Where, when and how consumers will shop during the 2021 holiday shopping season -- and what will impact their purchase decisions -- based on insights from nearly 8,000 consumers

Survey at a Glance:

The PowerReviews Holiday Consumer Survey 2021 is based on survey responses from 7,743 consumers across the United States. Key findings include:

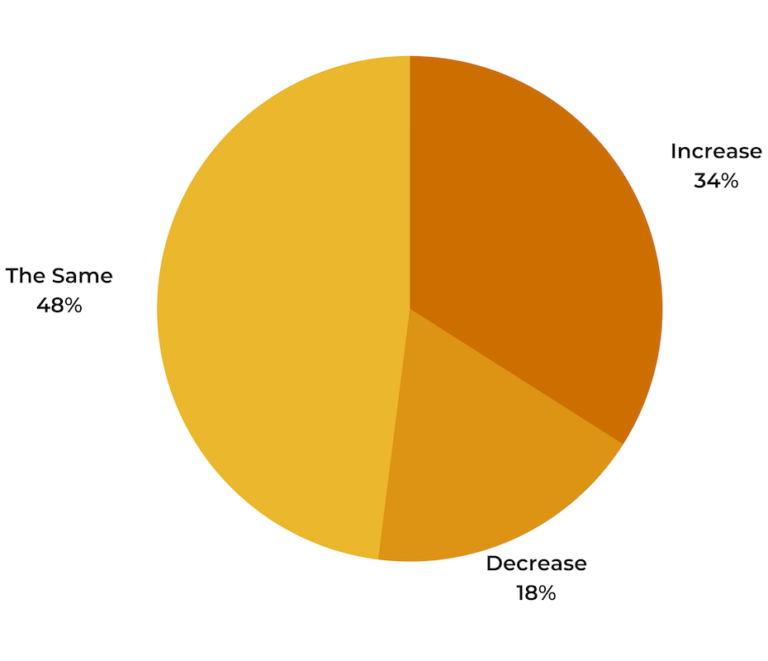

- 48% of consumers plan to spend the same amount during the upcoming holiday season as they did last year.

- Just over a third (34%) plan to increase their holiday spending this year (by 48%, on average).

- 18% plan to decrease their overall holiday spending this year (by 28%, on average).

- Nearly all (99%) of consumers will do at least a portion of their holiday shopping online this year. 50% will do most of their holiday shopping online, and 13% will do all of it online.

- 41% of consumers plan to do more holiday shopping online this year than last.

- Top online shopping destinations this holiday season will be Amazon (93%), retailer sites (85%) and brand sites (58%).

- 37% of consumers plan to do half or more of their holiday shopping in-store.

- 67% will do the same amount or more in-store shopping this holiday season, compared to last year.

- Over half (53%) are still concerned about shopping in-store due to the effects of COVID. However, certain measures such as mask requirements for shoppers, mask requirements for associates, frequent sterilization, and the ability to buy online and pick up in store (BOPIS, also known as curbside pickup) would increase the comfort level of many.

- Many stores will serve as distribution centers during the holiday period. Just over half (51%) of shoppers will use curbside pickup as frequently as they did last holiday season. A third (33%) will use it more.

- As expected, price is the factor that will have the biggest influence on what consumers purchase during the holidays.

- Ratings and reviews are the second most impactful factor. 71% of consumers say that reading reviews impacts what gifts they purchase for others, and 68% indicate this content impacts what they buy for themselves during the holidays.

- 35% of shoppers indicate ratings and reviews will have a bigger influence on their holiday purchases this year, compared to last. This number is significantly higher — 55% — among Gen Z shoppers.

Contents

Introduction

Holiday Shopping Has Changed -- Perhaps Forever

In the past, the phrase “holiday shopping” conjured up images of consumers lined up outside of a brick-and-mortar retail store on Black Friday to get access to the “best deals of the year.” But over time, a steadily increasing portion of consumers have traded late night lines and busy, chaotic stores for the convenience of shopping online.

Then, the COVID-19 pandemic hit, sending ecommerce growth into overdrive. And it dramatically changed the way consumers approached holiday shopping.

In the latter months of 2020, the COVID vaccine wasn’t yet widely available. So many shoppers reduced their trips to brick-and-mortar stores during the busy holiday shopping season — or eliminated them altogether. As a result, U.S. online purchases during the 2020 holiday season grew 32.2% year over year and hit a record high of $188.2 billion.

Today, vaccines are widely available in most parts of the country. Yet, due to a combination of factors, the pandemic continues. So the question is, what will the 2021 holiday shopping season look like for brands and retailers?

Brands and Retailers Must Adapt to Reach Consumers This Holiday Season

We surveyed nearly 8,000 consumers in the U.S. to better understand how they plan to approach their 2021 holiday shopping.

Our goal was to understand where consumers plan to shop, how much they plan to spend, and what factors will influence their purchase decisions. We also sought to understand how these behaviors have changed and evolved since we fielded a similar survey last year.

The following report explores the key findings from this research. By understanding how consumers plan to shop this holiday season, brands and retailers will be better prepared to attract and convert them — wherever and however they choose to shop.

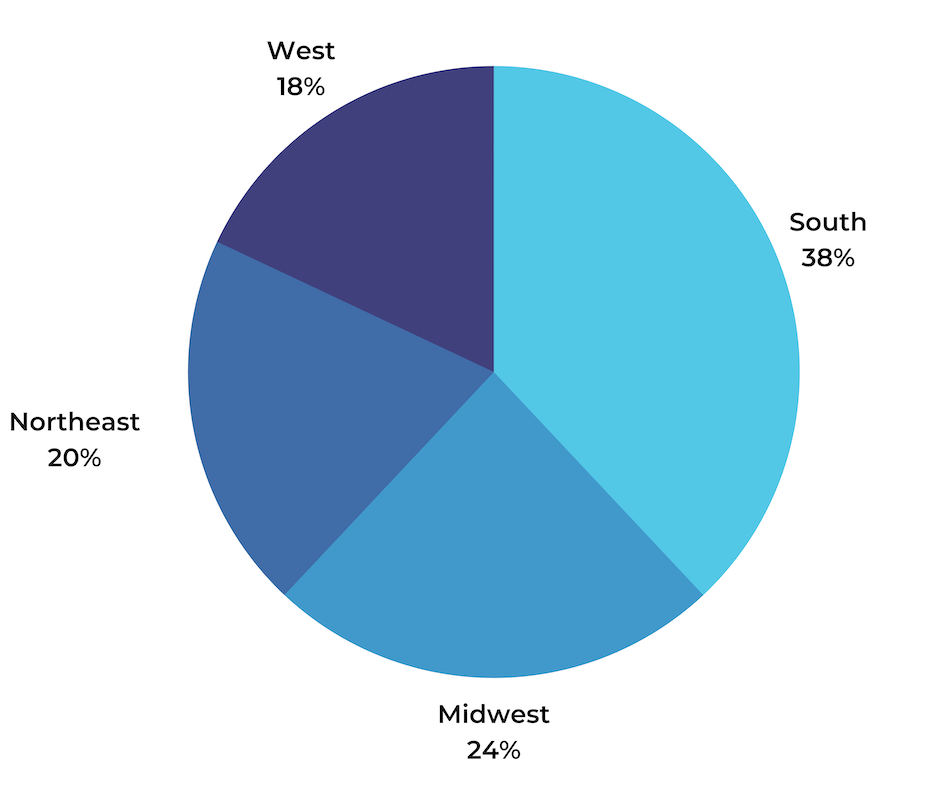

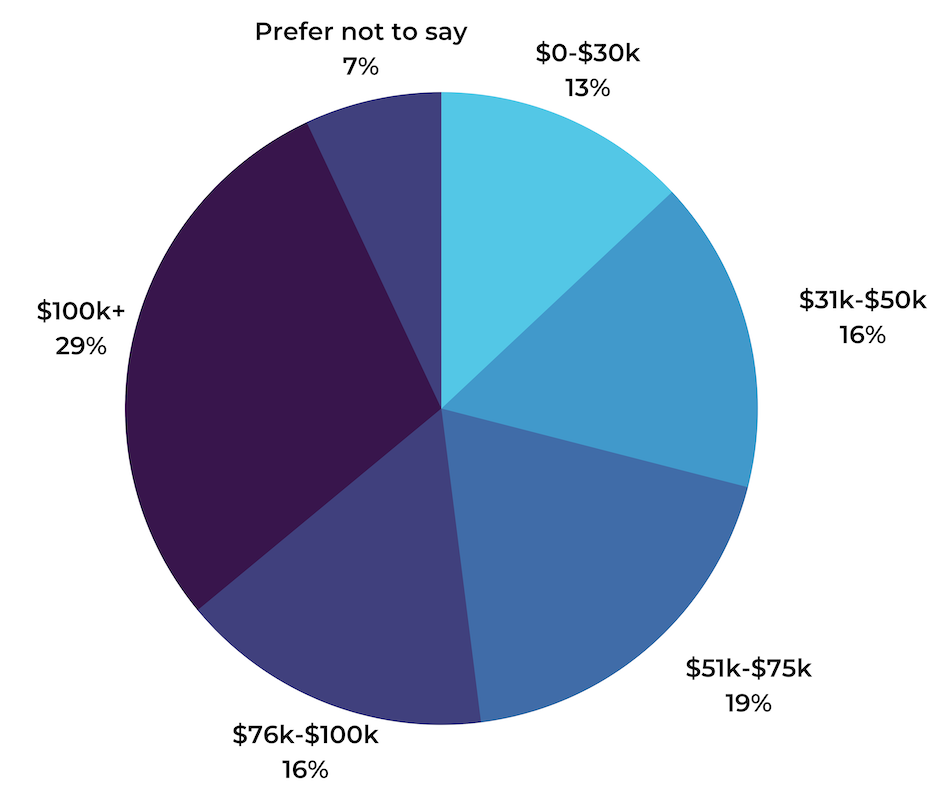

Who We Surveyed

Generations

(1997-present)

(1981-1996)

(1965-1980)

(1946-1964)

Household Income

Anticipated Total Holiday Spending for 2021

At the risk of stating the obvious, the pandemic has had a huge impact on the global economy. And today, many Americans remain un- or under-employed. How will these economic factors impact spending during the 2021 holiday shopping season?

Overall Spending Will Remain In Line with Previous Years

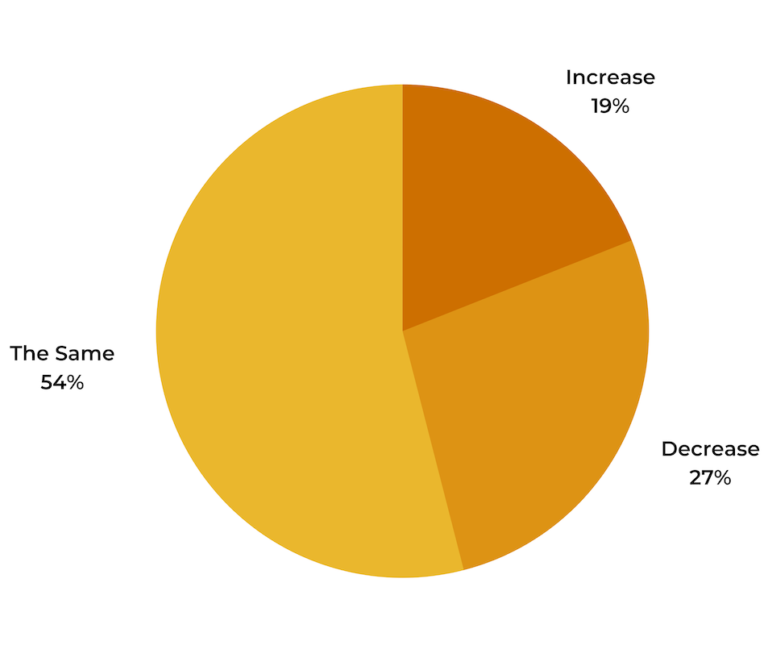

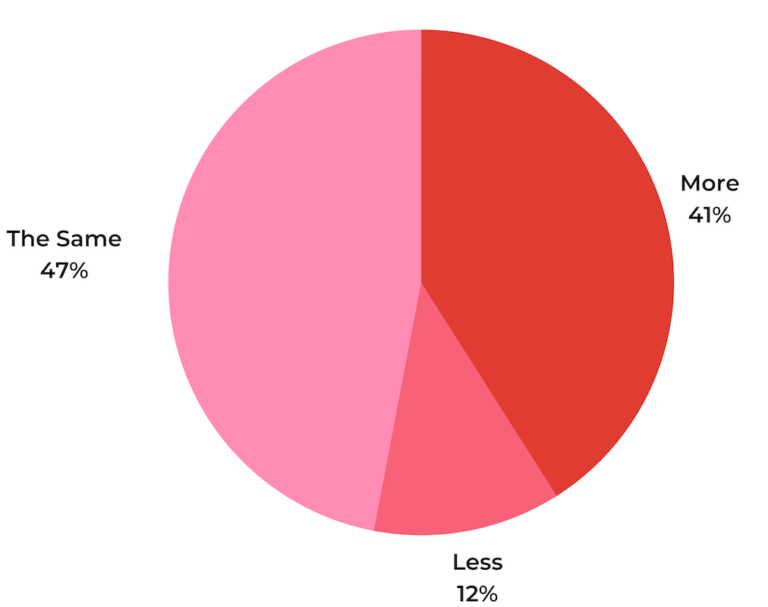

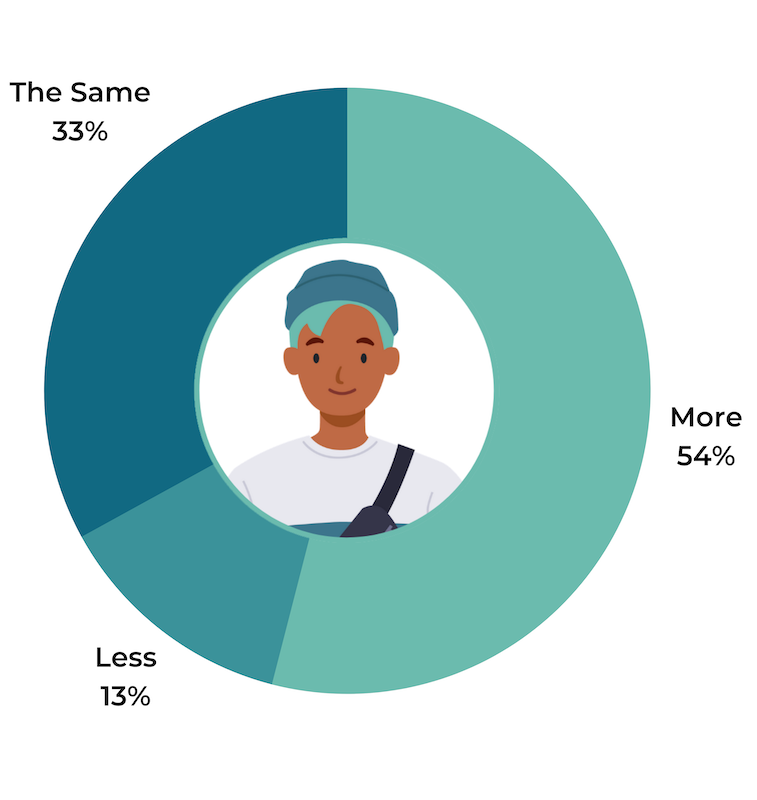

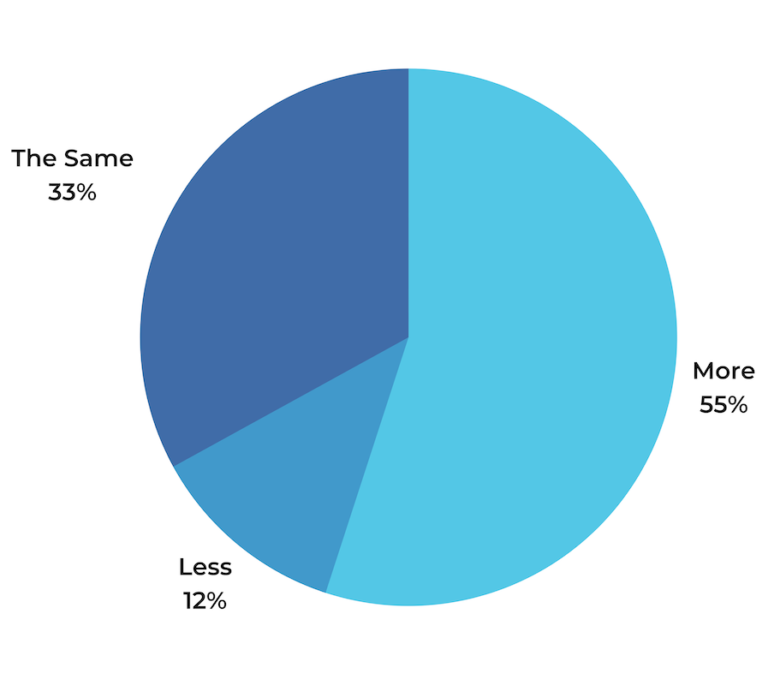

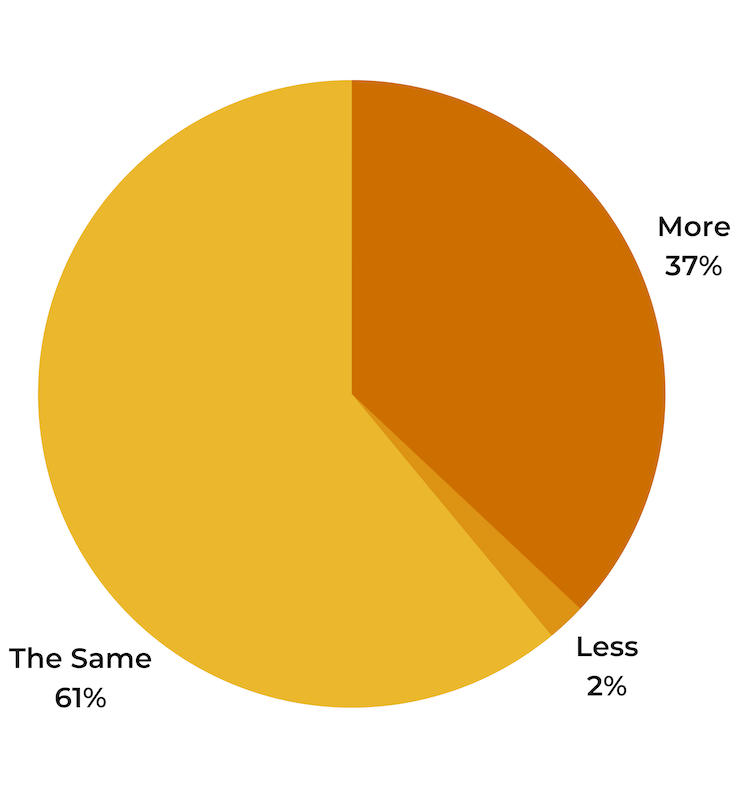

The largest portion of shoppers — 48% — plan to spend the same amount during the upcoming holiday season as they did last year. Just over a third (34%) plan to increase their total holiday spending, up significantly from 2020 when 19% of shoppers said this was the case.

The remaining 18% will decrease their total holiday shopping spend this year, which is markedly lower than the 27% of shoppers who decreased their holiday shopping spend in 2020.

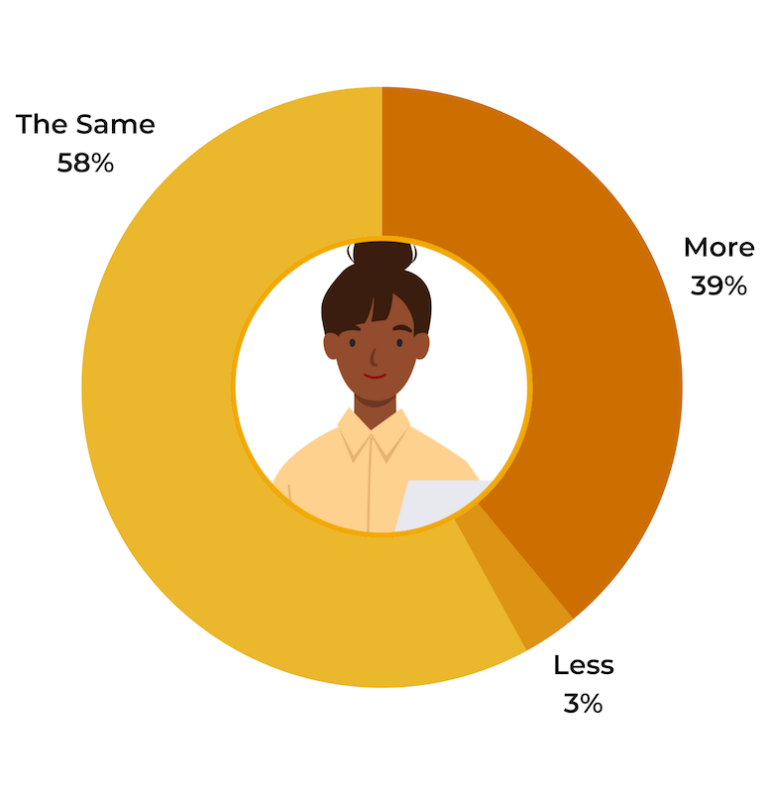

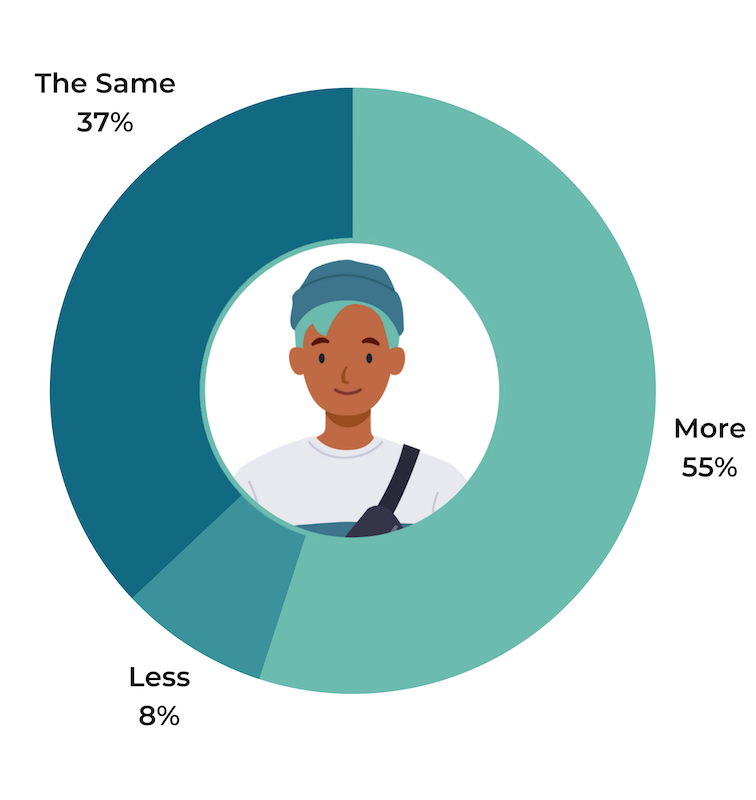

Younger consumers are more likely to indicate they’ll increase their holiday spending. 58% of Gen Z shoppers and 39% of Millennials will increase the amount they spend this holiday season, compared to 29% of Gen X’ers and 24% of Boomers.

It’s also worth noting (but probably not surprising) that those with lower household incomes are more likely to decrease their total holiday spending this year. 29% of households with incomes ranging from $0-$30,000 plan to decrease their total holiday spend, compared to 11% of households with incomes of $100,001 or more.

However, despite economic challenges, it seems many shoppers are ready to spend this holiday season.

How Much Holiday Spending will Change

We know that 34% of consumers will increase their total holiday spending this year. But by how much?

Those who plan to increase their holiday spending will do so by an average of 48%. On the other hand, those who will decrease their total holiday spending will do so by 28%, on average.

Total Holiday Spending Will Vary Widely

Most shoppers plan to spend the same or even more this holiday season. And those who plan to increase their spending will do so, on average, by a significant amount. But what does that amount to in terms of dollar amount?

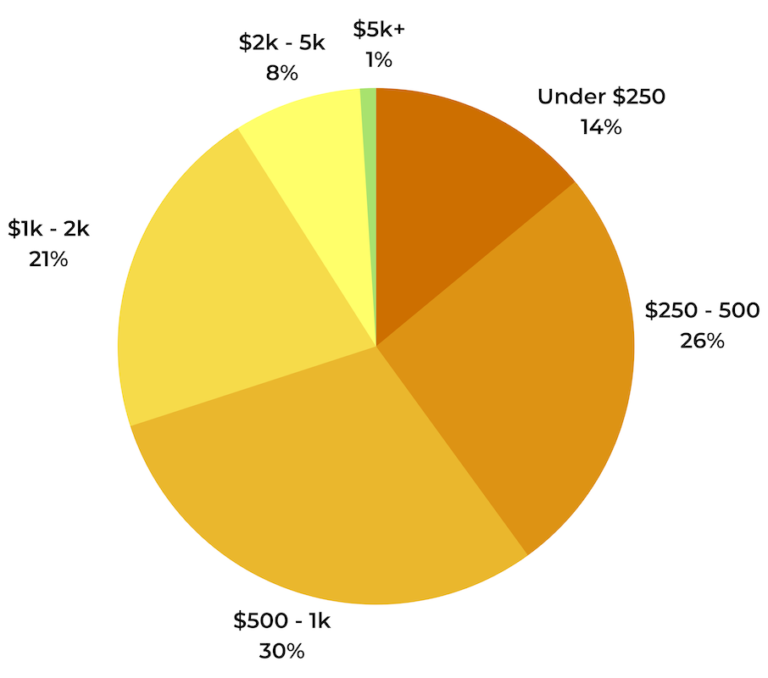

The greatest portion of shoppers — 30% — plan to spend between $501-$1,000. Just over a quarter (26%) will spend $251-$500, and total holiday spending for 21% of shoppers will be between $1,001 and $2,000. 14% plan to spend less than $250, and 9% will spend more than $2,000.

When 2021 Holiday Shopping will Commence

The National Retail Federation (NRF) defines “holiday spending” as that taking place in November and December. But in reality, many consumers start thinking about their holiday shopping much earlier. And many start to check things off their holiday lists long before Black Friday rolls around.

Many will Start Thinking About Holiday Shopping Early

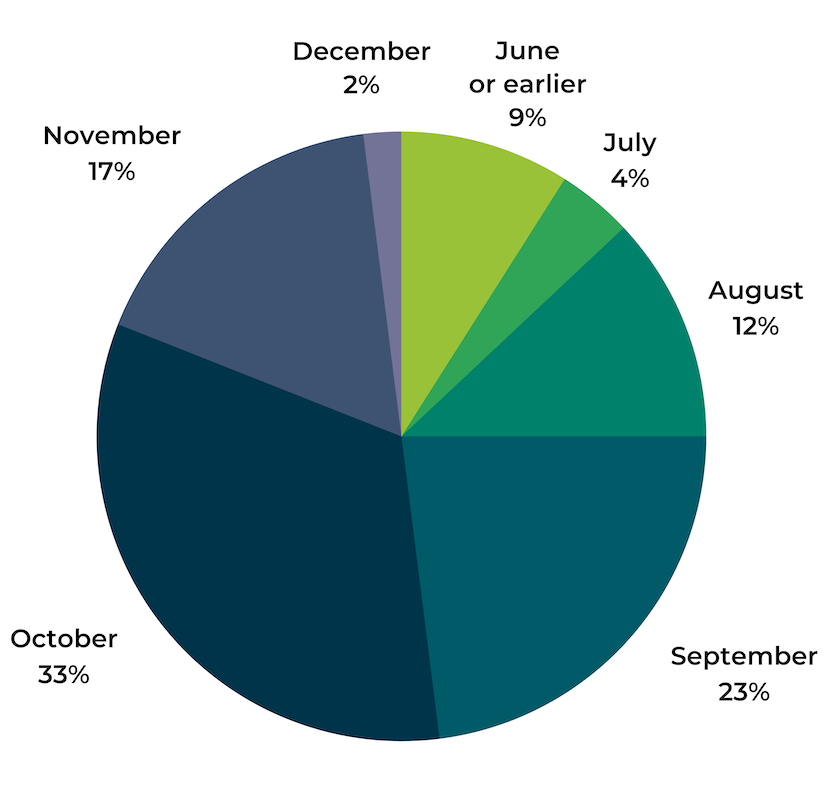

It seems it’s never too early to start thinking about holiday shopping. The largest portion of shoppers — 33% — start thinking about their holiday shopping in October. However, nearly half (48%) start thinking about it in September or earlier. 17% don’t think about holiday shopping until November, and the remaining 2% don’t give it a thought until December.

Consumers Start Ticking Off Their Holiday Lists Early

Many consumers start thinking about holiday shopping long before Black Friday. But when will they actually start shopping?

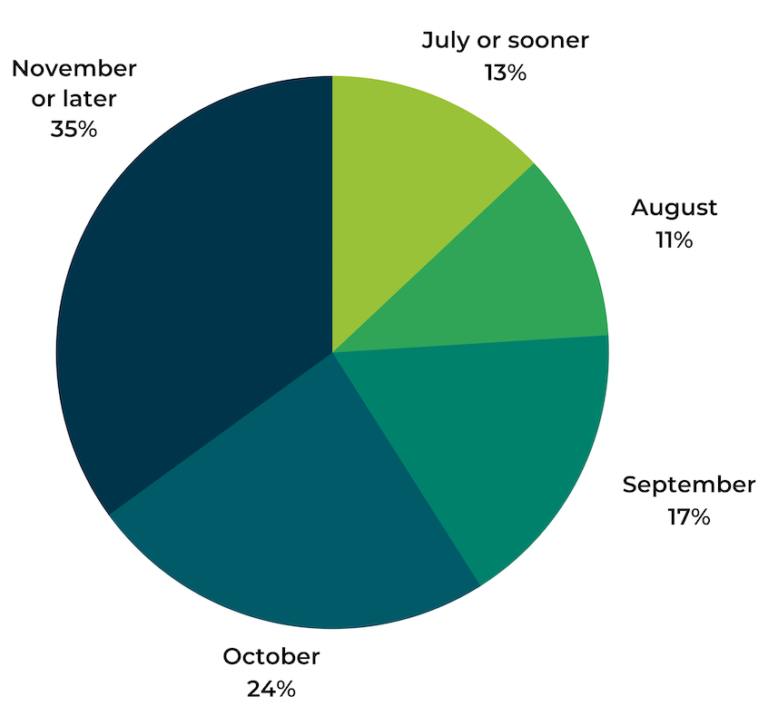

This year, just over a third (37%) plan to start their holiday shopping in November or later, and 30% plan to start in October. The remaining third (33%) plan to (or have already started) their shopping in September or earlier.

Interestingly, in 2020, significantly more — 41% of consumers planned to start their holiday shopping in September or earlier, likely due to concerns about shipping delays related to the COVID-19 pandemic.

Most Consumers Will Start Their Holiday Shopping at the Same Time as Usual

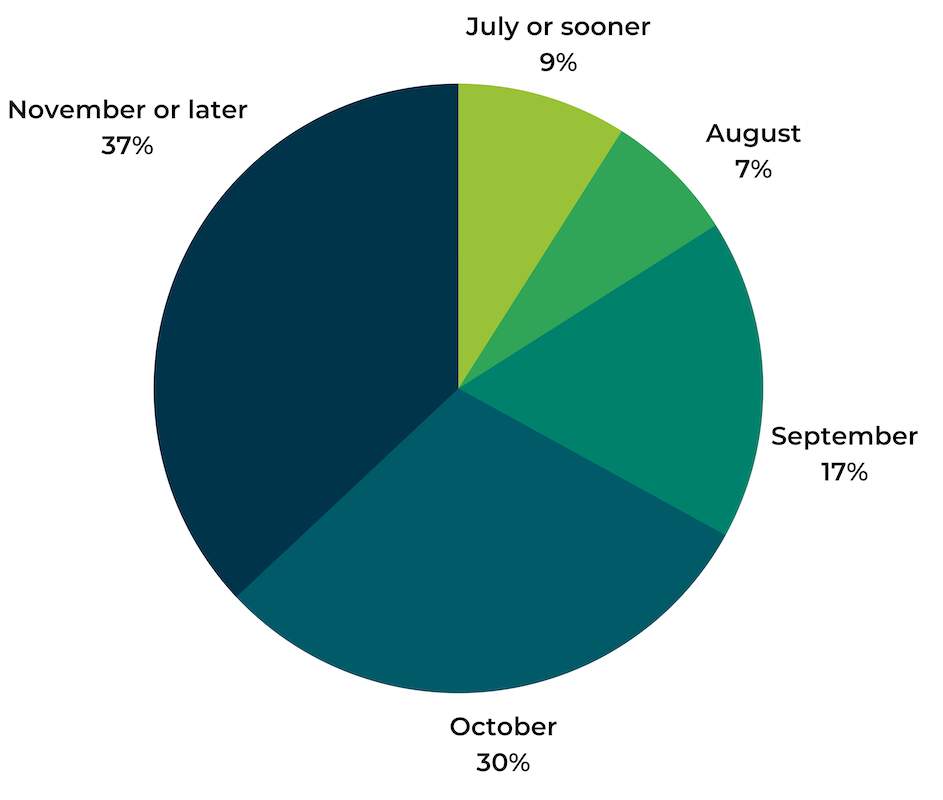

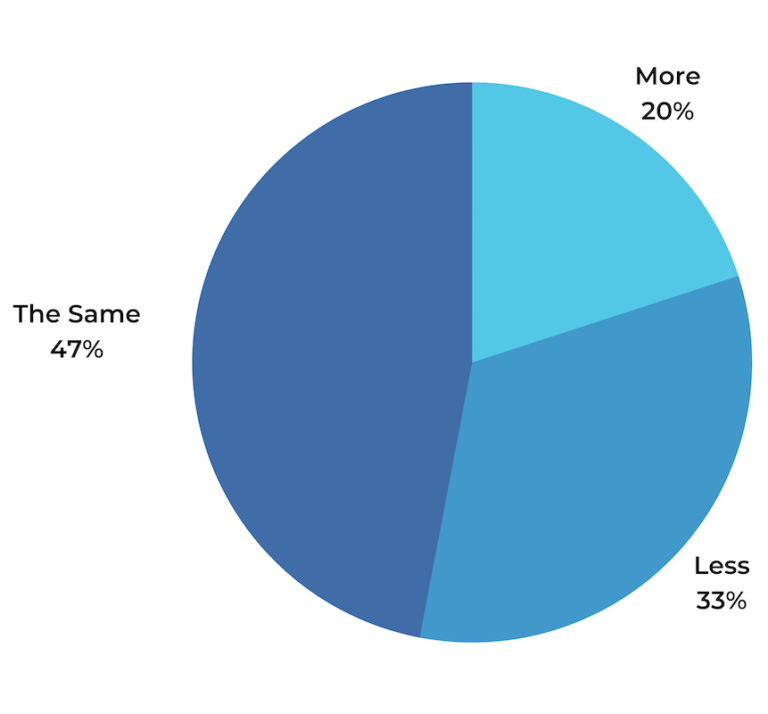

While some consumers will start their holiday shopping in September or early, others plan to wait until October or later. How does this compare to years past?

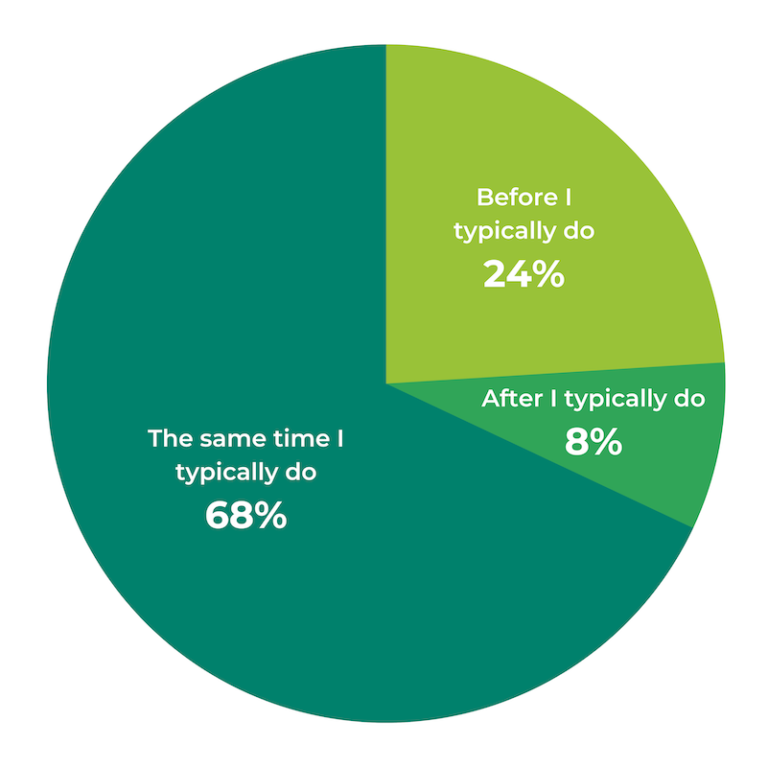

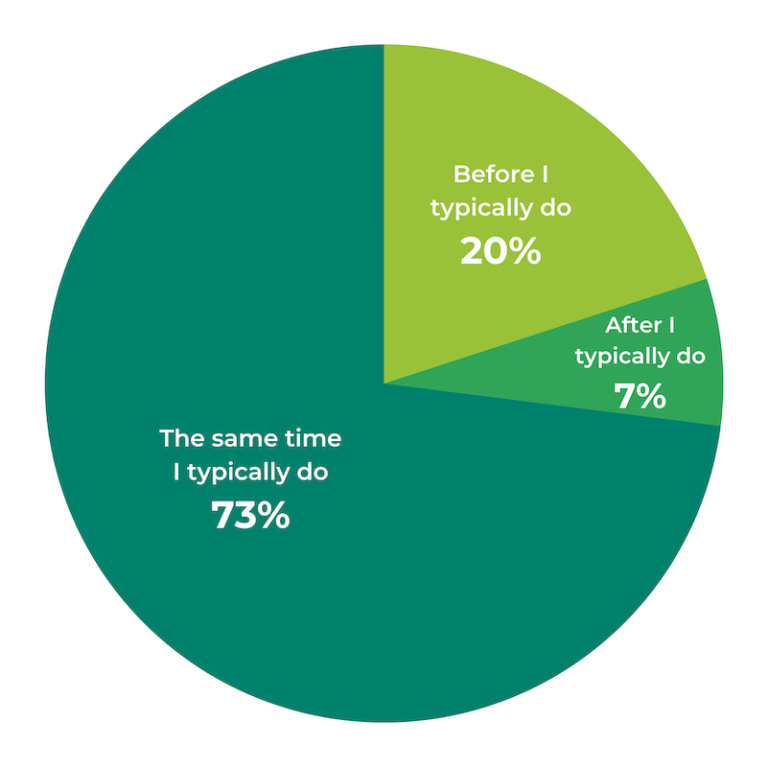

Nearly three-quarters (73%) indicate they will start their 2021 holiday shopping at the same time they typically have in the past, compared to 68% who said this was the case in 2021. 20% plan to start earlier than typical (compared to 24% in 2020), and the remaining 7% indicate they’ll start later than usual (this figure was 8% in 2020).

This year, a smaller percentage of consumers plan to start their holiday shopping earlier than usual. Last year, consumers were concerned about COVID-related shipping delays and altered their shopping timeline to account for this. However, this seems to be less of a concern this year.

Where Consumers will Shop This Holiday Season

The pandemic has ushered in a well-documented surge in ecommerce growth. And during the 2020 holiday season, online sales reached record levels.

Will holiday shoppers continue to trade trips to the store for the convenience of browsing and buying online?

The Top Holiday Shopping Destination for 2021: The Internet

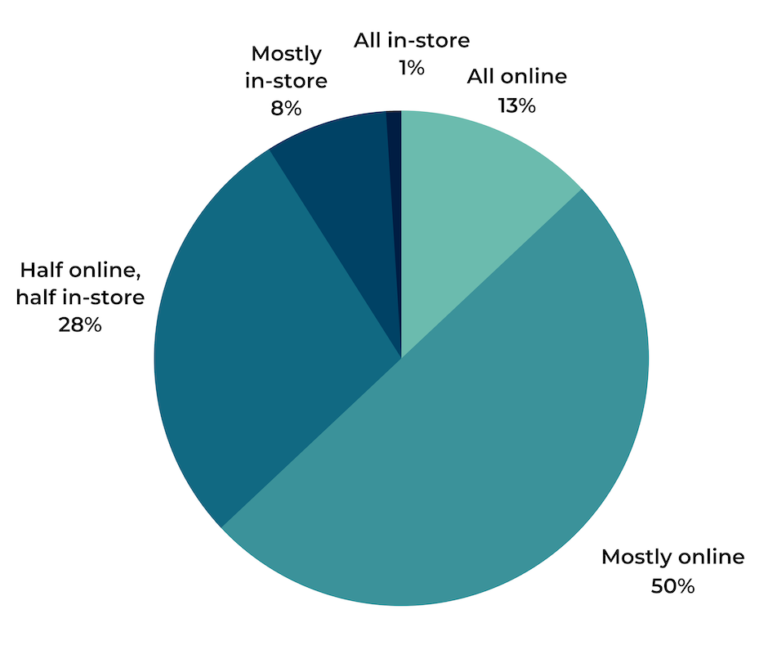

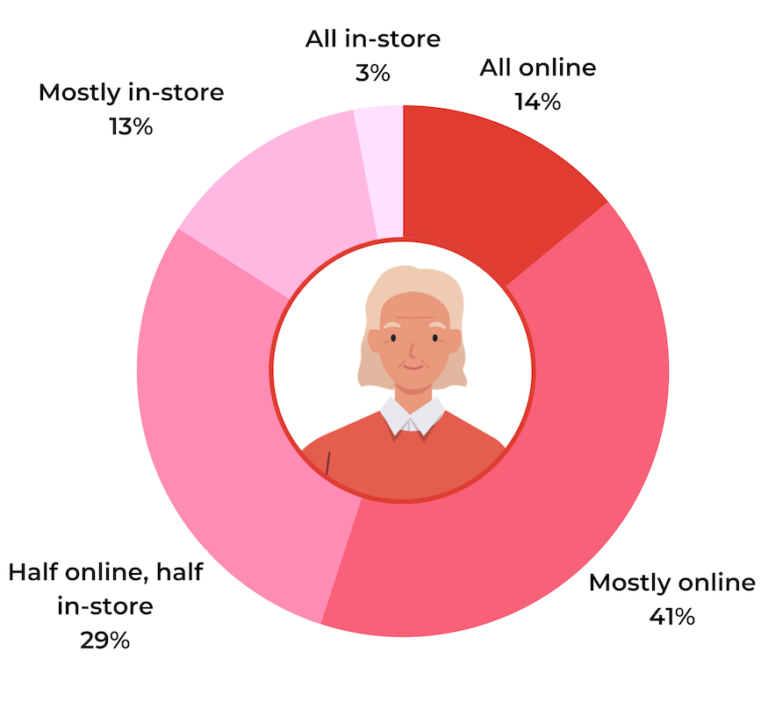

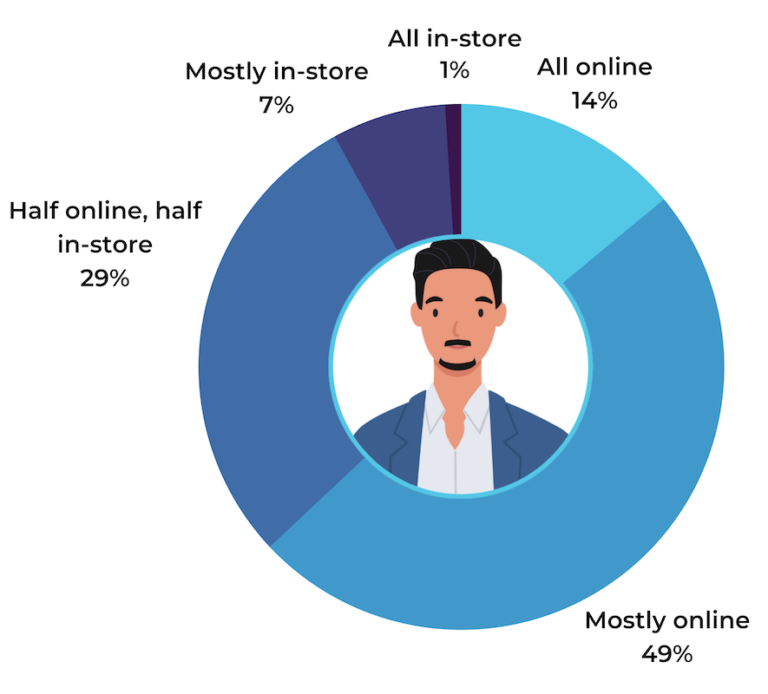

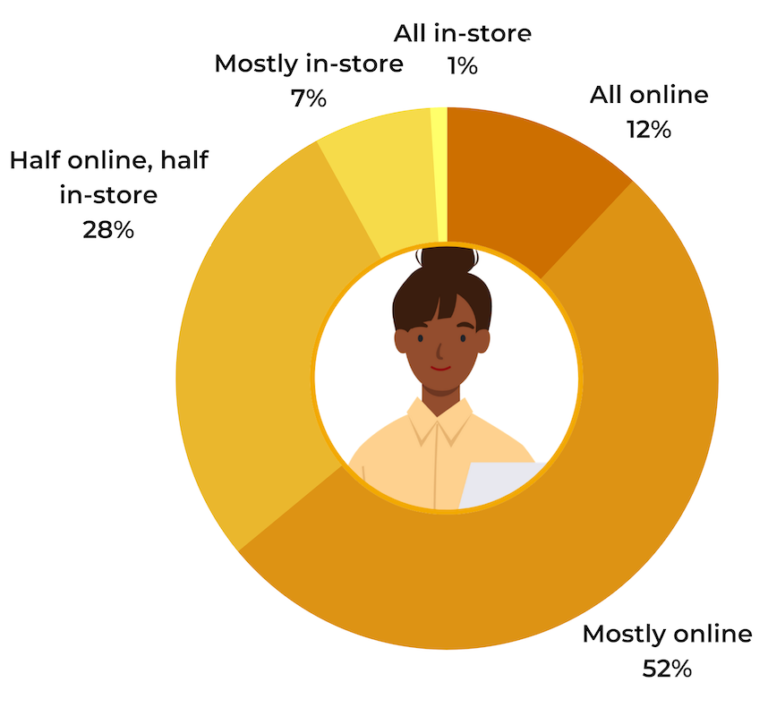

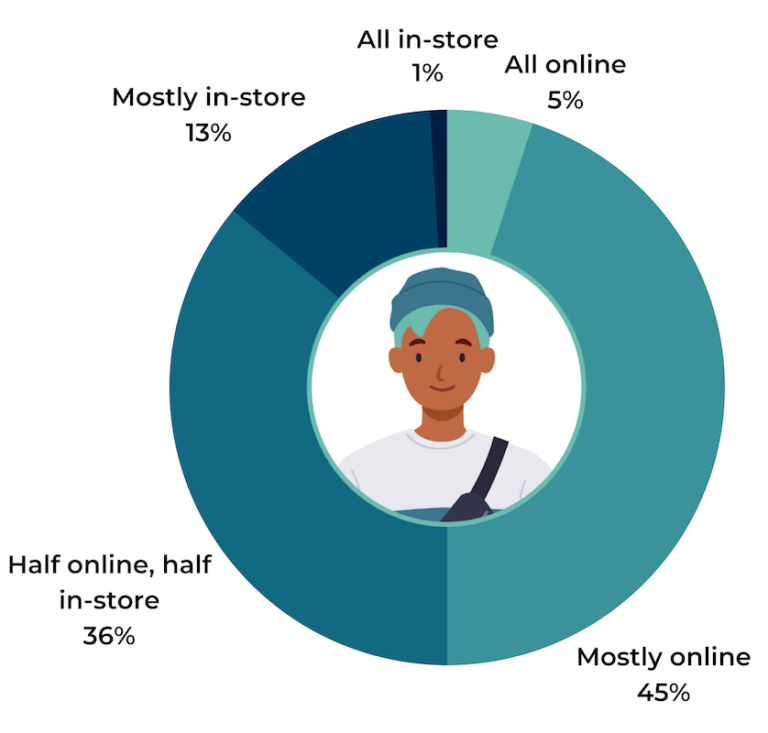

The vast majority of consumers plan to turn to the internet for at least some of their holiday shopping this year. 13% plan to shop exclusively online, and 50% will do most of their holiday shopping online.

Just over a quarter (28%) will do half of their holiday shopping online, and half in-store. A mere 9% of shoppers plan to do most or all of their holiday shopping at physical store locations.

Interestingly, older generations are more likely to indicate they’ll do all of their holiday shopping online. 14% of both Boomers and Gen X shoppers indicate this is the case, compared to 5% of Gen Z’ers.

However, Boomers are also the generation most likely to do all or most of their holiday shopping in-store. 16% indicate this is the case, compared to 8% of Gen X and Millennial shoppers and 14% of Gen Z’ers.

How Consumers will Navigate Online Holiday Shopping

We know that nearly all consumers will do at least part of their holiday shopping online. And 63% will rely on the internet for most or all of their holiday purchases.

But how and where are they planning to shop online?

Shoppers will Turn to the Internet More Than in Years Past

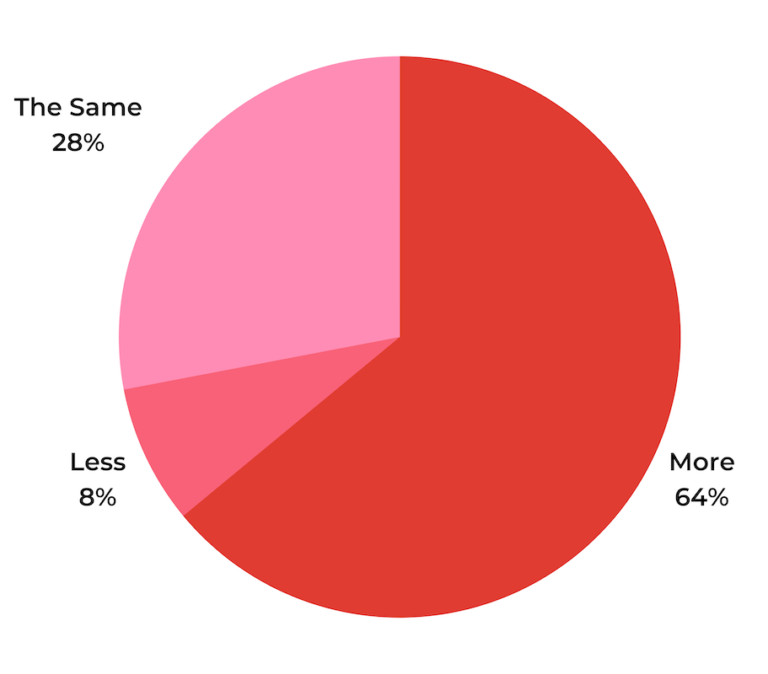

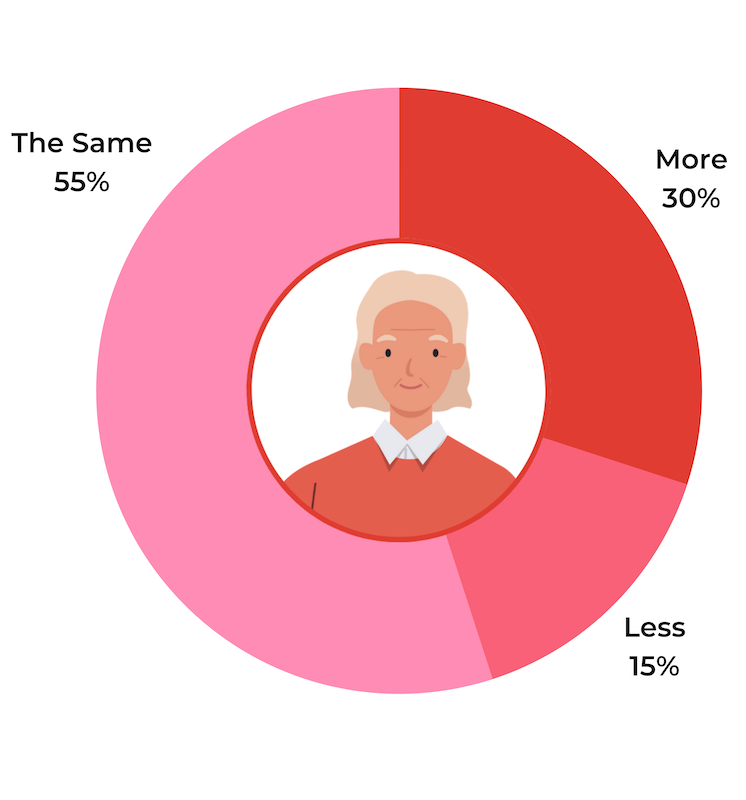

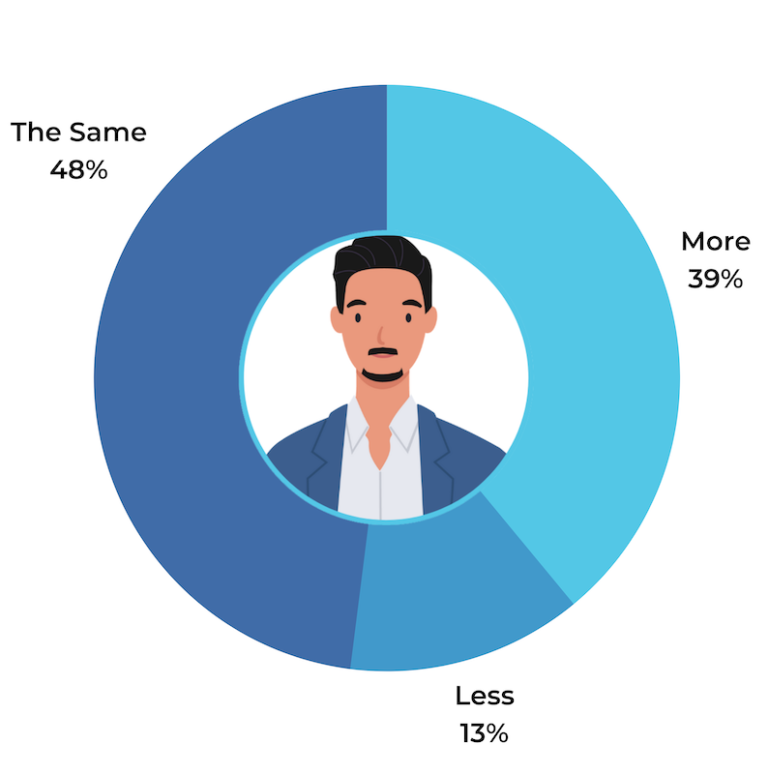

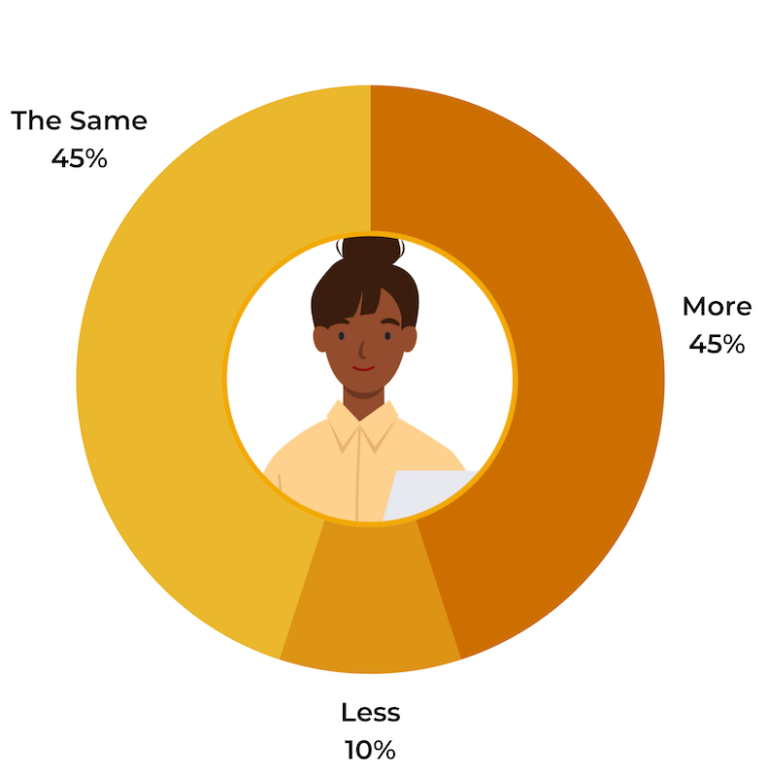

When we surveyed consumers in 2020, the majority (64%) indicated they planned to do more holiday shopping online than in years past. This year, 41% say this is the case.

Though the percentage is smaller, it’s still significant. And it proves that a large (and consistently growing) number of consumers are embracing the convenience (and safety) of making holiday purchases online.

Of note, younger consumers are more likely to ramp up their online holiday shopping this year, when compared to their older counterparts. 54% of Gen Z’ers and 45% of Millennials plan to do more holiday shopping online this year than last. In comparison, 30% of Boomers and 39% of Gen X’ers incidicate this is the case.

Online Spend will Vary This Holiday Season

This holiday season, many shoppers will spend the same amount or even more online than they have in the past. Exactly how much do they plan to spend online?

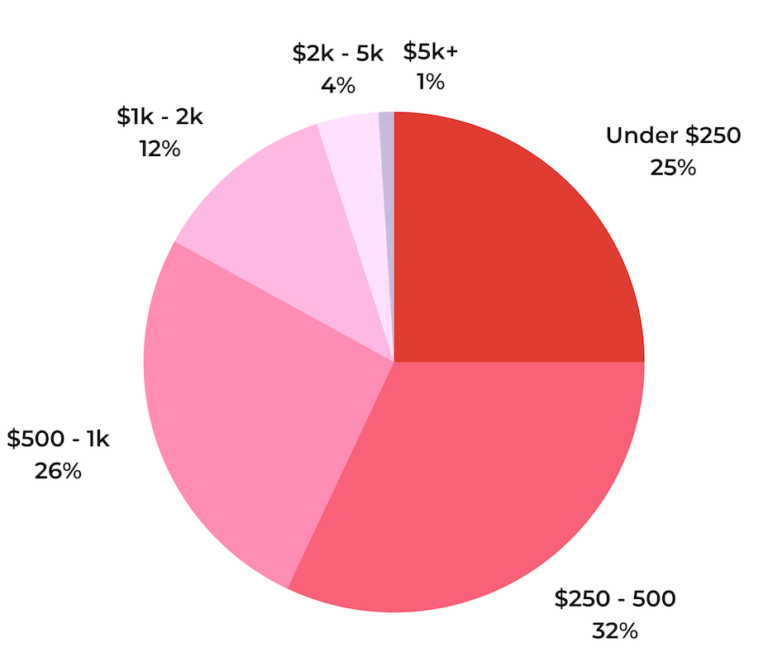

As expected, total anticipated online spend varies considerably. The largest portion of shoppers — 32% — plan to spend between $251 and $500 online this holiday season. Just over a quarter (26%) plan to spend between $501 and $1,000, and another quarter (25%) will spend less than $250. The remaining 17% plan to spend more than $1,001 online this holiday season.

Where Online Shoppers will Browse and Buy This Holiday Season

It’s clear that shoppers will be flocking to the internet to do their online shopping. But which ecommerce sites will benefit the most from this surge in online shopping?

It probably surprises no one that Amazon will be the top shopping destination this holiday season. 93% of those surveyed indicate they’ll shop on Amazon.com this holiday season, down just slightly from last year.

However, retailer sites aren’t far behind. 85% of consumers will use retail ecommerce sites — such as Target.com and Walmart.com — during the 2021 holiday shopping season, slightly down from 88% in 2020.

Over half (58%) of consumers plan to patronize brand-specific sites — such as Nike.com and Levi.com. This increased tendency for direct-to-consumer shopping is great news for brands, as it’s a slight increase from 2020, when the comparative figure was 56%.

The Role of Brick-and-Mortar Stores During the Holidays

Sure, a large portion of consumers plan to shop online for the holidays. But make no mistake: brick-and-mortar stores are still alive and well. In fact, over a third (37%) plan to do half or more of their holiday shopping in-store.

What role will stores play this holiday shopping season? And are there any factors that would convince more shoppers to browse and buy in-store?

Consumers will Still Shop In-Store

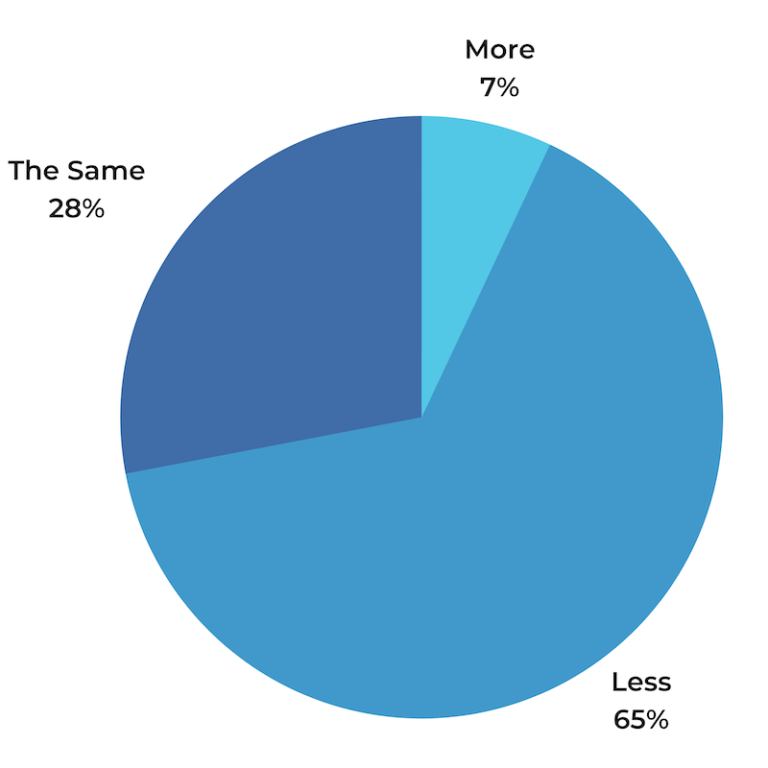

During the 2020 holiday shopping season, COVID vaccines weren’t widely available and much was still unknown about the virus. As such, many consumers avoided trips to the store.

In fact, in 2020, 65% of consumers indicated they planned to do less holiday shopping in-store, compared to the previous year.

This year, however, vaccines are widely available in most parts of the country. And pandemic fatigue has set in for many. So perhaps it’s not surprising that this year, just a third of consumers plan to do less in-store holiday shopping.

And 20% actually plan to do more holiday shopping in-store this holiday season, compared to last year. The remaining 47% plan to do the same amount of in-store holiday shopping as they have in the past.

Many Remain Concerned About the Risk of In-Store Shopping

While 20% of consumers plan to do more holiday shopping in-store this year, it’s important to remember that a full third plan to shop in-store less.

Of course, there are many explanations for this; health and safety concerns are no doubt chief among them.

This year, just over half (53%) of consumers indicate they’re concerned about shopping in-store during the holidays due to the effects of COVID. In 2020, this number was significantly higher — 70%. However, it’s clear this is a lasting concern for many shoppers.

It’s interesting to note that consumers across all generational groups seem equally concerned about in-store holiday shopping due to COVID, whereas in 2020, older shoppers were more concerned than their younger counterparts.

On the other hand, there are notable differences in concern on the regional level. 46% of consumers in the midwest are concerned about in-store shopping due to COVID, compared to 57% of those living in the south. This isn’t terribly surprising, because, as of this writing, the south is considered a COVID hot spot.

The Right Safety Measures Help Assuage Customer Concerns

Just over half of consumers are concerned about shopping in-store during the holidays because of COVID. However, there are certain factors that would make them more comfortable in store.

Three factors tied as top ways to reduce in-store shopper anxiety: other customers being required to wear masks, associates being required to wear masks, and frequent sterilization of store premises. 55% of consumers indicated each of these factors would make them more comfortable shopping in-store during the holidays.

The ability to buy online, and then pick up in store (often referred to as curbside pickup or BOPIS) was a close second; 52% of consumers said the availability of this service would make them more comfortable shopping in store.

Other top factors for assuaging concerns about shopping in-store during the holidays include restricting the number of customers allowed in a store (37%), contactless payment capabilities (38%), and plexiglass screens at checkout (28%).

It’s interesting to note that the percentage of consumers indicating any of these factors make them more comfortable shopping in-store has significantly decreased from 2020.

For example, in 2020, 67% of shoppers said they’d be more comfortable in-store if other customers were required to wear masks. But this number dropped to 55% this year.

And while 56% of shoppers indicated they’d be more comfortable shopping in-store during the 2020 holiday season if the number of people allowed to be in the store was limited, only 37% would be comforted by that measure this holiday season.

Many Plan to Ramp up Their Use of Curbside Pickup

This year, over half (52%) of shoppers indicate they’d be more comfortable shopping in a physical store if they had the ability to buy online, and then pick up their purchase in-store. How will the use of BOPIS compare to years past?

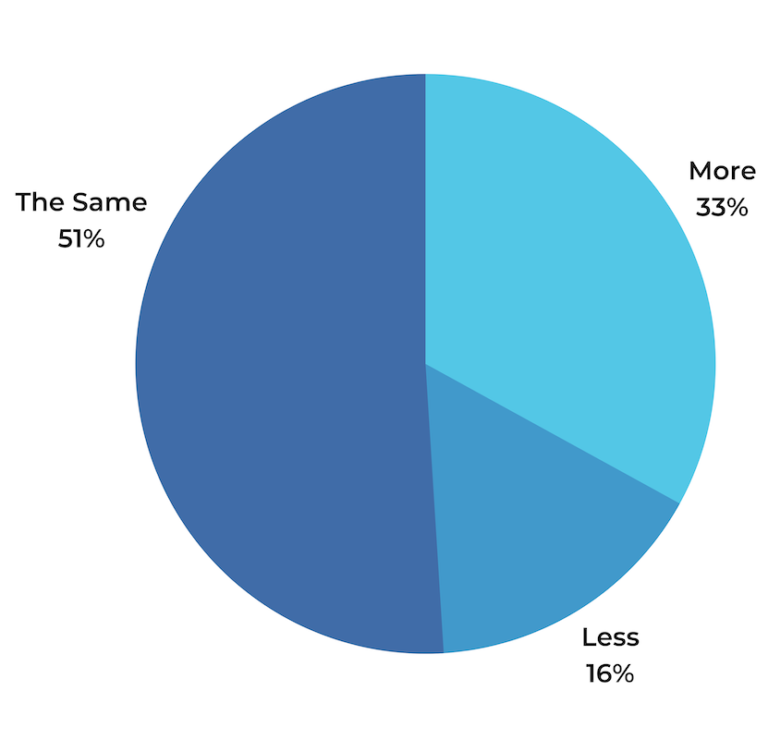

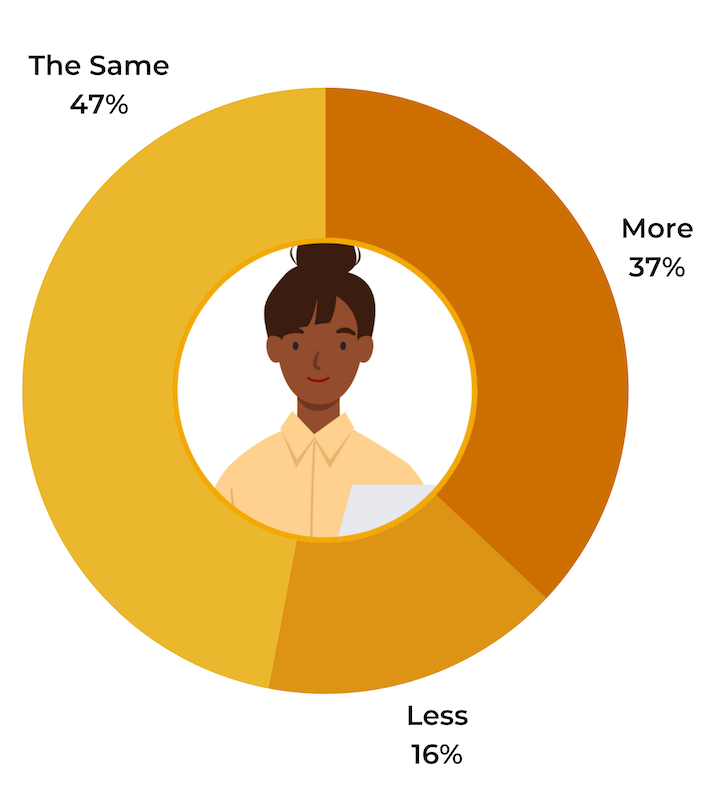

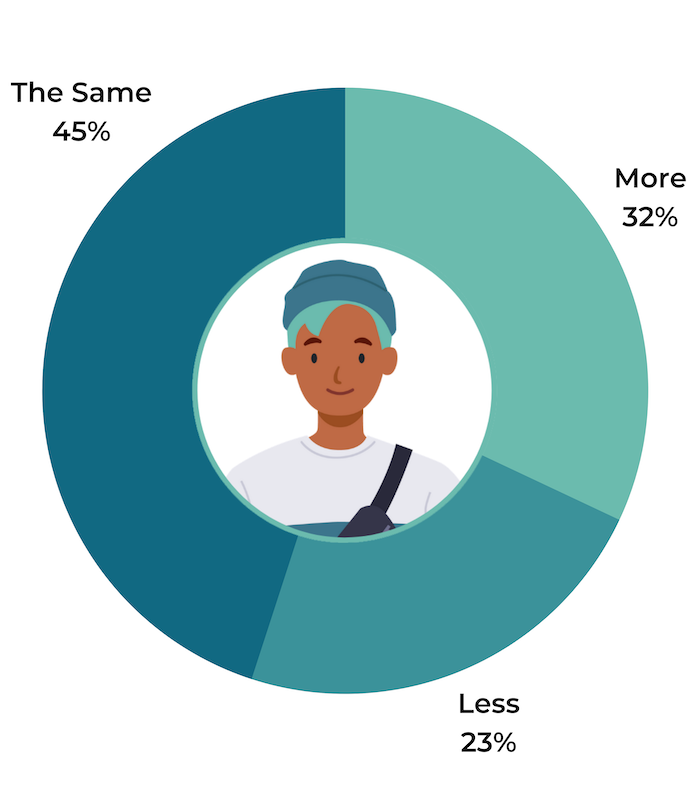

This year, 33% of shoppers anticipate doing more holiday shopping via BOPIS than in the past. This is significant; however, it’s smaller growth than last year, when 55% of shoppers indicated they’d use curbside pickup more than they had the previous year.

Half of shoppers (51%) plan to use BOPIS the same amount this year as they did last year. And 16% plan to leverage curbside services less this holiday season.

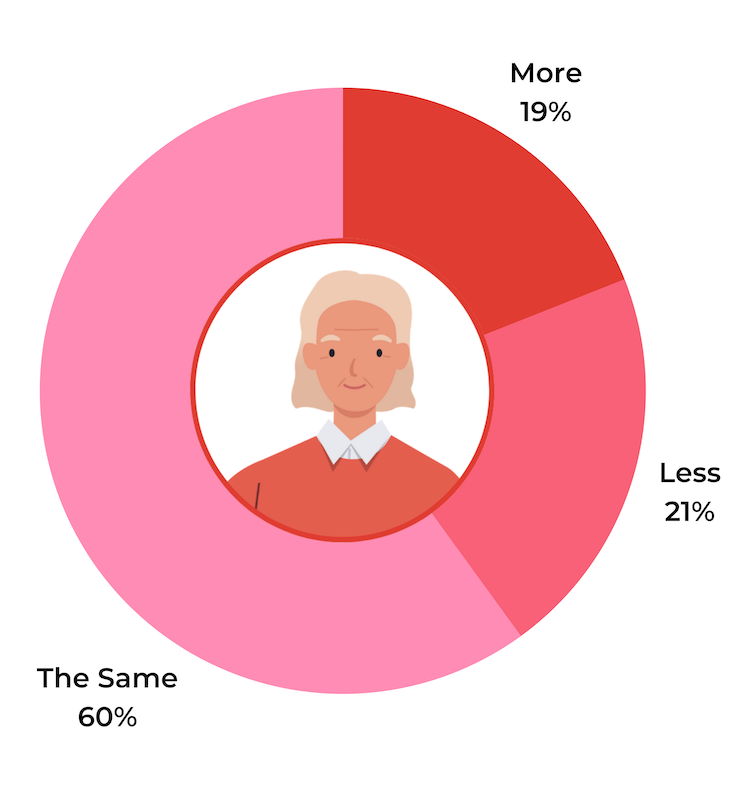

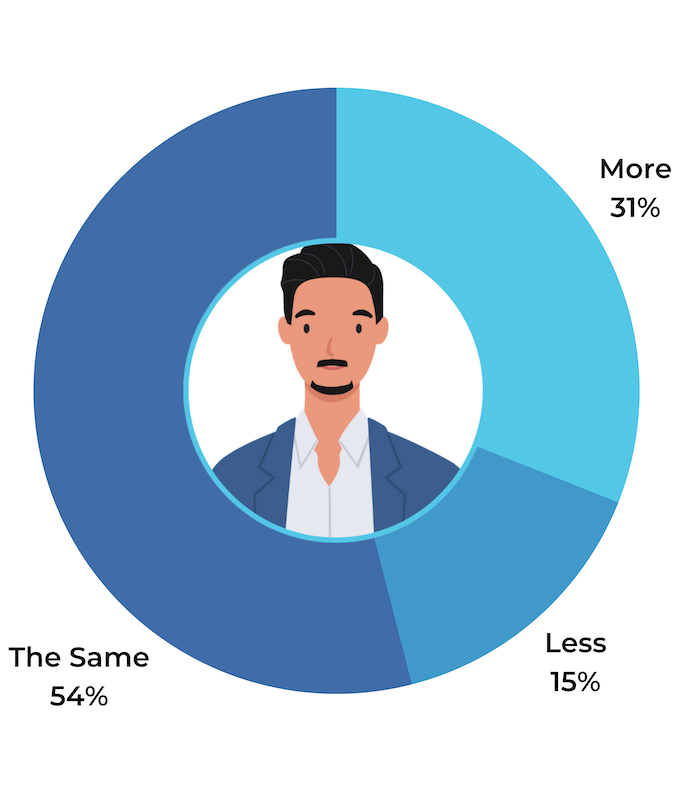

Boomers are the generation least likely to ramp up their use of buy online, pick up in store services. 19% plan to do so, compared to 37% of Millennials. Interestingly, the youngest generation — Gen Z’ers — are the group more likely to reduce their use of BOPIS this holiday season. 23% of Gen Z shoppers plan to use BOPIS less this holiday season, compared to 16% of Millennials who say this is the case.

For many shoppers, BOPIS offers the best of both worlds. They get the convenience of ordering online, and they can experience nearly instant gratification by getting the item in-hand sooner than they would if it were to ship to their homes. Brands and retailers must make it a priority to optimize their BOPIS process — both for the holiday season and beyond.

The Factors Expected to Influence Holiday Shopping Behavior

Consumers consider many factors when making holiday purchases for themselves or others. But which factors are expected to be most influential during the 2021 holiday shopping season?

Shoppers Will Weigh Many Factors When Shopping for Holiday Gifts

Consumers will consider myriad factors when purchasing gifts for others during the upcoming holiday season. As expected, price will be the top consideration; 82% of consumers say price will influence which products they purchase for holiday gifts.

Ratings and reviews are a close second. 71% of shoppers say that reading reviews from those who have already purchased a given product will influence which gifts they purchase for others.

Other impactful factors include shipping or delivery costs (65%), ease and speed of shipping (60%), the trustworthiness of the brand (58%), and whether or not the shopper has personal experience with the given product or brand (57%).

It’s interesting to note that in 2021, all factors ranked in the same order of importance as 2020 — although there were slight shifts in the percentage of shoppers who indicated each factor was influential.

Consumers Weigh the Same Factors When Shopping for Themselves

It’s not uncommon for shoppers to purchase items for themselves during the holiday shopping period. What factors influence what shoppers buy for themselves?

As it turns out, the factors that influence “self-gifts” directly mirror those that influence gift purchase for others.

Again, price tops the list, with 79% of shoppers indicating this influences what items they buy for themselves during the holidays.

But ratings and reviews from others who have already purchased the item in question is a close second; 68% say this content influences what they purchase for themselves during the holiday period.

Let’s take a closer look at how the impact of some of these top factors has changed since the last holiday shopping season.

For Many Consumers, Price Will be Even More Influential This Year

The pandemic has obviously had a huge impact on the global economy, leading many to scrutinize purchases more than before. So it’s not surprising that price remains the factor that most influences what consumers will purchase for themselves or others this holiday season.

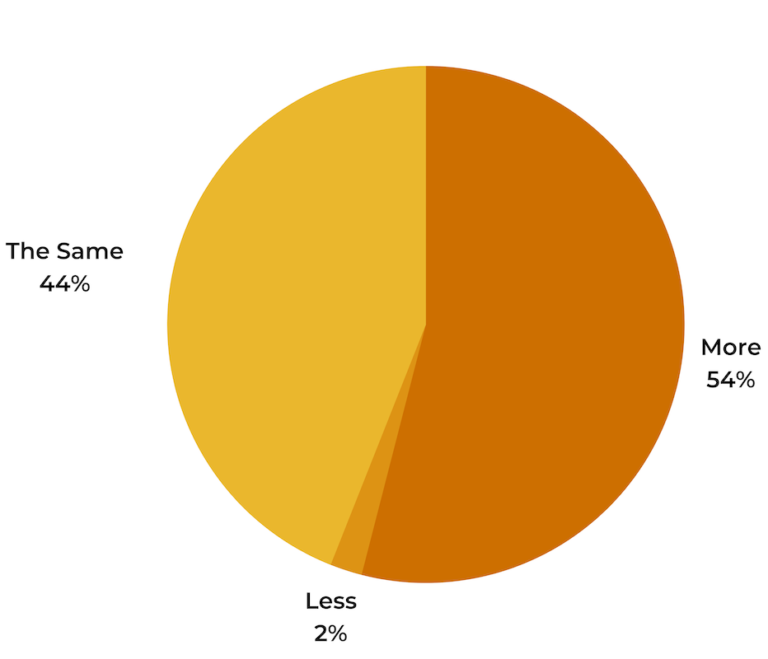

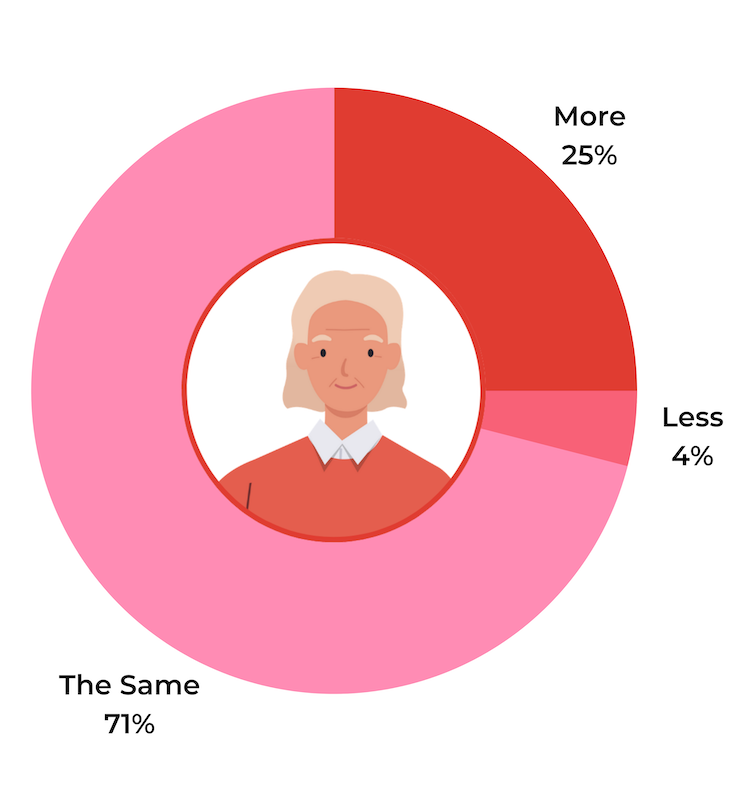

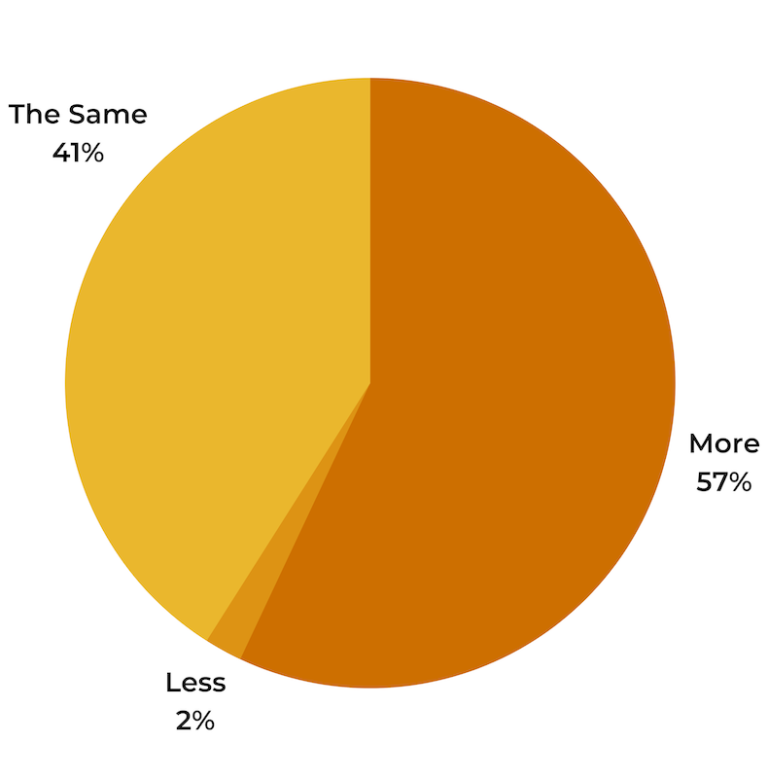

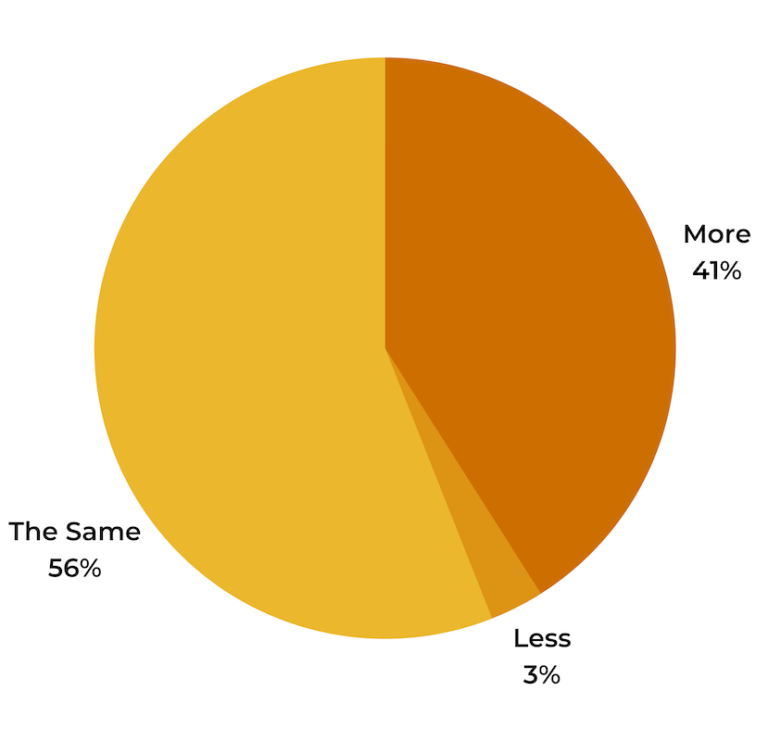

What’s more, nearly half (48%) of consumers indicate that price and the ability to apply a discount will have more of an impact on their holiday purchases this year than it did last year. In 2020, 54% indicated this was the case.

49% of consumers say that price will have the same influence as it did last year. And the remaining 3% indicate price will have less of an impact on holiday purchases this year.

Price sensitivity will be paramount this holiday season. Brands and retailers must benchmark appropriately to ensure their products are priced appropriately to sell, while still preserving profits.

Reviews are Becoming Even More Impactful on Holiday Purchases

Reviews will have a heavy influence on holiday purchases, whether consumers are buying gifts for others or themselves. But how does the impact of this content compare to last year?

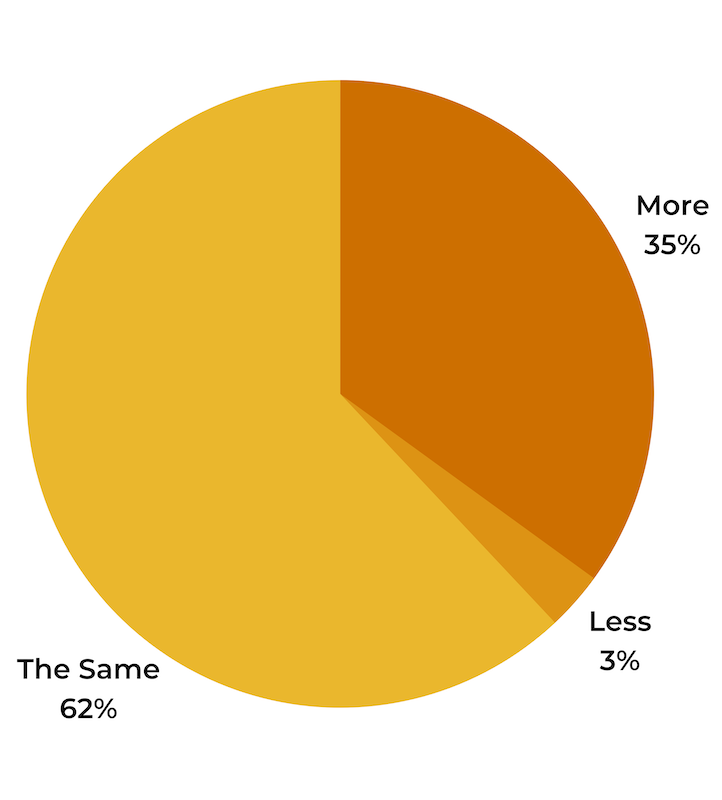

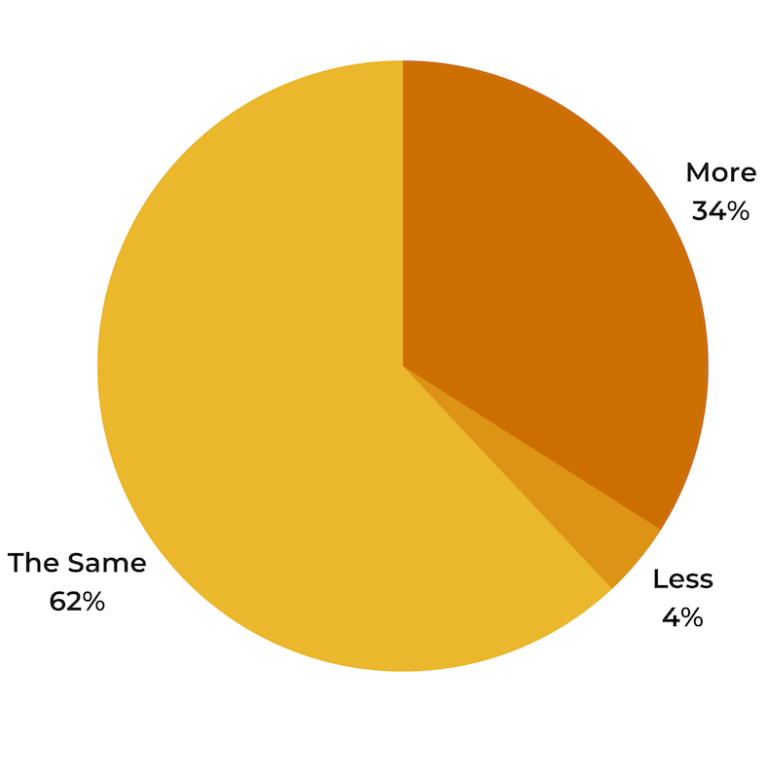

This year, over a third (35%) of shoppers say that ratings and reviews will have more of an impact on holiday purchase decisions than they did last year.

Gen Z shoppers are the generation most likely to say reviews will have a bigger impact on holiday purchases this year. 55% say this is the case, compared to far fewer — 25% — of Boomers.

We know from previous research that the vast majority of consumers (99.9%) read reviews at least sometimes. And our most recent research tells us that the influence of this content on holiday purchases is only growing.

Brands and retailers must make it a priority to ensure they have a steady stream of reviews coming in for their products — especially those featured during the upcoming holiday season.

Ease and Speed of Shipping Continues to Grow in Importance

The ease and speed of shipping is one of the top factors influencing holiday purchase decisions. 60% of consumers say it influences what gifts they buy for others — and 54% indicate it influences what they buy for themselves during the holiday period.

But will ease and speed of shipping have more or less of an impact on holiday purchases this year, compared to last?

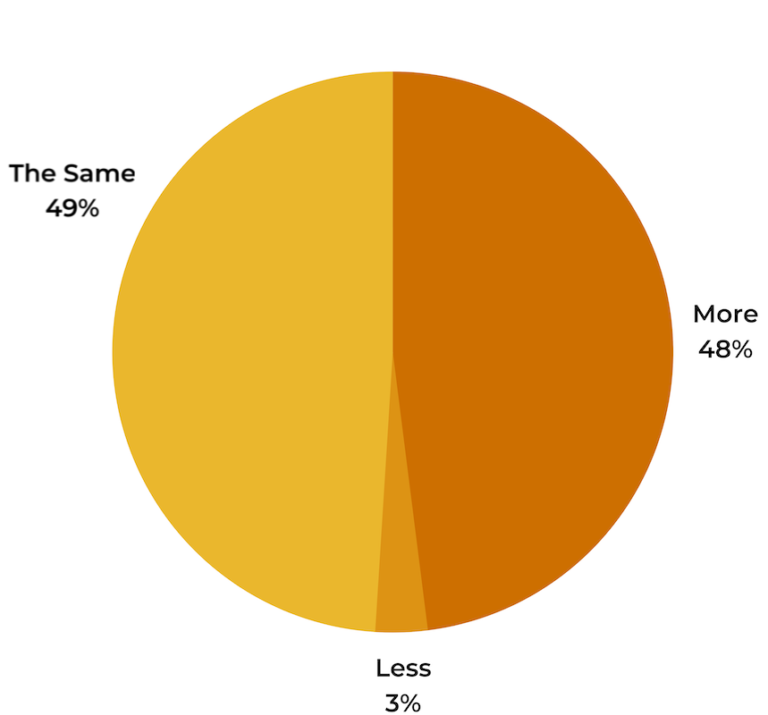

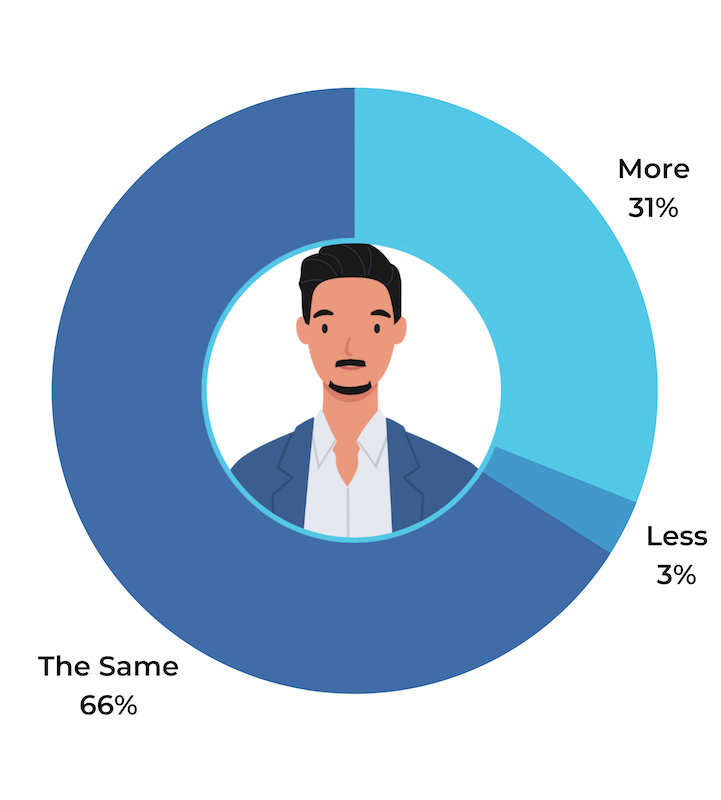

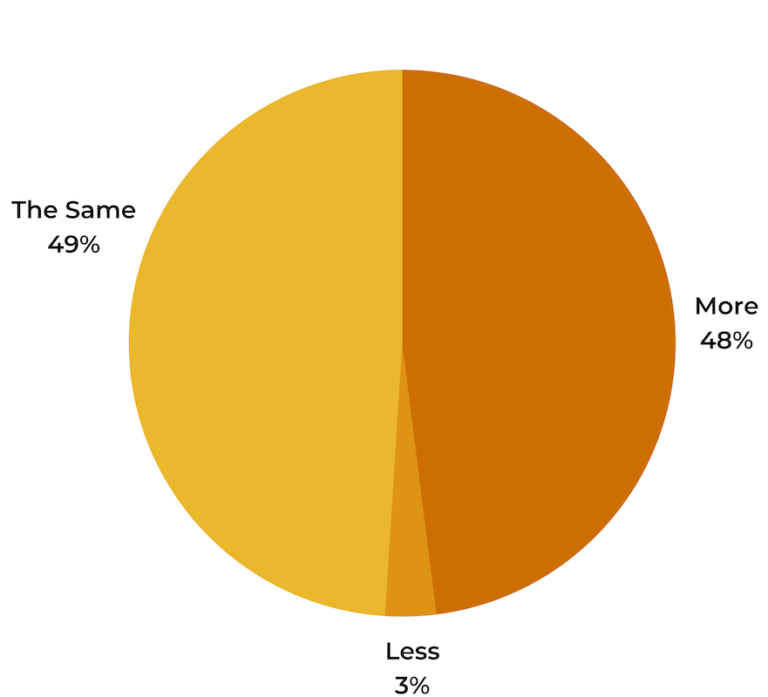

This year, nearly half (48%) of shoppers indicate that ease and speed of shipping will have a greater impact on their purchase decisions compared to last. 49% say it’ll have the same amount of impact, and for a mere 3%, shipping ease and speed will have less of an impact on holiday purchase decisions this year compared to last.

Return and Refund Policies Continue to Influence Holiday Purchases

There’s no sure way of knowing that a gift will be the right fit for the recipient. So it’s probably not surprising that 44% of consumers indicate that return and refunds policies influence what holiday gifts they purchase (and 43% say it influences items they purchase for themselves during the holidays).

In addition, just over a third (34%) say that refund and returns policies will have more of an impact on holiday purchase decisions this year. 62% indicate this is a factor that’ll have the same level of impact as last year. The remaining 4% say that refund and returns policies will have less of an impact on holiday purchases than last year.

Brands and retailers must establish refund and return policies — and ensure these policies are clearly communicated to shoppers.

The Lasting Impact of COVID on Shopping Habits

The pandemic has impacted just about every aspect of life, including our shopping habits, both during the holidays and throughout the year.

Will these new habits (namely, less trips to the store and more online shopping) stick around after the pandemic is over? Or will consumers revert to their pre-pandemic shopping behavior?

For Some Consumers, COVID-era Habits will Stick

About a third of consumers (32%) indicate that their shopping habits have changed forever as a result of COVID. Namely, 34% say they’re more comfortable shopping online than they were pre-COVID, and 26% don’t think they’ll ever store in-store as much as they did before the pandemic.

However, there are some who plan to revert to their pre-pandemic shopping habits. 10% of consumers anticipate returning to their “normal” shopping habits as soon as they’ve been vaccinated.

Notably, just over a third (34%) say that COVID hasn’t had an effect on their shopping habits — and they don’t anticipate that changing.

Key Takeaways

The upcoming holiday shopping season will look different than years past. Brands and retailers must understand how consumers plan to navigate holiday shopping this year — and then adapt their plans accordingly to meet (and exceed) the ever-evolving expectations of shoppers.

Here are five key takeaways from our research on consumers’ anticipated holiday shopping habits during 2021.

50% of consumers will do most of their holiday shopping online and 13% will exclusively shop online this holiday season. What’s more, 41% of consumers plan to do more holiday shopping online this year than they did last year. Now, more than ever, brands and retailers must make it a priority to deliver great digital experiences to the growing number of consumers expected to shop online this holiday season.

While shoppers weigh many factors when shopping for themselves or others during the holiday, price is the most impactful factor. 82% say price influences what gifts they purchase for others, and 79% say it’s a factor that impacts what they purchase for themselves during the holidays. It’s important to benchmark appropriately to increase the likelihood of sales — while still preserving profit levels.

Ratings and reviews from others who have already purchased a product are the second most influential factor when it comes to holiday purchases. 71% indicate this content influences holiday gift purchases, and 68% say it impacts self-gift purchases. Furthermore, over a third of shoppers expect that ratings and reviews will have more of an impact on their holiday purchases this year, compared to last. In order to compete (and win), brands and retailers must collect a steady stream of reviews for all items in their product catalogs, especially those featured during the holidays.

The rise of ecommerce doesn’t mean brick-and-mortar is dead (in fact, all the data indicates the majority of consumer dollars is still spent in a store environment despite continual ecommerce growth). 37% of shoppers plan to do half or more of their holiday shopping within the four walls of a physical store. What’s more, many stores will serve as distribution centers this holiday season, as 33% of shoppers plan to take advantage of BOPIS service more this year than last.

Over half (53%) of consumers are concerned about shopping in-store during the holidays because of COVID. Though this is a smaller percentage than last year, it’s still a significant number. However, with the right safety measures in place, including masking, frequent sterilization, and curbside pickup, many shoppers would be more comfortable shopping in-store.