Last month, we released our first monthly snapshot (summary here). This is our May edition of the same report, analyzing consumer activity across more than 1.5MM online product pages from more than 1,200 retail/brand sites.

This time, we focused on a two-month period (starting February 24 2020 and ending April 24 2020). We specifically looked at review submission levels, review length and sentiment, overall conversions/sales and review consumption.

Given this has been quite possibly the biggest disruption to retail and ecommerce since people started shopping online, the results continue to be extremely revealing.

The surge in online traffic and sales volumes have been well documented but the data is still breathtaking.

Key ecommerce market trends

01

02

03

Order transactions surge as online traffic also rises

Unsurprisingly and as reported widely elsewhere, our data reveals that digital consumer transactions have surged during these times of self-quarantine and “stay at home” orders. However, the numbers are still staggering. Online sales volumes leapt 210% between February 24 and April 15. This continued the trend we saw in last month’s snapshot, when we reported an increase of 101%. That seemed a massive increase but proved to be a sign of what has subsequently followed.

While product page traffic had been relatively stable in March, this also began to climb in April. However, these increases have not been at the same rate as order volumes – meaning shoppers are becoming even more decisive as conversion rates have also continued to increase. We again attribute these trends to consumers buying lower consideration products so spending less time browsing and comparing products.

Online shopping volumes continue to climb

Review submission levels and review length increase in April, while average rating steady

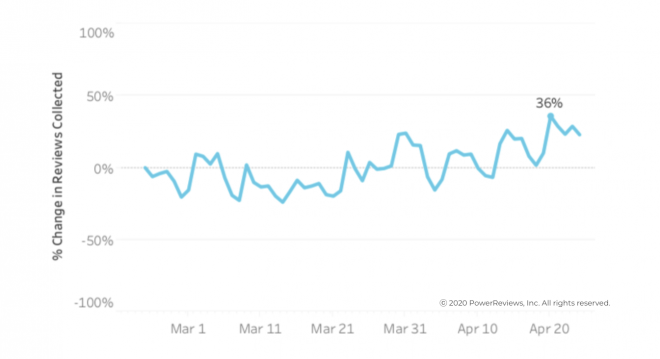

After initially staying relatively steady in March, review submission levels actually rebounded in April topping out at 36% higher on April 20 than they were at the end of February. Given the huge growth in online shopping volumes, this actually is a decline in real terms. This is possibly because much of the growth in order volumes is likely coming from consumers who typically shop offline.

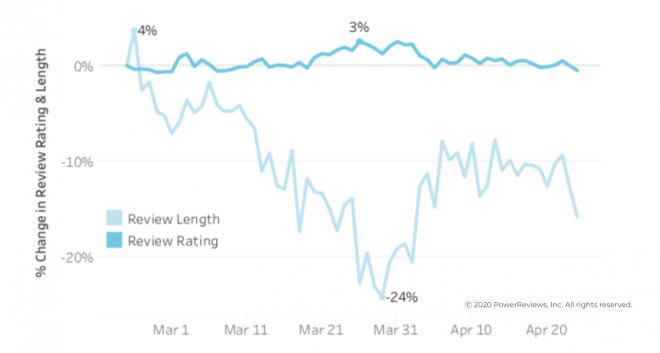

In the same way, review length did increase in April from what we saw in March, but overall reviews submitted remain shorter than before the impact of COVID-19 hit fully. However, a higher volume of reviews are still being submitted right now than in more “normal” times, meaning this still represents a good opportunity for brands and retailers to generate increased CGC levels.

Sentiment – in the form of average rating – remains flat, which makes sense given the products themselves are unlikely to have changed significantly in this period.

Review volumes begin to rise steadily after initial fall

Review length begins to rebound after initial fall

Engagement with consumer reviews surges

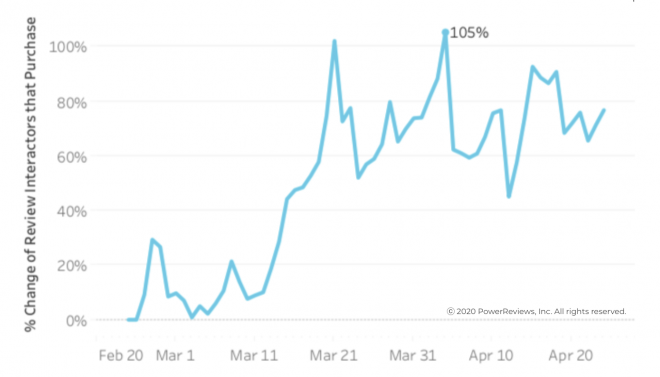

Reviews become even more important in the COVID-19 era. Consumers that convert are still engaging with review content (sorting, filtering etc) at as much as double the rate they were before the epidemic fully hit the U.S.

Given our data is based on review engagement as a proportion of consumers who buy (and, as we see above, this has jumped significantly), total review engagement is way up on “normal” levels and has climbed in line with increased sales volumes.

Shoppers are heavily relying on review content to make purchase decisions, perhaps because low inventory levels are forcing them to buy products they hadn’t previously before.

Review engagement remains skyhigh

Summary

The big story is the sheer increase in online sales volumes over the past two months, having more than tripled in this period.

Consumers continue to rely on ratings and review content to justify purchase decisions, providing the validation and social proof necessary to drive sales. Review engagement continued to be at around double the level of more typical times and total review engagement has soared over the past two months.

Review volumes are also starting to increase, which is to be expected given review submissions lag behind time of purchase. With sales levels at such high levels, we would expect this figure to continue to climb over the next one to two months. With this being the case, this period represents an excellent opportunity to generate deep and impactful review content from your customers.

For a deep dive into these findings, including a specific look at ecommerce trends across health and beauty, view the recording of our webinar.