visual social-media focused platforms like Instagram, TikTok and so on among this demographic.

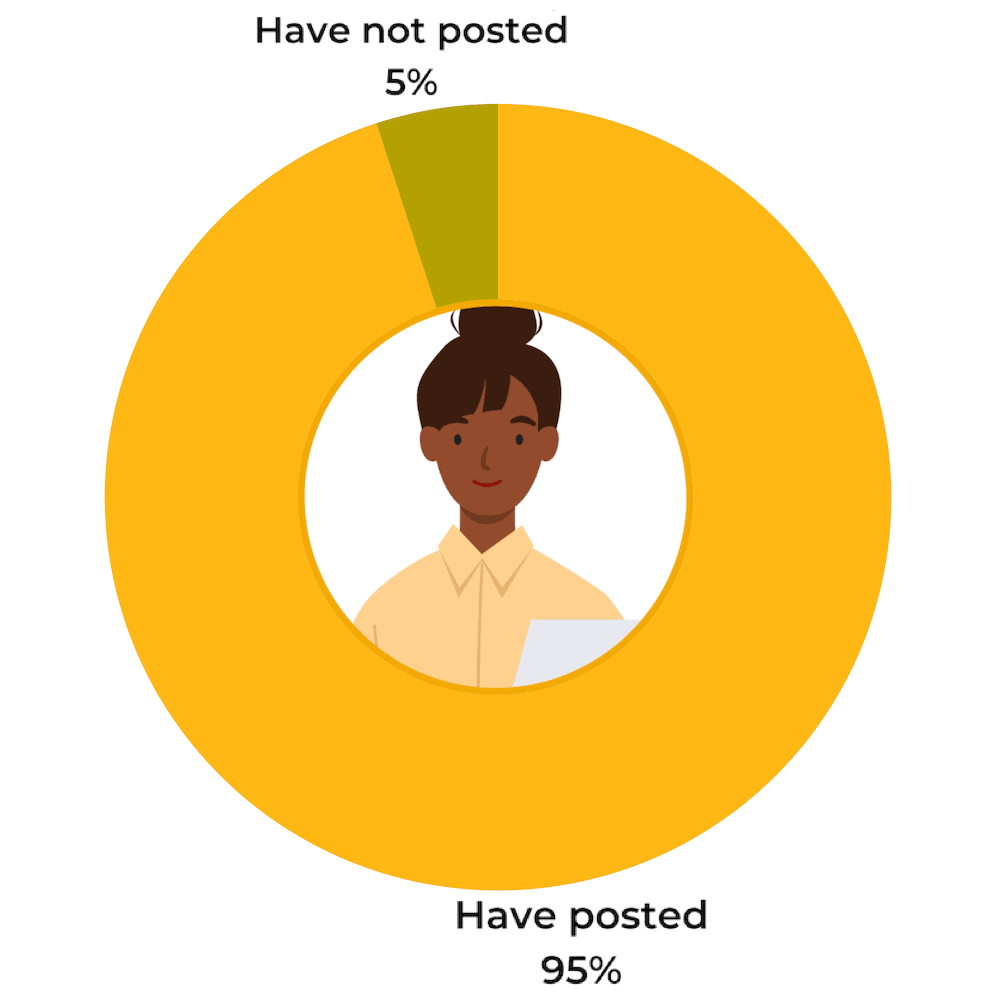

Posting about products on social media

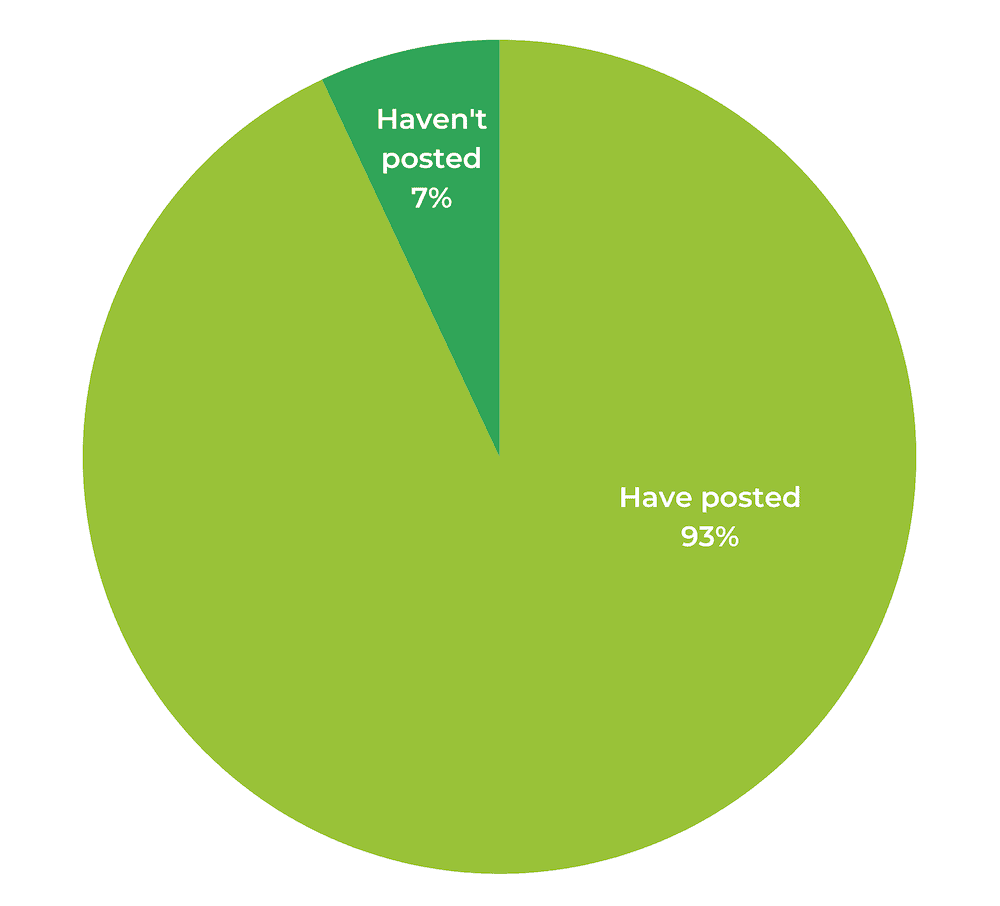

Nearly all the consumers we surveyed have posted about product experiences on social media.

However, why they are motivated to do so is slightly different to the reasons they provide imagery and videos within review content – with product and brand experience typically being the primary factor. This is demonstrated with 80% saying they do so to express gratitude (for a good experience) and 70% to help and guide others.

(Generation comparison)

(Generation comparison)

Similar to the trends identified directly above, the engagement element of social media really inspires younger generations to share content there about your brand.

Customer questions and answers on product pages are a tactic used by many brands and retailers to address consumer concerns. Essentially, both the questions and answers can be customer or brand-submitted but their purpose is to get right to the heart of known barriers to purchase.

And this content is really effective: as we highlight above, consumers who interact with Q&A content are 153% more likely to convert than those who don’t. This makes it the single most impactful type of UGC.

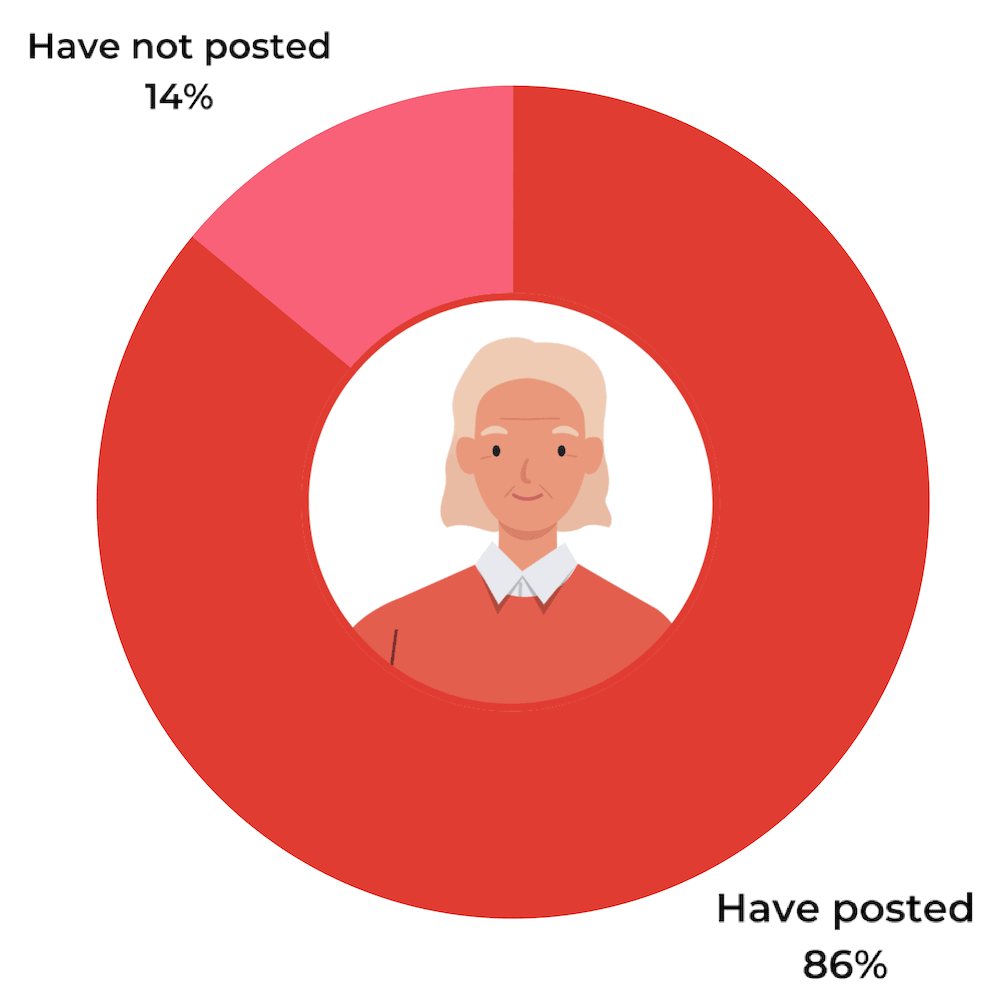

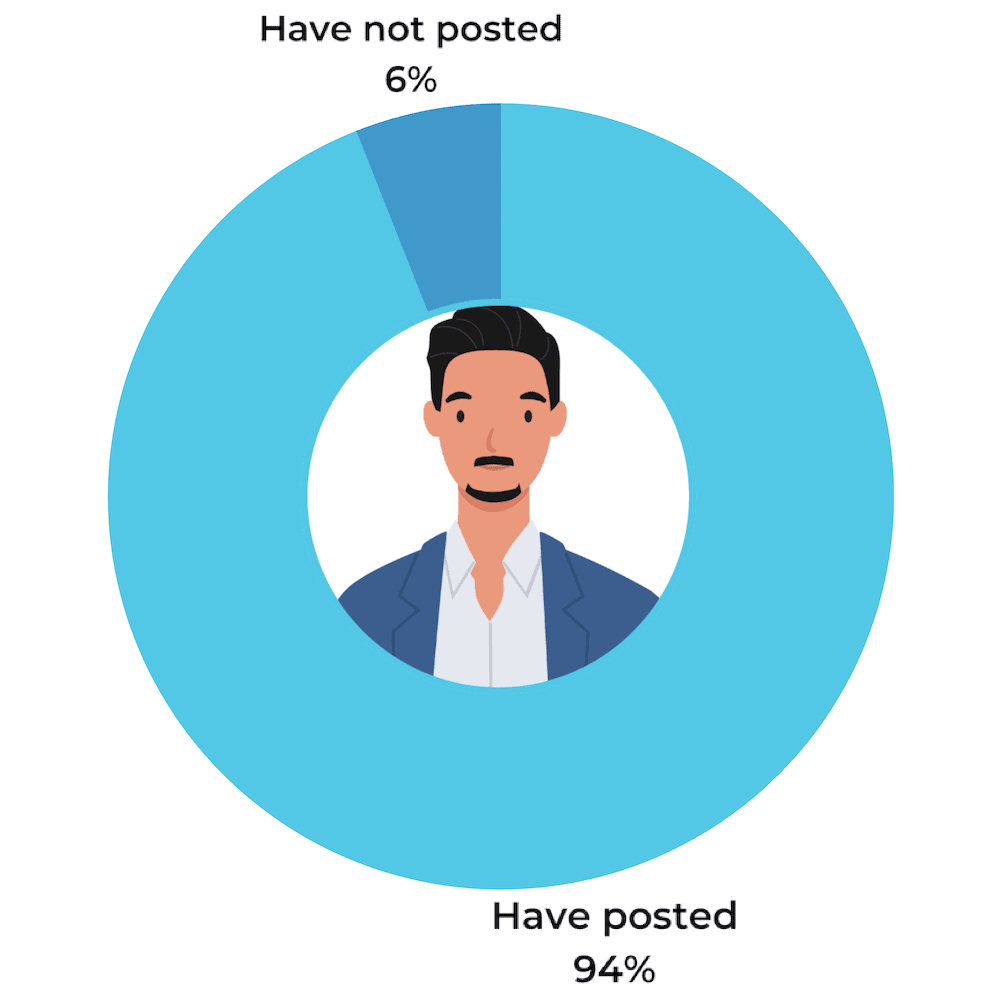

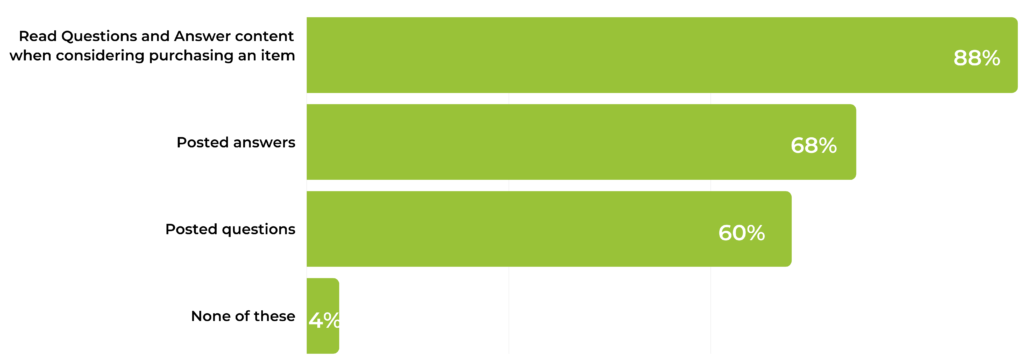

Our survey results reiterate the importance of Q&A content. Almost nine in ten consumers have read Q&A on product pages as they consider a purchase decision. Fewer have posted this content, but a healthy volume of shoppers claim to have done so.

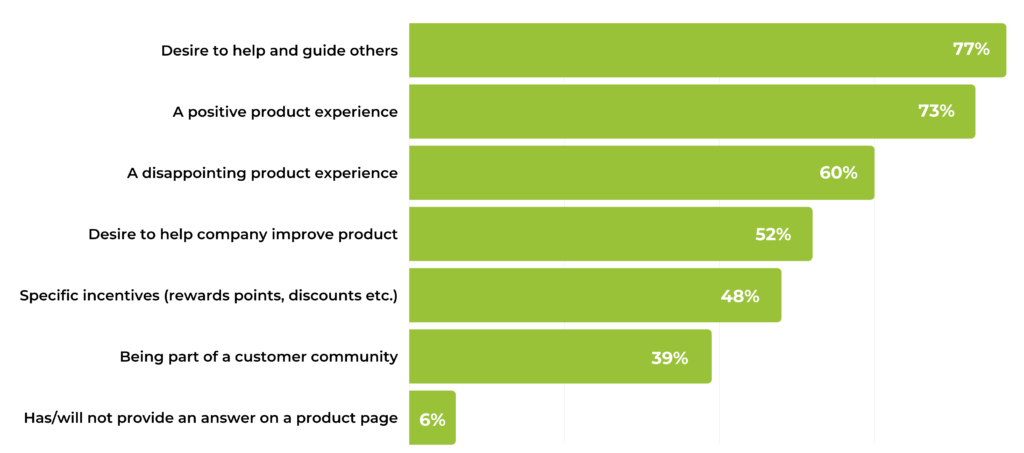

As with visual media, the main motivation for submitting either questions or answers is a desire to guide others in the event of either a positive or negative product experience. However, the fact that more than half do so to improve the product highlights strong personal brand attachment and investment.

Critically, consumers are very open to providing Q&A content. Only 6% are not (which – to state the obvious – means 94% are). So there is a definite opportunity to tap into this appetite for brands and retailers.

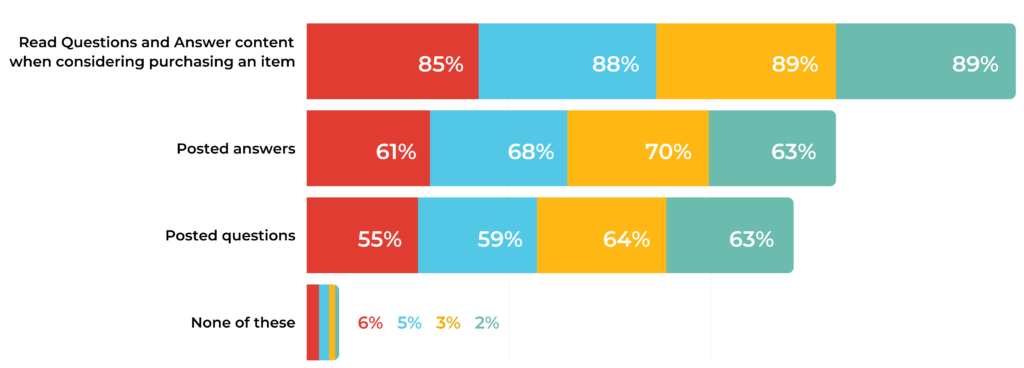

(Generation comparison)

(Generation comparison)

Similar themes evident throughout the rest of the survey are clear in responses to the questions we asked around Q&A content. Again, younger generations are motivated mostly by a desire to help and guide others in their purchase decisions.

In addition, 52% of respondents submit Q&A content to guide product development. The same figure for ratings and reviews is 65%. What this means: above and beyond it’s obvious conversion power, you should also look for the analytics value of this content. It’s a highly valuable form of customer feedback that can be used to drive tangible business improvements. To find out more about how to analyze your UGC, check out our Guide.

There’s no getting away from it: consumers are most likely to provide review content if they are incentivized to do so. Offering a free sample of the product is the single most effective way to generate a ton of fresh UGC.

Ultimately, the UGC you generate is a reflection of the quality of your products. However, you should do everything you can to manage expectations up front by educating shoppers with accurate product descriptions and imagery.

Not only does the overall experience your product delivers need to be great, it needs to be great from the very first use. The overwhelming majority of consumers leave a review within the first week of receiving the item, often after a single use.

Q&A and user-generated video and imagery is extremely impactful in providing buyer confidence and driving sales online. And your ability to generate this content is dictated more by a great experience than ratings and reviews (which, as we explain, relies more on incentives). A best-in-class UGC program will incorporate all these elements.

Sure, the primary reason you have a UGC program is to create buyer confidence at the moment of truth. But it also includes a goldmine of customer feedback that can significantly help improve your product experience, customer experience and overall marketing and messaging efforts. Make sure you make use of this insight to drive your business forward.

Different generations clearly have slightly different preferences and motivations to provide UGC. If you have products focused on different age groups or are able to segment your database by generation, consider adapting the nature of your collection outreach and requests.

Throughout the survey, we defined Baby Boomers as born in the years 1946 to 1964 (aged 56 - 74 on Dec 31, 2020), Gen X as born in the years 1965 to 1980 (aged 40 - 55 on Dec 31, 2020), Millennials as born between 1981 - 1996 (aged 23 - 38 on Dec 31, 2020) and Gen Z born in or after 1997 (ages 22 and younger on Dec 31, 2020).