Survey at a Glance:

The State of Apparel & Footwear Shopping in 2022 study is based on survey responses from 11,862 beauty clothing and footwear shoppers across the United States. Here’s a look at our key findings.

- 89% spend more than $101 online on apparel and footwear each year, with 67% of all clothing spend and 74% of all footwear spend occurring online.

- Just over half (51%) indicate they spend more money on apparel products online than they did pre-COVID.

- The most common places for consumers to start the apparel purchase journey online include retailer sites (35%), brand sites (33%), and Amazon.

- The top factors apparel shoppers pay attention to are fit/sizing (89%), comfort (84%), and overall quality of the product (76%).

- Apparel and footwear shoppers also seek out specific information when deciding whether or not to make a purchase., including price (84%), ratings and reviews (78%) and imagery provided by people who have previously purchased the product (56%).

- 99% of consumers read ratings and reviews when shopping for clothing online; 86% always or regularly do so.

- 98% read reviews when shopping for footwear at least occasionally; 85% do so regularly or always.

- Apparel and footwear shoppers pay particular attention to opinions on specific details relevant to the product (72%), average star rating (70%), review volume (65%) and review recency (56%).

- 42% of apparel and footwear shoppers say that ideally, they’d be able to find over 101 reviews for a product. However, the largest portion of shoppers (65%) only read between one and 25.

- 96% of consumers seek out photos and videos from other consumers when shopping for clothing online at least occasionally. 75% always or regularly do so.

- 95% of online footwear shoppers seek out user-generated photos and videos at least occasionally. 69% do so always or regularly.

- 97% of consumers read Q&A at least sometimes when shopping for apparel online. 64% do so regularly or always.

- Nearly all (97%) online footwear shoppers consult the Q&A section of product pages at least occasionally. 63% regularly or always do so.

Contents

Introduction

Modern Apparel Shoppers Have Endless Choices

There was a time when just about all clothing and footwear purchases for the family were made within the confines of a brick-and-mortar store. And any given apparel category was dominated by a handful of major players. Shopping for athletic footwear? Have your pick of Nike, Adidas, or Reebok. Browsing for jeans? Levi’s, Wrangler, and Calvin Klein dominated the market.

As with other types of products, consumers have increasingly embraced the convenience of browsing and buying clothing and footwear without leaving home – a trend that’s only picked up since the onset of the pandemic.

What’s more, new, direct-to-consumer apparel and footwear brands seem to pop up overnight. Barriers to entry have never been lower, which certainly creates opportunities for emerging brands. But it also creates fierce competition, as shoppers have more options than ever before – and many won’t hesitate to jump ship for the next big thing. Our latest research found that a mere 25% of apparel and footwear shoppers consider themselves to be brand loyal.

Apparel Shoppers Do Their Research

Whether they’re shopping for clothing and footwear online, in-store, or some combination of the two, consumers are weighing many factors and doing plenty of research before making a purchase decision. More and more, a key part of this research is seeking out feedback from others who have already purchased the product in question.

It’s Time to Shift Your Strategy to Meet Shoppers’ Expectations

One thing is clear: apparel brands and retailers must work harder than ever to attract, convert and retain customers. It all starts with understanding how these consumers are navigating the purchase journey

Who We Surveyed

This report is based on a survey completed by 11,862 US consumers during the month of June 2022. Here’s a closer look at who we surveyed.

Generations

(1997-present)

(1981-1996)

(1965-1980)

(1946-1964)

Household Income

A Snapshot of Clothing and Footwear Spending

Before we take a deep dive into how consumers are shopping for apparel and footwear products, let’s first take a look at how much they’re spending on these products – both overall and online.

Yearly Overall Apparel and Footwear Spending

Many shoppers have sizable apparel and footwear budgets. The largest portion of shoppers (31%) spend $2,001 or more overall on apparel and footwear products. Nearly a quarter (24%) spend between $501 and $1,000 and 22% spend between $1,001 and $2,000.

It’s no surprise that those with higher incomes tend to have higher annual clothing and apparel budgets.

An Overview of Online and Apparel Footwear and Spending

Online apparel and footwear spending tends to be less than overall spending, which proves that brick-and-mortar continues to be a viable option for many shoppers.

The largest portion of shoppers – 29% – spend between $101 and $500 online on apparel and footwear each year. A quarter (25%) spend between $501 and $1,000.

Online apparel spend is correlated with household income. Those with higher incomes tend to spend more online each year on clothing and footwear.

Significant majority of apparel and footwear purchases occur online

We also asked consumers to break down their overall spending by estimating the dollar amount spent on both clothing and footwear each year. Based on their responses, 67% of all clothing spend and 74% of all footwear spend now occurs online.

The Impact of COVID on Apparel and Footwear Spending

The COVID-19 pandemic has had a lasting impact on just about all aspects of daily life. This includes the size of shoppers’ apparel and footwear budgets – and where they choose to spend these dollars. The biggest takeaway is that the pandemic has led to an uptick in online spend despite overall spending being roughly in line with pre-pandemic levels.

COVID Has Impacted Overall Shopping Habits of Half of Consumers

Just over half (54%) of shoppers say their overall clothing and footwear shopping habits have been impacted by Covid. While 29% say they spend less money on apparel and apparel than pre-COVID, a quarter actually spend more.

Interestingly, Boomers and Gen X’ers are more likely to have tightened their overall apparel budgets, while Gen Z shoppers are the group most likely to have increased their spending.

Many Consumers Have Increased Online Apparel Spending Post-COVID

The pandemic has also impacted where consumers spend their apparel budgets.

Just over half (51%) of consumers say they spend more money on apparel products online than they did pre-pandemic. This number is even higher among Gen Z (62%) and Millennial (54%) shoppers.

The Factors that Matter Most to Apparel and Footwear Shoppers

Consumers weigh many different factors when making a purchase decision. But what specifically do apparel and footwear shoppers pay attention to? And what information do they seek out to fuel smart purchase decisions?

Shoppers’ Relationship to Apparel

One way we gauged what’s important to apparel shoppers is by asking them to describe themselves in relation to clothing and footwear. Typically, these purchases are deeply personal – with motivations dictated by individual preferences.

Interestingly, just a quarter (25%) of clothing and footwear buyers consider themselves brand loyal. This presents an opportunity to brands and retailers, as it’s clear that shoppers can be swayed. However, it’s also a reminder that businesses must work harder than ever to retain their existing customers.

Apparel and Footwear Shoppers Weigh Many Factors

Size and fit is the top factor considered by apparel and footwear shoppers, with 89% indicating it’s something they pay attention to. This isn’t surprising, as shoppers want to ensure the items they purchase will actually fit the way they expect.

Comfort is the next most important factor; 84% of shoppers pay attention to comfort when considering a clothing or footwear purchase.

Price and Feedback from Previous Customers are Essential for Apparel Shoppers

When considering an apparel or footwear purchase, there are certain things shoppers specifically seek out. Not surprisingly, price tops the list.

However, feedback from those who have already purchased the product is close behind. When considering a purchase, over three-quarters (78%) look for ratings and reviews and 56% look for imagery provided by people who have purchased the product in question.

That makes user-generated content more valuable than other factors including shipping, brand, and even recommendations from family and friends.

How Consumers are Shopping for Apparel Online

Many consumers have ramped up their online apparel shopping. But what types of apparel products are they purchasing online? And where are they typically browsing and buying these items?

Consumers Shop for Many Apparel Products Online

It seems consumers are purchasing just about all types of apparel and footwear online. Casual clothing and footwear tops the list, with 96% indicating they purchase their items online.

In addition, there are certain apparel categories that shoppers indicate they’re more likely to purchase online than in a brick-and-mortar store. Casual clothing and footwear is at the top of the list, with 71%.

Where Online Apparel Shoppers Start the Purchase Journey

Online shoppers now have plentiful options across just about all product categories. So where are online shoppers most often starting the search for apparel and footwear products?

Retailer and brand websites are nearly tied for first place. While 35% of shoppers typically start shopping for apparel and footwear products on a retailer’s website, a third (33%) start on a brand’s website. Amazon comes in at third place; just over a quarter (27%) of shoppers typically start their search for apparel and footwear products here.

There are some notable differences based on generation. For example, Gen Z’ers and Millennials are particularly fond of brand websites, while Gen X’ers and Boomers gravitate to retailer sites. In addition, Amazon is significantly more popular among older consumers.

Where Online Shoppers End the Purchase Journey

We know where online apparel shoppers are starting the purchase journey. But where are they ultimately making a purchase?

Retailer websites are the most popular, with 65% of shoppers indicating they frequently make purchases for apparel and footwear products on such a site. Over half (57%) frequently make apparel purchases on a brand’s website, and 55% often purchase on Amazon. About one in ten (11%) frequently purchase via a social media platform.

The Role of Ratings & Reviews in Apparel and Footwear Shoppers’ Purchase Decisions

Apparel and Footwear Shoppers Frequently Consult Reviews

Nearly all (99%) of consumers read ratings and reviews when shopping for clothing online, with 86% indicating they always or regularly do so.

Younger generations consult reviews more often than older ones. Nine in ten (91%) of Gen Z’ers and 98% of Millennials always or regularly read reviews when shopping for clothing online – compared to 82% of Gen X shoppers and 72% of Boomers.

Online shoppers also turn to reviews when browsing for footwear. Nearly all (98%) do so at least occasionally, and 85% do so regularly or always.

Again, younger consumers tend to consult reviews more frequently than older ones.

Apparel and Footwear Shoppers Consider Myriad Review Elements

When browsing reviews for apparel and footwear products online, consumers factor in many elements. The top one is consumer opinions on specific extra details relevant to the product.

Apparel and Footwear Shoppers Want a Large Volume of Reviews – But Actually Read Far Fewer

65% of shoppers consider the quantity of reviews available for a given product. But how many reviews do apparel and footwear shoppers want to be able to find? And how many do they actually read?

One in five (20%) of shoppers say that the ideal number of reviews for an apparel or footwear product is between one and 25, while another 20% indicate the magic number falls between 51 and 100. However, nearly half (42%) say that ideally, they’d be able to find over 101 reviews for a product.

Of note, younger shoppers have significantly higher expectations for ideal review quantity. While 51% of Gen Z shoppers and 45% of Millennials ideally want to find over 101 reviews for any given apparel or footwear product, 37% of Gen Xer’s and 21% of Boomers have this expectation.

Ideally, consumers of all ages want to be able to find a high volume of reviews for apparel and footwear products they’re considering. However, they’ll often settle for less.

The largest portion of consumers – 35% say that an apparel or footwear product must have between 1 and 25 reviews at a minimum for them to feel comfortable purchasing it. One in five (21%) say the sweet spot is between 26 and 100 reviews. Nearly a quarter (23%) say the minimum number of reviews a product needs to have is 101 or more.

Younger shoppers require a higher minimum number of reviews than older ones. For example, 24% of Gen Z’ers say that a product needs 101+ reviews for them to feel confident purchasing it, compared to 10% of Boomers.

While many consumers want to be able to find a large quantity of reviews for a given apparel or footwear product, they typically actually read far fewer. The largest quantity (66%) of shoppers read between one and 25 reviews before purchasing an apparel or footwear product, while 20% read between 26 and 50.

Younger shoppers tend to read more reviews than older ones – but not by much.

Why the difference between the ideal number of reviews and the number consumers actually read? Likely, consumers want to be able to find a large volume of reviews because that means they’re more likely to find content that speaks to their unique needs and use cases. They can sort and filter content – and then read just the content that’s relevant to them.

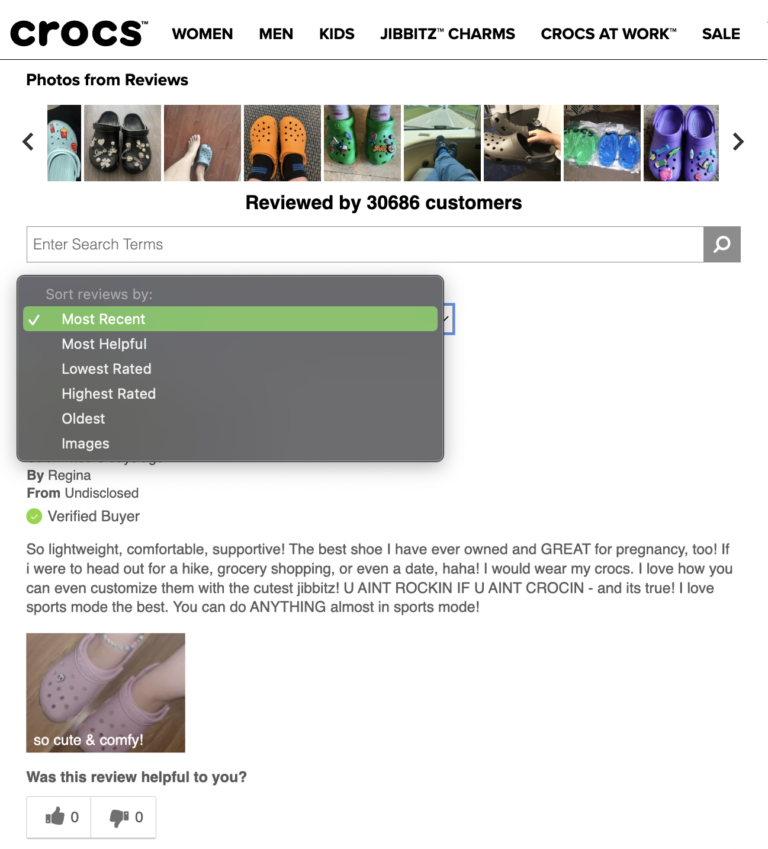

Apparel brands and retailers must work to generate a high volume of reviews for all products – and then provide sorting, filtering, and search capabilities so shoppers can quickly surface relevant content that will boost their confidence and likelihood of purchase.

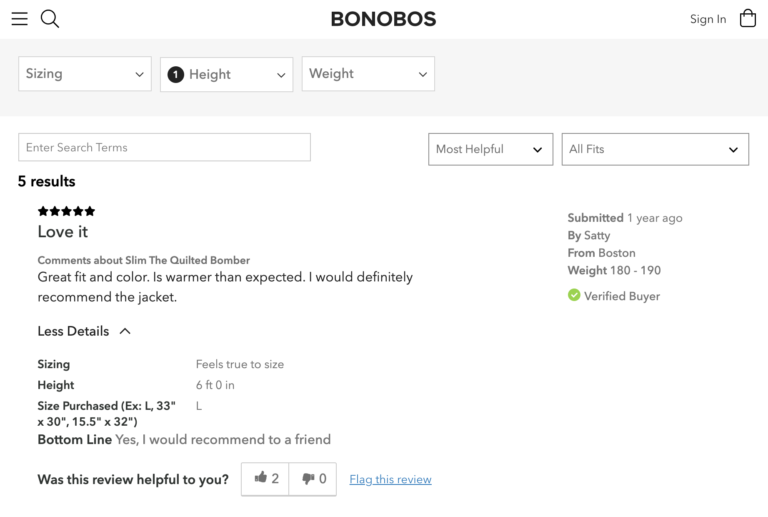

Sizing Information in Reviews Can Fuel Better Purchase Decisions

As mentioned earlier in this report, size and fit is the top factor considered by apparel and footwear shoppers. Providing plenty of information on how a given product fits and feels is essential.

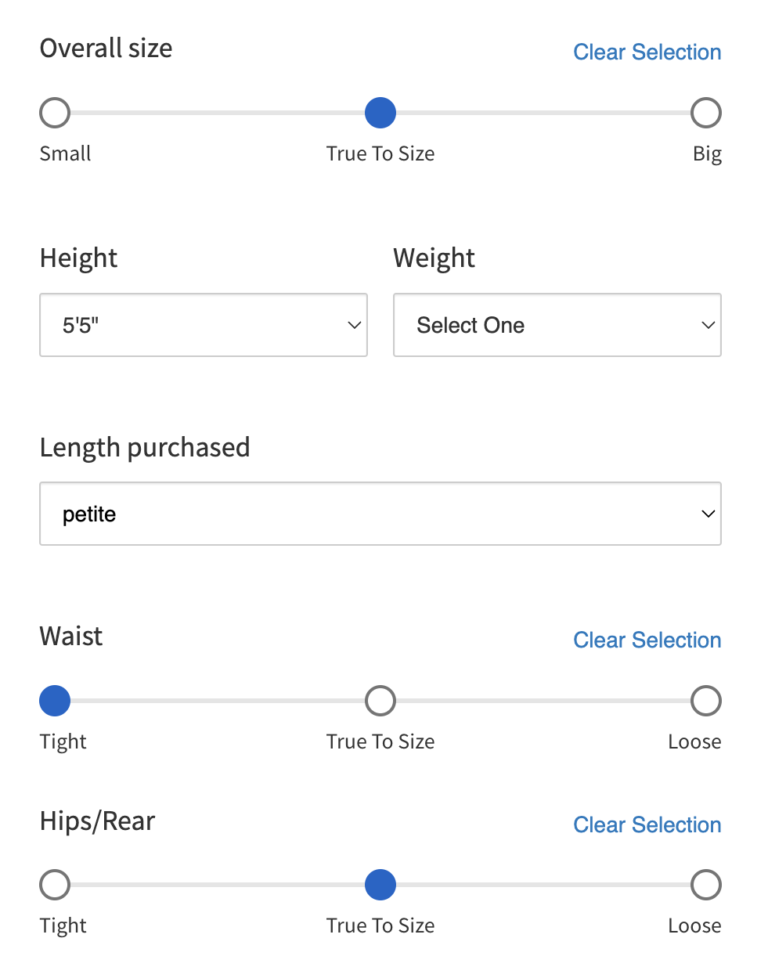

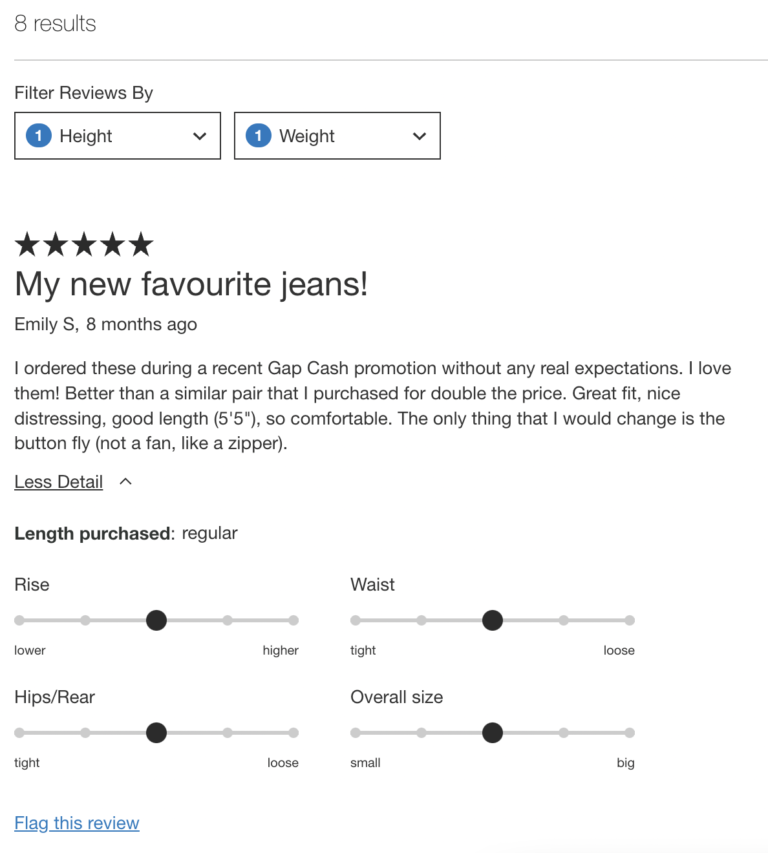

One way apparel and footwear brands and retailers can do this is by asking customers to include measurement information (such as height and weight) when submitting reviews.

Then, they can display this information in the review – and shoppers can use it to find reviews from others with similar body types. Some brands and retailers even allow shorts to filter to see reviews written by those with specific heights or weights.

The vast majority (94%) of online apparel and clothing shoppers say they would find it helpful if there was measurement information about the individuals providing reviews, photos, and videos. This number is slightly higher – 96% – among Millennial and Gen Z shoppers.

Including Information About Ownership Length in Reviews Can Help Shoppers Assess Quality and Durability

Earlier in this report, we explored how apparel and footwear shoppers weigh many factors when considering a purchase. Two of those factors are quality and durability. Just over three-quarters (76%) say that overall quality is an important factor, while 58% consider a product’s durability.

The true test of both quality and durability is how a product holds up over time. Knowing how long a consumer owned a product prior to writing a review can help future shoppers assess durability and long-term quality.

Most consumers (89%) would find it helpful to know the length of time an individual owned a product before submitting a review. Of note, insight into a reviewer’s ownership duration is especially valuable for younger shoppers.

The Value of Visual UGC for Apparel and Footwear Shoppers

Apparel Shoppers Depend on User-Generated Imagery

The vast majority – 96% – of consumers seek out photos and videos from other consumers when shopping for clothing online at least occasionally. Three-quarters do so always or regularly.

Gen Z and Millennial shoppers are the groups most likely to say they always seek out user-generated visual content when shopping for clothing online. 61% of Gen Z’ers and 52% of Millennials always do so, compared to 32% of Gen X’ers and 19% of Boomers.

Footwear Shoppers Also Value User-Generated Imagery

Those shopping for footwear online also turn to user-generated visual content to make informed purchase decisions. 95% of online footwear shoppers seek out user-generated photos and videos at least occasionally. 69% do so always or regularly.

Again, younger shoppers are more likely to indicate they always seek out user-generated photos and videos when shopping for footwear online. 57% of Gen Z’ers and 48% of Millennials say this is the case, compared to 31% of Gen X’ers and a mere 18% of Boomers.

Use of Q&A When Shopping for Apparel and Footwear

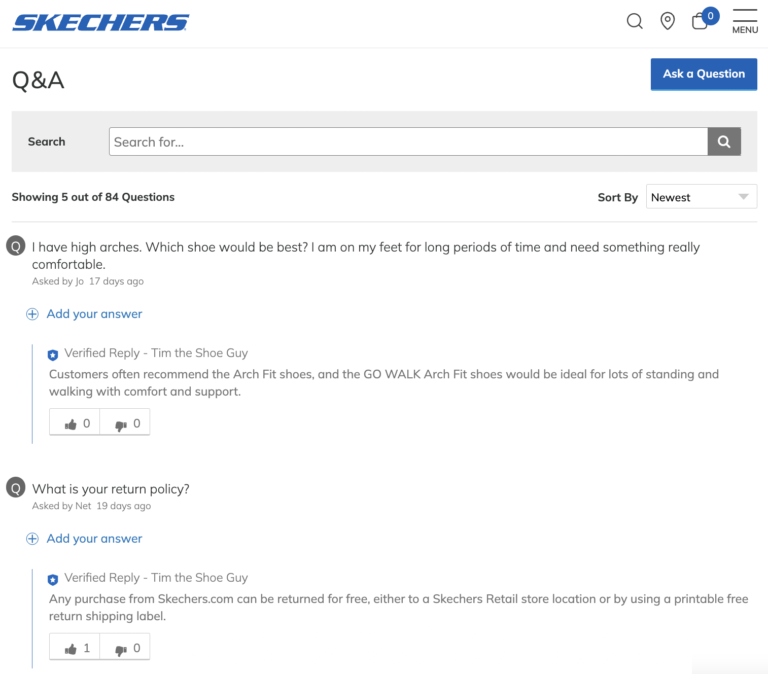

Consumers shopping online for clothing and footwear may have questions that aren’t covered in the product details page. And, unlike in-store shoppers, they’re not able to flag down a store associate to ask.

How do online shoppers bridge the gap to get answers to their outstanding questions? Oftentimes, by consulting the questions and answers (Q&A) portion of the product page.

Most Online Apparel Shoppers Consult Q&A

The vast majority of consumers – 97% – read Q&A at least occasionally when shopping for apparel online. 64% do so much more frequently – either always or regularly.

In line with other survey results, younger shoppers are more likely to always consult Q&A than their older counterparts. 34% of Gen Z shoppers and 33% of Millennials always read Q&A when shopping online for apparel, compared to a quarter of Gen X’ers and 21% of Boomers.

Consumers Read Q&A on Footwear Product Pages

Nearly all (97%) of consumers shopping for footwear online consult the Q&A section of product pages at least occasionally. 63% regularly or always do so.

Not surprisingly, younger consumers consult Q&A more frequently than older shoppers.

The Prevalence of Apparel Returns – and the Key Reasons Behind Them

Returns have always been a thorn in the side of brands and retailers. But the rise in ecommerce has further amplified the problem – especially for apparel and footwear brands and retailers.

Most Online Shoppers Make Apparel and Footwear Returns

Of those who have made a clothing or footwear purchase in the last 90 days, over half (54%) have made a return. Interestly, Millennials are the age group most likely to make apparel returns, and Boomers are the least likely.

Another interesting observation is that the higher a shopper’s income, the more likely it is that they’ve made an apparel or footwear return in the last 90 days. A likely explanation is that those with higher incomes spend more – and thus have more merchandise to return.

Apparel Shoppers Return Merchandise for Many Reasons

Apparel returns are prevalent. But why are shoppers returning the clothing and footwear they purchase online?

Most of the top reasons are related to a product failing to meet the shopper’s expectations. Over a third (39%) have returned a product because they didn’t like the sizing, and 29% have done so because the item didn’t look the way they thought it would.

Though returns will never be completely eliminated, apparel brands and retailers can drastically reduce them by providing accurate product descriptions and sizing information, as well as reviews and photos from existing customers that speak to size and fit and help shoppers get a more realistic picture of what to expect from a product (check out our complementary report Returns in Retail for more).

Key Takeaways for Apparel Brands and Retailers

The way consumers shop for apparel and footwear is evolving. Apparel brands and retailers must adapt their strategies to more effectively attract, convert, and retain modern apparel customers – whether they’re shopping online, in-store, or both.

Based on our research, here are six key takeaways for apparel brands and retailers.

Many consumers are spending a growing portion of the clothing and apparel budgets online – a trend that has ramped up since the start of the pandemic. Over half (51%) of consumers spend more money on apparel products online now than they did before the pandemic. Gen Z and Millennial shoppers are even more likely to have ramped up their online apparel spending.

That said, apparel brick-and-mortar continues to thrive, especially for specific apparel categories including formal clothing and footwear and business clothing and footwear, among others.

In order to compete and win, apparel brands and retailers must focus on delivering engaging, seamless experiences – regardless of whether their customers shop online, in-store, or a combination of the two.

There are certain things apparel and footwear shoppers look for when making a purchase decision. Ratings and reviews are #2 on the list, behind price. In fact, nearly all consumers read ratings and reviews when shopping for clothing and footwear products.

65% of consumers pay attention to the quantity of reviews available for a given apparel or footwear product, so brands and retailers must make it a priority to generate a high volume of reviews for all products in their catalogs. Nearly half (42%) want to be able to find 101 or more reviews for a given product.

What’s more, our analysis found that the more reviews an apparel product has, the larger the impact on conversion. While there’s a 65.5% lift in conversion among those exposed to between one and 100 reviews, there’s a 179.7% lift when apparel shoppers are exposed to 5,000 or more reviews.

However, it’s important to remember that while consumers ideally want to find a high volume of reviews, they’re actually reading far fewer. Be sure to include filtering, sorting and search capabilities in your review display so shoppers can quickly surface the content that speaks to what matters most to them.

Brand-provided imagery is important. But increasingly, apparel and footwear shoppers specifically want to see photos and videos from other consumers who have already purchased a specific product. 96% of consumers seek out user-generated imagery when shopping for clothing online at least occasionally. That number is just slightly lower – 95% – when consumers are shopping for footwear.

If you’re not already, start collecting visual content from your shoppers – both natively and through social media. Then, showcase this content on your product pages and throughout your website. This imagery will help shoppers better access size and fit and get a better idea of what a product looks like in “real life.” And this is a sure way to increase conversion. A previous analysis found that there’s a 106.3% lift in conversion when visitors interact with user-generated visual content on a product page.

It’s not uncommon for online apparel and footwear shoppers to have questions that aren’t addressed in the product description. Many turn to the Q&A portion of product pages to get answers. Our survey found that 97% of consumers read Q&A at least occasionally when shopping for both clothing and footwear online.

Be sure to include a Q&A section on your apparel and footwear product pages. Being able to browse existing questions and post their own will boost shoppers’ confidence – and purchase probability. Our recent analysis found that there’s a 194.2% lift in conversion among visitors who interact with Q&A content.

Apparel and footwear brands and retailers are all too familiar with product returns. While consumers return apparel products purchased online for many reasons, a few that rise to the top include issues with sizing (39%), an item not looking as they expected (29%), and an item not matching the description (14%).

One way to decrease these issues is to revisit your product descriptions on a regular basis to ensure they’re as clear and accurate as possible. Another way to reduce returns is to collect and display plenty of user-generated content. Reviews and visual content allow shoppers to get a feel for what a product is like in real life, which will provide more realistic expectations. What’s more, when brands display a customer’s sizing information alongside their review or visual content, it can help future shoppers get a better idea of what size would work best for them.

One thing is for sure: modern apparel and footwear shoppers depend on user-generated content. As such, apparel brands and retailers must focus on generating and displaying plenty of this content.

But don’t put your UGC program on autopilot. Instead, measure the performance of your UGC collection and display strategies on a regular basis. By doing so, you can uncover opportunities to optimize your program – and generate an even higher return.