This is the third edition of our monthly snapshot (previous versions here and here). This is our June version of the same report, analyzing consumer activity across more than 1.5MM online product pages from more than 1,200 retail/brand sites.

This time, we focused on a three-month period (starting February 24 2020 and ending May 24 2020). Each report, we specifically analyse review submission levels, review length and sentiment, overall conversions/sales and review consumption.

We are seeing stabilization in most of the data we capture, as the market seemingly adapts to a new “normal”. Ecommerce sales volumes are still at around three times pre-pandemic levels, although there was a small increase in web traffic since our last snapshot report. The biggest change we saw was an increase in reviews submitted, which more than doubled in May alone.

Key ecommerce market trends

01

02

03

Order transaction volumes stabilize at new high level but page visits climb

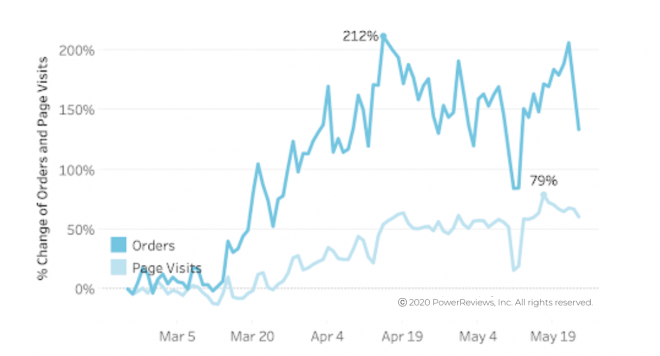

In last month’s snapshot, we reported two months of continuous and significant growth in digital consumer transactions. It was unsurprising that these surged given broader social and political conditions driven by the pandemic. But the extent of the growth (up 212% in less than two months) really underlined the huge shift that occurred.

Based on what we’ve seen throughout the month of May, it seems that ecommerce is now operating in a “new normal” environment. Our data peaks towards the end of our analysis period (up 206% on May 22 in comparison to the end of February) highlighting no let-up in demand.

However, we did see a slight climb in traffic. Baselining our data at the end of February, page visits hit a peak increase of 63% in late April. This same number rose to a 79% increase on May 17. We had noted that consumers were buying rather than shopping before. This change indicates that they are becoming slightly less decisive as the pandemic continues.

We talked about channel shifting last time as consumers used to shopping in-store were forced to transition online. This slight increase in page traffic is also potentially part of this shift to a “new normal” as shoppers become more familiar with browsing online. Uncertainty around job security and income is also most likely playing a role in consumers becoming less decisive.

Traffic up, while order volumes hit a “new normal”?

Review submission levels more than double, while review content and sentiment remains consistent

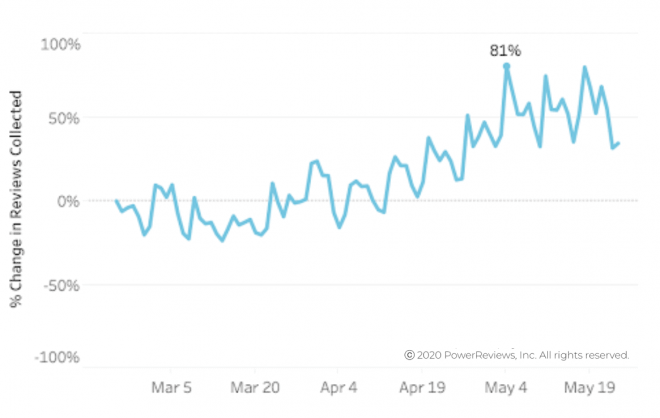

The big story when it comes to review content is that review volumes have risen significantly, up 2.3x from April to May. At the beginning of the month, review submission volumes were 81% higher than they were at the end of February. In late April, the same comparative figure was 36% – which was the peak we saw in that month.

This is to be expected to a certain extent: review submission volumes always lag behind purchases for obvious reasons (typically, consumers like to try the product a little before reviewing it). It is perhaps also a reflection of consumers not used to shopping online becoming more accustomed to doing so and adopting more typical ecommerce-driven behaviors.

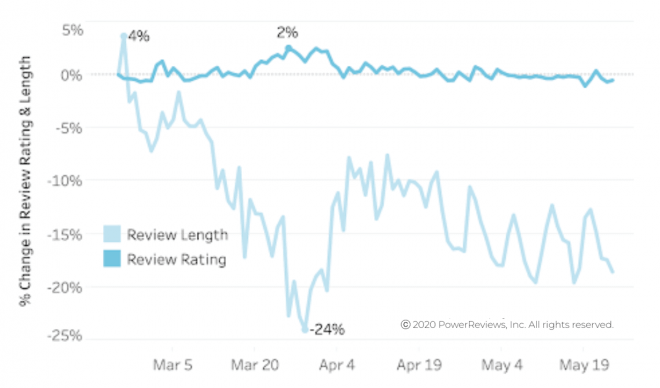

In terms of the actual content of reviews, there were not any huge shifts. Sentiment – in the form of average rating – remains flat, which makes sense given the products themselves are unlikely to have changed significantly in this period. Review length is down slightly on pre-pandemic levels but, given the average review length is 154 characters, a decrease of 10-20% is not particularly significant or meaningful.

Review volumes up 2.3x in May

Review length stabilizes, ratings unchanged

Review content continues to be critical to driving purchase decisions

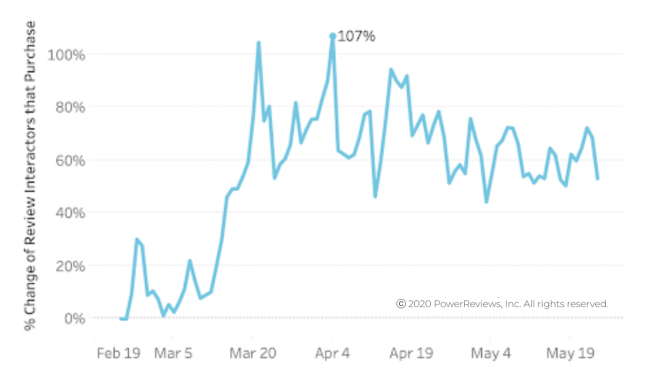

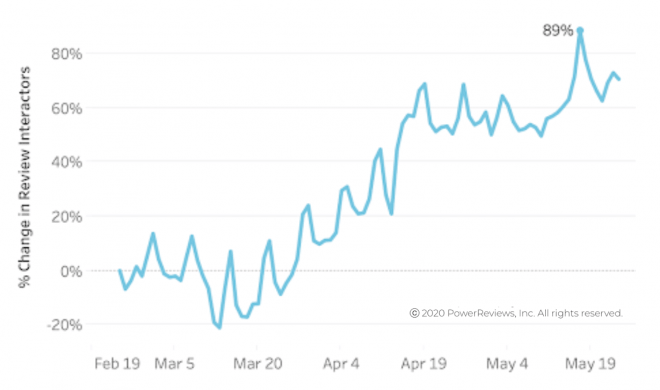

As we reported previously, reviews have become even more important in the COVID-19 era. Consumers that convert were engaging with review content (sorting, filtering etc) at as much as double the rate they were before the epidemic fully hit the U.S in April.

Mirroring how sales volumes have leveled off over the past month, typical review engagement was consistently 70%+ up on “typical” levels. Shoppers are still heavily relying on review content to assess product quality and make purchase decisions, as evidenced in total review interaction levels – which have increased steadily since we started capturing this data at the end of February. In May, this hit a high of 89% above end of February levels.

As we theorized last month, we believe this is most likely because low inventory levels are forcing consumers to buy products they hadn’t previously before.

Review content continues to have big impact

Review engagement increases

Summary

Review submission volumes increased significantly in May, which was the biggest change in all the metrics we analyze. We actually predicted this in last month’s snapshot because we know review submissions lag behind the time of purchase. With sales levels showing no signs of declining, we would expect this figure to either climb further still or at the very least remain at its currently high level. With this being the case, this period represents an excellent opportunity to generate deep and impactful review content from your customers.

Speaking of sales volumes, they continue to consistently be at around three times pre-pandemic levels. They did not significantly decrease or increase since last month’s snapshot report. This implies normalization in the market. It’ll be very interesting to see how much of this holds once stores reopen.

Consumers continue to rely on ratings and review content to justify purchase decisions, providing the validation and social proof necessary to drive sales. Review engagement among purchasers is now at around 70% higher than more typical times and total review engagement has steadily increased in the last three months.