Survey at a Glance:

The PowerReviews Meeting Beauty Shopper Digital Expectations in a Post-Pandemic World study is based on survey responses from 11,115 beauty shoppers across the United States (and is an update of our 2021 study, The Changing Face of the Beauty Shopper). Here’s a look at our key findings.

- This year, nearly half (49%) of consumers say they buy more beauty products online now than they did prior to COVID, down just slightly from 53% in 2021.

- The most popular place for online shoppers to begin the search for beauty products is a beauty retailer’s website (such as Ulta.com or Sephora.com); 58% say it’s their preference. Amazon is a distant second, with 19% of shoppers indicating it’s where they typically begin shopping for beauty products online.

- Brick-and-mortar continues to thrive, with 97% of shoppers purchasing at least some beauty products each month in-store.

- When purchasing a habitual product, 96% of consumers are at least somewhat likely to also purchase a new-to-them product.

Over half of consumers (52%) are more likely to try a new beauty product now than pre-COVID, up from 40% in 2021. - The most popular destination for purchasing unknown beauty products is a specialty retailer’s website; 36% say it’s where they typically go to buy new-to-them products.

- 92% of consumers say that reviews are a factor they consider when accessing a new beauty product they’ve never purchased before. This is up significantly from 74% just a year ago.

- Nearly all shoppers (99%) read reviews at least sometimes when shopping online for beauty products. This is the case for 85% of consumers shopping in-store for beauty products.

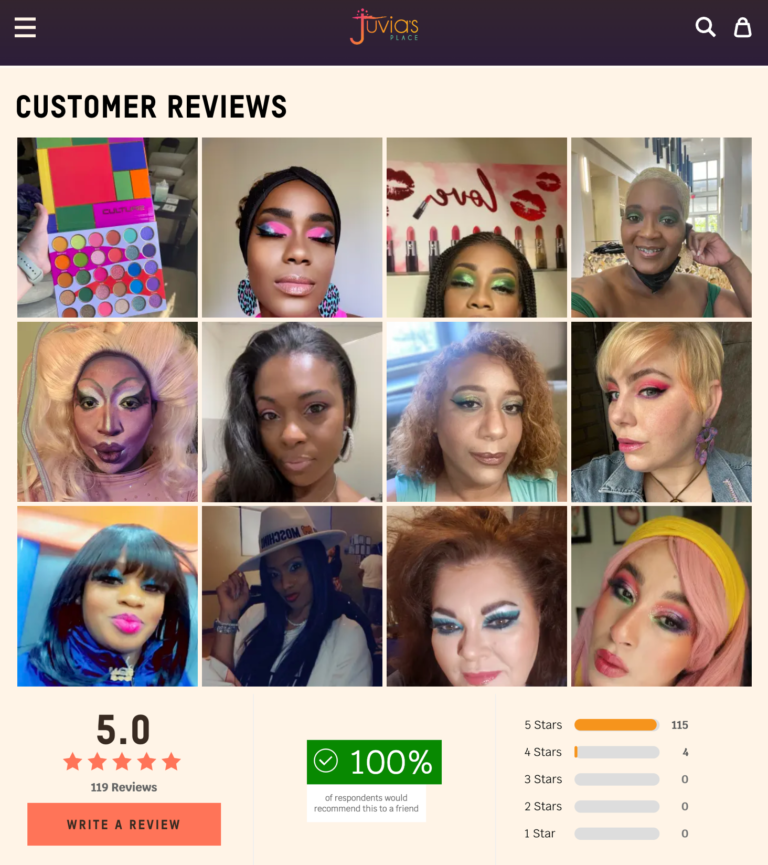

- 96% of consumers look for photos and videos from other consumers when shopping for beauty items online; 33% always do so.

- 98% of those shopping for beauty products online read Q&A at least sometimes; 70% do so regularly or always.

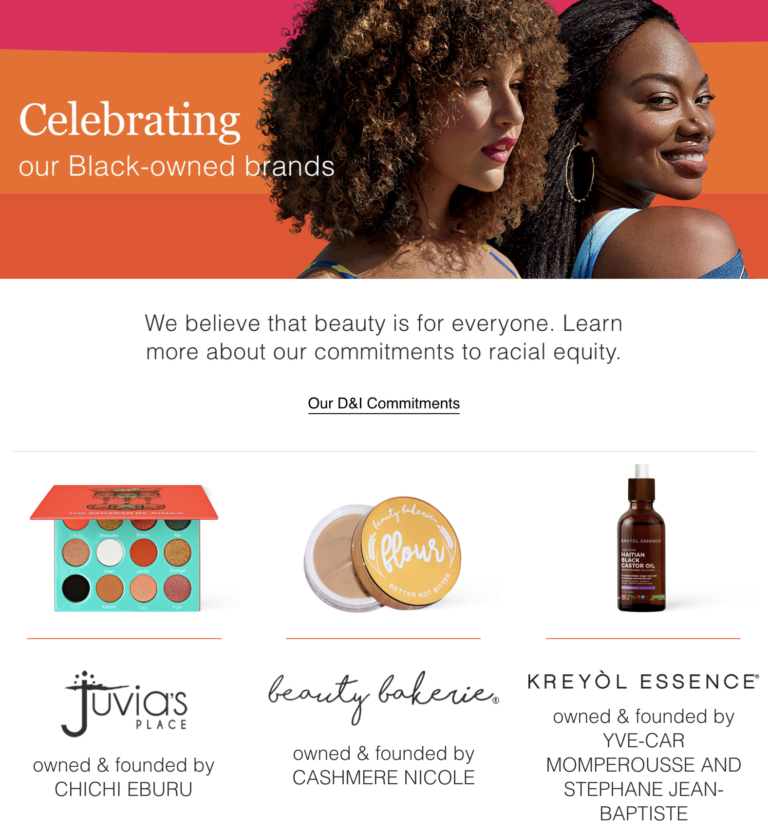

- 34% of shoppers say it’s at least somewhat important to them that a beauty brand is Black-owned. And 46% plan to specifically purchase products in the future that are made by Black-owned beauty brands.

- 85% of consumers indicate it’s at least somewhat important to them that a beauty product is made sustainable with natural ingredients (aka “clean”). 71% have plans to seek out and purchase more of these products in the future.

- The fact that a beauty product is vegan is at least somewhat important to 51% of shoppers. 42% plan to purchase more vegan beauty products in the future.

Contents

Introduction

COVID’s Impact on Beauty Shopping Habits is Lasting

Not long ago, the vast majority of beauty purchases were made in brick-and-mortar stores. There, shoppers had the opportunity to get recommendations from sales associates – and try out products prior to purchase.

Then, consumers started getting comfortable purchasing beauty items online, leading to steady growth of beauty ecommerce. When the pandemic hit, that growth went into overdrive.

What do consumers’ beauty shopping habits look like now that we’re over two years into the pandemic? Recently, we surveyed more than 11,000 consumers in the U.S. to find out.

Who We Surveyed

This report is based on a survey completed by 11,115 US consumers during April 2022. Here’s a closer look at who we surveyed.

Generations

(1997-present)

(1981-1996)

(1965-1980)

(1946-1964)

Type of Beauty Shopper

Household Income

Total (Online and In-Store) Monthly Beauty Spend

The Lasting Impact of COVID on Beauty Habits

Last year, over half of consumers (54%) indicated they wore less makeup than they did prior to the pandemic. This year, just over a third (38%) say this is the case. This makes sense, as consumers are venturing out more than they did a year ago – and are more likely to use makeup when going out than when staying home.

Interestingly, the percentage of consumers who focus more on skincare has grown. This year, 63% say they focus more on skincare than they did pre-COVID, compared to 56% who said this was the case a year ago.

COVID Impact on Beauty Spending Decreasing

This year, 27% of consumers say they spend less on beauty products now than they did pre-COVID – down significantly from 41% in 2021. Similarly, 25% say they spend more on beauty products, up from 21% who said this was the case in 2021.

Interestingly, beauty brand loyalists are most likely to have decreased their spending on beauty products post-COVID. Beauty enthusiasts are the group most likely to have ramped up their beauty spending post-COVID.

Beauty Spending Across Channels

At the start of the pandemic, many shoppers started spending more money online – and less in-store. This was the case across many categories, including beauty.

More than two years later, where are shoppers spending their beauty budgets?

COVID-Influenced Online Beauty Spending Habits are Holding

This year, 49% of consumers say they buy more beauty products online now than they did prior to COVID, despite widely available vaccines and a general desire to return to “normal life.” This is down just slightly from last year.

It seems that online beauty shopping habits established at the start of the pandemic are here to stay.

As was the case last year, consumers with higher incomes are more likely to indicate they spend more money online on beauty products now than they did prior to the pandemic.

Many consumers have ramped up their online beauty spending. But what does this translate to in terms of actual dollars spent?

In line with last year, the largest portion of shoppers (42%) spend between $1 and $50 online each month on beauty products. However, a significant portion spend between $51 and $100 (28%) and over $101 (24%).

A Growing Portion of Online Shoppers Start Shopping on a Beauty Retailer’s Website

Beauty retailer sites – such as Ulta.com and Sephora.com – remain the most popular starting point for online beauty shoppers. This year, 58% of consumers most commonly start the online purchase journey for beauty products on a beauty retailer site, up from 44% in 2021.

Amazon continues to be less popular among beauty shoppers. This year, 19% indicate they most often begin shopping for beauty products on the ecommerce giant, down from 22% in 2021.

Amazon is often perceived as unbeatable. But by providing engaging experiences to online beauty shoppers, it’s clear brands and retailers can compete, and win.

In-Store Beauty Shopping is Alive and Well

Beauty ecommerce continues to grow. However, that doesn’t mean in-store beauty shopping is a thing of the past.

This year, the largest portion of consumers (52%) spend between $1 and $50 each month on in-store beauty purchases. However, the majority spend between $51 and $100 (28%) and $101+ (17%).

It’s clear brick-and-mortar stores continue to be valuable to beauty shoppers. In fact, as we’ll explore later, physical stores are a destination for many beauty shoppers, whether they’re stocking up on tried-and-true items or looking to try something new.

The Growing Role of User-Generated Content in Beauty Shopping

By now, the importance of user-generated content across all product categories is quite clear. But how are beauty shoppers leveraging UGC to make better purchase decisions?

Beauty Shoppers Value Many Forms of User-Generated Content

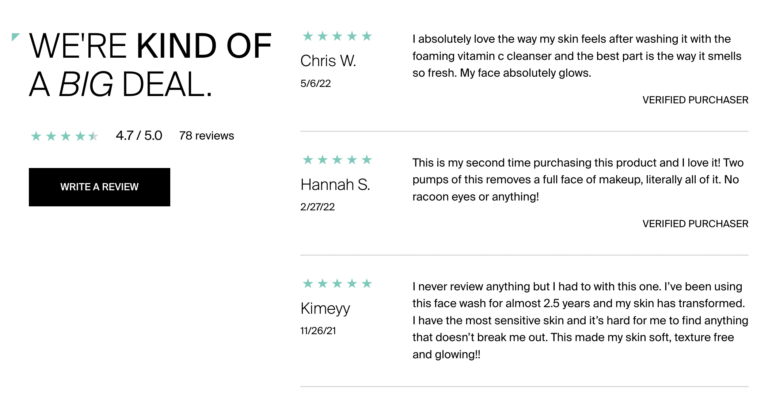

User-generated content can take many forms – from star ratings to written reviews to photos and videos – among others.

Which of these forms of UGC do beauty shoppers pay attention to?

Ratings are the top consideration; three-quarters of beauty shoppers indicate they pay attention to a product’s average star rating. A customer’s opinion on specific extra details relevant to the product (aka the body of a review) are a close second, with 74% of beauty shoppers telling us this is something they pay attention to.

A good portion of beauty shoppers also pay attention to review volume (68%), review recency (54%), customer-submitted photos (52%) and videos (25%), and customer-answered questions and answers (50%).

What types of information do beauty shoppers hope to find by reading reviews and consuming other types of UGC?

Now, let’s take a closer look at the types of UGC consumers turn to to get the information they need to make confident beauty purchases.

Online Beauty Shoppers Depend on Reviews

Consistent with last year’s findings, nearly all (99%) of consumers read ratings and reviews at least sometimes when shopping for beauty products online. 60% do so always, up from 54% last year.

Of note, Millennials and Gen Z’ers are more likely than their more senior counterparts to always read reviews when shopping for beauty products online.

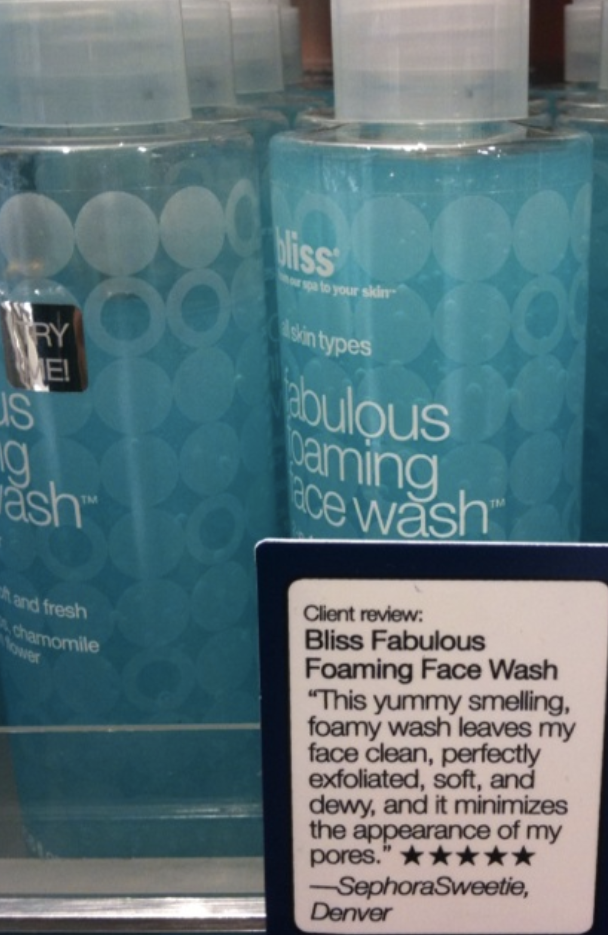

Beauty Shoppers Consult Reviews In-Store, Too

Reviews are also important for those making beauty purchases within the four walls of a brick-and-mortar store. 85% of beauty consumers read reviews at least sometimes when shopping in-store; 30% always do.

Younger consumers are even more likely to always consult reviews when shopping for beauty products in a physical store.

Beauty Shoppers Value Visual Content

Beauty products work differently for different people. For example, a moisturizer that works well for those with dry skin might not meet the needs of those with oily skin.

When shopping online, it can be difficult for a shopper to determine whether a given product will address their specific needs. However, finding photos and videos from other consumers with similar characteristics can help.

Nearly all (96%) of consumers seek out photos and videos from other consumers when shopping for beauty items online. A third (33%) always do so.

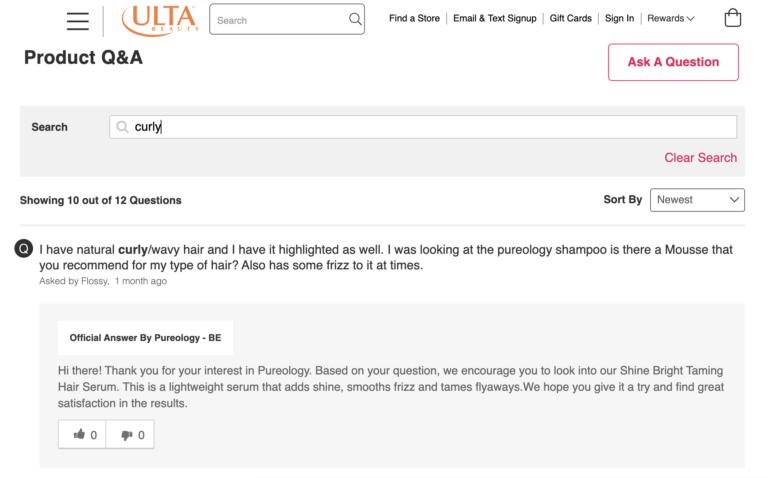

Online Beauty Shoppers Depend on Q&A

When a consumer is shopping for beauty products in a brick-and-mortar store, they have the opportunity to consult with a store associate to ask questions and get recommendations. That’s not the case for online beauty shoppers.

To bridge the gap, many brands and retailers have a questions and answers (Q&A) section on product pages that allow shoppers to read questions that have already been asked – and submit their own.

Today, the vast majority (98%) read Q&A at least sometimes; 70% do so regularly or always.

Younger shoppers are particularly frequent users of Q&A. Over a third (35%) of Gen Z’ers and 31% of Millennials always read Q&A when shopping online for beauty products.

Where & How Shoppers Purchase Tried-and-True Beauty Products

Most beauty shoppers have certain products they buy time and again. Maybe it’s a facial cleanser they’ve used for years or a mascara they know works great. Let’s explore where (and how) consumers are stocking up on their tried-and-true beauty products.

Beauty Retailer Websites Most Popular Destination for Stocking Up on Familiar Products; Amazon and Mass Retail Store Popularity in Decline for These Products

Consumers have many options when it’s time to replenish their go-to beauty products. Where are they most likely to buy?

Specialty beauty retailers’ websites continue to gain traction. This year, the largest portion of consumers (35%) turn to a website such as Ulta.com or Sephora to restock on their favorite beauty items. This is up significantly from 22% in 2021.

As above where we ask beauty shoppers where they start their online shopping journey, Amazon is a distant second – with 16% of consumers saying it’s where they typically purchase familiar beauty items.

In addition, a significant portion of shoppers are stocking up on their favorite beauty items in-store. 15% say they typically purchase beauty products they’ve already tried at a special beauty retailer’s store (such as Ulta or Sephora), and 13% indicate mass retailer stores like Target and Walmart are their go-to for replenishments.

Beauty Shoppers Cite Many Reasons for Choosing the Channels They Do

We know where consumers are going to stock up on tried-and-true beauty products. But what’s the reason they choose one channel over another? There’s not a single factor behind a shopper choosing a specific channel to purchase known products. Rather, it’s the overall experience provided by that channel.

Consumers are Likely to Purchase New (to Them) Beauty Products Alongside Habitual Items

When beauty shoppers are stocking up on their favorites, do they simply grab what they need – and then head to the checkout?

Not always.

Nearly all (96%) of consumers say that when they’re purchasing a habitual beauty product, they’re at least somewhat likely to also buy a new product within the same purchase – up slightly from last year. Nearly half (43%) indicate they’re very likely to do so.

The likelihood of purchasing a new beauty product alongside a tried-and-true one is particularly high among those who identify as beauty enthusiasts. Half (50%) of those in this group say they’re very likely to do so, compared to 21% of beauty brand loyalists and 24% of beauty novices.

In addition, younger consumers are more likely to add a new (to them) beauty product to the same shopping basket as a tried-and-true product. 53% of Gen Z’ers and 47% of Millennials indicate they’re very likely to do so, compared to 39% of Gen X’ers and just over a quarter (26%) of Boomers.

How Consumers Discover and Buy New-to-Them Beauty Products

While there are certain beauty products consumers purchase time and again, many are also open to trying out new products.

Consumers are Very Open to Buying New-to-Them Beauty Products

For many consumers, the willingness to try new products has increased since the start of the pandemic.

Today, over half (52%) of consumers say they’re more likely to try a new beauty product now than pre-COVID. This is up significantly from last year, when 40% of consumers felt this way.

In fact, new beauty products account for a significant portion of consumers’ beauty spending – whether they’re shopping online or in a brick-and-mortar store.

A third of shoppers say that new (to them) beauty products account for 26-50% of their online beauty spending. Another third indicate new products make up 1-25% of their total online beauty spending.

New products make up a significant portion of physical shopping baskets, too. The largest portion of shoppers (39%) say that between 26% and 50% of the beauty products they purchase in a brick-and-mortar store are items they’ve never tried before.

Specialty Beauty Retailer Website are the Top Destination for Consumers Purchasing New-to-Them Beauty Products

Consumers are spending a significant chunk of their beauty budget on products they’ve never purchased before. Where are they most often going to buy these unknown items?

A common theme running through our survey results, the most popular place to purchase an unknown beauty product is a specialty beauty retailer’s website. Over a third (36%) of consumers indicate this is where they typically go to buy new-to-them beauty products, up from 24% who said this was their go-to in 2021.

Amazon and specialty beauty retailer stores are tied for second, with 14% indicating each of these places is where they typically go to buy new beauty products. Brand websites – such as benefitcosmetics.com and glossier.com – are close behind, with 12% of consumers indicating these types of websites are where they go to purchase products they’ve never tried before.

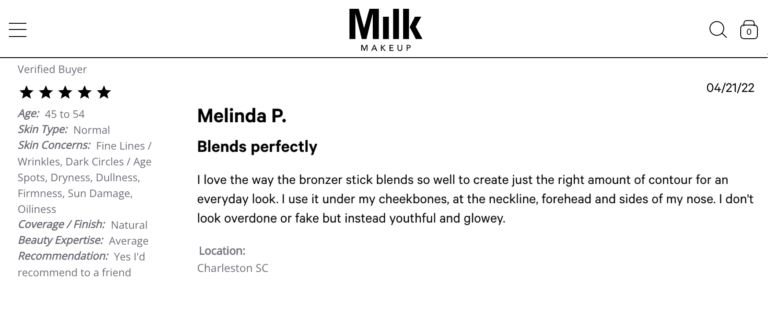

Reviews Give Shoppers Confidence to Purchase New Products

If a consumer purchases a habitual product, they know exactly what to expect. However, when they venture out to try a new-to-them product, there’s a certain amount of risk involved. This is especially true when they’re shopping online and don’t have the opportunity to see and try out a product before making a purchase.

However, there are certain factors that boost their confidence – and their likelihood to give a new product a try. Chief among them? Product reviews.

Nearly all (92%) of consumers say that reviews are a factor they rely on for information when accessing a new beauty product they’ve never purchased before – up significantly from 74% in 2021.

In fact, the top five factors that consumers consider most when purchasing new beauty products have remained the same year-over-year. However, it’s interesting to note that the percentage of consumers who rely on each factor has increased significantly.

How Influencers Impact Consumers’ Beauty Purchases

For many beauty brands, influencer marketing is becoming a growing line item in the budget. According to a report from Influencer Marketing Hub, more than three-quarters of brand marketers plan to dedicate a budget to influencer marketing this year. In fact, the influencer marketing industry is expected to grow to $16.4 billion in 2022.

But how much of an impact do influencers have on beauty shoppers?

Younger Shoppers are More Swayed by Influencers

Overall, 61% of consumers indicate they’re swayed by the influencers they follow to buy beauty products, up from 56% last year. Millennial (68%) and Gen Z (74%) shoppers are even more likely to be swayed by beauty influencers.

Beauty enthusiasts are particularly swayed by influencers, when compared to beauty brand loyalists and beauty novices. This makes sense, given they are generally more willing to try new products.

Beauty Shoppers Trust Their Favorite Influencers

It’s easy to assume that beauty shoppers place more trust in influencers with a large following. But is this actually true?

Not for the majority of beauty shoppers.

Over half (53%) of shoppers say they trust the influencers they’re loyal to – no matter their follower count. 12% indicate they trust micro-influencers (those with less than 100,000 followers) the most, while a mere 6% say they trust macro-influencers (those with more than 100,000 followers) the most.

The remaining 28% indicate they are more willing to trust beauty suggestions from people they actually know. Across the board, these percentages remain largely unchanged from last year.

How Shoppers’ Values Influence Their Beauty Purchases

Consumers weigh a number of factors when purchasing beauty products, including price, brand, quality and ease of use – among others. But these days, many shoppers also seek out beauty brands and products that align with their values.

In addition, 46% of shoppers say they specifically plan to purchase products in the future that are made by Black-owned beauty brands, down slightly from 50% a year ago. Again this year, younger shoppers are more likely to indicate they have plans to purchase from Black-owned beauty brands.

Of note, beauty enthusiasts are significantly more likely to have plans to support Black-owned beauty brands in the future, when compared to beauty loyalists and beauty novices. This makes sense, as in general, beauty enthusiasts are more willing to experiment and try out new products.

Clean Beauty Matters to the Majority of Shoppers

The environment is a serious concern for many. At the same time, many consumers are starting to pay more attention to what they put in and on their bodies.

So perhaps it’s not surprising that the vast majority – 85% – of consumers indicate that it’s at least somewhat important to them that a beauty product is “clean” – in other words, made sustainably with natural ingredients.

Interestingly, Boomers are the generation most likely to say that “clean” beauty is important to them when making a purchase.

The “cleanliness” of a beauty product is something that matters to a lot of customers. But do they have plans to specifically seek out and purchase sustainably-made products?

71% say they do, down slightly from 76% when we asked this question in 2021. Interestingly, this percentage is even higher among Gen Z (76%) and Boomer (75%) shoppers.

Beauty Shoppers Value Vegan Products

These days, a growing number of consumers are focused on animal rights. And many make it a priority to avoid animal products altogether.

Overall, 51% of consumers say that it’s at least somewhat important to them that a beauty product is vegan. This number is even higher among Gen Z and Millennial shoppers.

Consumers say vegan beauty is important to them. But do they have plans to seek out and purchase more of these types of beauty products in the future?

Overall, 42% say yes. Gen Z’ers are the generation most likely to indicate they’re planning on purchasing more vegan beauty products in the future.

In addition, beauty enthusiasts are the type of shopper most likely to say they plan to buy more vegan beauty products in the future. Again, this is likely because beauty enthusiasts are, in general, more open to trying new products.

7 Key Takeaways for Beauty Brands & Retailers

The way consumers shop for beauty products online and in-store is evolving – and will continue to do so. To remain competitive, beauty brands and retailers must understand the ever-changing needs and preferences of shoppers – and then adapt their strategies to meet them.

Here are 7 key takeaways from our research of the habits of modern beauty shoppers.

When COVID hit, many consumers shifted their beauty spending online. If the data is any indicator, this habit is one that seems to be sticking around. This year, just under half (49%) of consumers told us they buy more beauty products online than they did prior to the pandemic. Although this is down just slightly from the year prior, it’s a highly significant percentage.

Clearly, consumers have embraced the convenience of browsing and buying beauty products online. Brands and retailers must make it a top priority to deliver engaging online shopping experiences – or risk losing shoppers to a competitor that does.

Though many beauty shoppers are spending more online than they did pre-pandemic, brick-and-mortar continues to be important.

Today, nearly all (97%) consumers spend at least some of their monthly beauty budget in a brick-and-mortar store. And nearly half (45%) spend over $50 online each month on beauty products.

Of course, it’s important to invest in digital. But brick-and-mortar stores should contribute to a compelling and channel blended experience.

Most consumers have tried-and-true beauty products they purchase time and time again. However, many are also open to giving new products a try.

Just over half (52%) of shoppers are more likely to try a new beauty product today than they were pre-COVID. And many tell us they’re likely to buy habitual and new-to-them products within the same transaction.

Consumers weigh myriad factors when deciding whether to purchase an unknown product, but one rises to the top. A staggering 92% of consumers say reviews are a factor they consider when deciding whether to purchase a new (to them) product.

It’s essential to generate plenty of reviews for newly launched or lesser known products. This content will boost shoppers’ confidence – and the likelihood they’ll buy.

Modern consumers depend on user-generated content to make informed purchase decisions – whether they’re shopping online or in-store.

Nearly all (99%) of consumers read reviews when shopping online at least sometimes, and 85% do so when shopping in a physical store location. In addition, 96% seek out visual content from other shoppers, and 98% read Q&A.

The presence of this content gives shoppers the confidence to make a purchase. Make it a priority to generate plenty of user-generated content. Then, showcase this content so it’s easy for shoppers to find, whether they’re browsing from home on a computer or in a store on a mobile device.

Factors like price and packaging still matter. However, a growing number of consumers pay attention to whether a product or brand aligns with their values – and they seek out those that do.

Specifically, we found that many consumers plan to seek out and purchase beauty products that are made by Black-owned brands, as well as those that are clean and vegan.

Showcase what’s unique about your brand or products so consumers can quickly determine whether it aligns with their values. For example, a beauty retailer might add sections to its website that make it easy for shoppers to find products that are from Black-owned brands, as well as those that are clean and vegan.

61% of consumers are swayed by the influencers they follow to purchase beauty products. However, a greater following doesn’t necessarily equate to greater influence. Over half (53%) of beauty shoppers indicate they trust their beloved influencers – no matter how many followers they may have.

Consider leveraging micro-influencers who love your brand and products. One way to do this is to send samples to these influencers, and in exchange, ask them to write a review or post a photo on their Instagram account. This content will help future shoppers make more informed purchase decisions.

Nearly all beauty shoppers seek out user-generated content, whether they’re shopping online or in-store. So brands and retailers must make it a priority to collect and display more of this content if they expect to attract and retain shoppers.

When developing your UGC collection and display strategies, best practices (especially those for the beauty industry) are a great place to start. However, all businesses are different. As such, it’s essential to continuously measure the performance of your UGC program – and use those insights to make changes that’ll garner an even bigger ROI.