Survey at a Glance:

The PowerReviews Evolution of the Modern Grocery Shopper report is based on survey responses from 7,916 grocery shoppers across the United States. Key findings include:

- 73% of consumers have purchased grocery items online within the most recent three months of being surveyed, compared to 17% when we asked the same question in 2017.

- 61% of consumers shop for groceries online more now than they did pre-COVID.

- Top reasons include time savings (59%), personal safety (49%) and avoiding impulse purchases (31%).

- Ordering directly from a local grocery store (as opposed to — for example — online only ordering services like Instacart or Amazon Fresh) is the most popular way to shop for groceries online; 65% of consumers say they’ve done this.

-

93% of consumers have made an in-store grocery purchase within the most recent three months of being surveyed.

-

95% of consumers who have shopped for groceries online have also made an in-store grocery purchase within the same time period.

-

82% of online grocery shoppers say they read reviews at least occasionally.

-

83% of consumers are at least somewhat interested in accessing product ratings and reviews when they’re considering a new product while shopping in a brick-and-mortar grocery store.

-

78% of online grocery shoppers are more likely to purchase an unknown grocery item if there are customer reviews for that product. The figure is 64% among in-store shoppers.

Contents

Traditionally, Grocery Ecommerce Growth Has Lagged Behind Other Categories

Over the past decade, ecommerce has experienced steady growth. In 2010, ecommerce made up a mere 6.4% of overall retail sales. But by 2020, that number had grown to 21.3%. Other product categories, including electronics and footwear, have experienced even more significant growth.

But there’s one category that’s traditionally lagged behind when it comes to ecommerce growth: groceries.

In 2019, eCommerce accounted for only 3% of grocery shopping in the U.S.

According to Bain & Company Research, a mere 3% of grocery shopping in the U.S. happened online in 2019. And our own research from 2017 found that just 17% of consumers had purchased groceries online.

While consumers clearly enjoyed the convenience of shopping online for other product categories, many remained reluctant to purchase groceries online.

COVID Has Caused a Sea Change in Grocery Shopping Habits

Then, the COVID-19 pandemic hit, causing lasting impact to just about every aspect of daily life — including grocery shopping habits.

With safety top of mind, many shoppers cut down on trips to the grocery store — or eliminated them altogether. And a record number of consumers opted to shop for groceries online — many for the first time ever.

Newly Adopted Grocery Shopping Habits May be Long-Lasting

Of course, some shoppers may abandon online grocery shopping post-pandemic. But many predict the grocery shopping habits adopted during COVID will stick, even when the pandemic is behind us. Case in point? A survey from Acosta found that 75% of shoppers plan to stick to at least some of their new shopping habits post-COVID.

75% of shoppers plan to stick to at least some of their new shopping habits post-COVID.

There’s Plenty of Opportunity for Grocery Brands and Retailers

Grocery shopping behavior continues to evolve. Brands and retailers must continuously adapt to meet (and exceed) the changing expectations of shoppers.

And there’s plenty of opportunity for those that do. Incisiv predicts that by 2025, online grocery will account for 21% of total grocery sales, or $250 billion. That’s an 8% increase over pre-pandemic estimates.

By 2025, online grocery will account for 21% of total grocery sales.

Grocery Brands and Retailers Must Adapt to Thrive

But in order to grow market share, brands and retailers must first understand how grocery shopping habits are changing and evolving. After all, strategies and tactics that worked just a year ago may no longer be effective.

PowerReviews surveyed nearly 8,000 U.S. consumers to better understand where they’re now shopping for groceries, why they choose the channels they do and what information they depend on to make informed purchase decisions. We also sought to understand how these behaviors have changed in the four short years since we fielded a similar survey — and include these comparisons throughout.

This report explores the key findings of this research and provides impactful, data-driven actions grocery brands and retailers can take to better attract and convert grocery shoppers — both online and in-store.

For the purposes of this report, “grocery” is defined as any product typically found in a grocery store, including (but not limited to) produce, fresh/dry/frozen foods, cleaning products, health and beauty items, soft drinks and alcoholic beverages.

Generations

(1997-present)

(1981-1996)

(1965-1980)

(1946-1964)

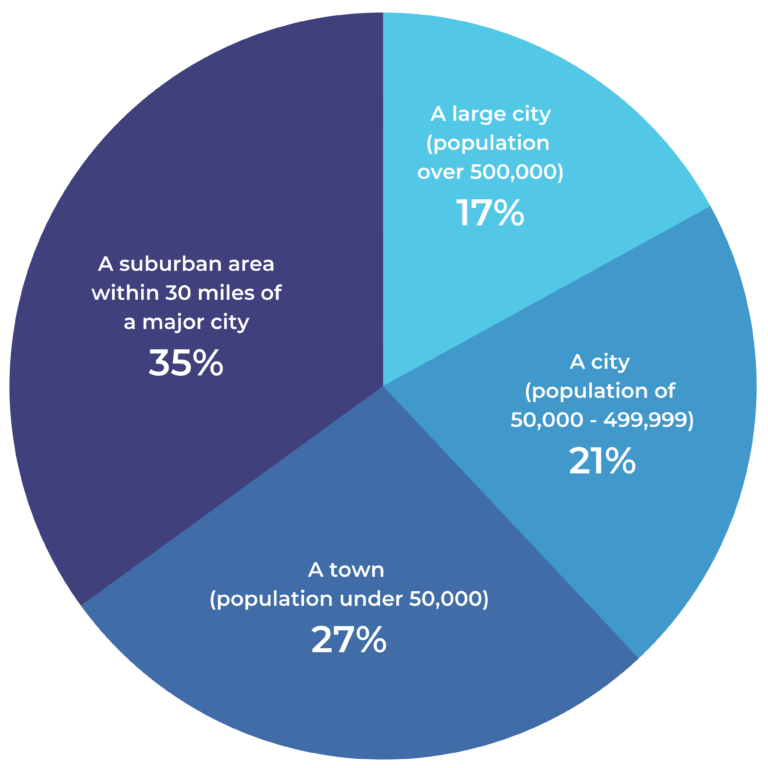

Geography

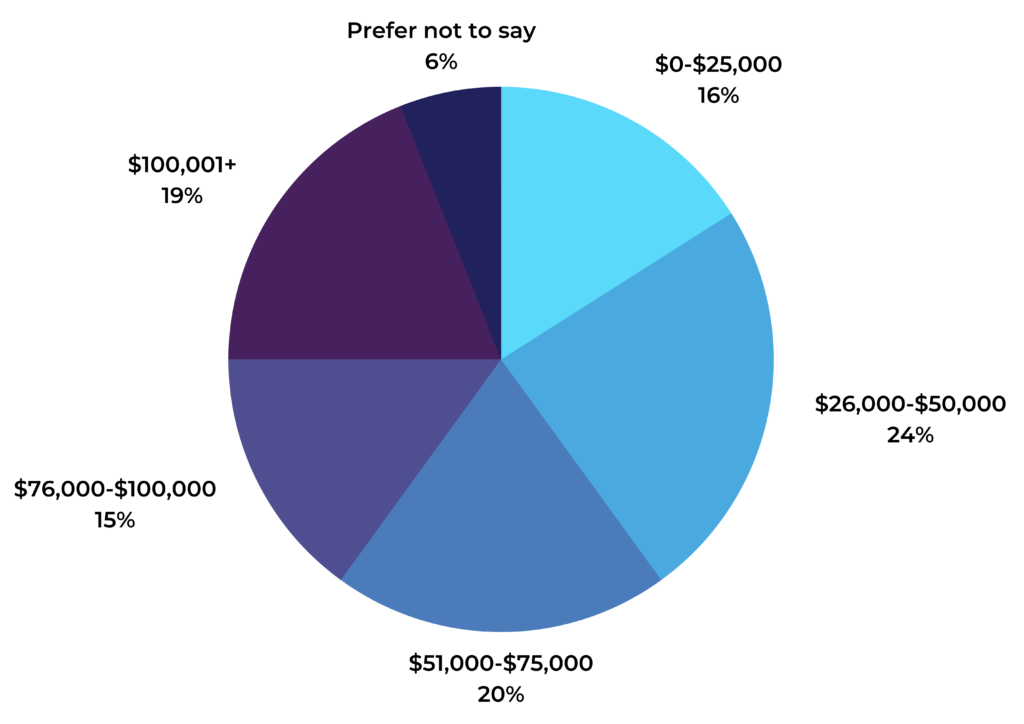

Household Income

In the past, when it was time to stock up on food, drinks and other household essentials, a consumer had little choice but to head to the grocery store. But today, grocery shoppers have myriad digital options to choose from. And as it turns out, the pandemic has made them more likely to give these online grocery shopping options a try.

Online Grocery Shopping is Experiencing Explosive Growth

The pandemic ushered in unprecedented eCommerce growth. According to Digital Commerce 360, eCommerce sales were up 44% in 2020 year-over-year.

So it’s probably not surprising that grocery eCommerce also experienced a significant boost.

Our research found that nearly three-quarters (73%) of consumers have purchased grocery items online in the past three months. In comparison, a mere 17% of consumers answered yes to this question in 2017.

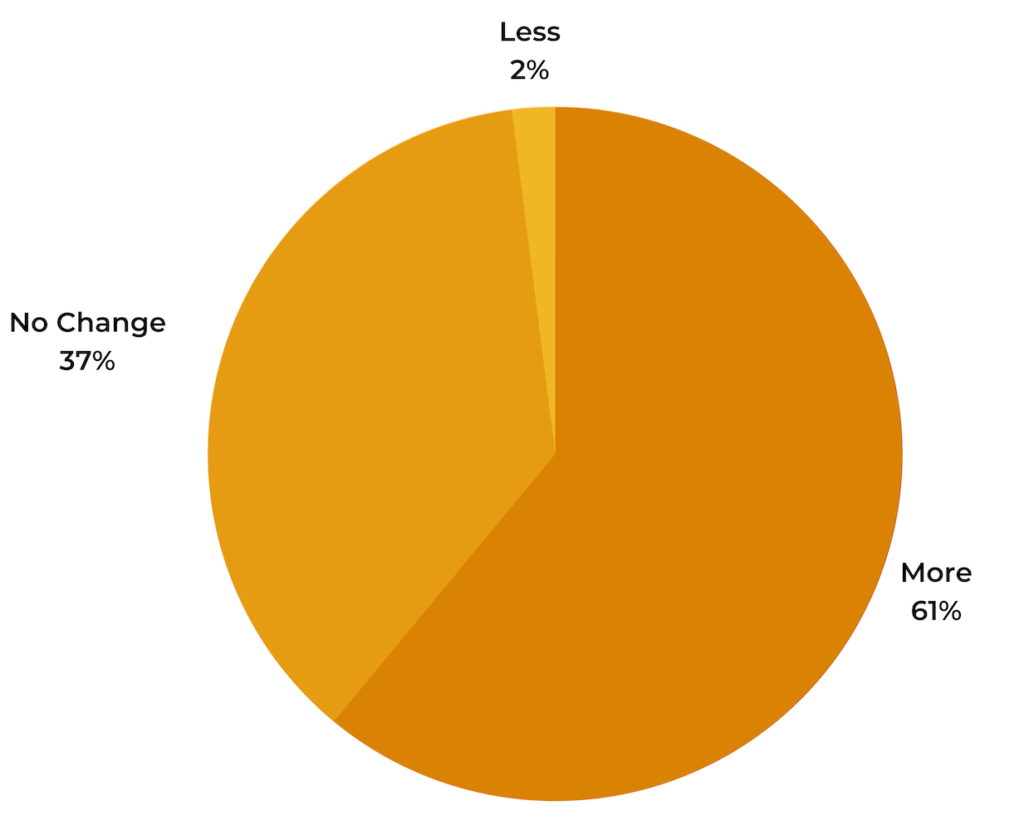

Many shoppers have increased their use of online grocery shopping services during the pandemic, too. In fact, 61% of consumers say they shop online for groceries more now than they did before COVID.

Age, Geography, and Income Level Impact Likelihood of Online Grocery Shopping

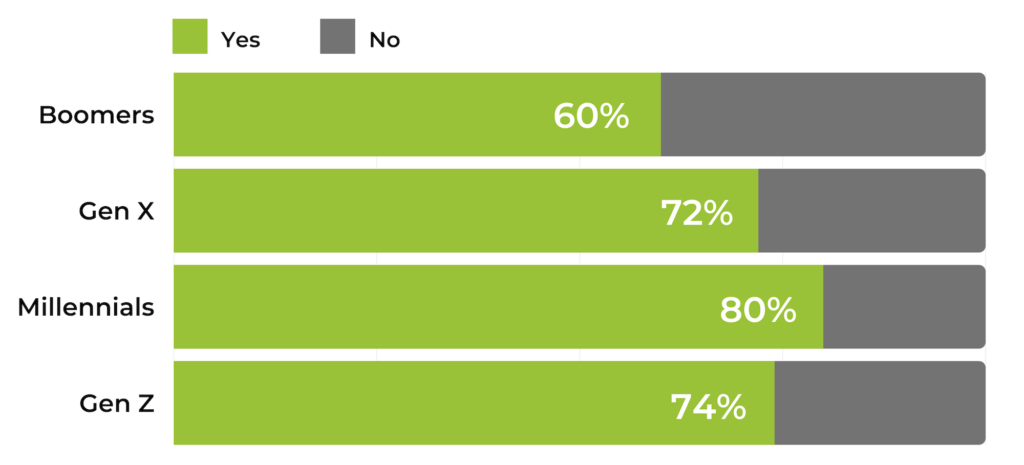

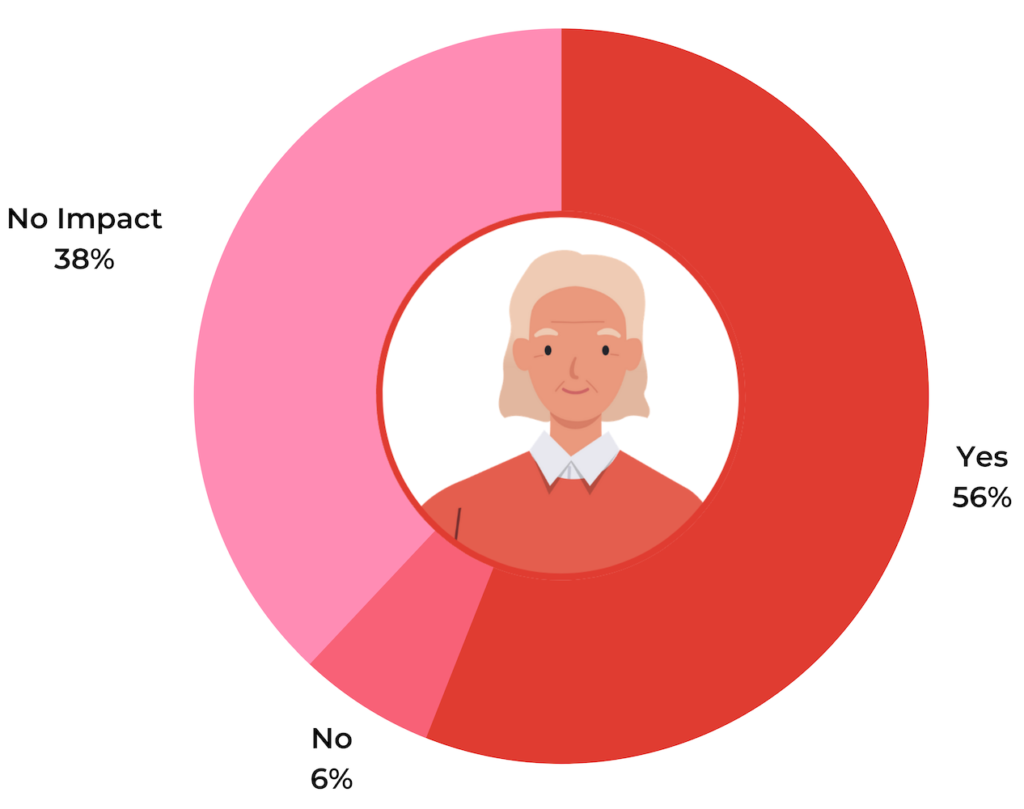

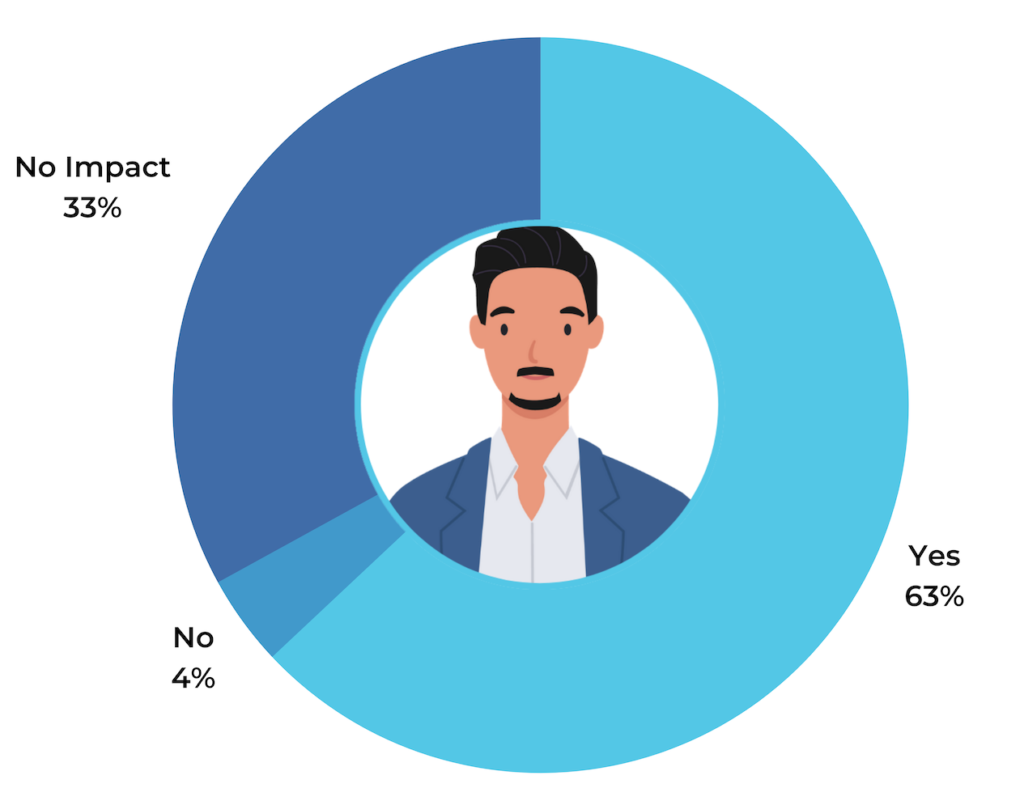

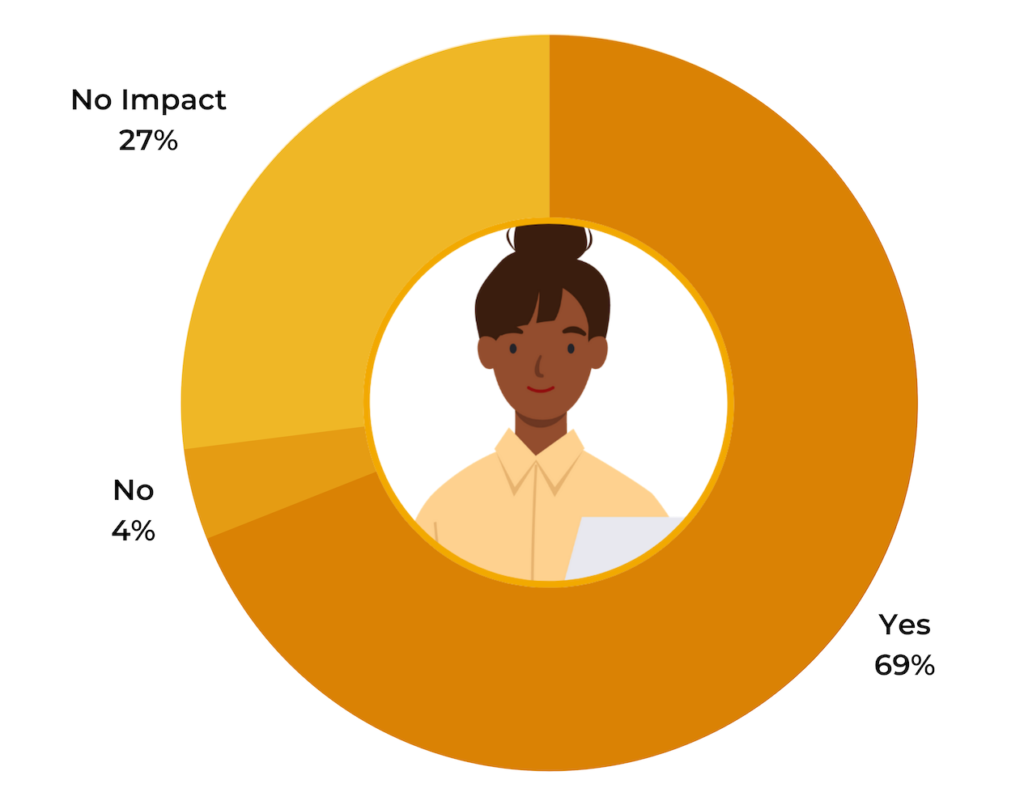

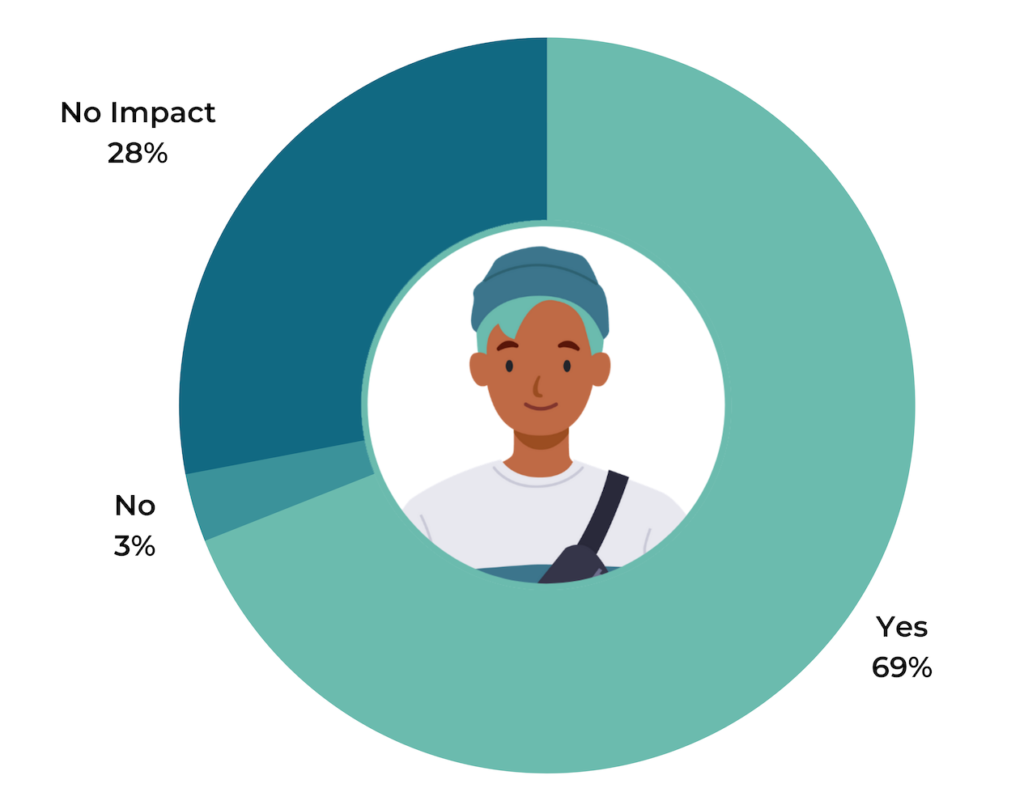

It’s interesting to note that younger generations are more likely to shop for groceries online. 80% of Millennials and 74% of Gen Z shoppers had purchased groceries online in the most recent three months of being surveyed, compared to 60% of Baby Boomers and 72% of Gen X.

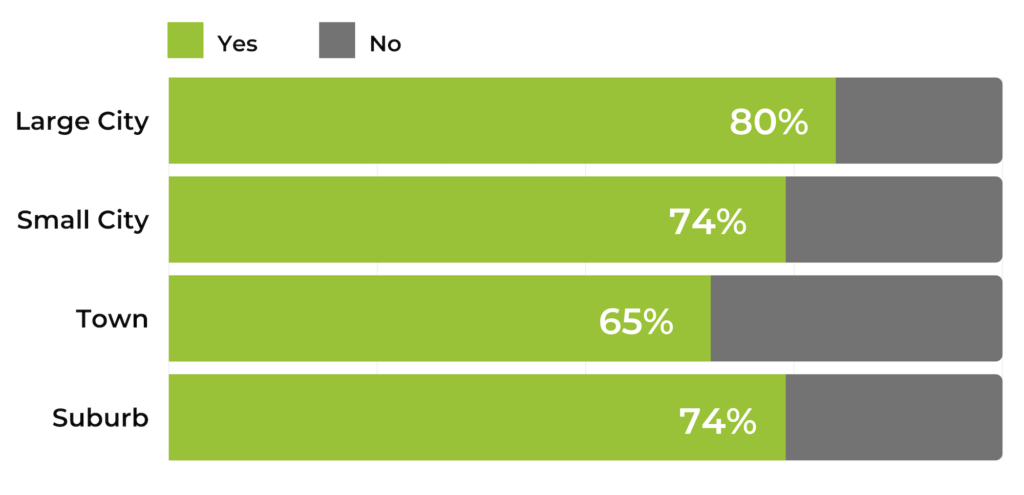

In addition, geographical location impacts a consumer’s likelihood of purchasing groceries online. 80% of city dwellers purchase groceries online, compared to 65% of consumers living in a town with a population less than 50,000 — which makes sense given there are more options for those living in larger cities.

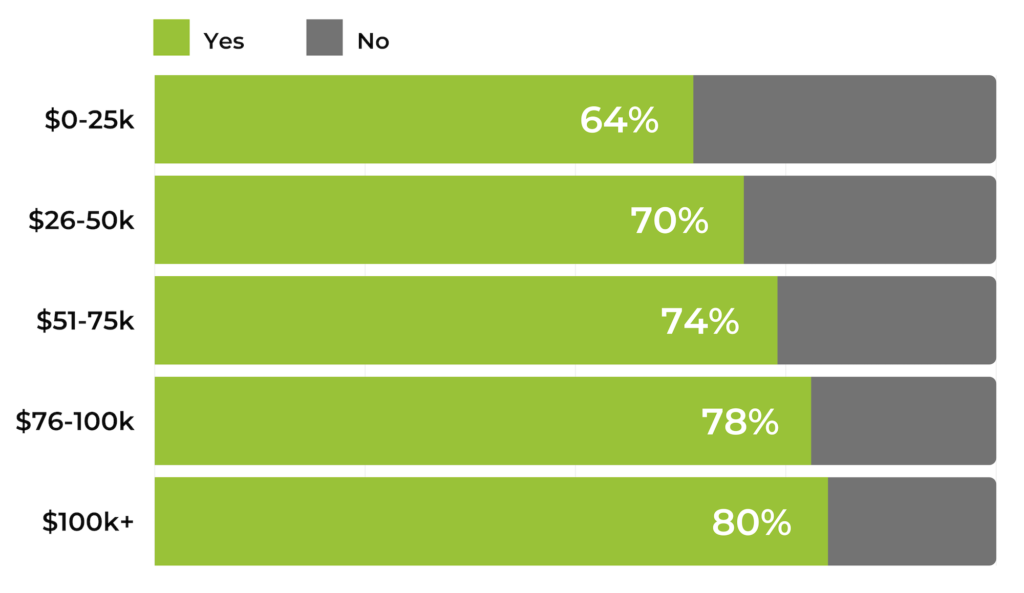

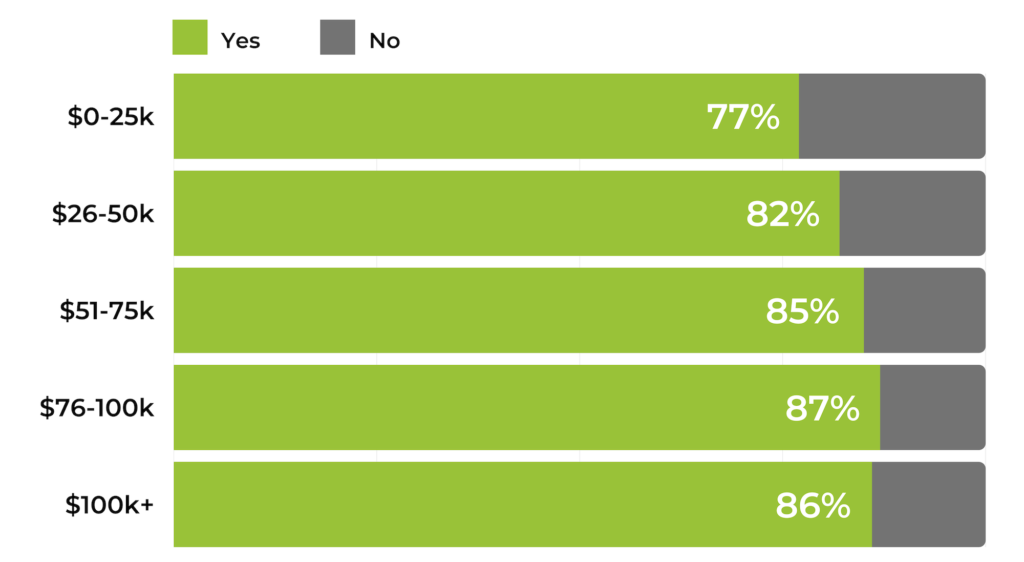

Finally, the higher the income, the more likely a consumer is to shop for groceries online. 80% of those who make over $100,000 have shopped online for groceries, compared to 64% of those who make $0-$25,000. This makes sense, as many grocery services charge a premium for online shopping.

Consumers Buy Groceries Online to Save Time and Ensure Personal Safety, Among Other Reasons

More consumers are opting to purchase groceries online. But what are the reasons behind this dramatic shift in shopping behavior?

Time savings is the most popular reason. 59% of consumers indicate it’s a key reason they choose to purchase groceries online, which indicates that the trend is likely to stick post Covid. And 49% say they purchase groceries online for personal safety reasons, which makes sense in the midst of the ongoing pandemic.

Brick-and-Mortar Grocery Shopping is Still Alive and Well

Online grocery shopping is experiencing a surge in popularity. But that’s not to say grocery stores will soon be a thing of the past. Quite the opposite: brick-and-mortar grocery continues to thrive. Nearly all (93%) of consumers said they had made a grocery purchase in a physical store location within the most recent three months of being surveyed.

93% of consumers have made an in-store grocery purchase within the most recent three months of being surveyed.

And as it turns out, most consumers are doing a blend of online and in-store grocery shopping. 95% of consumers who have shopped for groceries online have also made an in-store grocery purchase within the same time period.

95% of consumers who have shopped for groceries online have also made an in-store grocery purchase within the most recent three months of being surveyed.

It’s clear that online grocery shopping is quickly growing in popularity. But where exactly are these online shoppers purchasing their groceries? And what items are they buying when they do?

Consumers Use a Variety of Online Grocery Services

Today, there are a growing number of online grocery shopping options. Which are winning among consumers?

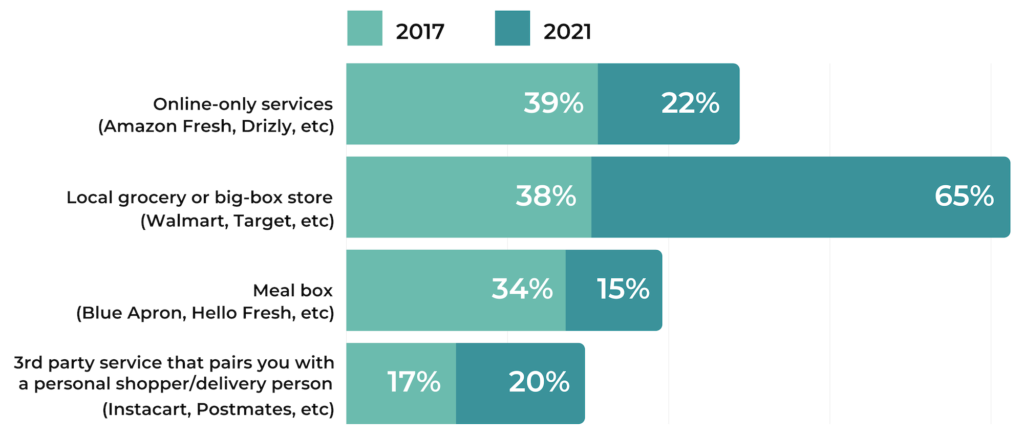

When asked where they’d purchased grocery items online from, more than half (65%) said they’d ordered pickup or delivery from a traditional grocery or big-box store. In comparison, only 38% chose this option when we surveyed consumers in 2017.

Nearly a quarter (22%) use an online-only service, such as Amazon Fresh or Boxed.com. Other popular options are a third party delivery service, such as Instacart (20%) and meal boxes (15%), such as Blue Apron or Hello Fresh.

It’s also worth noting that a third (34%) of online grocery shoppers use more than one online grocery service.

Online Grocery Shoppers Fill Their Shopping Baskets with a Variety of Items

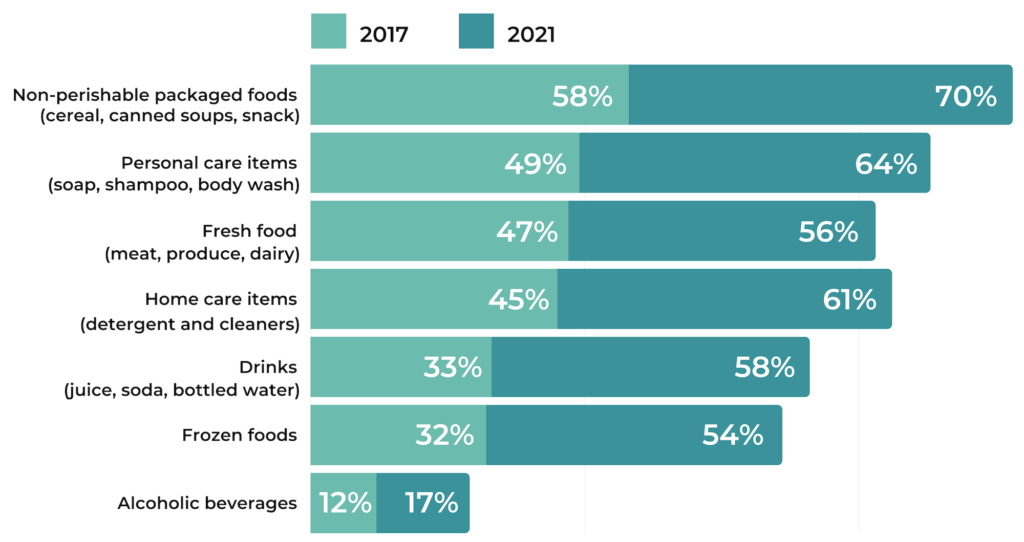

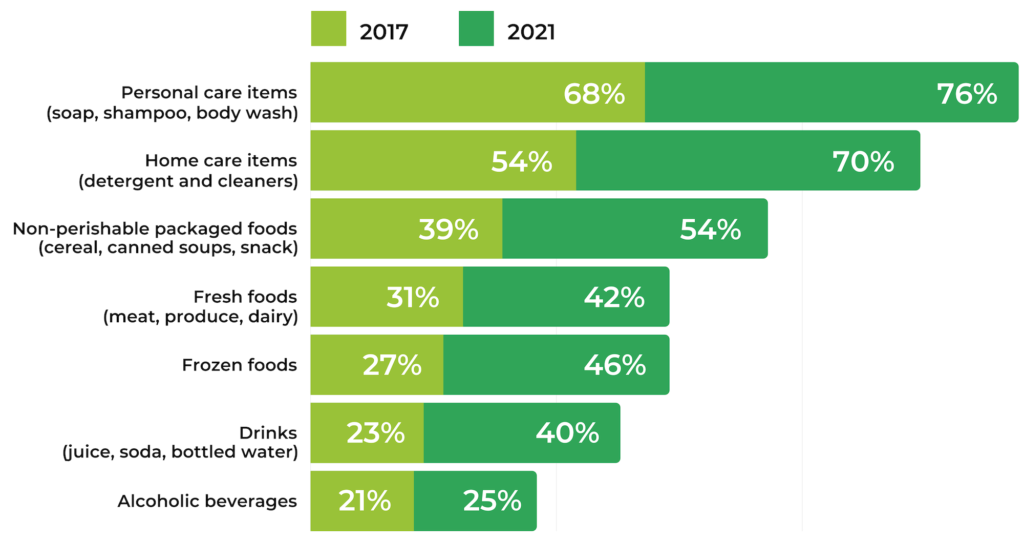

Four years ago when we asked grocery shoppers what types of products they’d purchased online, items that didn’t require refrigeration topped the list.

And that’s still the case. 70% of online shoppers indicate they’ve purchased non-perishable packaged foods online. Other popular product categories for online grocery shopping are personal care items (64%), home care items (61%) and soft drinks (58%).

But online shoppers aren’t completely steering clear of perishable items. 56% have purchased fresh food, such as meat, product and dairy online, and 54% have purchased frozen foods.

It’s also interesting to note that the percentage of shoppers purchasing every single category has increased since 2017.

Online Grocery Shoppers are Willing to Try New Products

There’s no doubt online grocery shoppers stock up on the same tried-and-true items staples time and time again. For example, most families probably add the same brands of milk, bread and eggs each time they place an order.

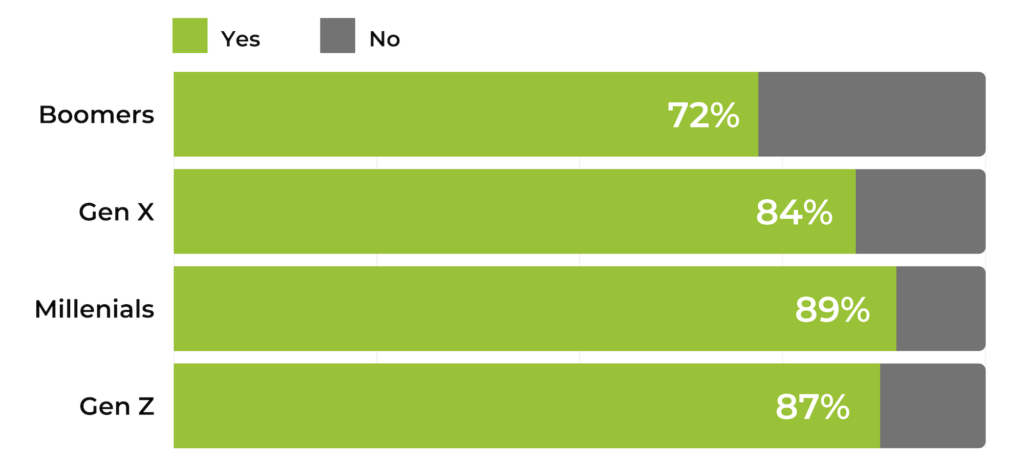

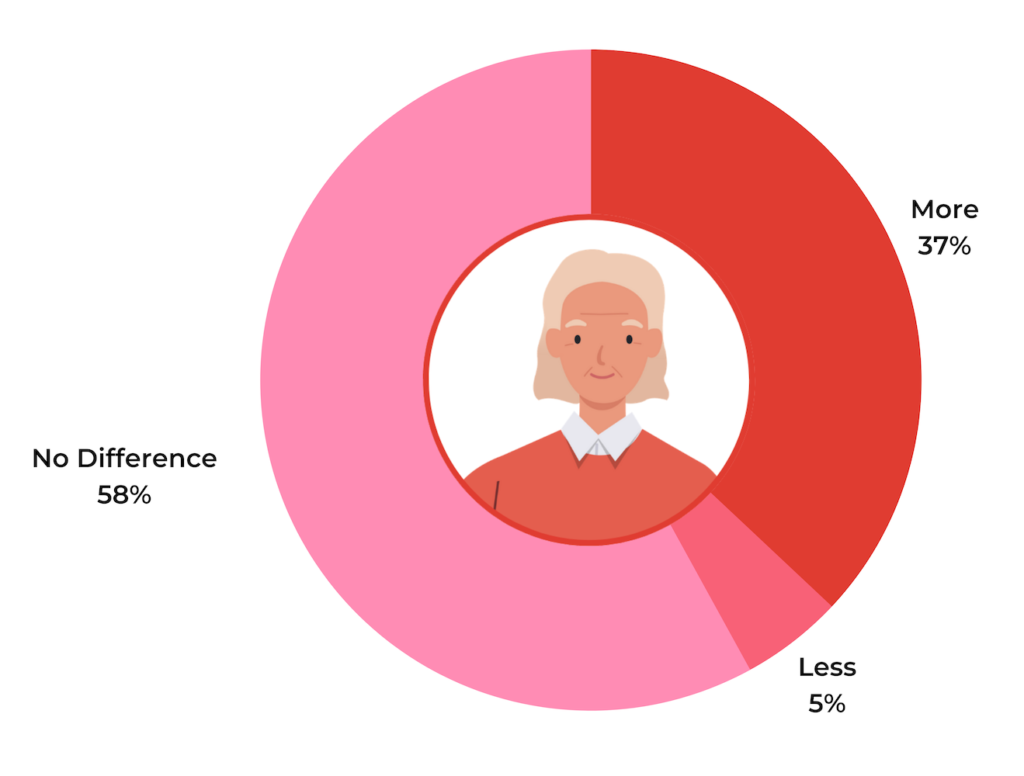

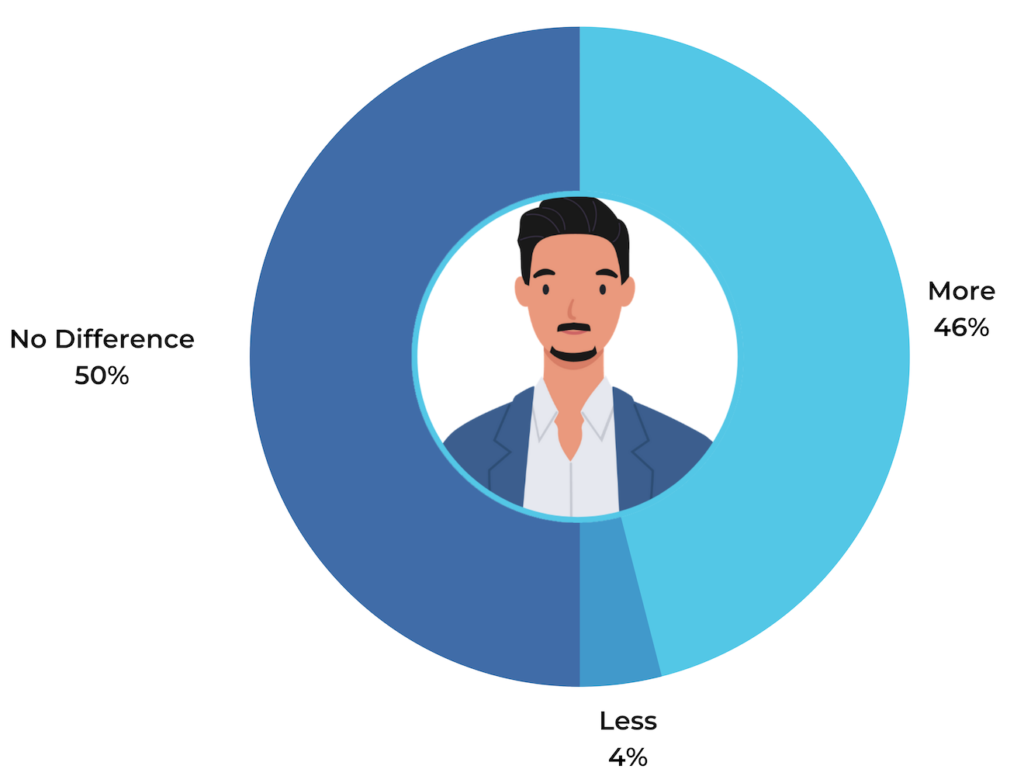

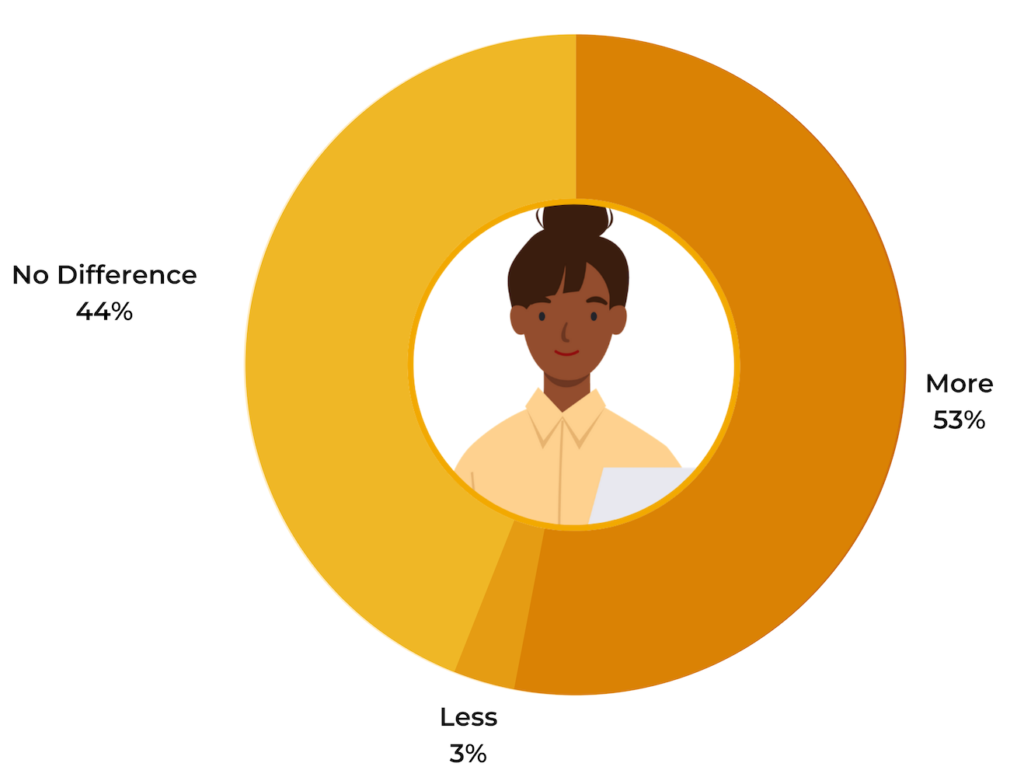

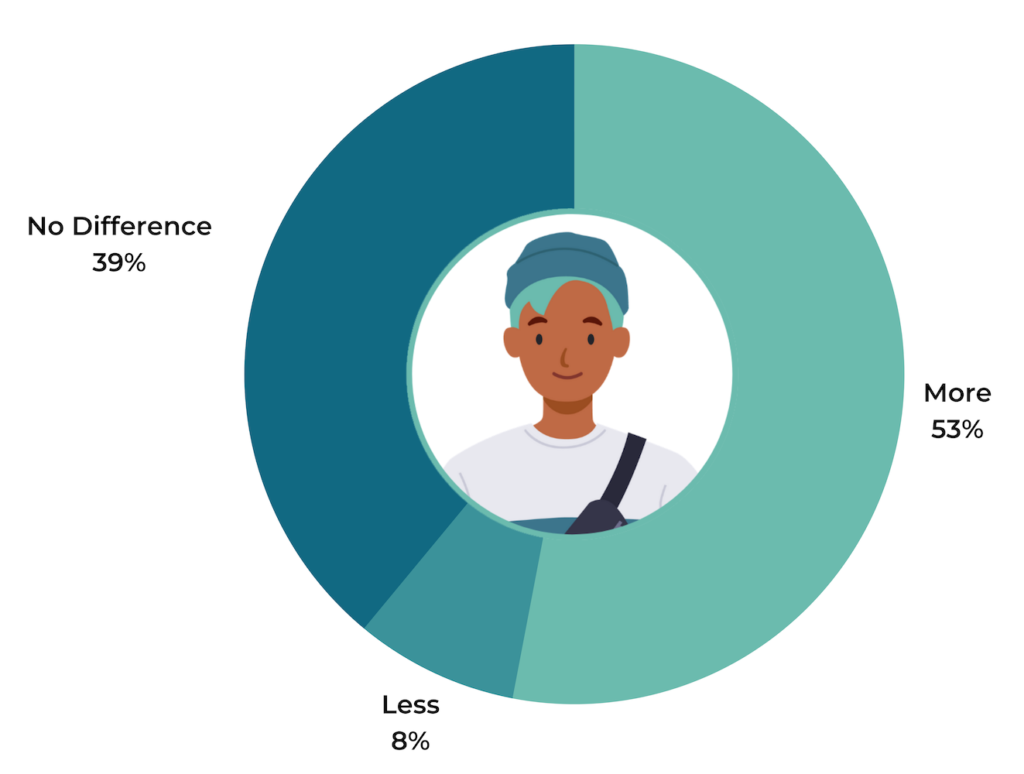

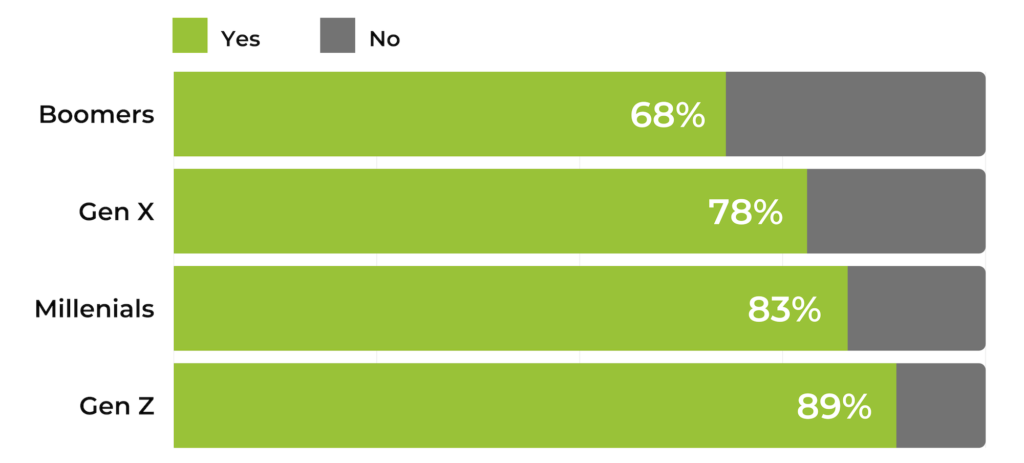

But the majority (83%) of online grocery shoppers are also open to purchasing products they’ve never tried before. Millennials (89%) are the generation most likely to try new products when shopping online for groceries, and Baby Boomers (72%) are the least likely.

In addition, as household income increases, so too does likelihood that a shopper will try a new product. 77% of those who make $0-$25,000 are open to buying new grocery products online, compared to 85% of consumers with incomes higher than $100,000.

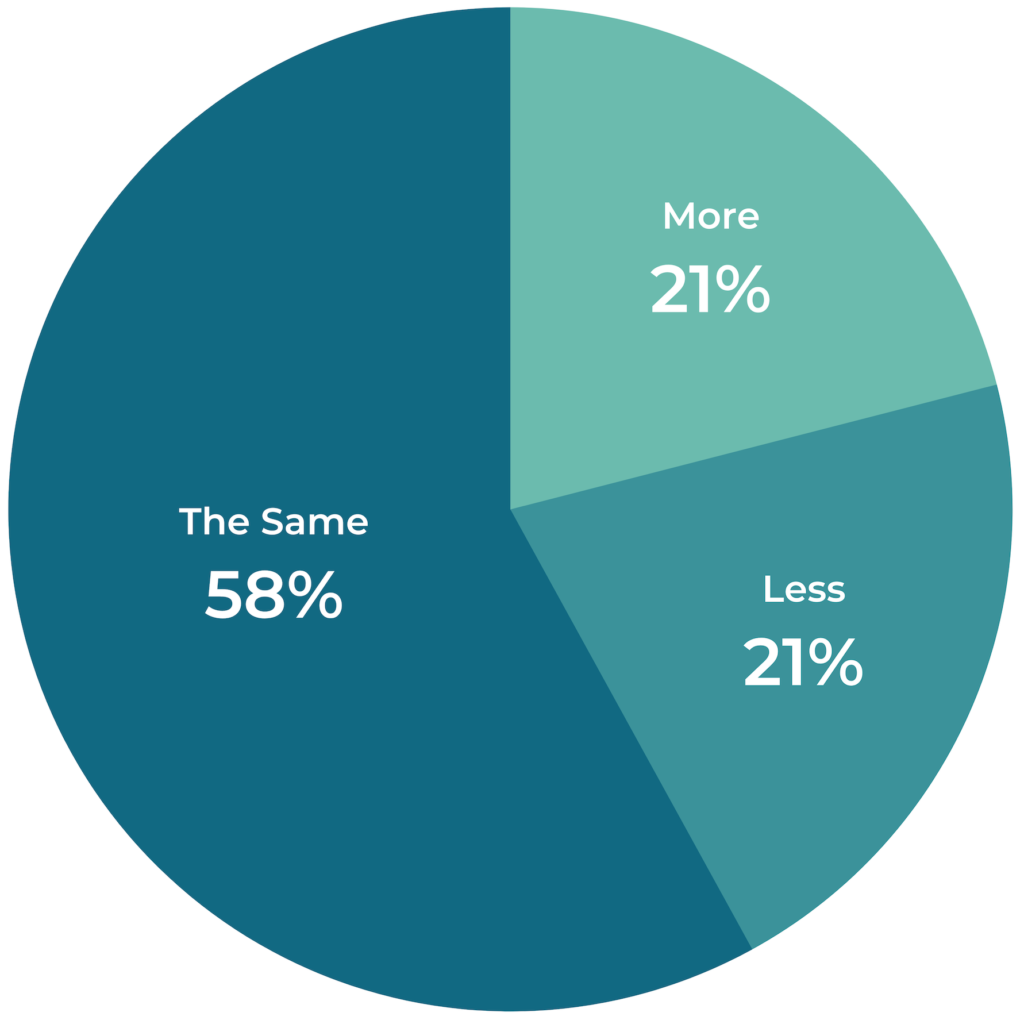

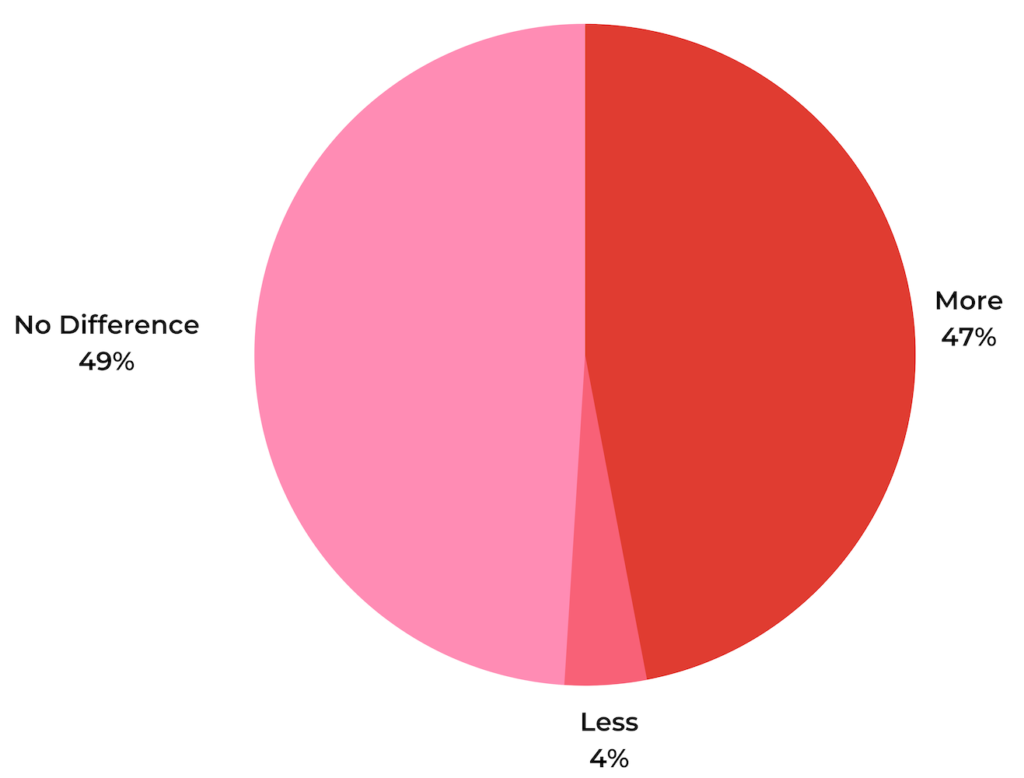

In addition, nearly a quarter (21%) of shoppers say they’re more open to buying a new (to them) product when shopping online than they would if they were shopping in a brick-and-mortar store. And over half (58%) say they’re as likely to try a new product online as they are in a store. This is interesting, as it proves that online grocery shoppers don’t necessarily need to see and touch a new product in person before committing to a purchase. We’ll dig into what gives them the confidence to try a new product later in this report.

By now, the importance of reviews is well understood. But just how impactful is this content for online grocery shoppers? Let’s take a closer look.

Most Online Grocery Shoppers Depend on Reviews

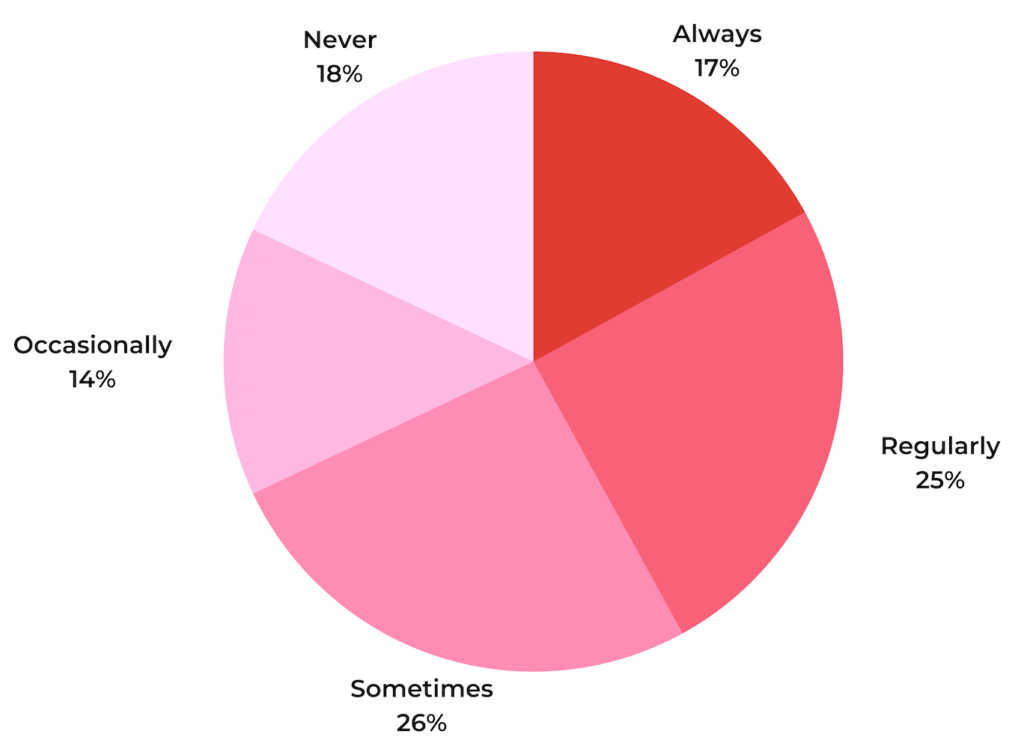

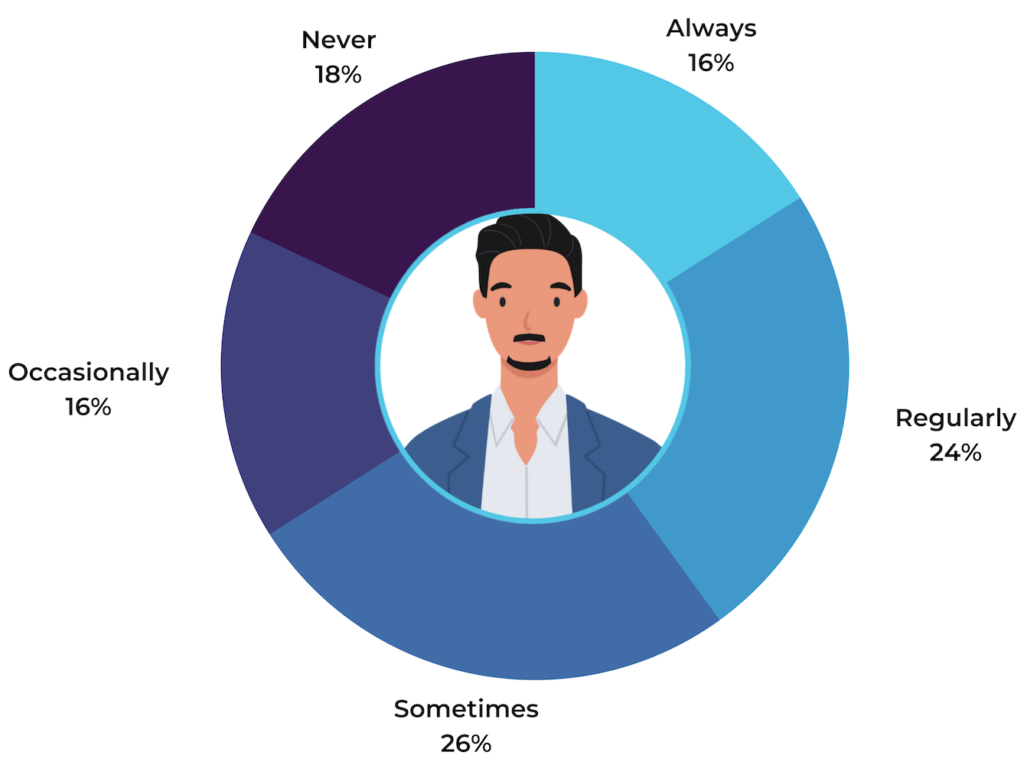

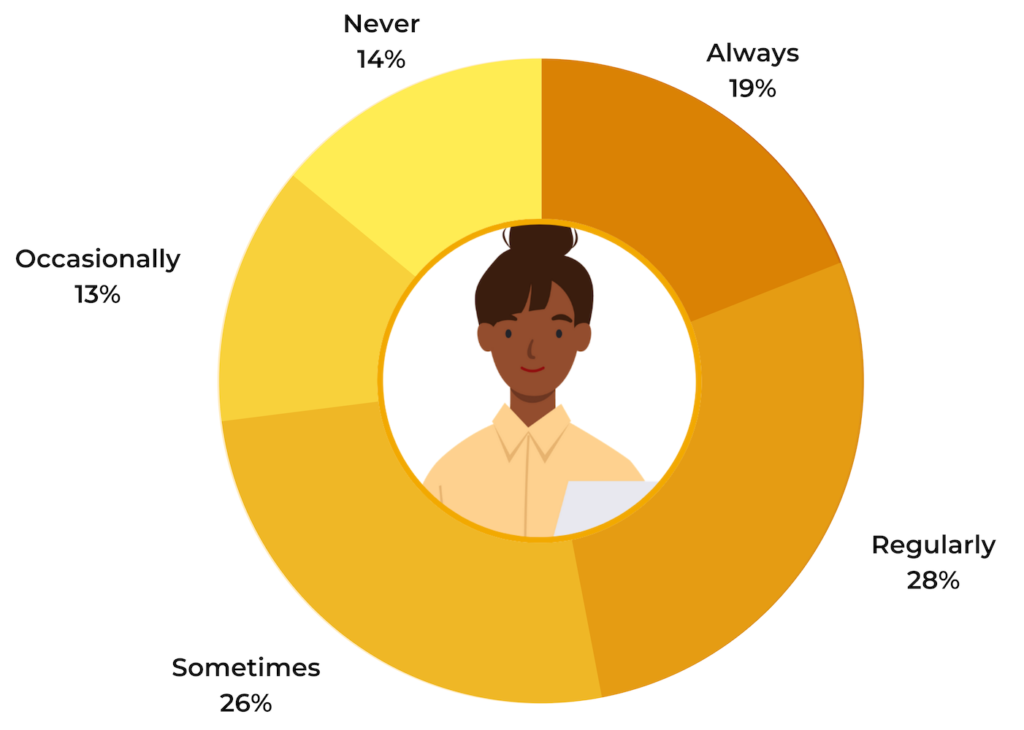

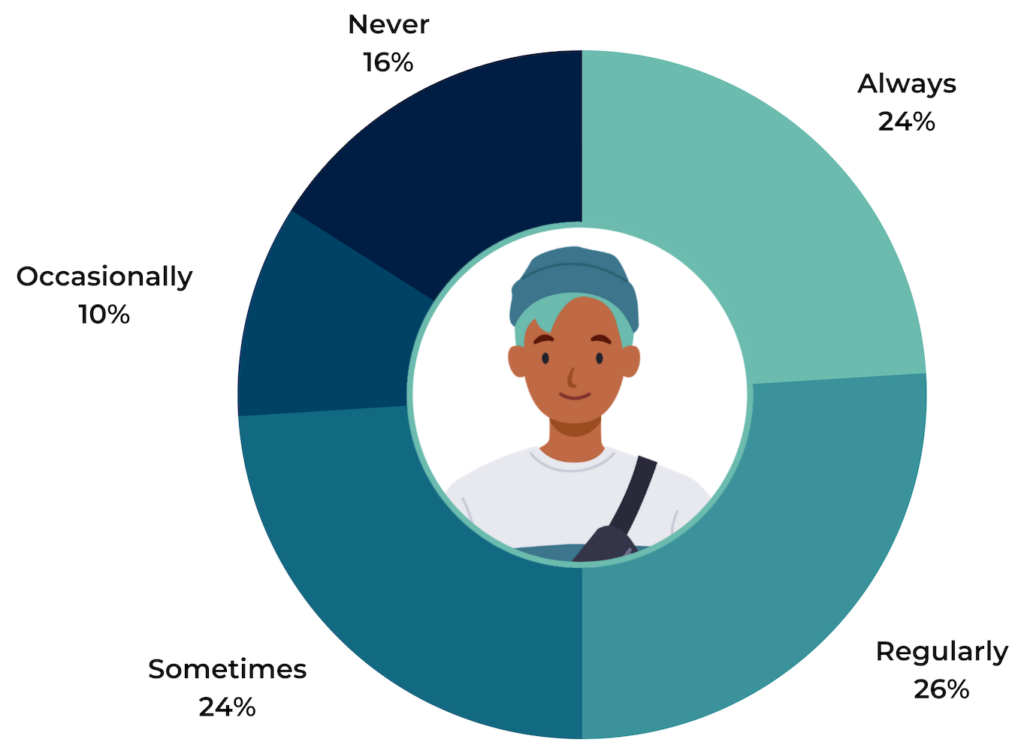

Shoppers turn to reviews when shopping for just about all types of products. And groceries are no exception. 82% of online grocery shoppers say they read reviews at least occasionally. Of online grocery shoppers that read reviews, 17% always read reviews and 25% do so regularly.

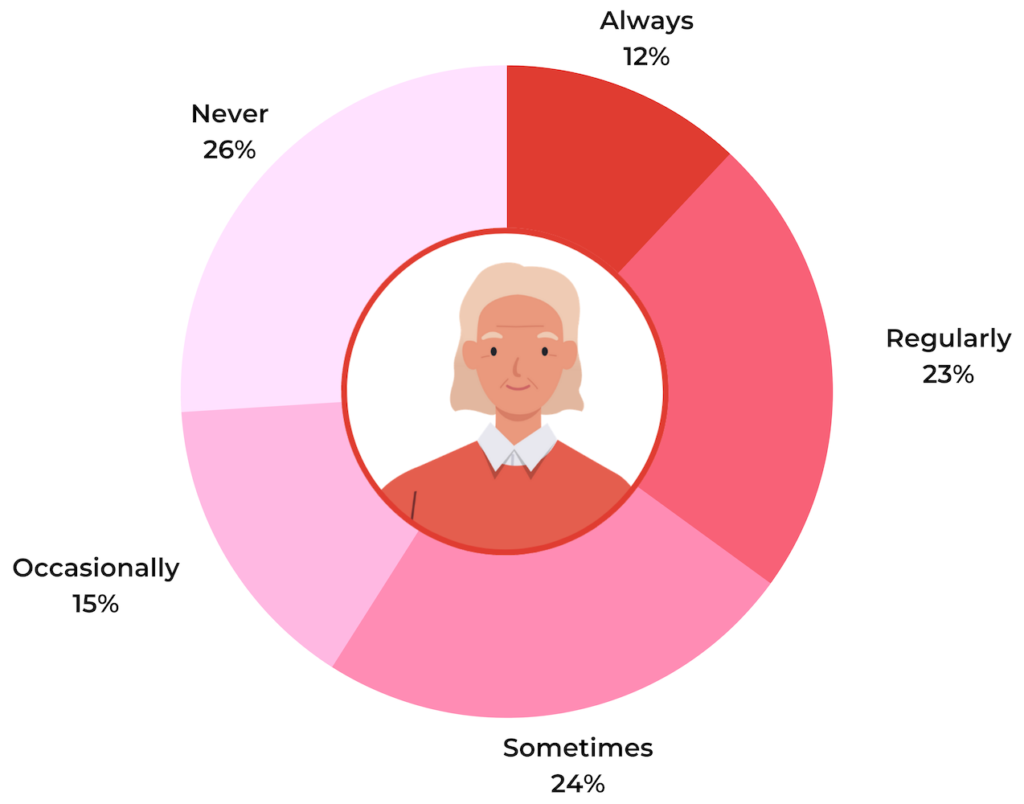

As expected, review consumption is more frequent among younger grocery shoppers.

Reviews Entice Online Grocery Shoppers to Learn More About a Product

When grocery shoppers browse online, reviews often spark interest — and increase the likelihood of clicking through to a product page to learn more.

Nearly half (47%) say they’re more likely to click through to a product page from search results or a grocery store’s homepage if there are ratings and reviews highlighted in these locations.

Millennials and Gen Z shoppers are even more likely to be influenced by the presence of reviews. Over half (53%) of each of these age groups indicate they’re more likely to click through to a product page if there are ratings and reviews highlighted on the homepage or in search results.

Reviews Give Online Shoppers Confidence to Try New Grocery Products

As mentioned earlier in this report, the majority of online grocery shoppers are open to purchasing products they’ve never tried before. But there’s a level of risk involved with purchasing a new or unknown product — especially when a shopper can’t first see it in person. What helps online grocery shoppers overcome that risk and convert? Oftentimes, reviews.

Over three-quarters (78%) of online grocery shoppers say they’re more likely to purchase a grocery item they’ve never bought before if there are customer reviews for that product, up from 72% in 2017. This number is even higher among Millennial (83%) and Gen Z (89%) shoppers.

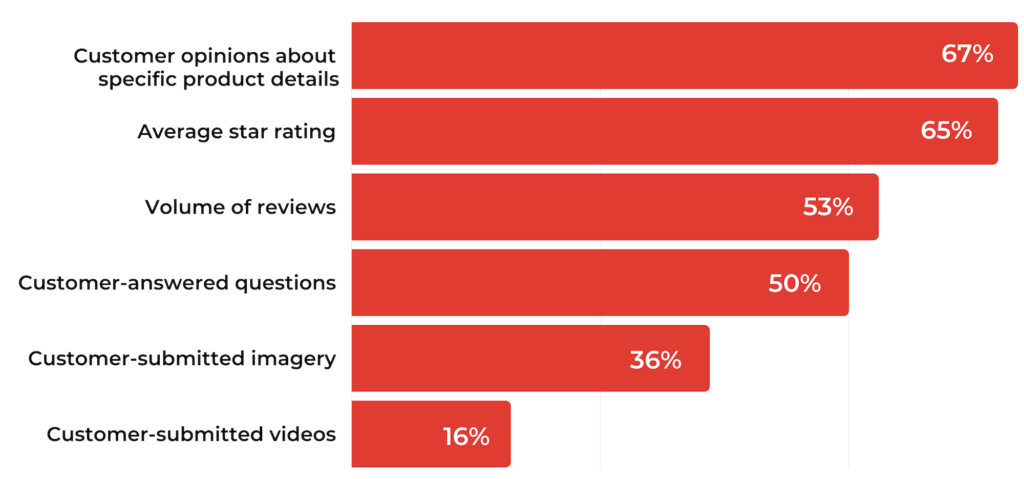

What elements of reviews and other types of user-generated content do grocery shoppers find most useful when making purchase decisions? 67% of shoppers say it’s useful to read other customers’ opinions on specific details relevant to a product. A product’s average star rating is valuable information to 65% of shoppers, and the volume of reviews matters for 53%.

Many grocery shoppers also value other types of UGC, including Q&A (50%) and visual content such as photos (36%) and videos (16%).

These findings point to the importance of generating a steady stream of reviews, Q&A and visual content for all of your grocery products.

In order to attract and retain the growing number of online grocery shoppers, businesses must consistently meet (and exceed) customer expectations. One key way of doing that? Providing online shoppers with all of the content they need to make confident shopping decisions — including reviews — in the places they want to find this content.

Shoppers Seek Reviews for a Variety of Grocery Products

We know that the majority of online shoppers read reviews at least occasionally. But do reviews matter more for certain types of grocery products?

Some categories do rise above the others. Three-quarters (76%) of online grocery shoppers want to access reviews for personal care items, and 70% desire this content for home care products. But the reality is, modern consumers want to access ratings and reviews for a wide array of grocery products, from non-perishable items and frozen foods to soft drinks and baby care items. And their appetite for this content has only grown since we last surveyed grocery shoppers in 2017.

Where Online Grocery Shoppers Want to Access Reviews

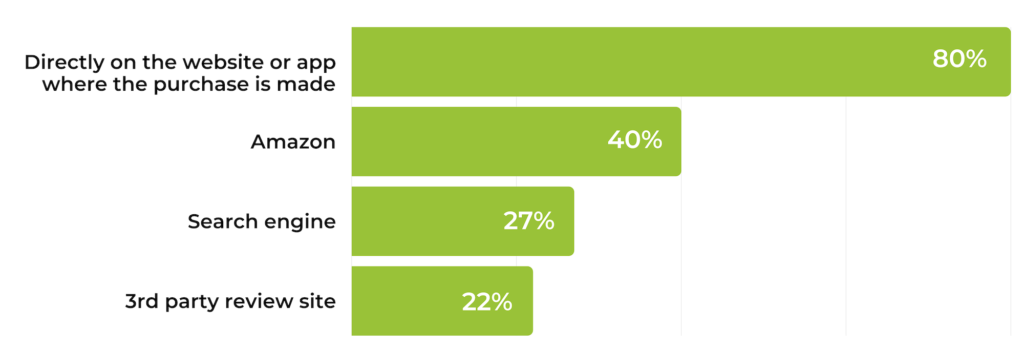

Online shoppers want to access reviews for a wide variety of grocery products. But where do they ideally want to find this content?

80% want to find reviews directly on the website or app they’re purchasing from. And 40% seek reviews for grocery products on Amazon. Other preferred spots for finding reviews are search engines (27%) and third party reviewers or review sites (22%).

This points to the importance of collecting reviews for plenty of your grocery products — then displaying this content so it’s easy to find on your website and mobile app. If you don’t, you risk losing shoppers to Amazon or another service that displays this content.

While online grocery shopping has hit record levels, it’s important to remember that physical store locations aren’t going anywhere anytime soon. As we revealed earlier, nearly all (93%) of those we surveyed said that someone in their household made an in-store grocery purchase within the last three months. And 95% of online grocery shoppers also make in-store grocery purchases.

But while brick-and-mortar grocery is certainly alive and well, the way shoppers navigate the aisles and the information they use to make purchase decisions is changing.

Most Shoppers Use Their Mobile Phones In-Store

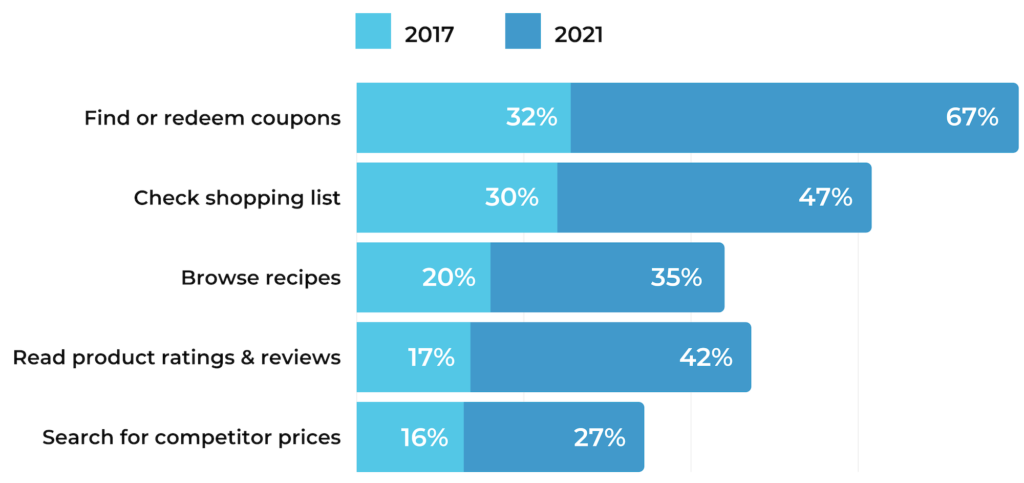

The majority of shoppers (87%) use their mobile phone as a tool while shopping in a physical grocery store. In comparison, 59% said they used their phone to aid in in-store grocery shopping when we asked this question in 2017.

The most popular activities in-store grocery shoppers are using their phones for are finding or redeeming coupons (67%), reviewing shopping lists (47%) and reading product ratings and reviews (42%). It’s worth noting that in-store shoppers are doing all of these activities much more frequently than they were in 2017.

Online grocery shoppers depend on reviews to make informed purchase decisions. And as the findings of this survey indicate, this content has the power to impact in-store grocery shopping, too.

In-Store Shoppers Want Reviews for New or Unknown Products

An in-store shopper is unlikely to consult reviews for their tried-and-true grocery products. But when they’re considering a product they’ve never purchased before, this content can be extremely valuable.

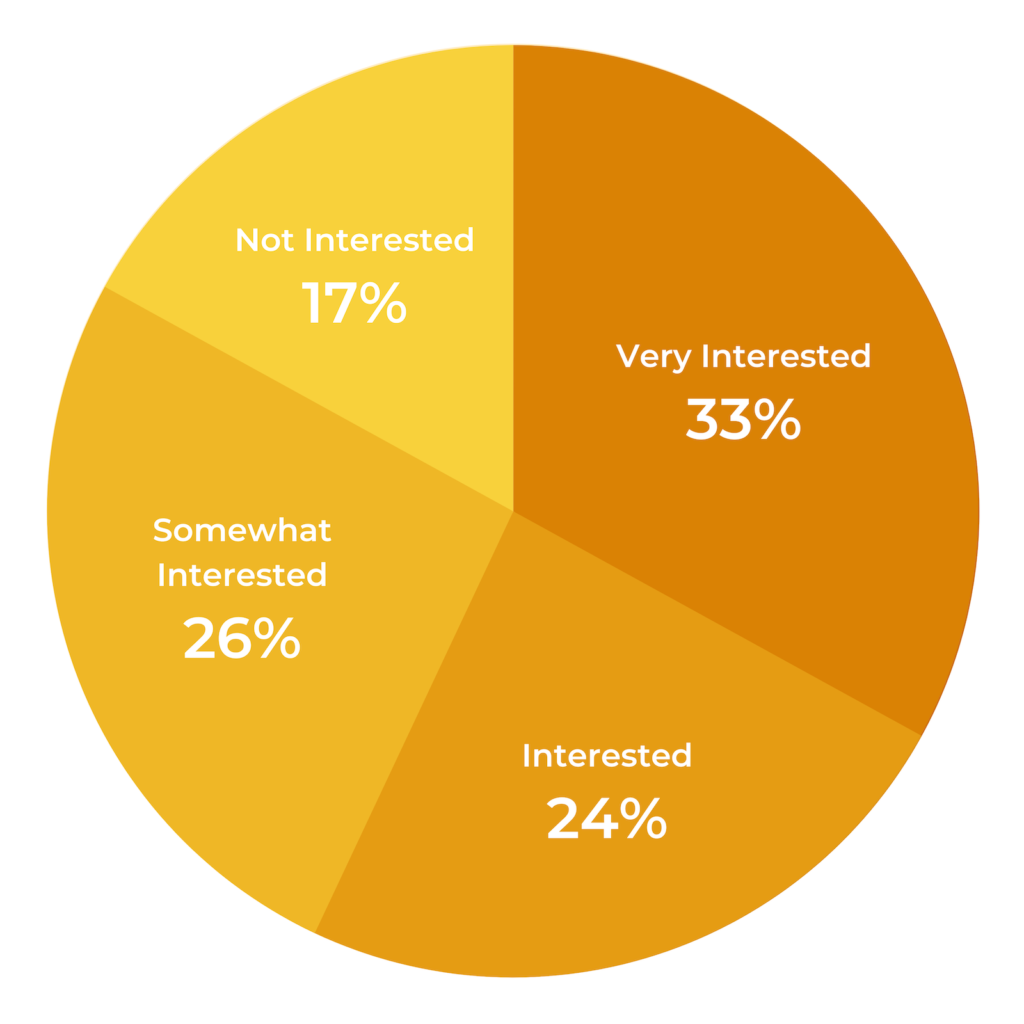

The majority (83%) of consumers are at least somewhat interested in accessing product ratings and reviews when they’re considering a new product while shopping in a brick-and-mortar grocery store. This is up significantly from 2017, when 68% of consumers indicated they wanted access to this content. Of note, Millennials are the generation most likely to be interested in reviews when considering a new product in-store.

Reviews Boost In-Store Shoppers’ Confidence

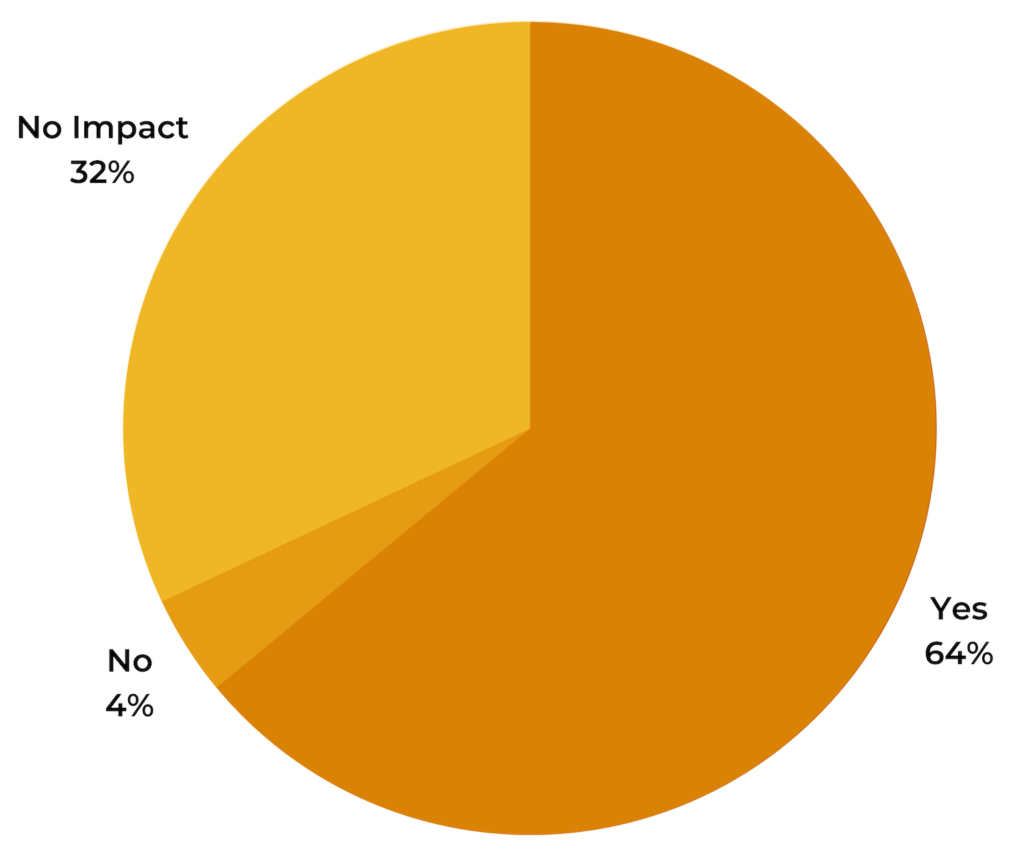

We already know that 78% of online grocery shoppers are more likely to purchase an unknown grocery item if there are customer reviews for that product. And as it turns out, this content can boost confidence for in-store shoppers, too.

When shopping in a grocery store, 64% of shoppers say they’re more likely to purchase a grocery item that they’ve never purchased before if they are able to read customer reviews for the product. In 2017, 52% of consumers indicated this was the case. In line with other survey findings, younger grocery shoppers are even more likely to be persuaded to buy unknown products after reading reviews.

How Grocery Shoppers Want to Access Reviews While Shopping In-Store

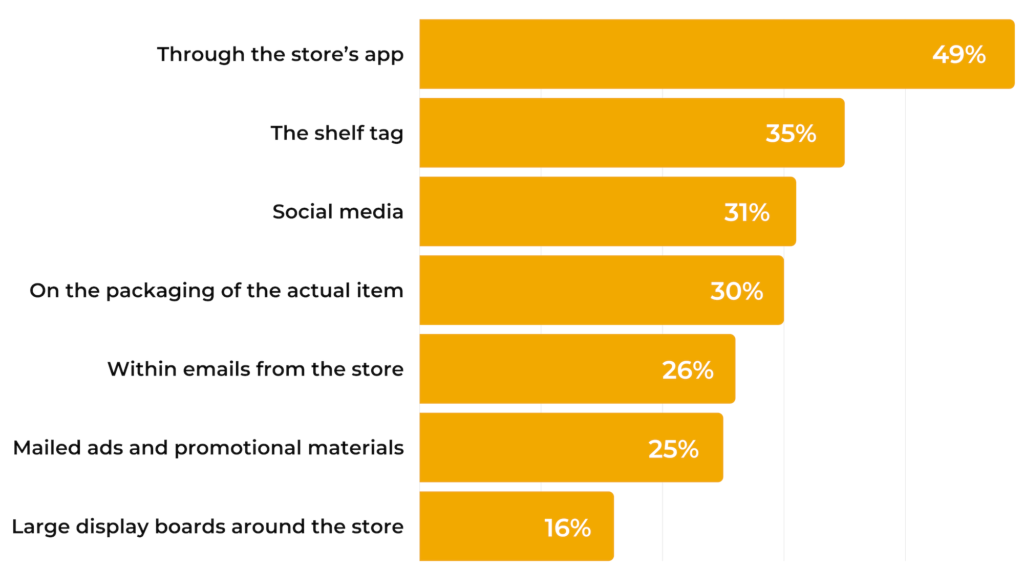

In-store grocery shoppers want to read customer reviews — especially for products they’ve never purchased before. But how do they want to access this content when receiving communications from a grocery provider or shopping in a grocery store?

The most popular answer is through the store or grocery provider’s app, with 49% of in-store grocery shoppers indicating this is where they want to find ratings and reviews. But plenty of shoppers want to see reviews on in-store signage, as well as through other print and digital marketing channels.

Make sure you have easily accessible reviews on your mobile app. And look for opportunities to enhance your in-store signage and marketing campaigns with this powerful social proof.

The way consumers are shopping for groceries has changed — perhaps for good. Grocery brands and retailers must adapt quickly in order to attract, convert and retain shoppers — whether they shop online, in-store or a combination of the two.

Read on for five impactful actions to take to better meet (and exceed) the expectations of modern grocery shoppers, based on the key findings of this report.

Collect reviews.

Online and in-store shoppers alike have a growing appetite for reviews across a number of grocery categories. And the presence of this content increases the likelihood that a shopper will try a product they haven’t purchased before. If you’re not already, start collecting reviews across your product catalog.

Display reviews on your website and mobile apps.

Once you’ve started collecting reviews, be sure to prominently display this content on your website and mobile apps. Both online and in-store grocery shoppers are seeking out reviews on these channels.

Display review content in-store.

Nearly half (49%) of in-store grocery shoppers want to access ratings and reviews via your website or mobile app. But there’s also a good number of shoppers who want to find this content within the store itself. So look for opportunities to enhance your shelf tags, price labels, store signage and even the packaging of your products with star ratings and review information.

Consider product sampling.

Reviews are especially important when shoppers are considering grocery items they’ve never purchased before. So if you’re launching new grocery items in the coming year (or if you have products with a high volume of traffic and a low volume of reviews), consider sending out free samples in exchange for honest reviews. After all, three-quarters (78%) of online grocery shoppers and 64% of those who shop in-store are more likely to purchase a grocery item if they’re able to read reviews for the product first.

Regularly analyze review content to identify areas to improve.

Reviews are a gold-mine of insights that can help you understand what your shoppers love about your products — and what they don’t. By regularly analyzing your review content, you can uncover opportunities to improve your products and your customer experience. And by making data-based, impactful changes, you’ll boost customer loyalty — and your bottom line.