Survey at a Glance:

The PowerReviews Changing Face of the Beauty Shopper Study draws on survey responses from 10,646 active beauty consumers across the country. Key findings include:

-

87% say they spend more or the same online than before Covid

-

49% say they now spend more than $50 online on beauty products; compared to 16% than when we asked this same question in 2019

-

57% of shoppers say that they had never tried more of a quarter of the beauty products they bought online in 2020 (i.e. they were first time purchases)

-

However, in-store beauty spending at this level has also increased: 41% say they now spend more than $50 in store, compared to 21% in 2019; 55% also say they use curbside pick-up more than before the pandemic

-

99% always or sometimes read ratings and reviews when shopping for beauty products online, same figure for in-store shoppers is 85%

-

79% focus on average star rating, 58% care about overall volume of reviews and 49% say they look for recent review content.

-

41% say they rely on reviews more than they did pre-Covid. This is most prominently the case among younger generations, with 58% of Gen Zers claiming this to be the case.

-

User-generated imagery and video is also key, with 38% saying it’s more important than before the pandemic (again this figure is highest among Gen Zers at 53%)

-

76% focusing on buying products that are sustainably made

-

50% actively seek out products made by Black-owned beauty brands.

Contents

Beauty Shopping is at an Inflection Point

In the past, when a shopper was in the market for a beauty product such as lipstick, mascara or moisturizer, they’d drive to their neighborhood drug store or pay a visit to a beauty counter at a local department store. And when they did, they’d find shelves dominated by products manufactured by a relatively small number of legacy brands.

But that’s no longer the case. The way consumers shop for beauty products is constantly evolving — a process supercharged by the Covid pandemic.

A growing number of consumers now purchase beauty products online. This has inevitably led to an increased dependence on user-generated content as shoppers seek validation for their purchases.

What’s more, new beauty brands and products seem to emerge daily. And the criteria shoppers use to make purchase decisions is evolving; increasingly, shoppers seek out brands and products that align with their values.

The Covid Pandemic Has Impacted Beauty Shopping Habits -- Perhaps for Good

Just when it seemed businesses finally had a handle on the shopping habits and preferences of beauty shoppers, Covid hit. The global health crisis has had a huge (and lasting) impact on just about every facet of life — including the way we shop.

There’s Plenty of Opportunity for Customer-Centric Beauty Businesses

Beauty brands and retailers must adapt their plans and strategies to effectively reach and convert today’s shoppers. And there’s plenty of opportunity for those that do. According to a report from Fior Markets, the global beauty and personal care products market was $493 billion in 2018. By 2026, it’s expected to reach $756 billion.

By 2026, the global beauty and personal care products market is expected to reach $756 billion.

In order to develop effective strategies, though, brands and retailers must first understand how consumers are shopping for beauty products — and how the global health crisis has shaped these habits.

Adjust Your Strategy to Attract and Convert More Beauty Shoppers

Recently, PowerReviews surveyed 10,646 consumers to shed light on the shopping habits and preferences of those purchasing beauty products — specifically makeup and skincare items. We also aimed to understand how beauty shopping habits have changed since 2019, when we fielded a similar survey.

This report will share the key findings of our research — as well as practical, impactful actions beauty brands and retailers can take to meet (and exceed) the expectations of today’s beauty shoppers…and boost their bottom line.

For the purposes of this report, “beauty” is defined as products in the makeup and skincare categories.

Generations

(1997-present)

(1981-1996)

(1965-1980)

(1946-1964)

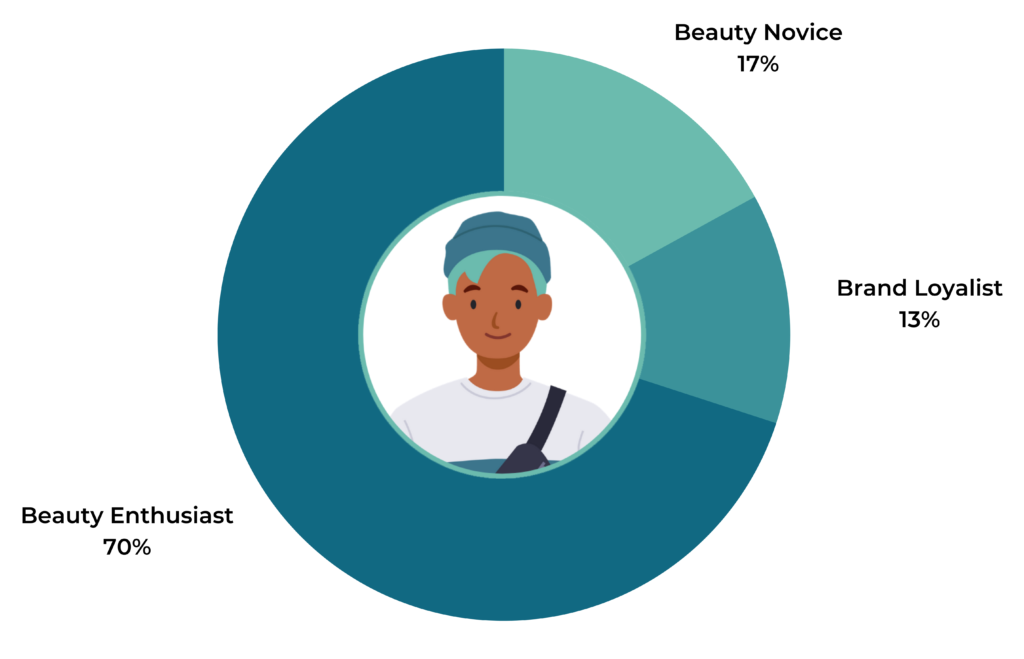

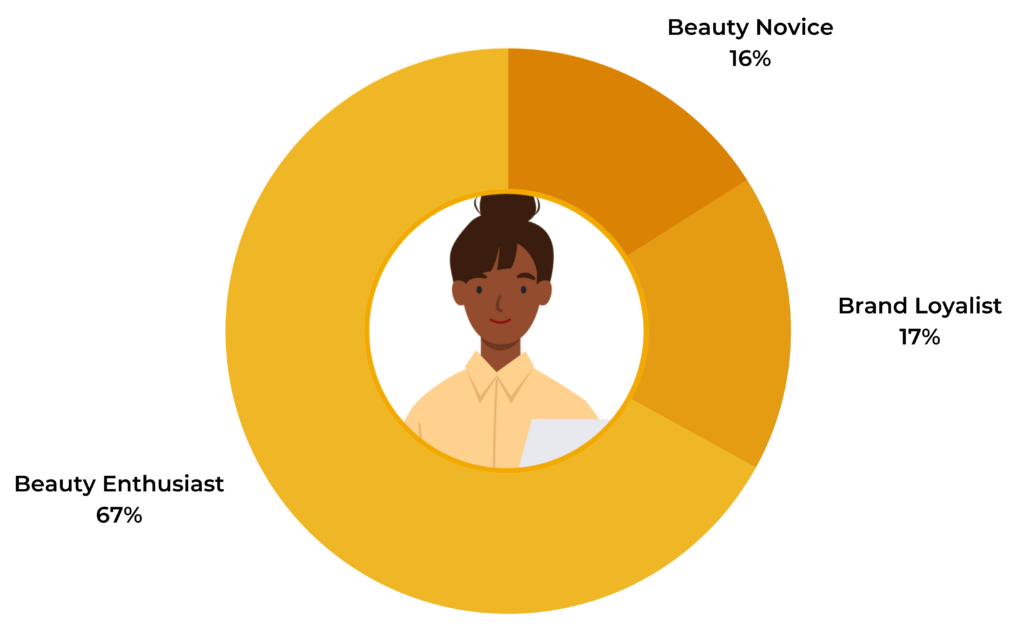

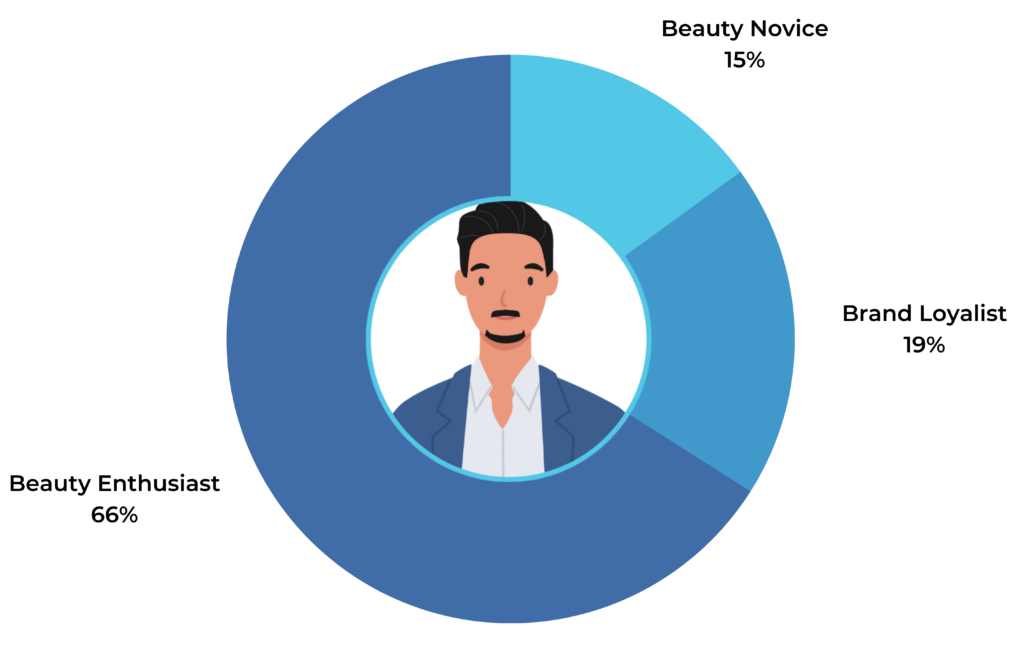

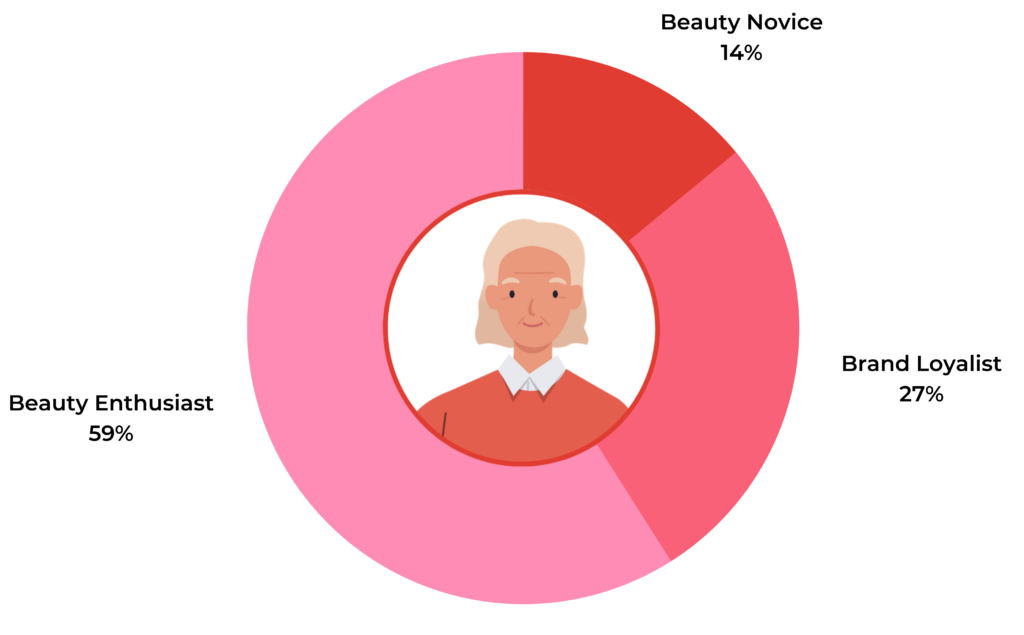

Type of Beauty Shopper

Shopper Type by Generation

Gen Z is the generation most likely to identify as beauty enthusiasts.

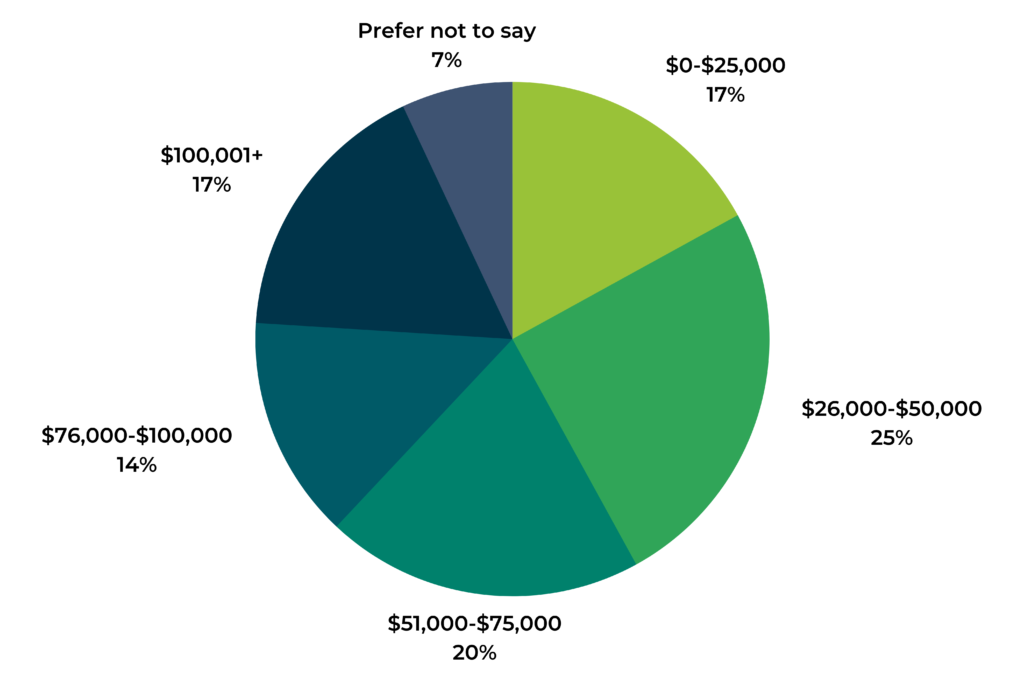

Household Income

The pandemic has turned peoples’ lives upside down. Many people are working from home — while simultaneously supervising their childrens’ eLearning. And the vast majority of vacations and events have been cancelled — at least for the time being.

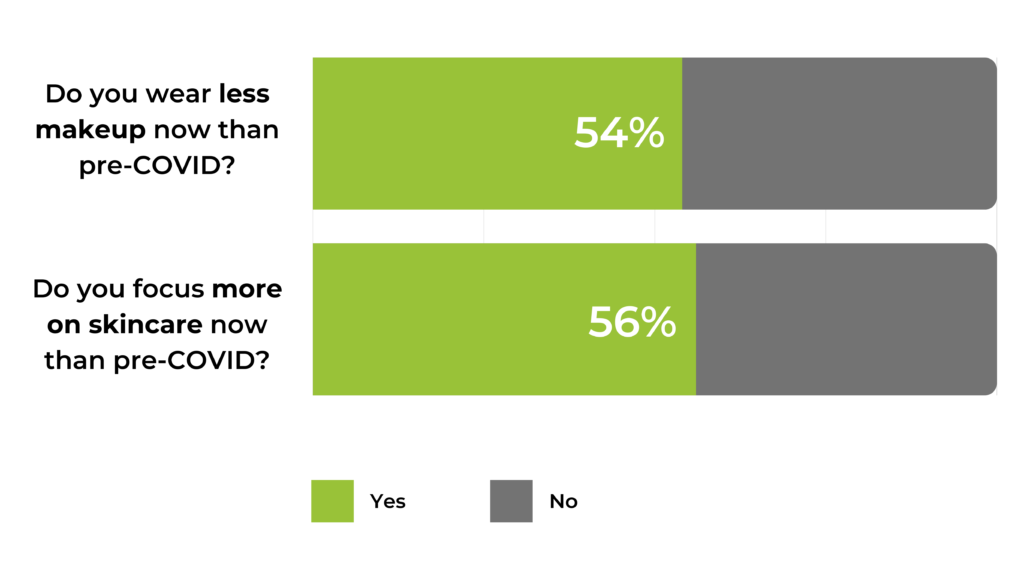

Beauty Habits Have Evolved

These lifestyle changes have led to changes in beauty habits, too. For example, many consumers are cutting back on makeup use, likely because they’re not leaving the house as much.

In fact, our survey found that more than half (54%) of consumers indicate they wear less makeup now than pre-COVID.

On the other hand, it seems many consumers are making skincare a priority. More than half (56%) indicate they’re more focused on skincare now than they were before the pandemic.

People are spending more time at home, which means they may have more time to devote to more thoroughly caring for their skin.

Beauty Spending Has Changed

The pandemic has had a negative financial impact for many consumers. According to the Department of Labor, the U.S. unemployment rate was 6.7% in December 2020.

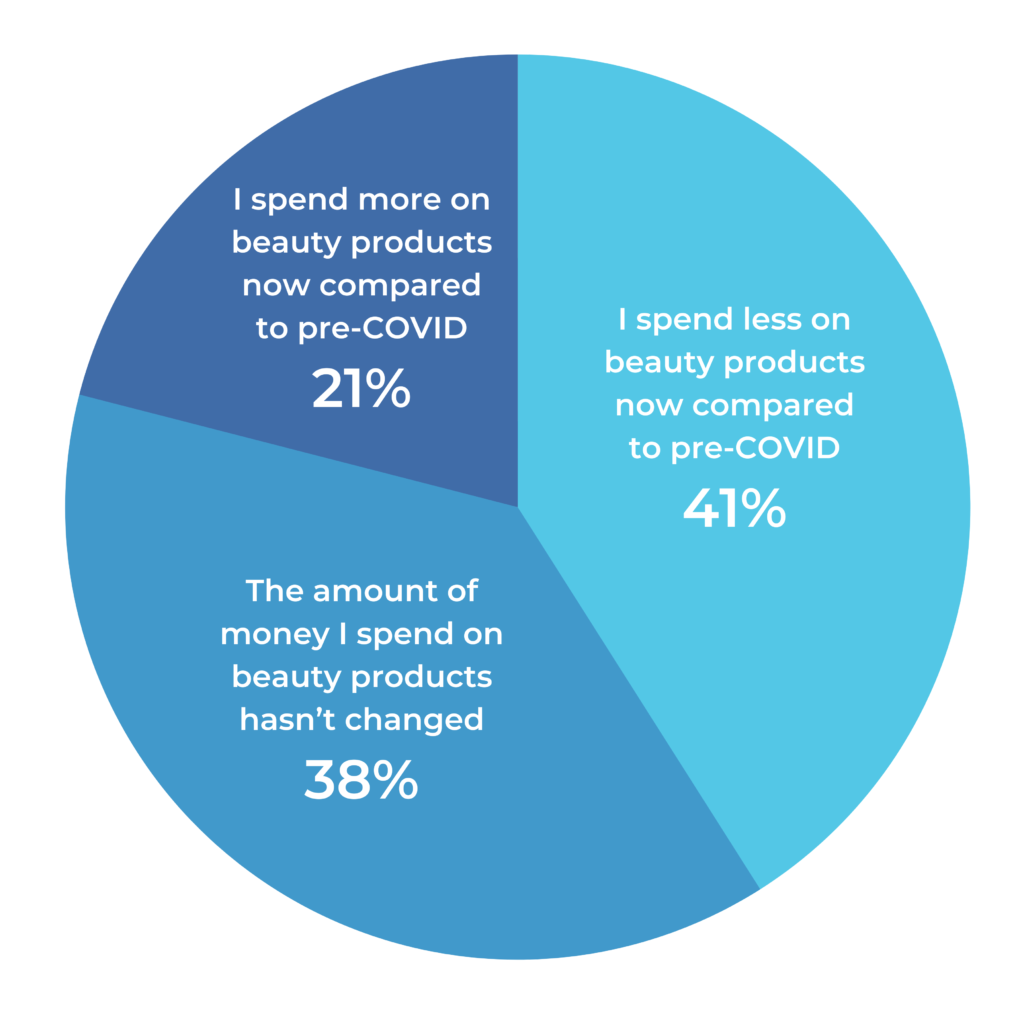

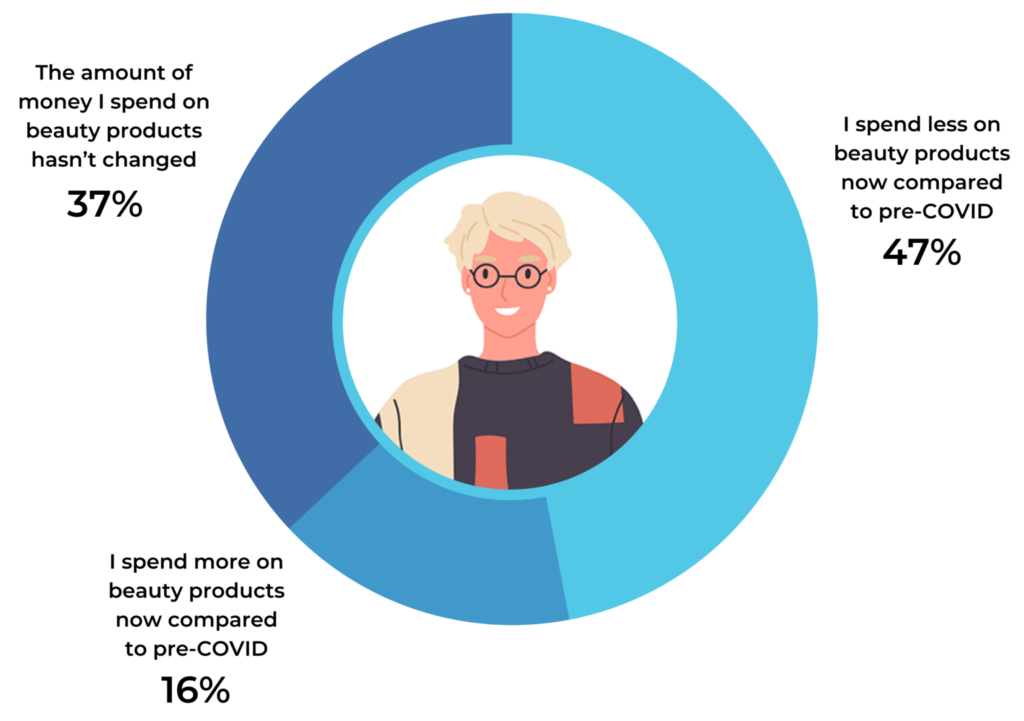

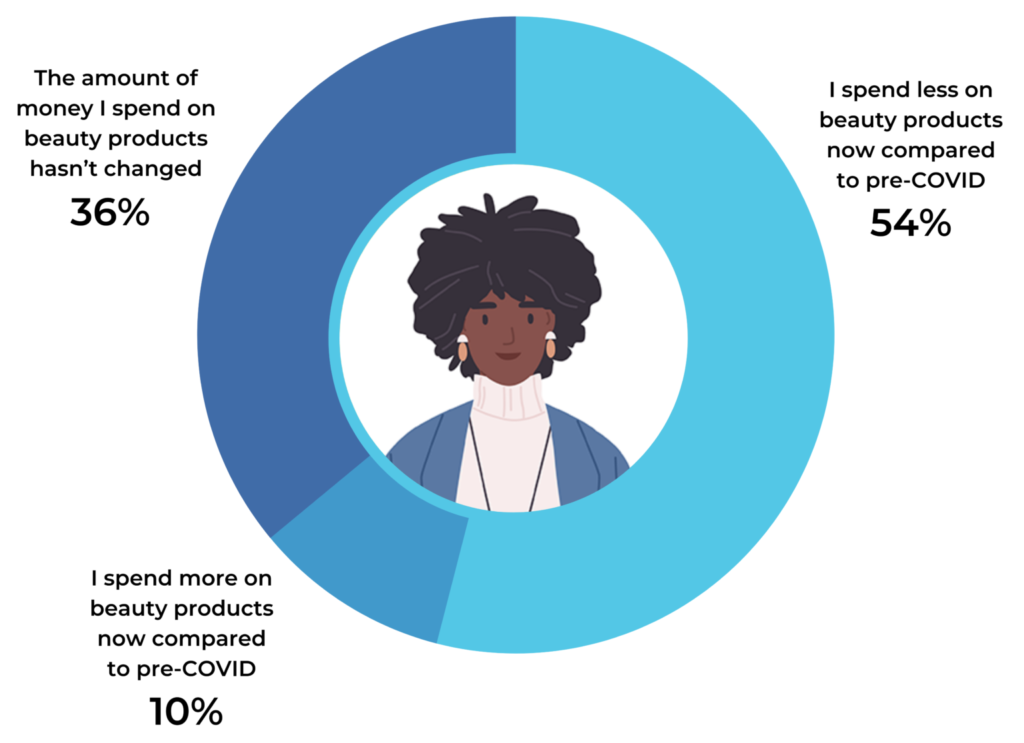

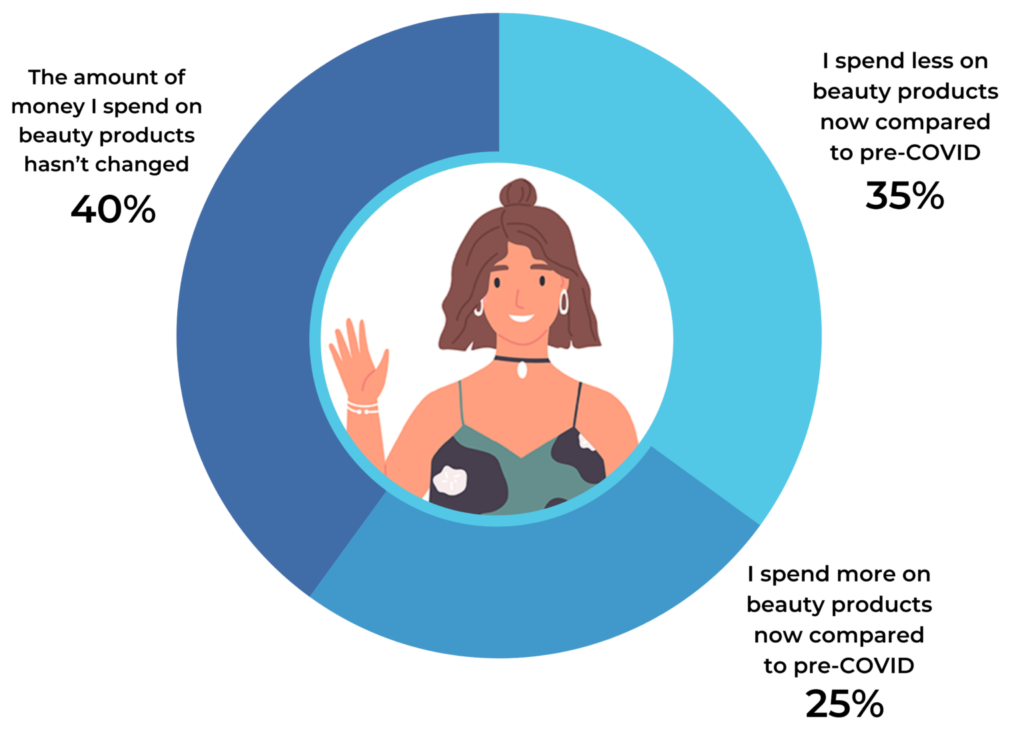

With so many unemployed (and underemployed) people, it’s not surprising that 41% of consumers say they spend less money on beauty products now than before COVID. Over a third (38%) indicate their beauty spending hasn’t been impacted by COVID, and the remaining 21% say their beauty spending has actually increased.

Beauty enthusiasts are the least likely to have decreased their beauty in the midst of COVID (and most likely to have increased spending), when compared to beauty brand loyalists and beauty novices.

Income also seems to impact whether shoppers have decreased their beauty spending — but perhaps not as much as expected. Those making higher incomes are just slightly less likely to have cut beauty spending post-COVID than those with smaller incomes.

| I spend less money on beauty products now than before COVID | I spend more money on beauty products now than before COVID | The amount of money I spend on beauty products has not changed | |

| $0 – $25,000 | 44% | 18% | 38% |

| $26,000 – $50,000 | 42% | 20% | 38% |

| $51,000 – $75,000 | 39% | 21% | 40% |

| $76,000 – $100,000 | 38% | 23% | 39% |

|

$100,000+ |

38% | 24% | 38% |

| Prefer not to say | 43% | 16% | 41% |

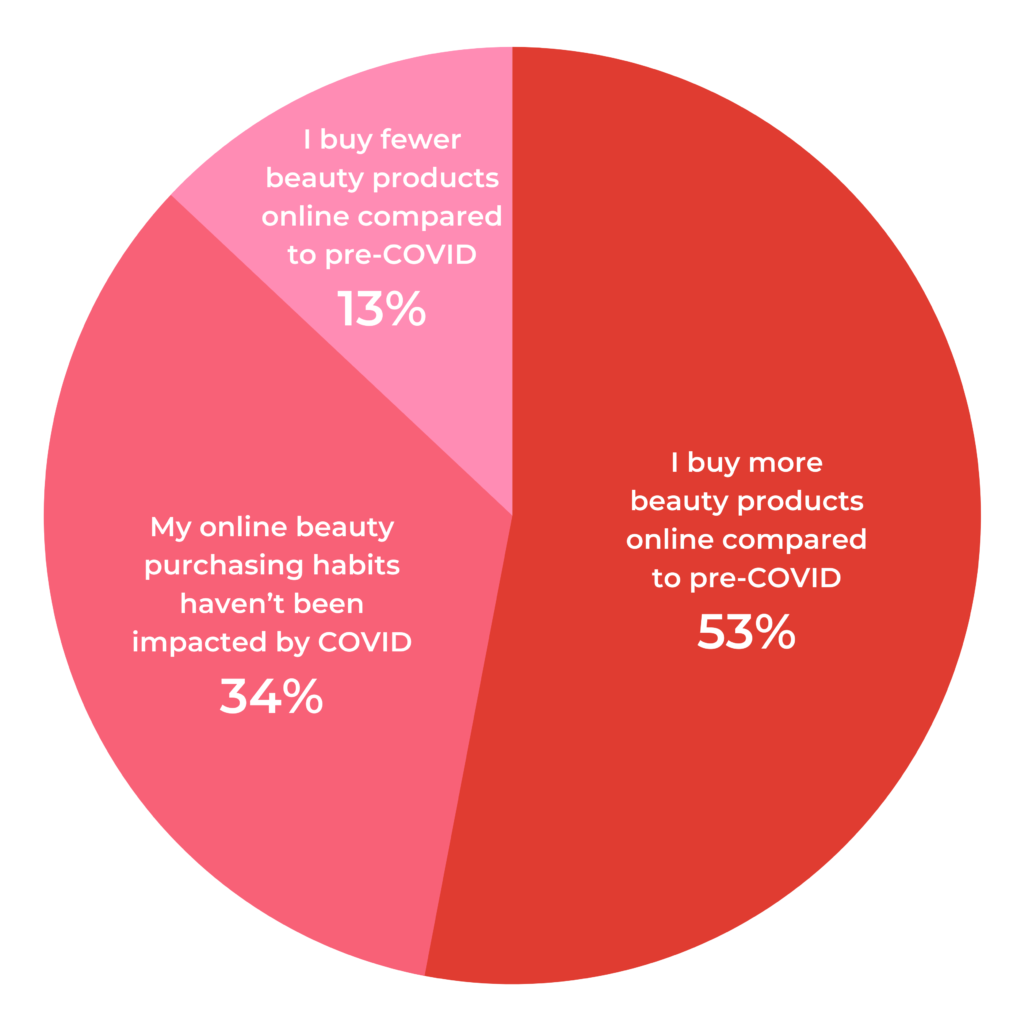

Online Beauty Shopping is Growing

There’s been a well-reported uptick in eCommerce shopping since the start of the COVID-19 pandemic. So it’s probably no surprise that a growing number of shoppers are purchasing beauty products online, too.

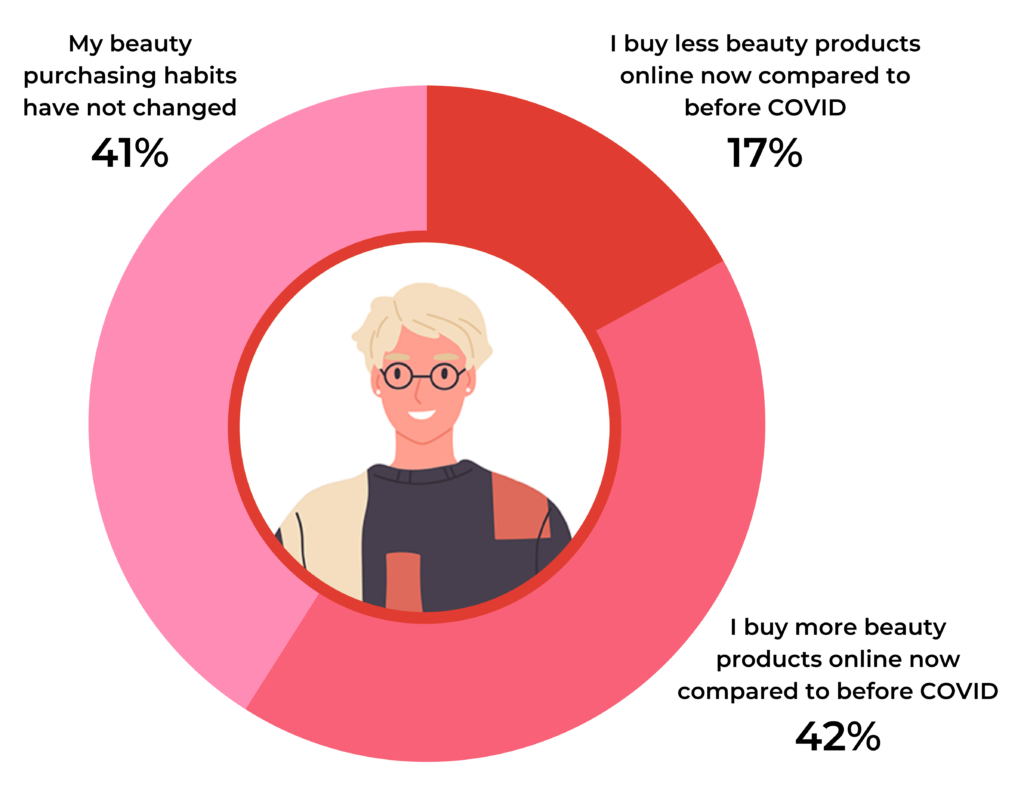

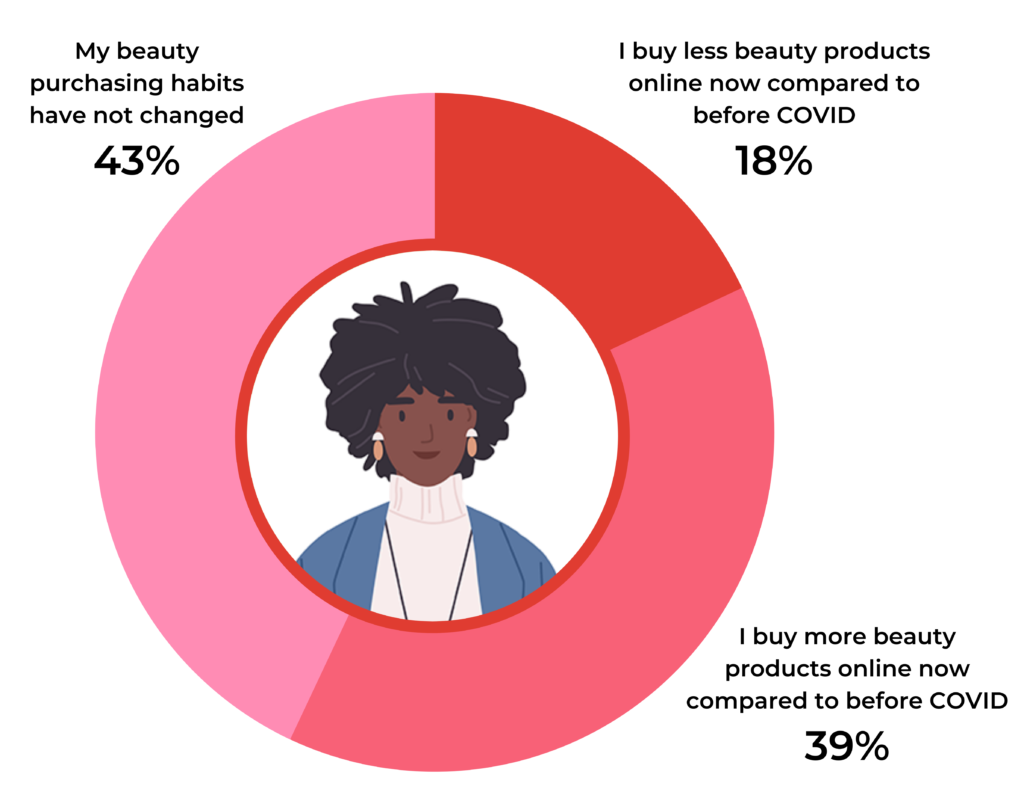

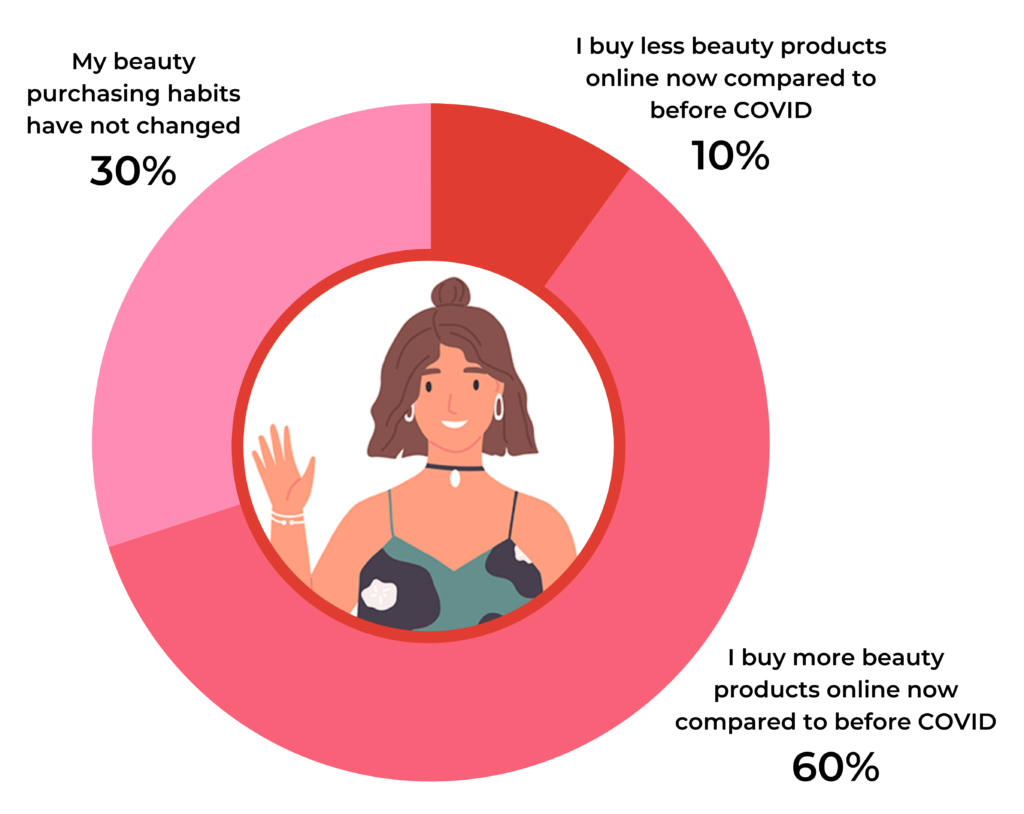

More than half of shoppers (53%) buy more beauty products online now, compared to pre-COVID. This number is even higher among younger consumers. 66% of Gen Z shoppers and 58% of Millennials say they spend more online on beauty products now than they did before the pandemic.

Also of note, 60% beauty enthusiasts are spending more online now, compared to 39% of beauty brand loyalists. What’s more, those with incomes of $100,000 or higher are more likely to have increased online beauty spending than their lower-income counterparts.

| I buy less beauty products online now compared to before COVID | I buy more beauty products online now compared to before COVID | My beauty purchasing habits have not changed | |

| $0 – $25,000 | 18% | 43% | 39% |

| $26,000 – $50,000 | 13% | 50% | 37% |

| $51,000 – $75,000 | 11% | 56% | 33% |

| $76,000 – $100,000 | 11% | 49% | 40% |

|

$100,000+ |

11% | 62% | 27% |

| Prefer not to say | 14% | 47% | 39% |

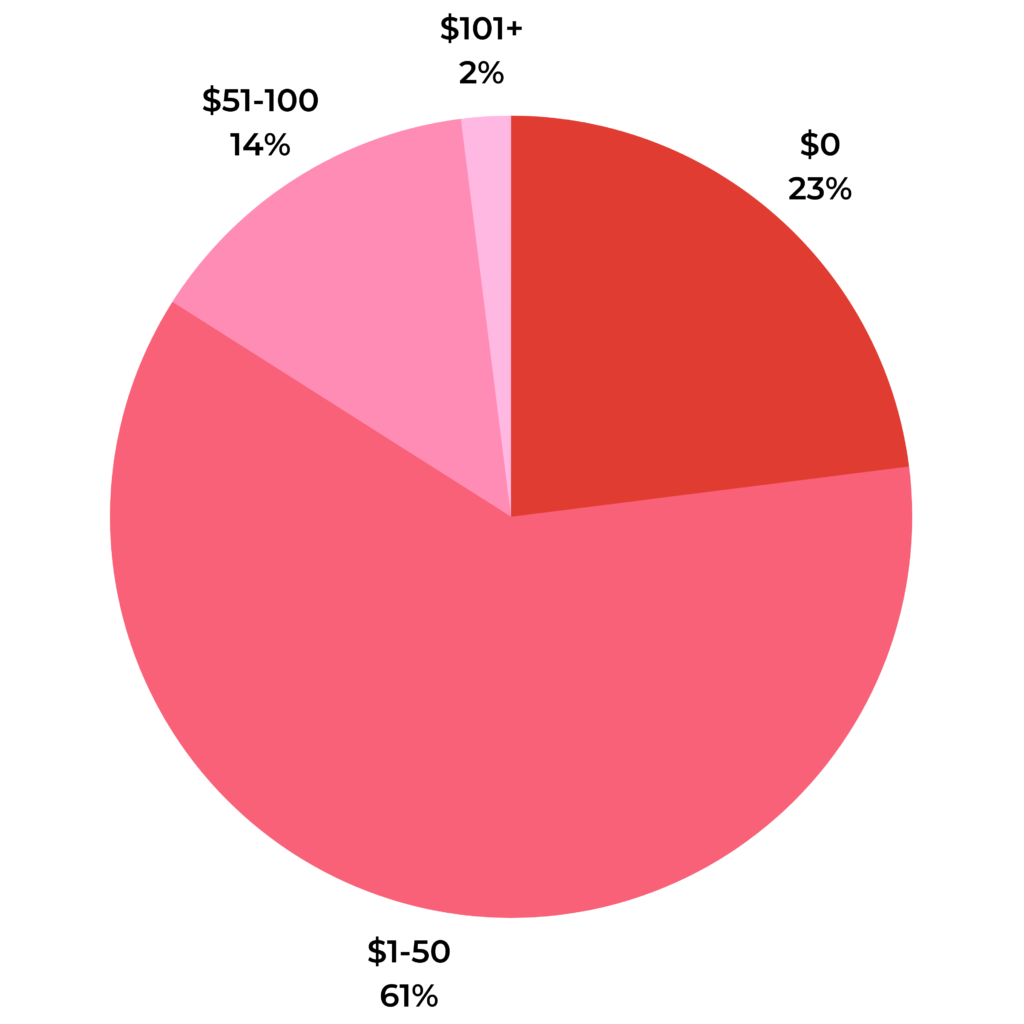

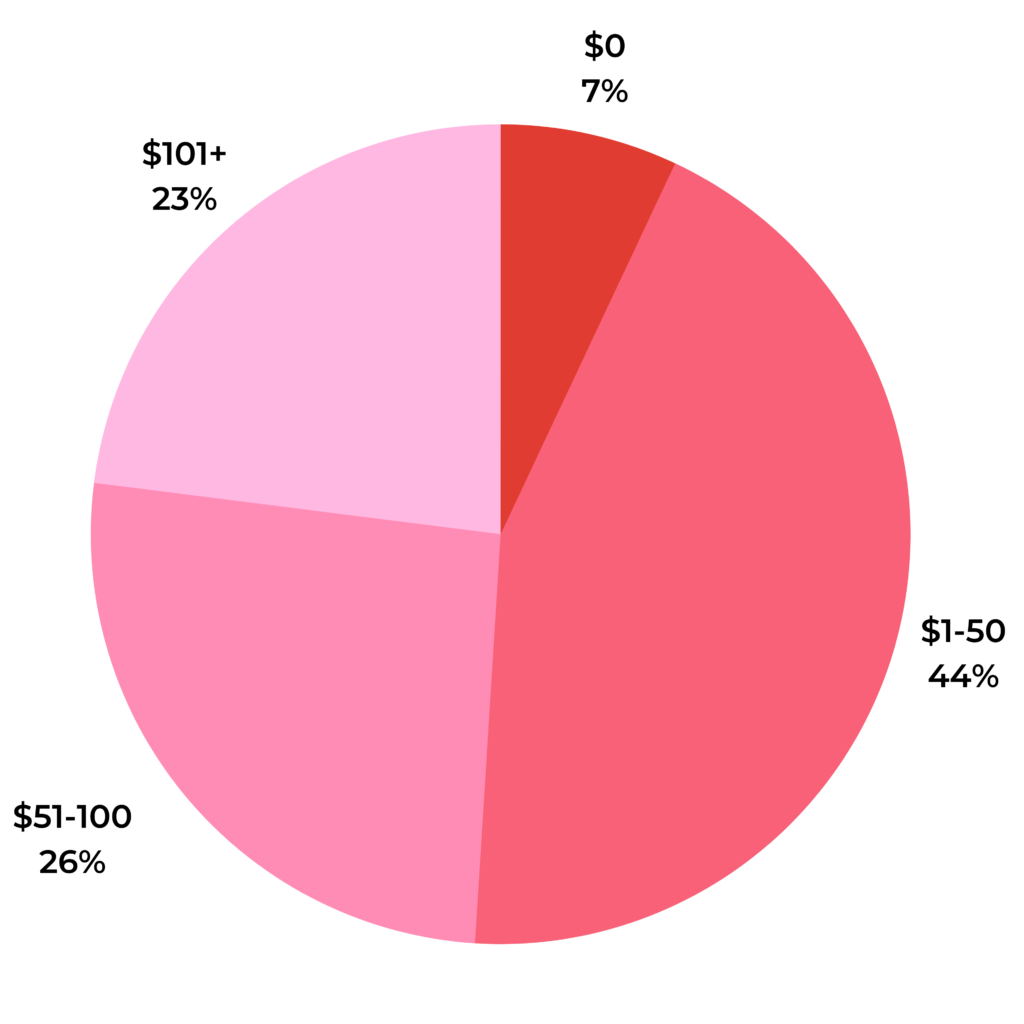

We also asked consumers to indicate how much they spend each month on online beauty purchases. And as it turns out, they’re spending significantly more each month compared to just a few years ago when we asked consumers the same question. For example, in 2019, just 2% of respondents indicated they spent more than $101 per month on online beauty purchases. In 2021, that number has grown to 23%!

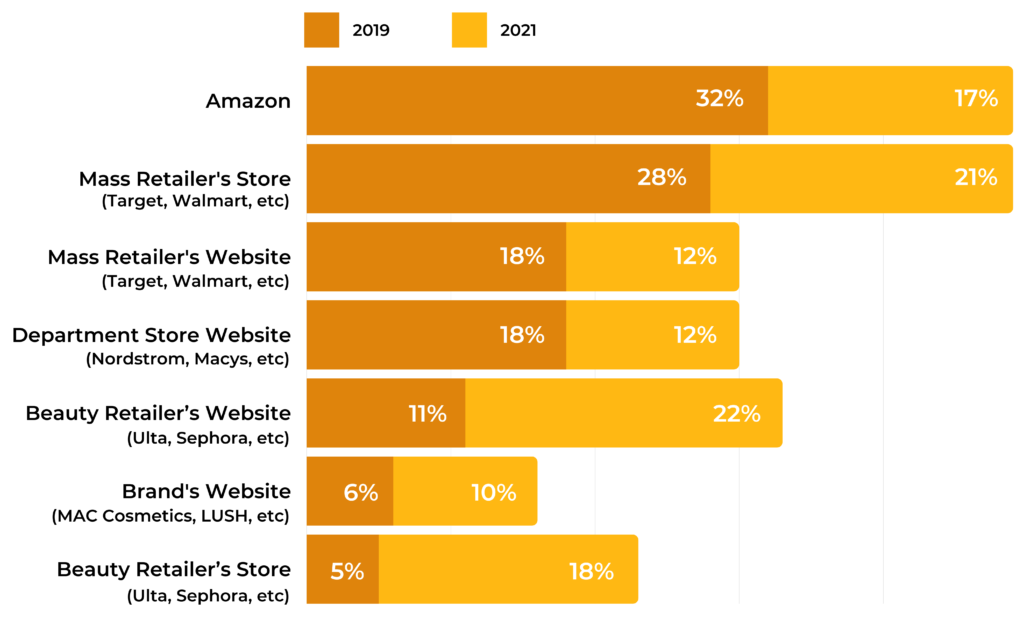

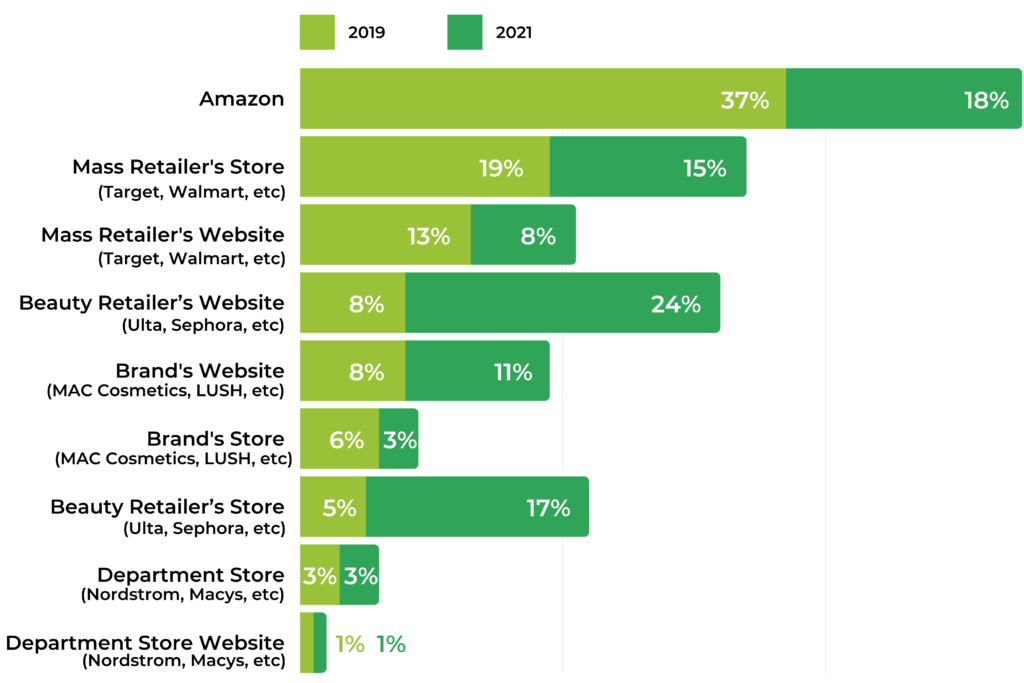

Amazon is Actually Declining in Importance

When it comes to online shopping, there are nearly endless options. So where do online shoppers most often start the purchase journey for beauty products?

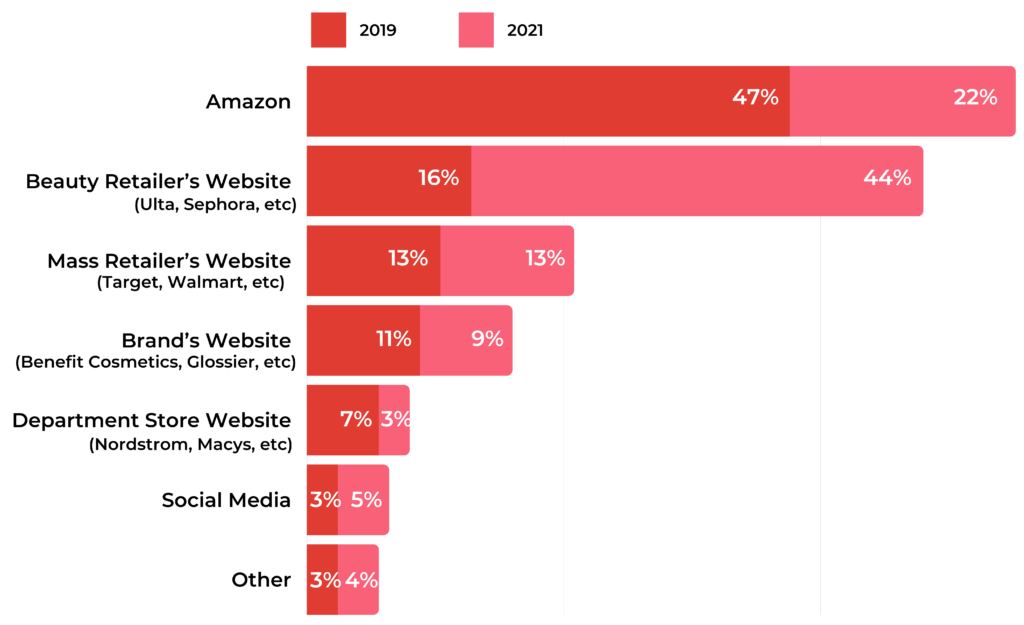

The starting point of nearly half (44%) of shoppers is a beauty retailer’s website — think Ulta.com or Sephora.com. Amazon is a distant second, with 22% of shoppers indicating its where they start the online purchase journey for beauty products.

It’s worth noting that when we asked this same question just two years ago, 47% of shoppers indicated they typically start shopping on Amazon. This suggests that Amazon has become less of a threat to beauty retailers.

And by providing great online shopping experiences, it’s very much possible for beauty businesses to compete (and win) against the eCommerce giant.

In-Store Beauty Shopping Continues to Thrive

Make no mistake: the rise in beauty eCommerce doesn’t mean stores are dead.

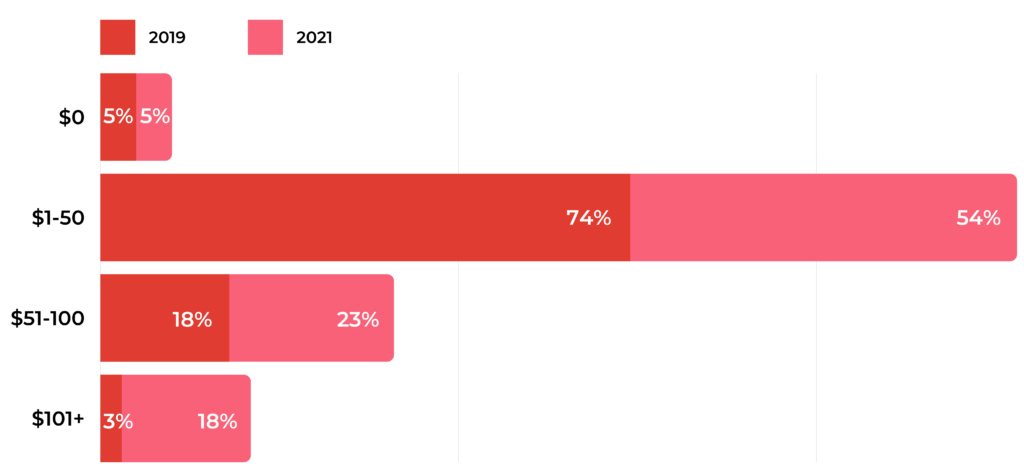

In fact, our data tells us that the amount consumers spend on beauty products in stores each month has actually increased from 2019.

For example, in 2019, during any given month, just 3% of consumers spent more than $101 in a store on beauty products. In 2021, that number grew to 18%.

A key finding of this research is that stores remain a popular place to buy tried-and-true products — and discover new ones. We’ll explore this in more detail later in this report.

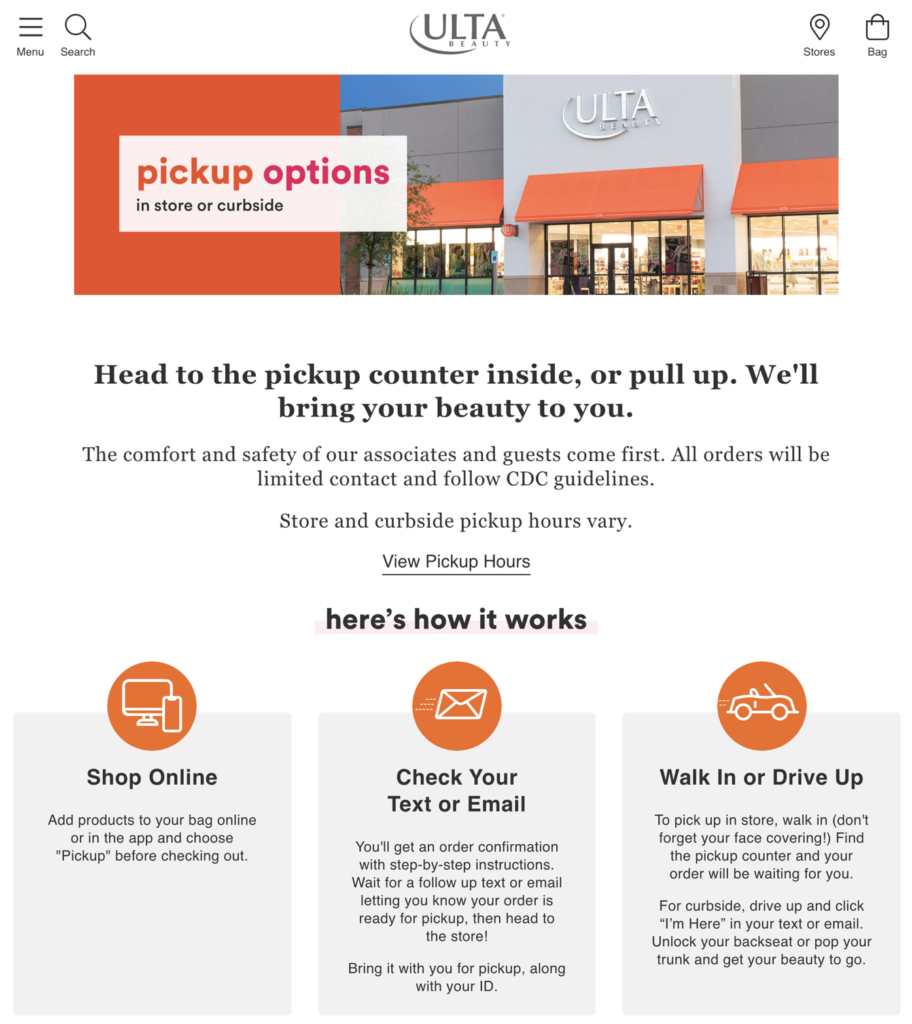

Stores Serve as Fulfillment Centers

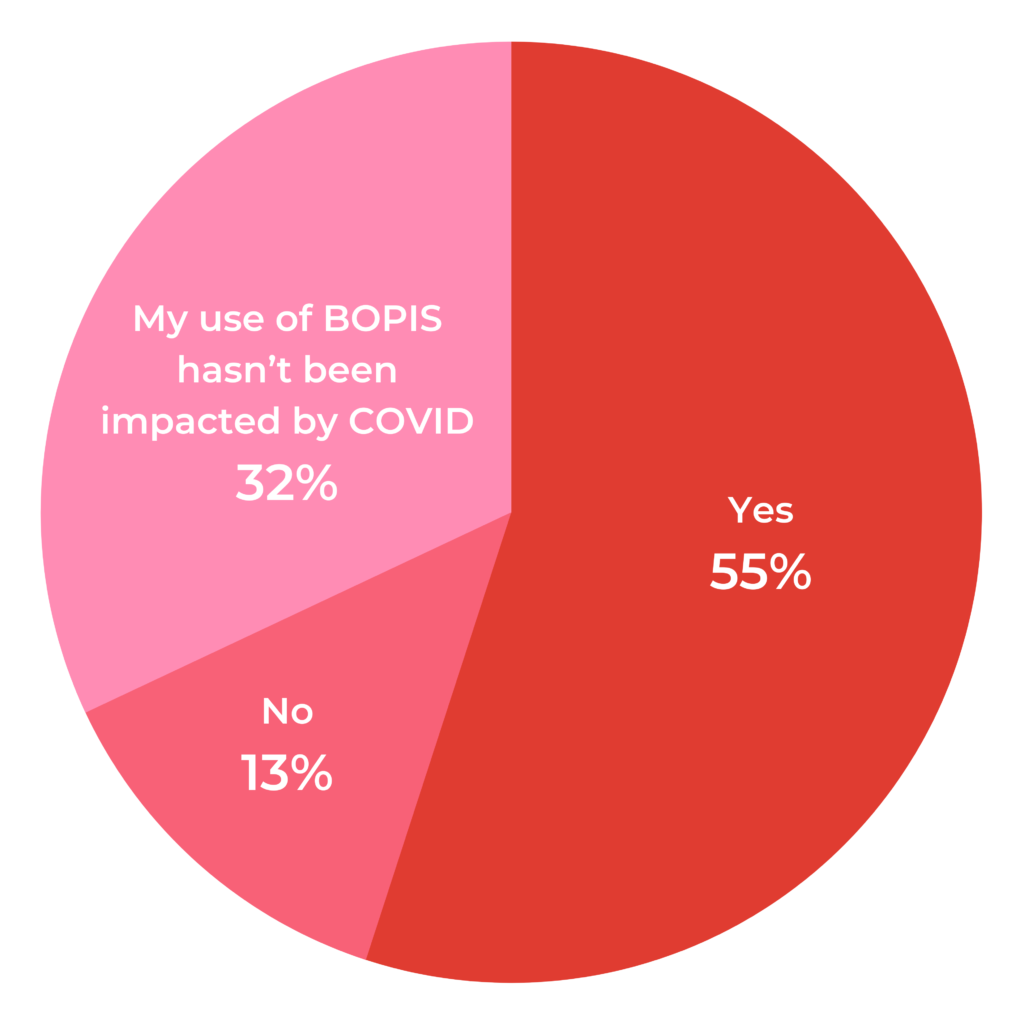

Curbside pickup — also known as Buy Online Pick up in Store (BOPIS) offers shoppers the best of both worlds. They can browse online and minimize in-person contact — but still enjoy the (nearly) instant gratification of in-store shopping.

The popularity of BOPIS has grown significantly among beauty shoppers. In fact, 55% say they use curbside pickup for beauty products more now than they did pre-pandemic.

Younger generations are taking advantage of curbside pickup even more. 60% of Millennials and 58% of Gen Z shoppers say they’ve ramped up their use of BOPIS services for beauty products.

User-generated content — including reviews, Q&A, photos, and videos — has a big impact on purchase decisions. That’s not exactly news.

But thanks to this survey, we can now clearly see that for beauty shoppers, this content has never been more important.

Reviews Fuel Smart Beauty Purchase Decisions Online and In Store

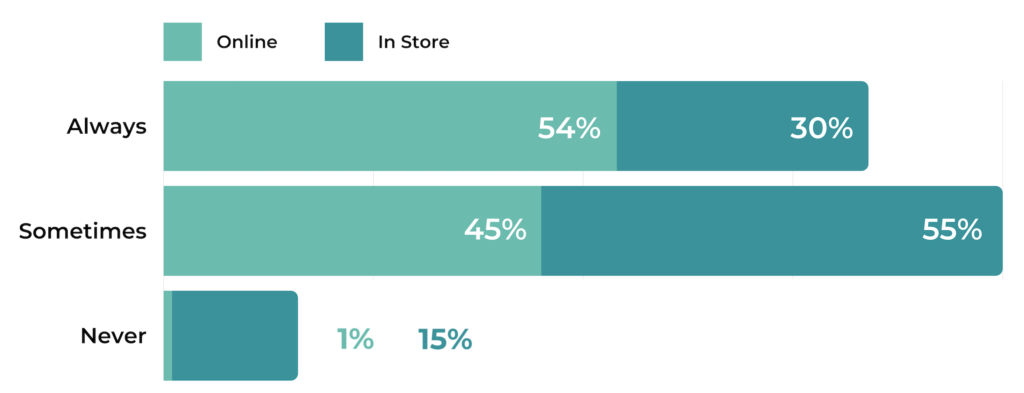

Our research found that all shoppers (99%) read reviews at least sometimes when shopping online for beauty products, with 54% saying they always do so.

Reviews matter for in store shoppers, too. 85% say they read reviews at least sometimes when shopping for beauty products within the four walls of a brick and mortar store.

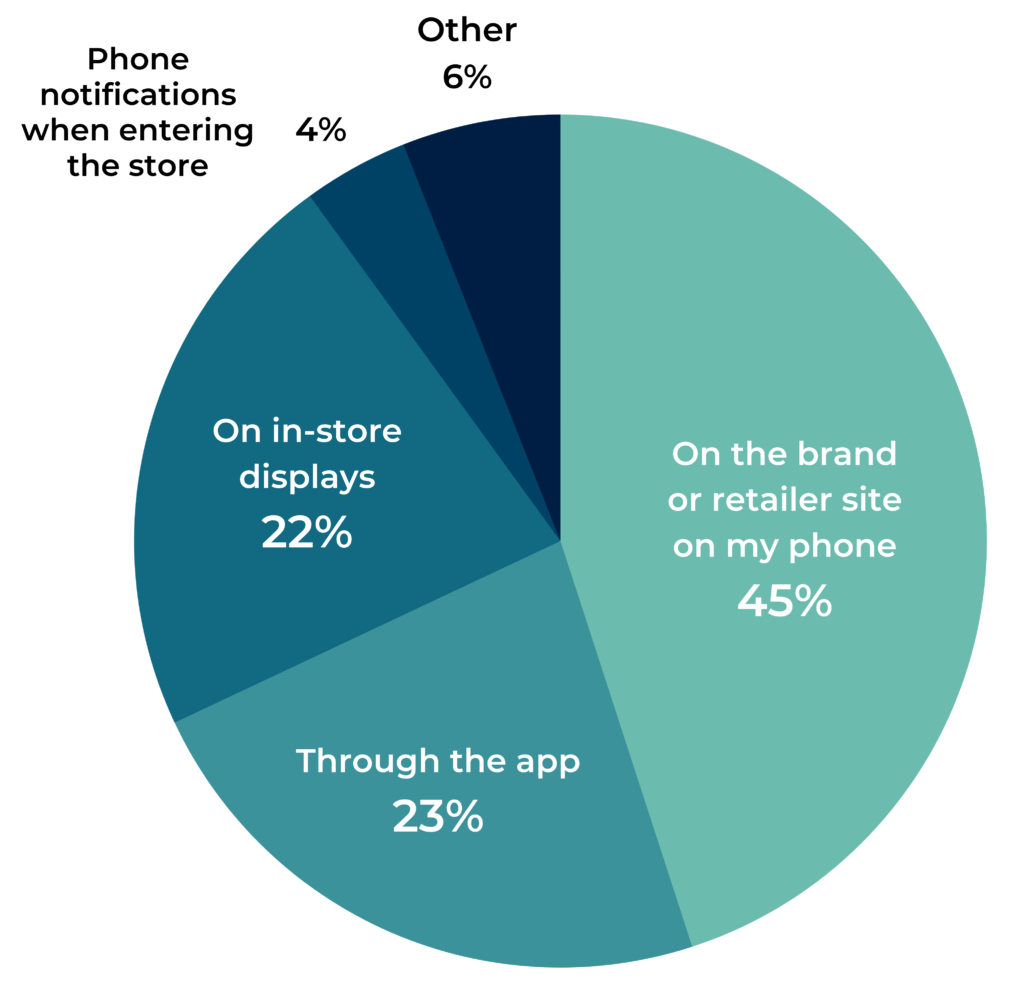

How do they want to access reviews when shopping in a store? Nearly half (45%) prefer to find reviews by visiting the brand or retailer’s website on their phones.

The message here? Ensure your reviews are easy for shoppers to find and consume — regardless of device.

What elements of reviews do beauty shoppers value when making purchase decisions?

79% say the average star rating is important. More than half (58%) care about the overall number of reviews for a product. And 49% say the number of recent reviews is important. Note: respondents could select all that applied.

This highlights the importance of consistently generating a steady stream of great reviews.

Helpful Hint: Recency, quantity and quality of reviews all matter to beauty shoppers! So make it a priority to collect plenty of great reviews on an ongoing basis.

During the Pandemic, Dependence on Reviews Has Increased

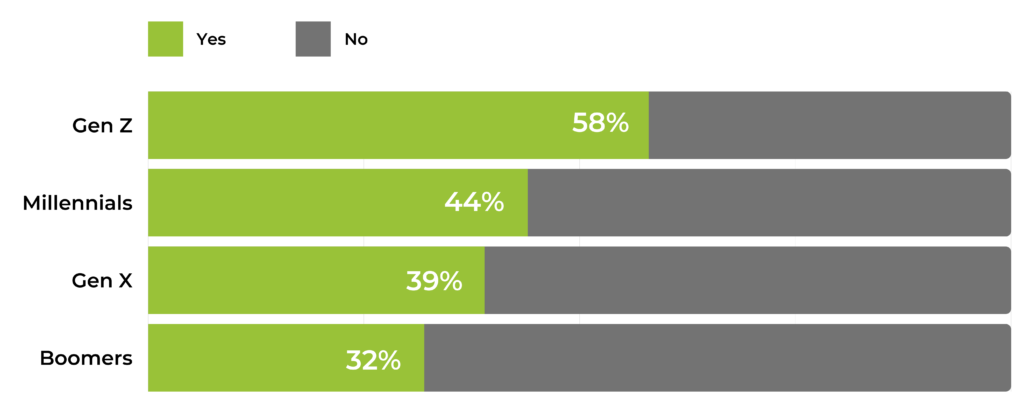

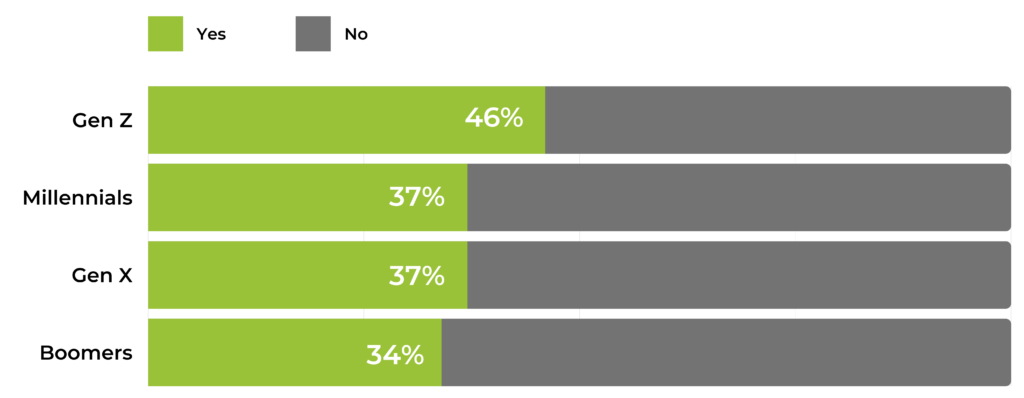

It seems shopper dependence on reviews has only grown in the midst of the COVID-19 pandemic. 41% of beauty shoppers indicate they’re more reliant on ratings and reviews now than they were before the start of the global health crisis. This number is even higher — 58% — among Gen Z shoppers.

41% of beauty shoppers are more reliant on ratings and reviews now than pre-pandemic. This number increases to 58% for Gen Z shoppers.

Beauty Shoppers Rely on User-Generated Visual Content

Beauty products are highly personal purchases. While a children’s toy will look the same regardless of who buys it, a makeup item will look different on every person.

Customer-submitted photos and videos help shoppers understand what a beauty product will look like on someone like them. During Covid, user-submitted visual content has become even more important.

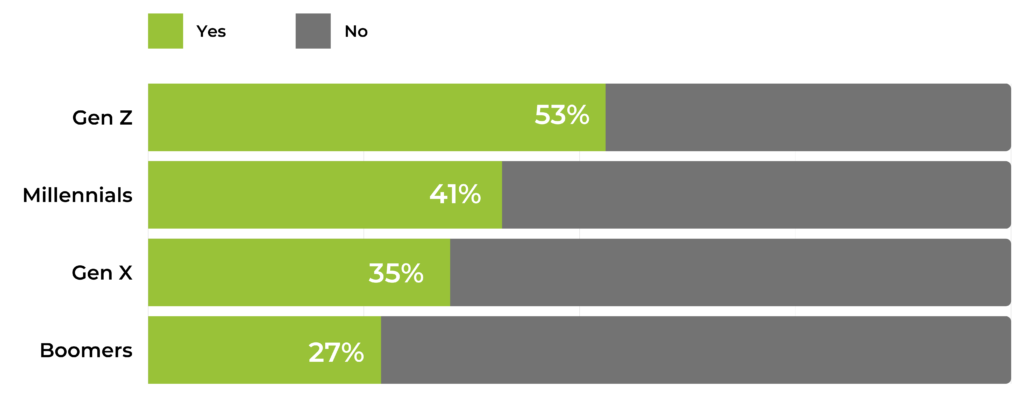

Just over a third (38%) of those we surveyed say they are more reliant on user-submitted visual content now, compared to pre-Covid. This number soars to 53% among Gen Z shoppers. Clearly, these younger consumers have an appetite for user-submitted photos and videos.

38% of beauty shoppers are now more reliant on user-submitted visual content than they were pre-COVID. This number increases to 53% among Gen Z shoppers.

Helpful Hint: User-generated photos and videos help beauty shoppers get realistic expectations of products -- especially when they can’t try them out in person first! Be sure to collect plenty of photos and videos from your shoppers.

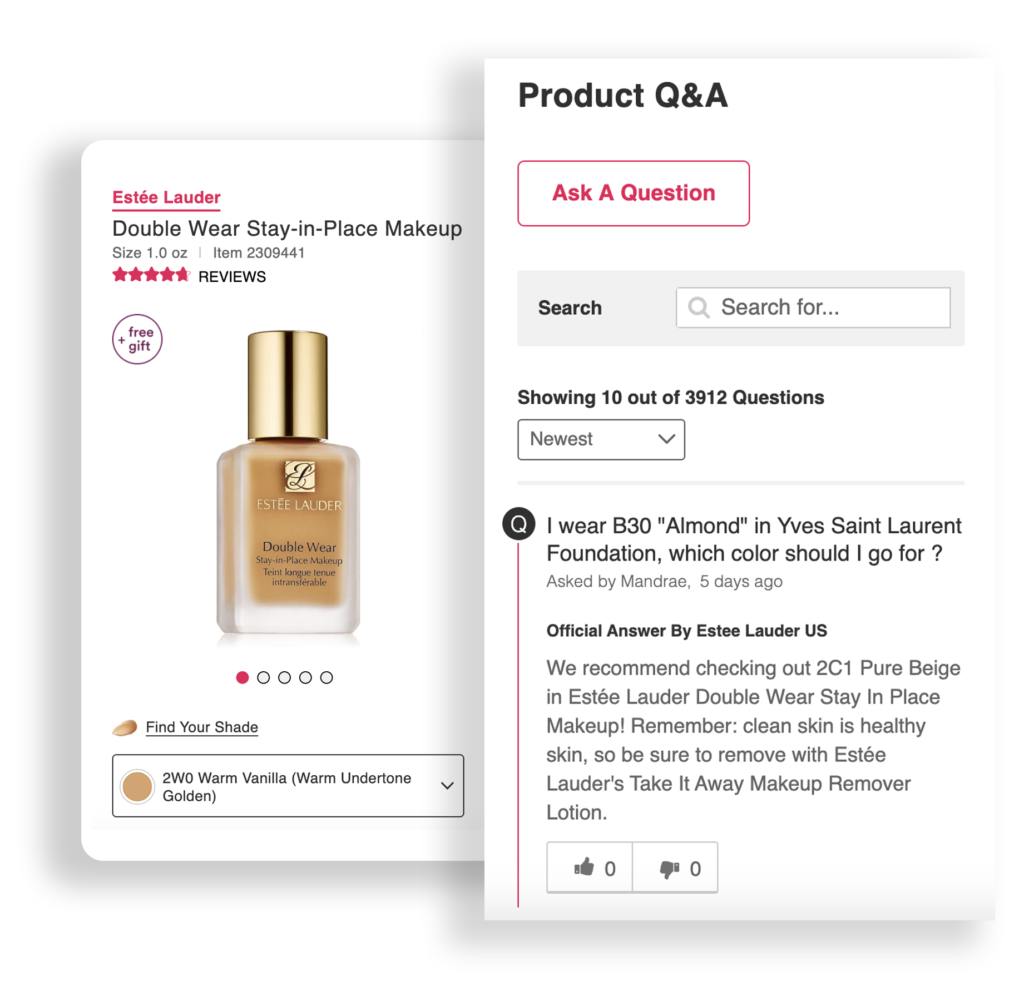

For Online Beauty Shoppers, Q&A Replaces the In-Store Associate

When a consumer is shopping in a brick-and-mortar store and has a question about a beauty product, they can ask an in-store associate. But when they’re shopping online, they often turn to the product’s Q&A (and as we mentioned earlier, consumers are shopping online a whole lot more these days).

So it’s probably not surprising that over a third (36%) of beauty shoppers say they’re more reliant on Q&A now than pre-COVID. Gen Z is the generation with the largest increase in dependence on Q&A. Nearly half (46%) say they depend on this content more now than they did before COVID.

36% of beauty shoppers are now more reliant on Q&A than they were pre-COVID. At 46%, this number is significantly higher for Gen Z shoppers.

There are beauty products that a given consumer will turn to time and time again. Perhaps it’s a foundation that perfectly matches a shopper’s skin tone — or maybe it’s an eye cream that instantly makes them look like they got a solid eight hours of sleep.

Let’s take a closer look at how consumers shop for these tried-and-true beauty products.

Beauty Brands and Retailers are Gaining Traction

Consumers have countless shopping options. But when it comes to shopping for beauty products they’ve tried before, a few of those options rise to the top.

Nearly a quarter (22%) will buy on a specialty beauty retailer’s website, and 21% will opt for a mass retailer’s store — such as Walmart or Target. Another 18% will purchase at a specialty beauty retailer’s store and 17% will buy on Amazon.

Other less popular spots for stocking up on tried-and-true beauty products include mass retailers’ websites (12%) and brands’ websites (10%).

Interestingly, the popularity of speciality beauty retailer stores and websites — as well as brand websites — has soared since the last time we surveyed beauty shoppers.

On the other hand, the popularity of Amazon and mass retailers seems to have waned — at least when it comes to beauty products. Cleary, it’s very much possible for beauty brands and retailers to compete and win.

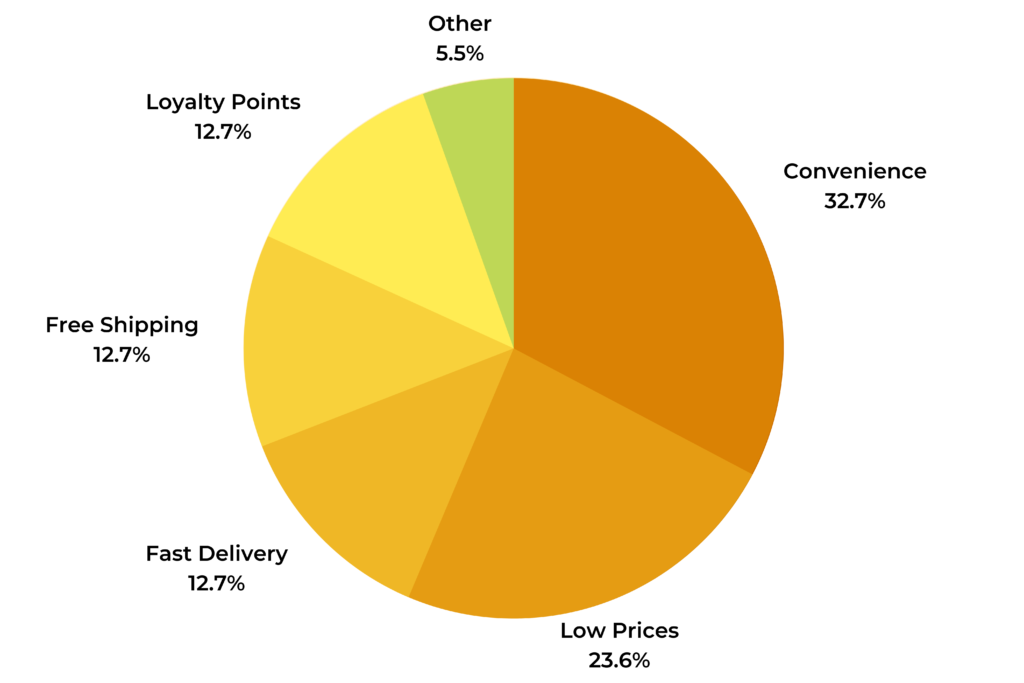

When stocking up on tried-and-true products, what makes a shopper choose one store or website over another? Some of the top reasons include convenience, low prices, free shipping, fast delivery and loyalty points.

Consumers Purchase Habitual and New Beauty Products at the Same Time

When consumers are stocking up on their go-to beauty products, they don’t just grab what they need and head for the checkout.

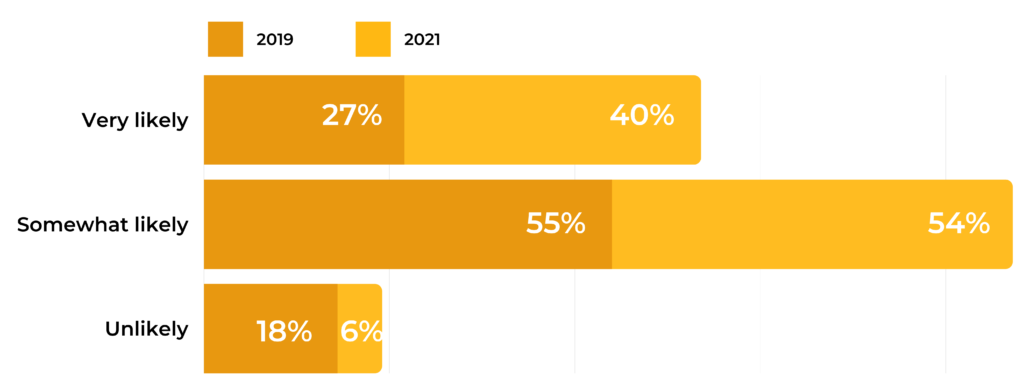

Instead, 94% of consumers say that when they’re purchasing a habitual product, they’re at least somewhat likely to also buy a new product during the same transaction. This is up from 82% when we asked the same question just a couple years ago.

It seems today’s beauty shoppers are more willing to try something new than they were just a few years ago — which we’ll explore more in the next section.

Today, consumers are spending more time at home. Many are using this as an opportunity to do things they didn’t have the time for before — like trying out new beauty products.

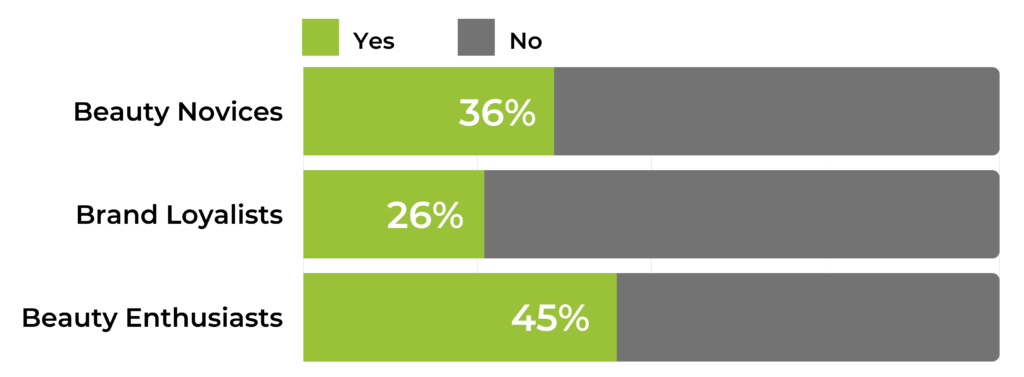

In fact, two in five (40%) of those we surveyed said they’re more likely to try new-to-them beauty products now than pre-Covid. This number is even higher for Millennials (46%) and Gen Z (53%). What’s more, beauty enthusiasts are more likely to try new beauty products (45%) than those who identify as beauty brand loyalists (26%) and beauty novices (36%).

Where are they shopping for these products? And what information do they depend on to make confident purchase decisions? Let’s take a closer look.

Shoppers Purchase New Beauty Products From a Variety of Sources

Whether they’re shopping online or in-store, beauty shoppers are spending a good chunk of their budget on products they’ve never tried before.

Of note, online shoppers are slightly more likely to spend 51-100% of their budget on new products than those shopping in-store.

Where are consumers shopping for these new-to-them beauty products? The top five destinations for purchasing new beauty products are a specialty beauty retailer’s website (24%), Amazon (18%), a speciality beauty retailer’s store (17%), a mass retailer’s store (15%) and a brand website (11%).

Consistent with other findings in this survey, brand and specialty beauty retailer stores and websites are gaining traction when compared to our results from 2019 — with Amazon losing favor.

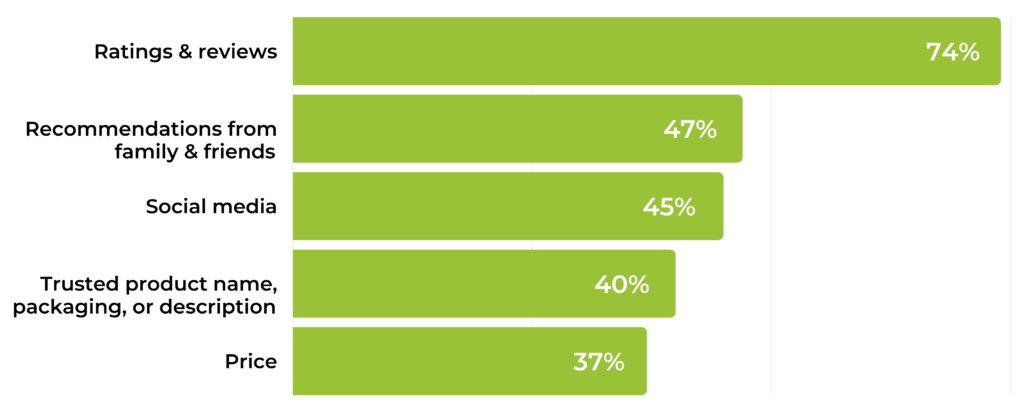

Reviews Motivate Beauty Shoppers to Try New Products

There’s a certain level of risk associated with purchasing a product you’ve never bought before. So how do shoppers gain the confidence they need to purchase new-to-them beauty products?

Three-quarters (74%) say ratings and reviews motivate them to try new beauty products. This number jumps to 79% for both Millennial and Gen Z beauty shoppers.

In fact, for all age groups, it seems this content is significantly more impactful than recommendations from family and friends (47%) and price (37%)!

Our survey found that nearly half (45%) of shoppers are motivated by social media to try new beauty products. This number is even higher for Millennials (52%) and Gen Z (63%).

So it makes sense that a growing number of brands are investing in influencer marketing. MediaKix predicts that brands will spend up to $15 billion on influencer marketing by 2022.

But how exactly are beauty shoppers swayed by influencers? Let’s explore.

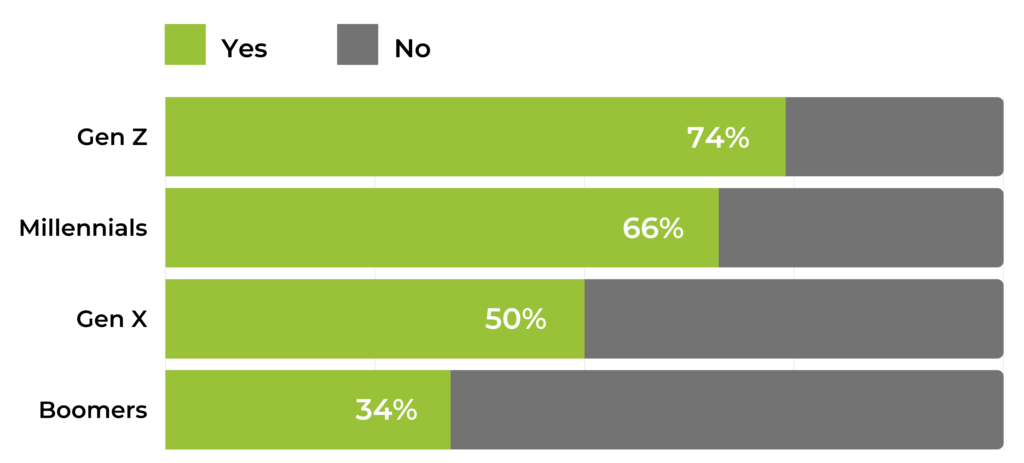

Shoppers of all Ages are Swayed by Beauty Influencers

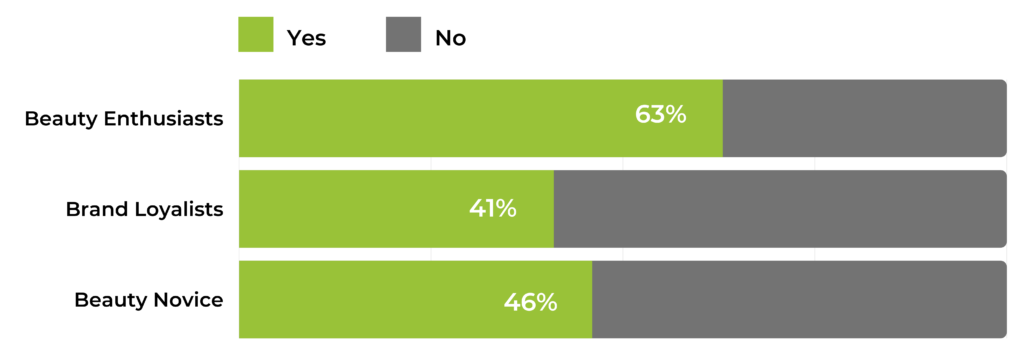

Over half (56%) of consumers say they are swayed by the influencers they follow to purchase beauty products. And younger shoppers are even more likely to be influenced.

Three-quarters (74%) of Gen Z shoppers and 66% of Millennials say they are swayed to purchase beauty products by influencers they follow.

What’s more, beauty enthusiasts are much more likely to be swayed by influencers than other types of beauty shoppers. This makes sense, as those who identify as beauty enthusiasts are always on the lookout for the next big thing.

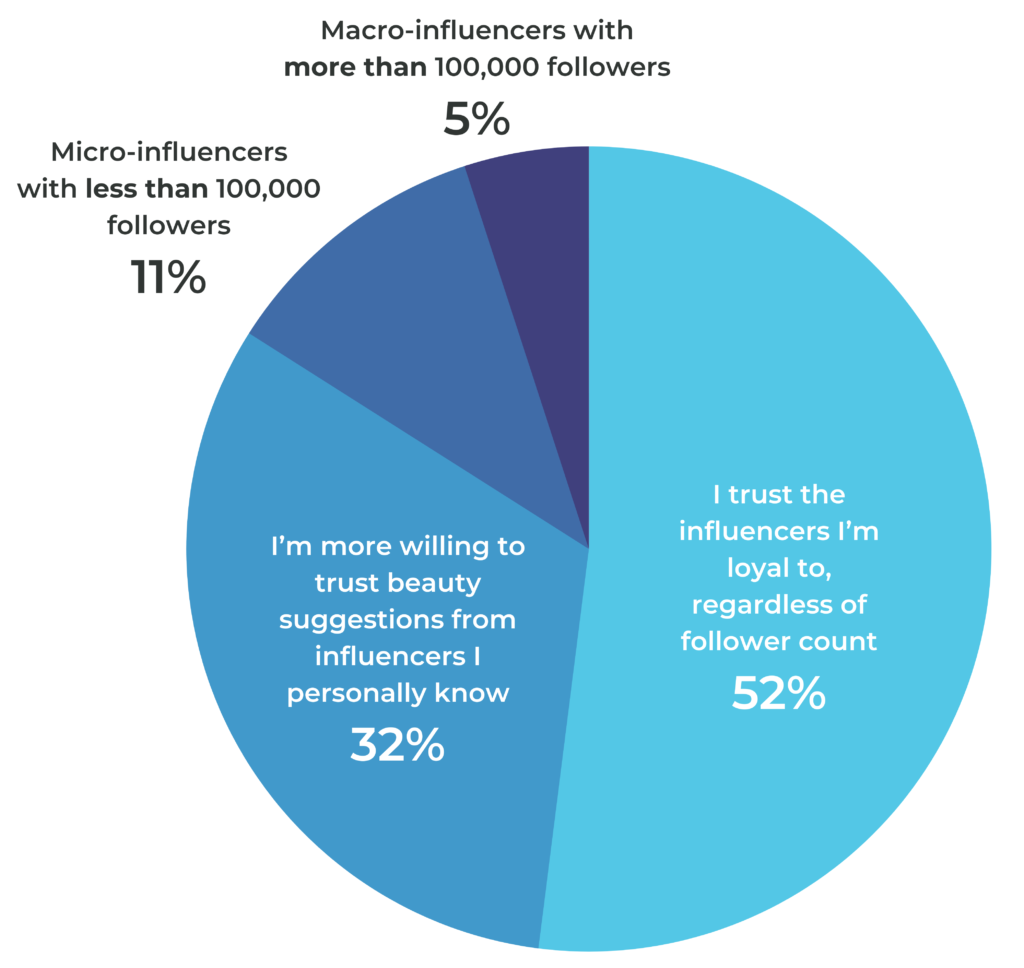

Beauty Shoppers are Loyal to Their Trusted Influencers

Does the number of followers an influencer has impact how much beauty shoppers trust them? For many, it doesn’t.

Over half (52%) of consumers say they trust the influencers they’re loyal to no matter their follow count.

A third (32%) say they’re more willing to trust beauty suggestions from influencers they personally know, and 11% indicate they’re more likely to trust micro-influencers with less than 100,000 followers.

Just 5% of beauty shoppers say they most trust macro-influencers with more than 100,000 followers.

In the past, shoppers weighed factors like price, brand and quality when choosing beauty products. Of course, these factors still matter. But increasingly, beauty shoppers also seek out products and brands that align with their values.

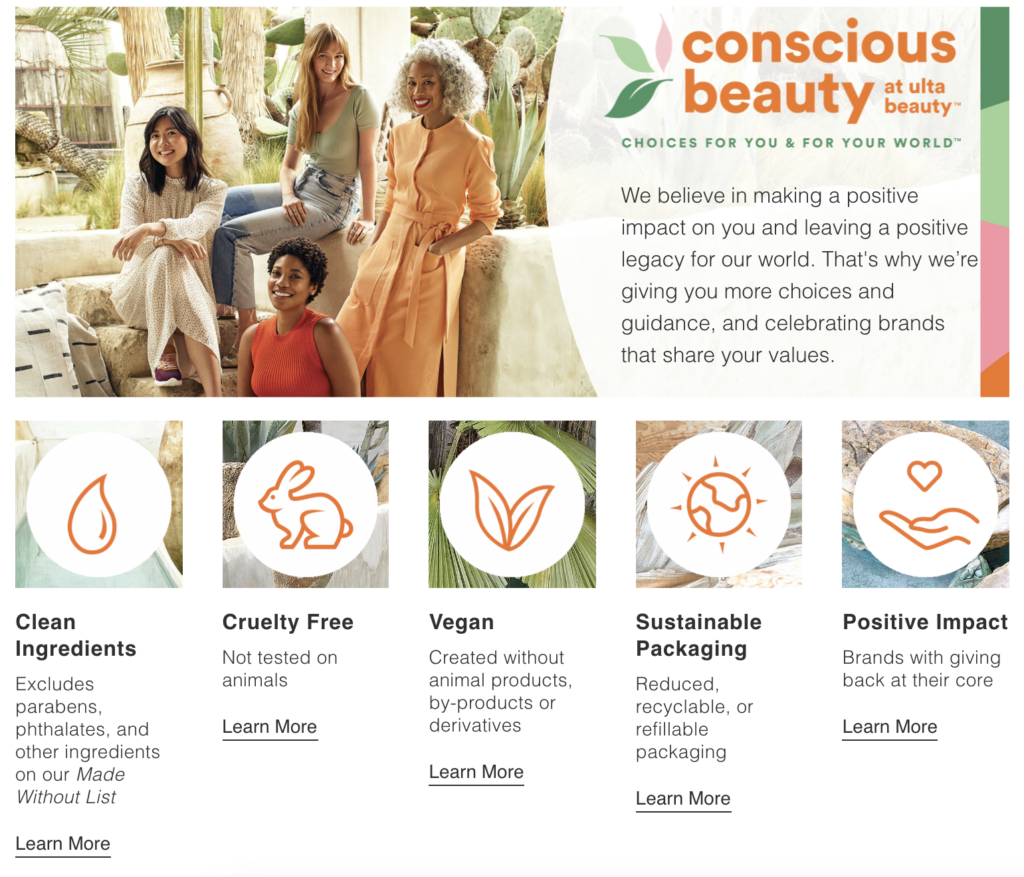

The Majority of Shoppers Plan to Purchase Eco-Friendly Products

For many, the state of the environment is a growing concern. As such, an increasing number of shoppers are seeking out eco-friendly products and brands.

Beauty shoppers are no exception. More than three-quarters (76%) of shoppers plan to buy beauty products in the future that are made sustainably.

Gen Z shoppers (86%) and Millennials (80%) are even more likely to purchase sustainable beauty products.

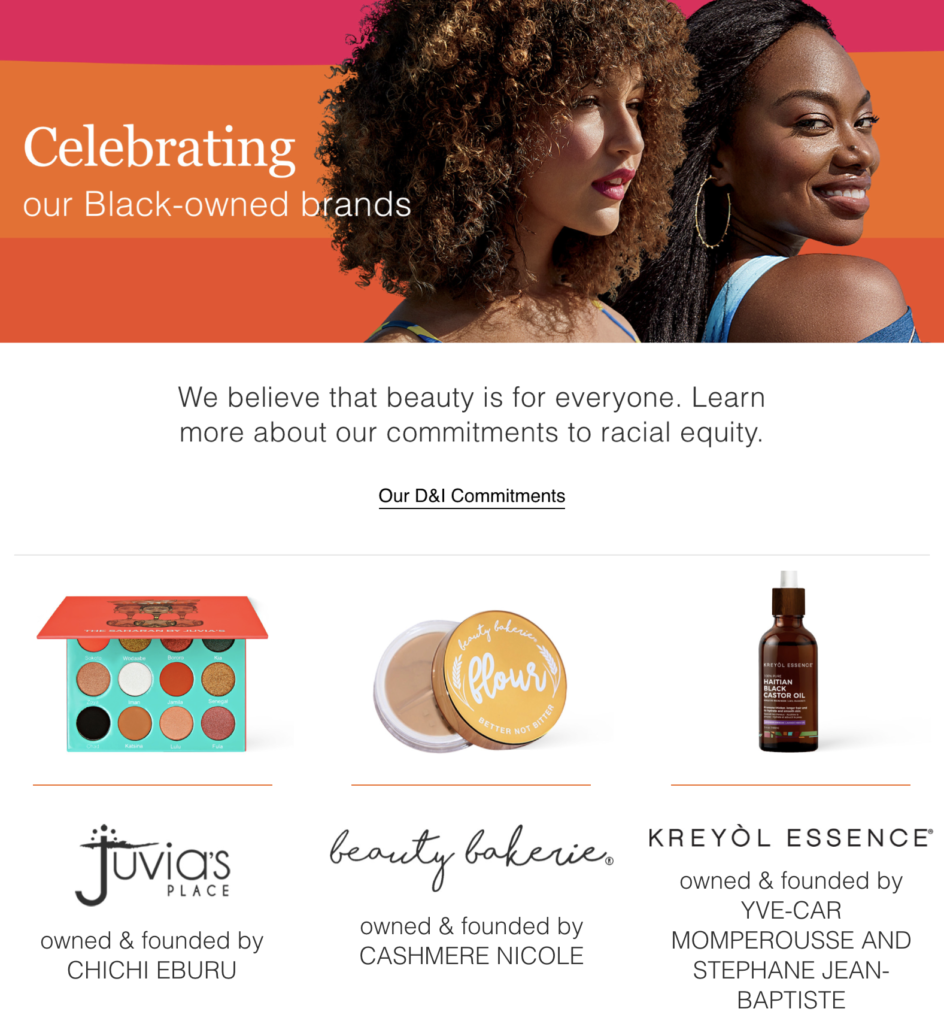

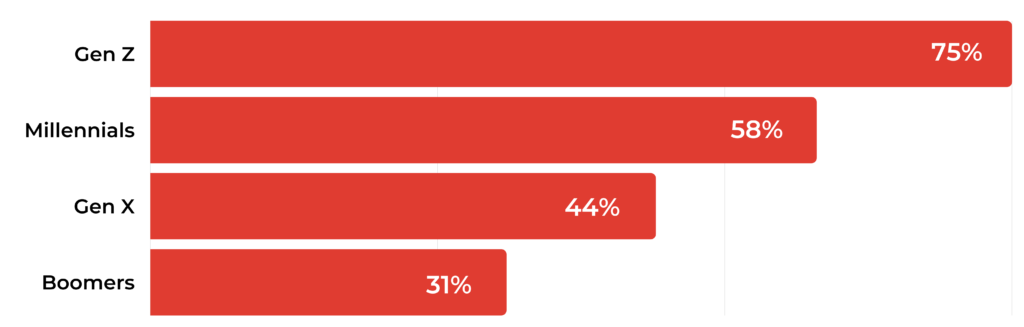

Half of Shoppers Plan to Support Black-Owned Beauty Brands

In 2020, a growing number of consumers took action in the fight for racial justice. One way consumers chose to support this cause was by seeking out and buying from Black-owned businesses.

According to Yelp, from May 25 to July 10, 2020 there were more than 2,500,000 searches for Black-owned businesses — up 7,043% from the same period in 2019.

So it may come as no surprise that half (50%) of consumers say they plan to actively seek out beauty products made by Black-owned beauty brands. This number is even higher among Gen Z (75%) and Millennials (58%).

In addition, beauty enthusiasts are much more likely to seek out Black-owned beauty brands (55%) than beauty brand loyalists (38%) and novices (45%). That makes sense, as these shoppers are typically more open to trying out new products.

The way consumers shop for beauty products is evolving. And the COVID-19 pandemic has only sped up this evolution. Brands and retailers must adapt to meet and exceed the expectations of beauty shoppers — or risk losing them for good.

Read on for six practical, impactful actions to take, based on the key findings of this report.

Provide great shopping experiences across channels.

A growing number of consumers are shopping for beauty products online, especially in the midst of the COVID-19 pandemic. But at the same time, brick-and-mortar retail is still very much alive and well. Be sure you’re providing great, seamless shopping experiences across channels. Remember: your shoppers should be able to find all of the information they need to make smart purchase decisions — regardless of whether they’re shopping online or in-store.

Collect and display ratings and reviews.

Shoppers depend on reviews to make informed purchase decisions both online and in-store. And 41% of beauty shoppers rely on this content even more now than pre-COVID. This number is even higher among younger shoppers. Recency, quantity and star rating all matter — so be sure to collect a steady stream of reviews on an ongoing basis. Finally, remember that reviews motivate three-quarters of shoppers to try new beauty products. So if you’re launching new products in the coming year, consider sending out free samples in exchange for honest reviews.

Showcase visual content from your shoppers.

Beauty products are highly personal. As such, shoppers want to see how a product works (or doesn’t) for someone with similar characteristics. User-submitted photos and videos allow them to do that. And over a third of beauty shoppers are more reliant on user-submitted visual content now than they were pre-COVID. This number is even higher for younger shoppers. So be sure to collect and display photos and videos of your shoppers using your products “in real life.” Collect this content both natively and where it already lives: on social media.

Empower online shoppers to ask questions.

A third of shoppers (and an even greater number of younger shoppers) rely on Q&A more now than they did pre-COVID. If you don’t have Q&A software on your product pages, now’s the time to add it. It’ll help shoppers make smarter purchase decisions — which will lead to happier customers and fewer returns. Also, consider allowing previous customers to answer shopper questions. After all, consumers trust the opinions of others like them!

Leverage everyday influencers.

Influencers have the power to sway beauty shoppers. But over half of beauty shoppers consider the number of followers an influencer has to be irrelevant. So think about ways to leverage the micro-influencers who love your brand and products. For example, send samples to these everyday influencers, and in exchange, ask them to write an honest review. Or, ask them to post a photo of your product in action on their Instagram account — and then repurpose that content on your website.

Showcase your key differentiators.

Factors like price and packaging are still important. But today, a growing number of beauty shoppers also want to purchase products that align with their values. Specifically, we found that many shoppers are actively seeking out products that are sustainably made and created by Black-owned businesses.

If there’s something unique about your brand or products, be sure to showcase it. Or if you’re a beauty retailer, make it easy for shoppers to find products that align to the things that matter most to them. For example, Ulta features sections on their website that make it easy for shoppers to find products from Black-owned brands — and those that are eco-friendly.