When it comes to UGC, there are a lot of industry benchmarks out there — from what’s considered an ideal star rating to the number of reviews customers expect to see (in fact, we extensively cover those benchmarks here).

Knowing the industry benchmarks is an essential first step. To take your UGC strategy even further, however, you need insights into your particular niche. What other brands are your customers considering? How do consumers feel about their products in comparison to yours? Do your competitors have more reviews than you, or higher ratings?

To boil it down: how exactly do you compare on the digital shelf – be this on search engines, retail channels and so on – to your competitors?

Having the answers to these questions — and taking action on them — is the only way to truly stand out. Fortunately, customer product reviews contain the information to help you find these answers.

Read on as we share seven key metrics to watch to better understand your competitor’s product performance and brand health.

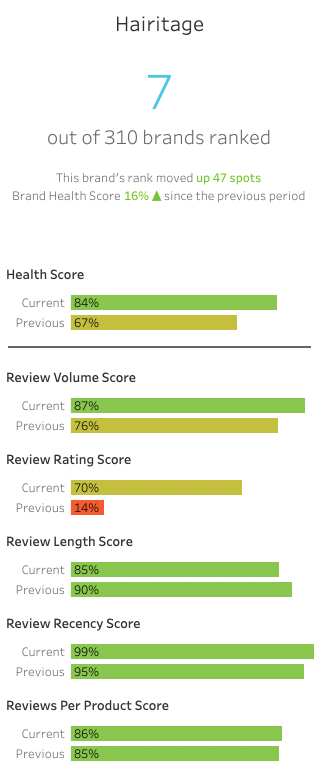

1. Brand Health Score

This provides an overall score of Brand Health, out of 100, based on five weighted factors: review volume, review rating, review length, review recency, and reviews per product.

Knowing your Brand Health Score gives you a quick, bird’s-eye view of the review footprint of your brand.

To improve your Brand Health Score, increase review collection across the board, paying special attention to products with fewer reviews and lower ratings. Implement a review meter and prompt questions to encourage people to write longer reviews.

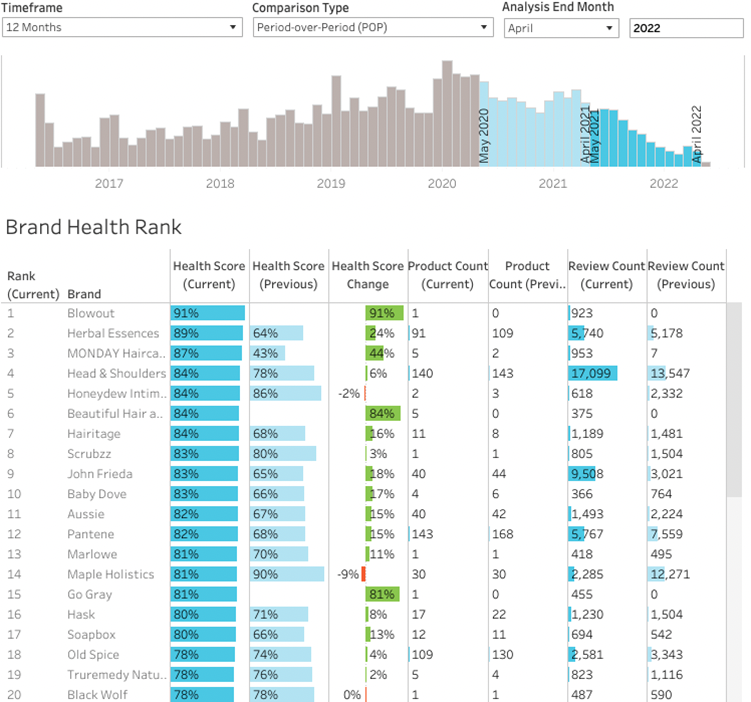

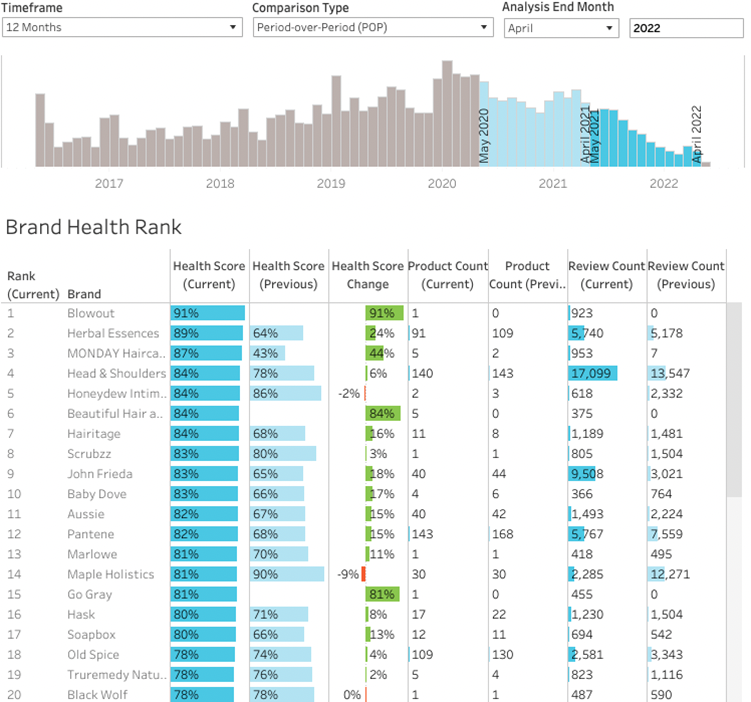

2. Brand Health Rank

This report shows you where your brand ranks among your competition, based on Brand Health Score. You can also see how your Brand Health has changed over time.

Understanding how your brand ranks among your competition can help you pinpoint where and how your competitors are outperforming you. You can see if they have increased review collection, for instance, or improved their star ratings.

Research the competitors who are ranking above you. Consider them a source of inspiration for improving your own UGC strategy. How are they collecting and displaying reviews? What tactics can you adopt to take them on and ultimately usurp them?

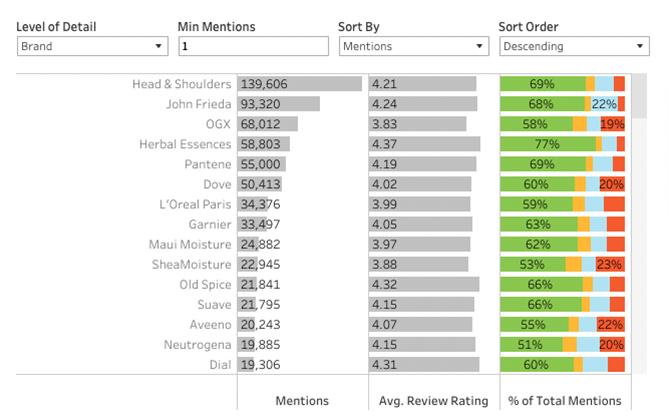

3. Review Count

This is the total number of reviews a brand has across all of its products.

Review volume is a key consideration for consumers, and can be the deciding factor in whether a consumer purchases from you or a competitor. If two products have the same star rating, 64% of consumers say that they are more likely to purchase the product with more reviews.

In the Brand Health Rank report, you can see how many reviews you have compared to your competitors. Run a sweepstakes or sampling campaign to generate new reviews quickly and beat out the competition.

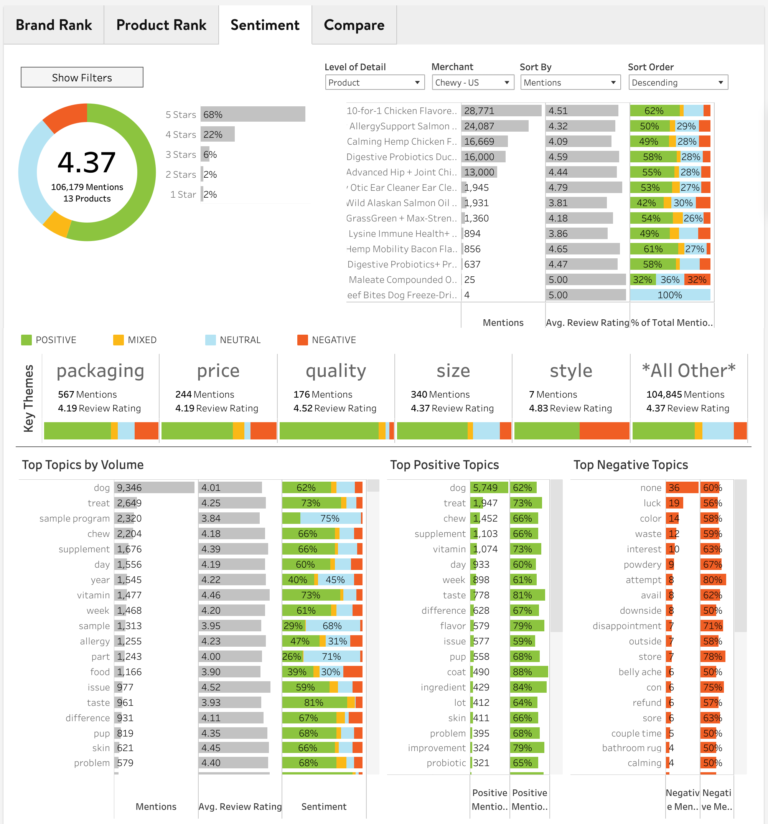

4. Key Themes

These shows you the number of mentions, review rating, and sentiment around custom themes important to your business, such as packaging or price.

This type of sentiment analysis shows you at a glance how customers feel about important aspects of your brand, such as product quality or price. You can analyze key themes for your brand as well as your competitors, giving you insights into areas you can improve and opportunities to stand out.

If you notice a high number of negative reviews related to a theme, dig into the reviews to understand what your customers are complaining about, and take action to remedy those complaints.

Alternatively, you may notice all of your competitors share negative sentiment in a particular area, such as packaging. If you develop and launch a next-level packaging experience, that could become a key differentiator for your brand.

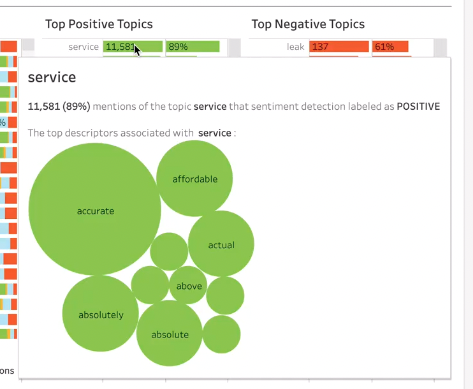

5. Top Topics

These are the top words people use in their reviews around a specific topic, organized by positive vs. negative sentiment.

When you have a lot of reviews, it can be challenging to review them all in depth. The Top Topics Report does the heavy lifting for you, enabling you to zero in on the top words people are using in their reviews in relation to a specific topic, such as customer service, price, or size. You can view the Top Topics for your brand as well as your competitors, providing insight into what they are doing well or not so well.

Review your Top Negative Topics to understand what you need to prioritize fixing first. Then, review your competitors who rate positively around those topics, or look at your Top Positive Topics, to brainstorm ideas for a solution.

6. Average Review Rating

This is the average star rating among all the reviews for a product or brand.

By reviewing your competitor’s average star rating — or by dialing down to their average star rating by product — you can get a sense of how consumers feel about your product compared to the competition.

To improve or maintain a positive review rating, regularly request reviews via a post-purchase email campaign. To improve a negative rating, review the common issues and work to address them. Then, once you’ve implemented improvements, spin up new reviews with a sweepstakes or sampling campaign.

7. Product Sentiment by Retailer

The Retailer Product Sentiment report offers all the above competitor analytics — review count, star ratings, and sentiment — on a retailer-by-retailer basis. It's focused on UPC/SKU as opposed to category to provide the most meaningful product comparisons.

This report reveals how your customers really feel about your brand and products, on any marketplace where your products are sold online. With this report at your disposal, you can uncover why a product isn’t selling as well on a particular retailer, or what attributes of your products drive negative reviews.

Brands can also use this report to build a story at a retailer around why a certain product may bring in more incremental revenue to the category based on consumer sentiment.

Watch out for red flags (negative sentiment) around key topics or themes. Address those issues, and then run a dedicated review campaign for that retailer to improve your star rating.

This report can also be a useful tool when building your product development or marketing strategy. For example, the Key Themes section shows where more positive and negative sentiment is being bucketed. Your marketing and sales teams can then use this information to guide which product features they choose to focus on, based on how their sentiment compares at the retailer level.

Stay ahead of the competition with brand health analytics

With Brand Health Benchmarking, you can quickly compare your performance with your competitors, unlocking insights and opportunities that enable you to push ahead and win big.

If you’re a current PowerReviews customer, great news: you can access all of these metrics using our platform. Not yet a PowerReviews customer? Learn how we can help you do more with UGC.