This is the sixth edition of our monthly snapshot (most recent versions here and here), originally established to assess the impact of the coronavirus pandemic on consumer behavior. This is our September version of the same report, analyzing consumer activity across more than 1.5MM online product pages from more than 1,200 retail/brand sites.

This time, we focused on a six-month period (starting February 24 2020 and ending August 23 2020). Each report, we specifically analyse review submission levels, review length and sentiment, overall conversions/sales volumes and review consumption (both absolute and among those who go onto purchase).

After some unprecedented and drastic extremes were evident over the course of March through May, we experienced continued stabilization for the third month running. We’ve been talking about a “new normal” for some time now in these reports, and we are only seeing continued confirmation of that trend.

Key ecommerce market trends

01

02

03

Ecommerce purchase volumes and site traffic consistent for a full quarter

COVID has had a huge impact on consumer behavior, with unprecedented growth in ecommerce purchase volumes at the start of the pandemic. We consistently saw 3x increases in purchase volumes during April and May. However, for the last three months, we have seen continued stabilization.

Consumer behavior is clearly becoming more predictable, with purchase volumes consistently consistently at around 1.5x to 1.75x where they were at the start of the pandemic during this period.

Why? Most likely because the entire population has settled into a “new normal”. People are no longer buying in the bulk they were because they have confidence in supply chain and product availability. They know they will be able to source whatever items they need at short notice.

Traffic and purchase volumes stable for third month running

Review submission volumes now consistent with pre-pandemic levels

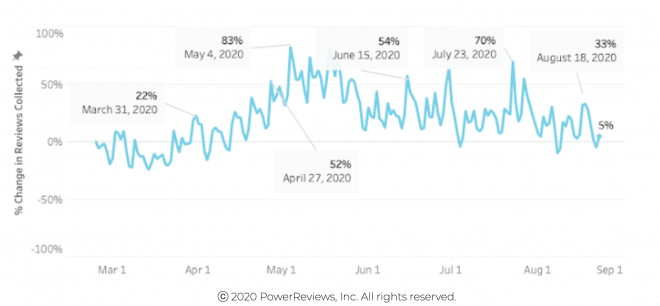

After reporting a giant 2.3x leap in review submission levels from April to May, we highlighted a slight drop over the past two months. This continued to the point where levels are now consistent with what we saw pre-pandemic.

This is most likely because consumers have now got to the point where they are no longer buying items they hadn’t tried before. Instead, they now have established product preferences so are less inclined to be motivated to submit reviews.

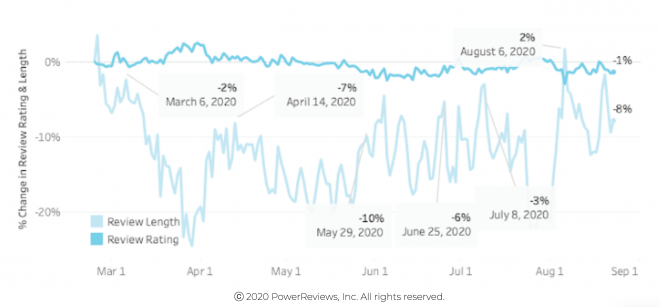

In terms of the actual content of reviews, there have not been any huge shifts over the past six months. Sentiment – in the form of average rating – remains flat, which makes sense given the products themselves are unlikely to have changed significantly in this period. Review length is down slightly on pre-pandemic levels but has rebounded notably in recent months. This may be because reviewers have become accustomed to the “new normal” and are approaching the task with renewed focus and mental capacity.

In our June webinar, we focused on review length in detail and offered some tips how to improve review quality. Check out our blog for a summary of that webinar.

Review submission volumes now comparable to pre-COVID

Review length and sentiment flat throughout pandemic

Reviews still convert shoppers to buyers more than they were pre-COVID

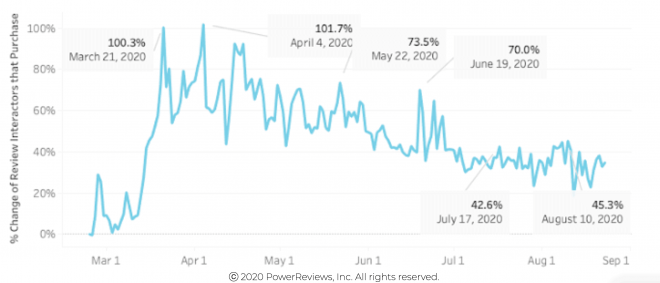

As with the other trends we highlight, the impact of review content on consumer behavior remains relatively consistent with what we saw in previous months. In other words, review content continues to be more influential on the path to purchase than it was before the pandemic.

However, while the June and July high in total review interactors were identical (at 66% above the end of February levels), the proportion of review interactors who went onto purchase is actually down (the July peak was 63% below the equivalent figure for June). So consumers are interacting with review content at the same rate as they were last month but are then going onto purchase less than they were then. This is consistent with July’s decrease in orders overall and aligns with the idea that shoppers are becoming more comfortable browsing online, and are less “decisive” in their shopping habits.

But the bottom line remains: Shoppers are still heavily relying on review content to assess product quality and make purchase decisions.

Reviews still convert shoppers to buyers more than they were pre-COVID

Summary

The story for the September snapshot is that it has proven to be the third month of continued stabilization. Trends are now very stable so we can confidently say we are now in a COVID-driven “new normal”.

We have been talking about this for the last two months, and it has completely borne out in this report.

As we pointed out last month, the wild and almost out of control growth patterns we saw at the start of the pandemic appear now to be a drastic reaction to drastic and unprecedented circumstances.

Given market conditions are unlikely to change any time soon, this “new normal” will soon simply become “the normal”.