This is the seventh edition of our monthly snapshot, an analysis consumer activity across more than 1.5MM online product pages from more than 1,200 retail/brand sites.

The impact of COVID on ecommerce has been fairly clear to pinpoint. A huge initial surge led to an overall 3x increase in online purchase volumes between February (pre-pandemic) to May. However, the subsequent four months through to September led to a steady decline and then stabilization, with purchase volumes consistently between 40% and 70% higher than they were pre-pandemic.

Due to this stabilization, we re-aligned this month’s report to show the last three months.

The general story is yet more month-on-month stabilization, as we would see in more “normal” years. This means ecommerce sales volumes are higher than where we would typically expect them to be pre-pandemic, but there are also no real major fluctuations indicative of major market shifts.

With this being the case, the Holidays is likely to be the next major event on the horizon when we see any meaningful change.

Key ecommerce market trends

01

02

03

“New normal” continues as Holidays loom

Consumer behavior has clearly become more predictable, with purchase volumes consistently consistently at around 1.4x to 1.7x where they were at the start of the pandemic.

Why? Most likely because the entire population has settled into a “new normal”. People are no longer buying in the bulk they were because they have confidence in supply chain and product availability. They know they will be able to source whatever items they need at short notice. Pandemic life has become normal. We are now used to buying our groceries and other everyday items online. This is reflected in our recent survey, which highlighted how 33% of consumers say their shopping habits have changed forever.

We expect the next major shift to be the Holidays. It’s difficult to predict what these will look like this year but – and this is perhaps not the most groundbreaking observation – we are predicting significantly more spending occurring online than in previous years. In fact, the survey highlighted above illustrated how 64% will spend more online than the last Holiday season. Perhaps of more significance is the timing of this Holiday spend. Our survey also shows that three-quarters will start Holiday shopping earlier than they usually do. So we anticipate notable increases in activity to start over the next month.

Continued stabilization in both online sales and site traffic

Review submission volumes flat for three straight months

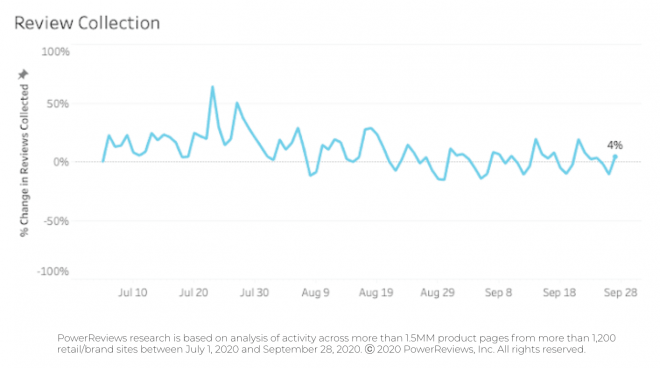

After reporting a giant 2.3x leap in review submission levels from April to May, we subsequently highlighted a consistent drop through to August to the point where levels are now consistent with what we saw pre-pandemic. This again continued for the last month.

We hypothesized previously that this is most likely because consumers have now got to the point where they are no longer buying items they hadn’t tried before. Instead, they now have established product preferences so are less inclined to be motivated to submit reviews.

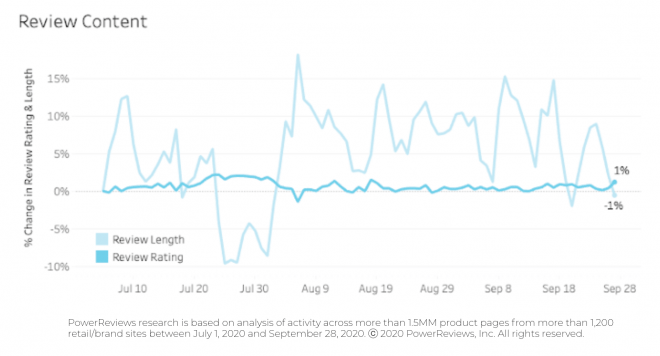

In terms of the actual content of reviews, there have not been any huge shifts over the past six months. Both have been unaffected by the pandemic, which is unsurprising because overall product catalogs themselves will not have shifted too significantly.

No significant variations in review submission levels

Review length and sentiment flat throughout pandemic

Reviews more important than pre-COVID, will become increasingly critical for Holidays

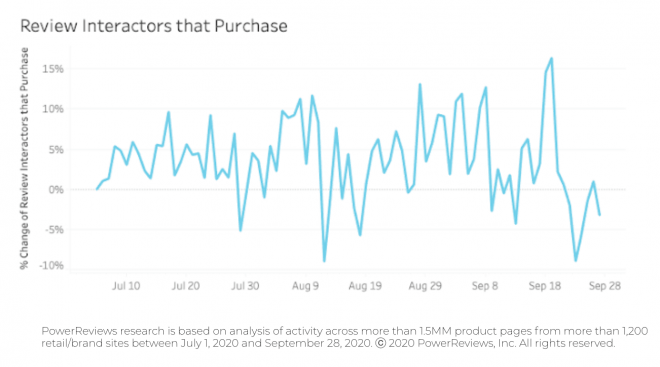

Review content is more influential in driving purchase decisions than it was before the pandemic. A higher proportion of those who interact with reviews are going on to purchase than were doing so pre-COVID.

The August high of 45% above pre-COVID levels was virtually identical to the July high (43% above). As you will note from the scale of this chart, we saw similar numbers through September.

As thoughts turn to the Holidays, this trend is only likely to be accentuated. Our Holiday Survey highlights how 37% of shoppers will pay more attention to ratings and reviews this year than last when making purchases.

When we segmented out consumers who will increase spend this year, this trend was even more pronounced. 25% of this group will be more influenced by ratings and reviews this Holiday season (this is compared to the 19% who say they will increase spend overall).

Reviews still convert shoppers to buyers more than they were pre-COVID

Summary

The story for the October snapshot is that it has proven to be the fourth month of continued stabilization. Trends are now very flat so we can confidently say we are now in a COVID-driven “new normal”.

However, the Holidays – the biggest time of year for ecommerce and retail – loom large. Our research indicates, predictably, that this will be the biggest Holidays ever for ecommerce.

Two other key findings in our Holiday report are particularly worth noting though:

- 73% say their Holiday spending will either be consistent with or increase in comparison to last year. In the context of overriding economic conditions and uncertainty, this is surprising. But the reality is people have not been spending money this year (e.g. bars, restaurants, movie theatres and other entertainment outlets have been off-limits) and are looking for a lift. Either way, this is good news for brands and retailers.

- Shopping will start earlier than normal – given this has been an objective of the entire industry for years, it will be music to the ears of brands and retailers looking to cash in after a difficult year for many.

With this being the case, we expect ecommerce traffic and sales to increase through October in the run-up to the Holiday season.